ETH ETF Likely Approved on July 23, Significant Rebound in Ethereum Ecosystem

BTC led the overall market rise, breaking through the $64,000 resistance level, with positive wealth effects in the market. Key points include:

- Strong wealth creation sectors: Meme sector, AI sector, ETH ecosystem projects.

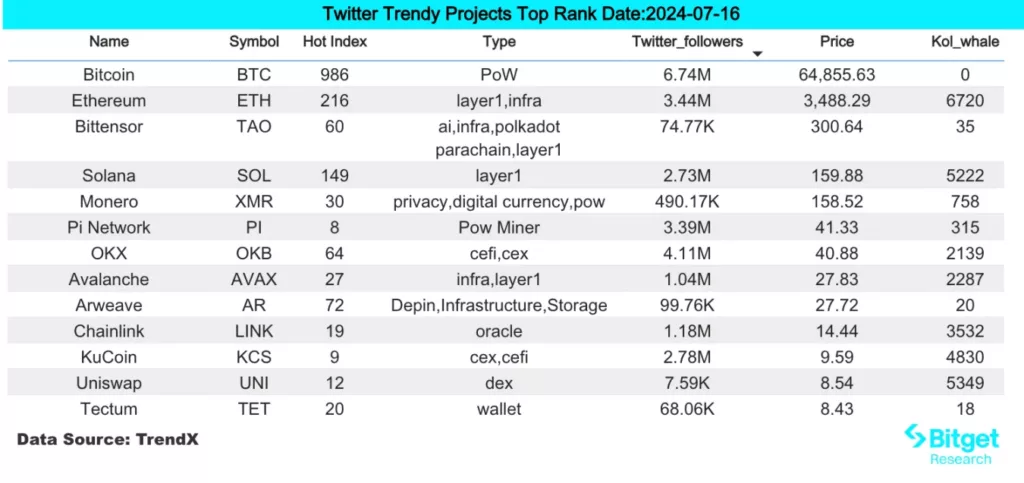

- Top trending tokens & topics: UXLINK, ETH, JD Vance.

- Potential airdrop opportunities: Sonic, Solayer.

Data compiled as of July 16, 2024, 4:00 (UTC+0).

I. Market Environment

Over the past 24 hours, BTC has shown unilateral upward movement, rising from $62,000 to the current $64,500. BTC spot ETFs have seen net inflows for the seventh consecutive trading day, with $300 million inflows yesterday, driving BTC’s major uptrend.

Bloomberg’s noted ETF analyst Balchunas stated on social media that the SEC has requested ETF issuers to submit final S-1 documents by this Wednesday, implying that the SEC could announce approval results by next Monday, with potential ETF listings by Tuesday.

On the news front, BlackRock CEO Larry Fink stated on CNBC that “his view on Bitcoin five years ago was wrong,” reaffirming Bitcoin as digital gold and a legitimate financial tool. Dell’s CEO retweeted BlackRock’s CEO interview video, calling BTC fascinating.

Trump appointed crypto-friendly J.D. Vance as vice presidential candidate. Influential figures in technology, finance, and politics are endorsing BTC, shifting market sentiment to optimistic.

II. Wealth Creation Sectors

1) Sector Movements: Meme Sector (PEPE, WIF, FLOKI)

Key Reasons:

Blue-chip tokens like ETH and SOL are showing signs of bottoming out, boosting interest in the meme coin sector.

PEPE, WIF, FLOKI saw increases of 26.4%, 23.2%, and 23.1% respectively in the past 24 hours.

Future Influencing Factors:

Price trends of valuation tokens: For PEPE, ETH’s token movements impact PEPE prices due to BONK priced in SOL on DEX. Continued monitoring of ETH and SOL trends is advised; a sustained uptrend in ETH and SOL could benefit related meme assets.

Changes in open interest contracts: Using tv.coinglass data to track contract trends, PEPE saw a 30% surge in open interest in the past 24 hours, primarily from increased net long positions, with an account long-short ratio falling below 1, indicating major capital opening long positions via contracts. Future attention to changes in contract data is recommended.

2) Sector Movements: AI Sector (ARKM, TAO, NEAR)

Key Reasons:

As the crypto market rebounds overall, the AI sector leads the way, with mainstream AI tokens steadily rising and sector funds active.

Dell, an active stock in the US AI sector this round, retweeted crypto-related tweets, keeping the market focused on AI encrypted asset sectors.

Increases in the last 24 hours: ARKM, TAO, NEAR rose by 10.5%, 5.5%, and 8.6% respectively.

Future Influencing Factors:

Primary market’s large financing information: ETHCC held in Brussels as scheduled, with institutional participation focused on the AI sector’s primary trends. AI Model-related research project Sentient raised $85 million, bringing market attention back to the effective combination of AI ecosystems and blockchains.

Traditional tech company actions: OPENAI’s launch of new products often drives AI sector growth. Currently, this race remains early, requiring continuous stimulus from the news to raise secondary market valuations.

3) Key Sector to Focus Next: ETH Ecosystem Projects (UNI, LDO, PEPE)

Key Reasons: ETH spot ETF’s S-1 document may officially list on the US capital market on July 23, with speculation potential for ETH ecosystem assets. This sector recently saw a significant correction, providing an exit strategy.

Specific token list:

- UNI: The first DeFi Swap project on blockchain applications, Uniswap has averaged around $1 million in daily revenue, providing substantial income.

- LDO: A leading LSD project in the ETH ecosystem, TVL reaching $29.6 billion, with a valuation of just under $1.8 billion, is in a relatively undervalued state.

- PEPE: Currently, the most meaningful meme coin in the ETH ecosystem, with a strong community base, ETH price increases may continue to rise.

III. User Hot Searches

1) Popular Dapp

UXLINK:

Web3 social platform and infrastructure UXLINK announced trading listings on 8 exchanges, including Bitget, OKX, Bybit, Gate, KuCoin, etc., at 4:00 pm on July 18, Singapore time. According to UXLINK, the project currently has over 15 million registered users, covering 110,000 Telegram groups, with 8 million on-chain users. The project has been profitable and continues to invest profits into the community and ecosystem.

2) Twitter

ETH:

Three sources reported that the US SEC has given preliminary approval to at least three of eight asset management companies to launch ETH ETFs. Final approval depends on applicants submitting final issuance documents by the end of this week. Positive news has significantly raised ETH and ETH ecosystem token prices.

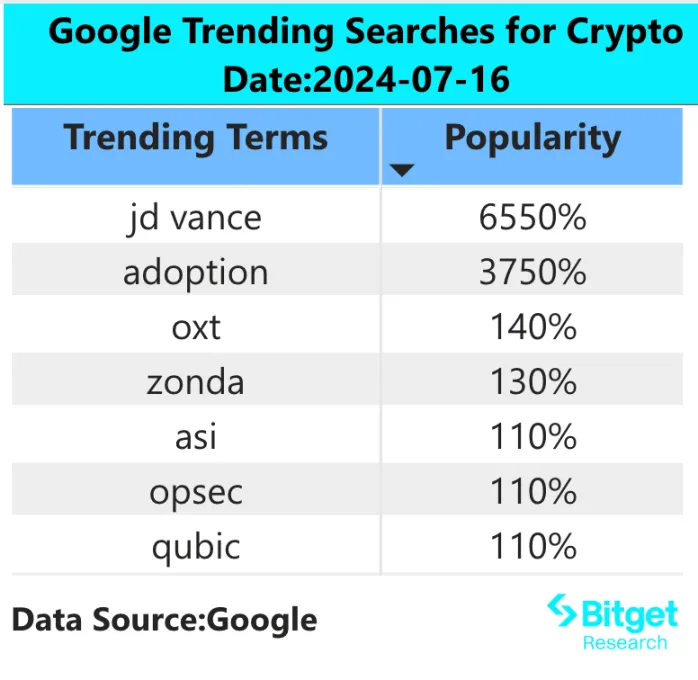

3) Google Search & Regional

Global Trends:

JD Vance:

According to recent video disclosures, Republican vice presidential candidate JD Vance fiercely criticized Gary Gensler, chairman of the US Securities and Exchange Commission, for his crypto regulation policies, stating that his regulatory approach to the crypto market was “completely opposite to ideal policies.” Market expectations favor JD Vance’s potential election, anticipating favorable crypto-friendly policies.

Regional Hot Searches:

(1) Asia showed no obvious commonality in yesterday’s regional hot searches, with particular interest in Tesla, Nvidia, and other leading US stocks in the Philippines.

(2) In Europe and the US, JD Vance appeared in multiple countries’ hot searches. JD Vance, a Republican vice presidential candidate, was reported to hold BTC himself and had criticized US SEC Chairman Gary Gensler’s crypto regulatory policies.

IV. Potential Airdrop Opportunities

Sonic (Zero-Cost Interaction Testnet)

Sonic is a gaming chain based on Solana, proposing the first scaling architecture, HyperGrid, which efficiently manages game state, logic, and events for game developers. Sonic is fully compatible with all EVM smart contracts and has a native game engine, providing comprehensive On-Chain game development components for game developers.

In June 2024, Sonic completed a $12 million Series A financing round, valued at $100 million. Bitkraft led the round, with participation from Galaxy Interactive and Big Brain Holdings.

Specific participation methods:

- Open developer mode in the Backpack wallet preferences, add the Sonic Devnet test network;

- Obtain SOL test coins from https://faucet.sonic.game/;

- Visit the Sonic Odyssey mission page to follow prompts for social media account binding, daily check-ins, and game trials.

Solayer

Solayer is building a re-staking network on Solana. Solayer uses its economic security and high-quality execution as decentralized cloud infrastructure to achieve a higher level of consensus and block space customization for application developers.

In July 2024, Solayer announced the completion of the Builder round financing, with specific investment amounts undisclosed. Investors include Solana Labs co-founder Anatoly Yakovenko, Solend founder Rooter, and Tensor co-founder Richard Wu.

Specific participation methods: Pledge SOL and some supported project SOL LST (jitoSOL, mSOL, bSOL, INF) to earn points for each episode. It is also important to note that rewards will decrease if pledged assets are redeemed before the deadline.