Looking at the Historical Development of GameFi

DeFi and NFTs Cultivate the Soil for GameFi Development

DeFi and NFT lay the foundation for GameFi

Since the launch of the Ethereum mainnet on July 30, 2015, the Web3 era has officially begun. The smart contract deployment functionality of the Ethereum mainnet supports the design and operation of DApps (decentralized applications).

On this basis, a large number of popular DeFi (decentralized finance) projects emerged, such as Uniswap, which realized DEX (decentralized exchange) through automated market makers, and MakerDAO, which implemented contract lending.

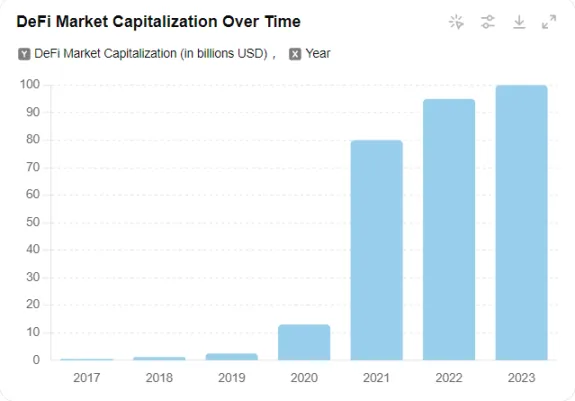

These DeFi projects attracted a large influx of capital with their high investment returns, transparency, privacy, and openness. The total market value of the DeFi sector grew from $50 million in 2015 to $100 billion in 2023.

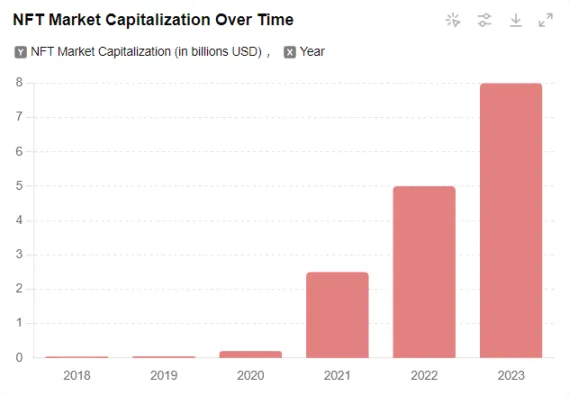

As DeFi flourished, capital began exploring the potential for combining decentralized finance with other fields. During this period, the NFT market experienced a massive boom. In 2017, CryptoKitties, an Ethereum-based NFT project that allowed players to buy, breed, and trade digital cats, garnered widespread attention and is often considered the starting point of the NFT explosion. The total market value of the NFT sector rose from a few million dollars in 2018 to $8 billion in 2023.

If DeFi brought continuous capital into the crypto market, NFTs shifted blockchain’s focus to entertainment and gaming. The combined impact of DeFi and NFTs provided fertile ground for the development of blockchain games, paving the way for the emergence of GameFi, which integrates DeFi and blockchain gaming concepts.

The Starting Point of the GameFi Dream

In the second half of 2019, Mary Ma, Chief Strategy Officer of MixMarvel, first proposed the concept of GameFi—”gamified finance” and “new gamified business.” This concept combines elements of gaming and finance, aiming to introduce new business models and economic systems to the gaming industry through blockchain technology.

According to Mary Ma, future games will not only be entertainment tools but also financial tools. Blockchain technology can transform in-game virtual items into valuable digital assets that players can acquire, trade, and appreciate in value. In this model, game companies and players can participate in economic activities in a decentralized environment, achieving mutual benefit.

However, due to the immaturity of blockchain technology and its application paradigms at the time, the GameFi concept did not immediately gain widespread attention and application.

The Beginning of GameFi’s Explosion

In September 2020, Andre Cronje, founder of Yearn.finance, elaborated on his understanding and vision of GameFi in a speech and public statement. Thanks to Andre Cronje’s authority in the DeFi industry, the GameFi concept began to enter the public eye. His many viewpoints on GameFi also clarified its future development direction.

According to Andre Cronje, the DeFi industry is in the “TradeFi” (trade finance) stage, where users’ funds are primarily used for trading, staking, and lending operations, failing to highlight the differences between cryptocurrencies and traditional finance.

GameFi is expected to be the future direction of DeFi development, where user funds will have actual application value in virtual game worlds, and users can earn substantial token rewards through activities in virtual game worlds, similar to real-life work.

This marked the first wave of growth in the GameFi field!

GameFi Reshapes the Gaming Track

GameFi is a blockchain technology that combines DeFi, NFTs, and Blockchain Games, with in-game assets and some logic running on blockchain smart contracts, managed by DAOs (decentralized autonomous organizations) to ensure users’ ownership of in-game assets and governance rights. GameFi focuses on building a complete financial system, supporting the use of native game tokens for item trading and other activities. Users can earn token income through games, sharing the benefits of game development.

Solving the Problems of Traditional Games

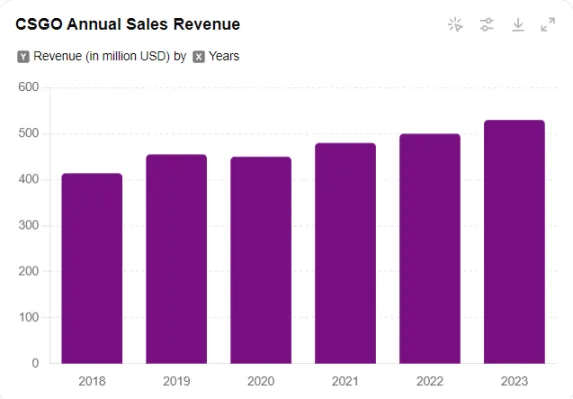

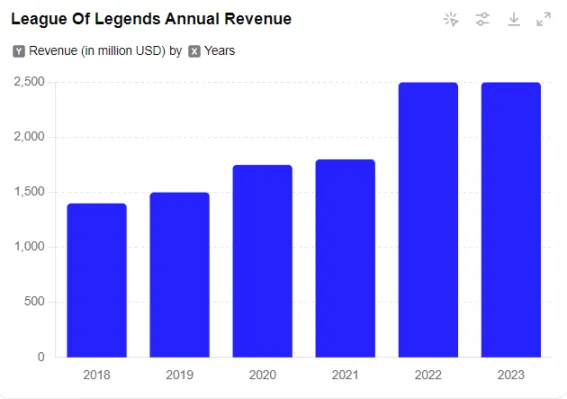

In traditional games, items such as props and skins have certain value, which is well-acknowledged. CSGO’s annual sales of props averaged over $420 million from 2018 to 2023, and the sales have been increasing each year. League of Legends’ skin item annual sales rose from $1.4 billion in 2018 to $2.5 billion in 2023. The sales of Honor of Kings’ skin items reached an astounding $2.74 billion in 2023. Whether domestically or internationally, game items have a vast market space.

However, since item trading often undermines the profits of game publishers and touches legal red lines in some countries and regions due to their financial attributes, game companies typically adopt two strategies: monopolizing the item trading market with high transaction fees, as seen with CSGO and Steam, or providing unlimited item supply through a unified purchasing channel and strictly prohibiting account trading, as seen with League of Legends and Honor of Kings.

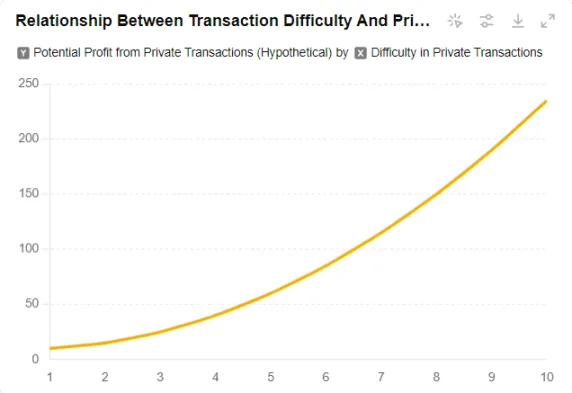

Due to game companies’ and local regulations’ restrictions, the black market for game item sales has become a highly profitable business. As game companies and local regulations increase efforts to crack down on black market transactions, the supply line of black market items shifts leftward, increasing selling profits.

GameFi, constructed with blockchain technology and inherently possessing DeFi attributes, can perfectly resolve the monopoly of game companies and the rampant black market. GameFi is both a game and a market, with game skins and items existing as NFTs. All transactions will follow market rules and remain as transparent as possible.

Additionally, DAO governance in game development, allowing all players to share governance rights, is another major feature of GameFi. Currently, game companies often manipulate lottery probabilities and discount previously expensive game items to boost sales, harming the interests of purchased players.

Protests against these measures are often fragmented and suppressed by these tech giants through traffic control. DAO governance measures can shatter the absolute dominance of game companies, preventing users from constantly worrying about unfavorable developments and enjoying the overall economic benefits of game development.

Perfectly Aligning with the History of Game Development

Looking at the history of game development, it often relies on improvements in computer technology, hardware upgrades, and innovation in game concepts.

- Early Computer Game Stage (1970s-1980s): The early stage of video game development mainly occurred in laboratories and universities. Notable early games include “Spacewar!” and “Pong,” the latter marking the beginning of commercial video games.

- Home Console Era (1980s-1990s): Nintendo released the NES, bringing classics like “Super Mario Bros.”

- 16-bit Console Era (1990s): Sony launched the PlayStation, ushering in the CD-ROM game era, with games like “Final Fantasy VII” sparking a gaming craze.

- 3D Game Era (late 1990s-early 2000s): Valve released “Half-Life,” praised for its deep storyline and immersive experience.

- Online Game and MMORPG Era (2000s): Blizzard Entertainment’s “World of Warcraft” became one of the most successful MMORPGs, promoting the development of online multiplayer games.

- Mobile and Social Game Era (2010-present): Supercell’s “Clash of Clans” became a successful mobile strategy game, while Niantic’s “Pokémon GO” combined AR technology with mobile gaming, sparking a global phenomenon.

The past development of games mainly relied on improvements in computer technology, hardware upgrades, and innovation in game concepts. Today, GameFi represents the cutting-edge and most interesting technology in blockchain, combining DeFi and NFTs.

It is an intersection of computer science and finance, with a novel “play-to-earn” game concept, providing examples for financial market research. GameFi perfectly aligns with two of the three major elements in the history of game development, conforming to the historical trend of game development.

GameFi has developed rapidly in recent years, introducing novel concepts and designs and giving birth to many top projects.

- Early Exploration (2018): Decentraland launched as one of the early GameFi projects, allowing players to buy, develop, and trade virtual land, achieving true ownership through blockchain technology. Gods Unchained introduced a blockchain-based trading card game, showcasing the potential of NFTs in games.

- Concept Introduction (2019): Mary Ma proposed the concepts of “gamified finance” and “new gamified business,” marking the birth of the GameFi idea. Sky Mavis’s Axie Infinity began to gain public attention.

- Initial Rise (2020): Yearn.finance founder Andre Cronje reiterated the GameFi concept in September 2020, predicting that DeFi would evolve towards gamified finance, with user funds used as equipment in games. During this period, the DeFi and NFT markets also entered a golden period, laying the groundwork for GameFi’s explosion.

- Explosive Growth (2021): Axie Infinity achieved great success, attracting millions of players and reaching $1 million in daily trading volume in August. The “play-to-earn” model allowed players to earn income through games, becoming the primary source of income for tens of thousands of residents in Southeast Asian countries during the pandemic. The Sandbox also exploded in popularity, allowing users to create, own, and trade virtual assets and land, attracting numerous venture capital firms.

- Sharp Decline in Traffic (2022-present): Due to the overall downturn in the crypto market, GameFi’s popularity significantly declined. Axie Infinity’s daily active users plummeted from 740,000 in August 2021 to 35,000 in August 2022, and many GameFi projects faced severe inflation issues. The number of tokens in DeFi Kingdoms increased from 60 million at the beginning of 2022 to 100 million by mid-year.

GameFi’s boom also boosted the concept of the metaverse. The essence of the metaverse is to create a virtual shared space realized by AR (augmented reality) and VR (virtual reality) technologies, combined with decentralized technologies like blockchain.

It not only encompasses games but also various aspects of life. GameFi’s free ecosystem construction makes it synonymous with the metaverse in many scenarios. From 2021 to 2022, many traditional tech companies began to get involved in GameFi and metaverse concepts.

- Facebook rebranded to Meta, reflecting its long-term vision for the Metaverse.

- Tencent established a new TiMi Studios focusing on developing metaverse-related games and invested in The Sandbox and Decentraland.

- Microsoft acquired Blizzard for $68.7 billion, planning to combine traditional popular games with blockchain technology to create a new generation of GameFi.

- Goldman Sachs and SoftBank increased their investment in GameFi, endorsing well-known projects like Axie Infinity and The Sandbox.

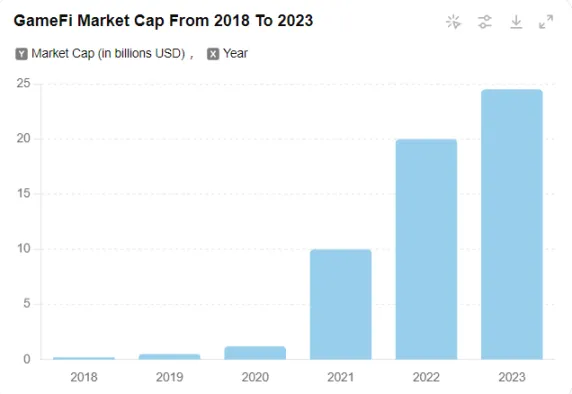

The total market value of GameFi rose from $200 million in 2018 to $24.52 billion in 2023, with a growth rate of 733.3% from 2020 to 2021.

Although GameFi currently faces some issues, the strong involvement of traditional tech companies and the gradual maturity of the technology indicate that the future holds endless possibilities.

The Narrative of Integrating the Best from All

GameFi is a combination of DeFi, NFTs, and Blockchain Games, making the previously dull DeFi more engaging and providing practical applications for NFT technology. Additionally, GameFi’s governance model offers opportunities for the implementation of DAOs. With the current buzz around the metaverse, AR, and VR, GameFi is poised to become a part of future AAA game titles. Therefore, GameFi represents a significant application of blockchain technology and its integration with virtual technology.

DeFi+NFT Token Economy: Building an Independent Financial Ecosystem

The financial nature of GameFi differentiates it from Blockchain Games. While Blockchain Games typically focus on using blockchain technology to enhance transparency, fairness, and asset ownership within games, GameFi emphasizes integrating a complete financial system into games, creating Blockchain Games with financial attributes. Hence, while Blockchain Games can be simple blockchain application games, GameFi inherently includes financial functions and economic systems.

- From a technical perspective: The uniqueness and indivisibility of NFTs give each game item unique value. By limiting the number of issued NFT items, scarcity value can be created.

- From a rights perspective: In GameFi, project teams act only as game developers, bug fixers, and decision-makers. They sell tokens and NFT items to players at the game’s inception and delegate most of the power to ordinary players. Decisions regarding game updates, development, and profit distribution are made by a DAO composed of players and the project team.

- From a mechanism perspective: The “play-to-earn” model in GameFi allows players to earn NFT items or tokens through time investment and initial financial input in the game, which can be exchanged for real-world currency, generating economic benefits.

Introducing a financial system into games is not unique to GameFi; some traditional games already feature complex financial systems, proving its feasibility. MMORPGs like “EVE Online” are renowned for their intricate financial systems, simulating real-world markets with production, trade, and resource management. “EVE Online” developers even employed an economist to study and regulate the in-game economy to prevent market collapse.

Although GameFi’s current financial systems are not as complex as those in games like “EVE Online,” “World of Warcraft,” or “Second Life,” its decentralized nature ensures that GameFi players own their assets without the need to trust game publishers.

Cross-chain Asset Interoperability and Building a Large Financial Ecosystem

A single GameFi may face issues such as a small user base, low activity, and unstable funds. Cross-chain asset interoperability and multi-platform operation could address these problems. Each GameFi is an economic entity, and when interconnected, they can form a large economic market. This requires the integration of technologies like cross-chain compatibility, multi-platform compatibility, data synchronization and consistency, and decentralized account management.

- Cross-chain technology: Using cross-chain bridge technology or interoperability protocols, users can directly trade and communicate across different blockchains.

- Cross-platform compatibility: GameFi development should ensure compatibility with various hardware and software environments, utilizing highly compatible game engines like Unity or Unreal Engine and standardized APIs.

- Data synchronization and consistency: Utilizing State Channels technology allows off-chain transactions, only submitting the final state to the blockchain for synchronization, reducing data transmission pressure.

- Decentralized account management: For supporting cross-chain and multi-platform GameFi operations, decentralized identity (DID), single sign-on (SSO), and distributed account storage become crucial, reducing the burden of account management and enhancing security.

A unified and effective financial cycle can not only improve the liquidity of funds within the cycle but, as Andre Cronje envisioned, could also become the future direction of DeFi development. Furthermore, the GameFi financial cycle will simulate the financial behaviors between countries and regions in the real world, providing examples for further economic research.

Integrating AR and VR Technology: Realizing “Ready Player One”

Thanks to GameFi’s explosive growth in 2021, the metaverse concept once dominated popular stocks in the A-shares and US stock markets. During this period, fraudulent activities under the metaverse concept emerged. In this context, GameFi gradually became seen as a potential successor to the metaverse concept.

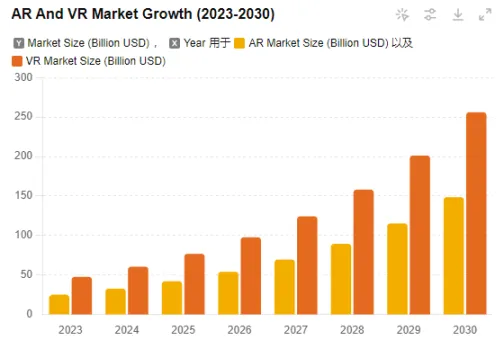

At the same time, AR and VR technologies associated with the metaverse began to flourish. By 2023, the global AR and VR market size exceeded $70 billion and is expected to surpass $400 billion by 2030.

Many projects have started focusing on integrating blockchain with AR and VR technologies, making it possible for future GameFi to combine with AR and VR technology, bringing the “Ready Player One” concept closer to reality.

- Render Network: Provides distributed GPU rendering services, supporting high-quality 3D rendering for AR and VR. Many applications, including Apple Vision Pro, offer this service.

- Ozone: Provides 3D applications and cloud computing services supporting multi-chain and cross-chain interoperability.

- IOTX: Offers a secure, privacy-protected, and scalable blockchain platform for connecting and managing IoT devices.

Given the future demand for the virtual market, combining AR and VR technology with GameFi to create a new generation of AAA titles has become a consensus.

GameFi 1.0 Era: Ponzi Games Running Ahead

CryptoKitties: The Frenzy That Started the GameFi 1.0 Era

On November 28, 2017, CryptoKitties launched on the Ethereum blockchain, becoming the first phenomenon-level DAPP. It demonstrated to users that Ethereum was not just for issuing tokens but also for simple and fun NFT games. CryptoKitties offered a series of innovative gameplay mechanics.

- Users could buy their own cat NFTs with ETH in the CryptoKitties market.

- Each cat had a unique genetic code, allowing users to trace its parents, siblings, and past activities.

- Two cats could breed to produce a new generation of kittens. After breeding, cats would enter a cooldown period, which lengthened with more breeding.

- Players could rent out their cats for breeding, gift them, or auction them in the market.

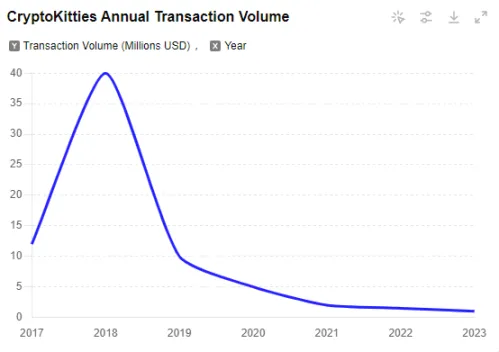

CryptoKitties’ innovative gameplay and high profit expectations quickly drew speculators’ attention, with one cat named “Dragon” selling for 600 ETH (about $170,000), setting a historical record. The CryptoKitties project separated from its original studio, Axiom Zen, and secured a $12 million investment from top venture capital firms a16z and usv.

By 2024, CryptoKitties had conducted over 700,000 transactions with a total volume of 67,818 ETH, equivalent to about $115 million. However, since mid-2018, transaction volumes for CryptoKitties have plummeted, and it is no longer a market hotspot.

Although the original intent of CryptoKitties was not a Ponzi scheme but to explore more channels for Ethereum’s future development through NFT games, it also caused a significant economic bubble.

Fomo3D: A Pure Gambling Game

The brief popularity of CryptoKitties sparked an early Blockchain explosion, but most of these Blockchain projects lacked innovation. The most notorious among them was Fomo3D, a game with a simple gambling mechanism and various gameplay types. Its core mechanism was a treasure hunt, enhanced by team dividends, referral rewards, and lucky candy mechanisms.

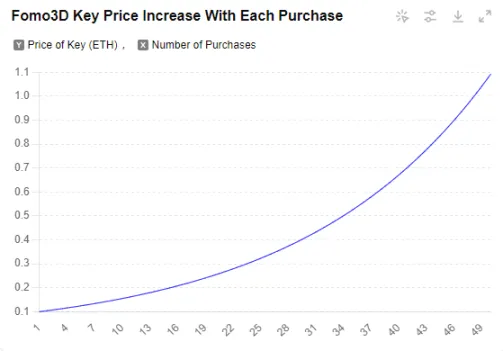

In Fomo3D, each game round included a 24-hour countdown. Players bought in-game tokens—”Keys”—with ETH. Every time a player bought a “Key,” the countdown extended by 90 seconds (up to 24 hours). The last player to buy at least one “Key” before the 24-hour countdown ended would win 48% of the prize pool. To ensure the game could end, Fomo3D dynamically adjusted the price of “Keys,” increasing the cost with each purchase, eventually leading to a situation where the countdown sped up faster than 90-second increments, ending the game.

Clearly, Fomo3D was a typical Ponzi scheme, where everyone hoped to be the final winner, but most lost everything.

Games like Fomo3D were common during the GameFi 1.0 period, often being Ponzi schemes that siphoned money from new users to reward old ones. Their fragile balance could easily be disrupted by factors like currency sell-offs, waning interest, or a decline in new users. Compared to traditional games, these Blockchain Games were not as entertaining. Therefore, fundamentally, these Blockchain Games lacked complete financial systems and could not be considered true GameFi.

GameFi 2.0 Era: Inspired by “Play-to-Earn”

The GameFi 2.0 era is a stage where the concept of GameFi flourishes, expanding the blockchain financial system step by step from “play-to-earn” to “x-to-earn,” gradually integrating financial elements such as community, trading, combat, and markets into GameFi.

Axie Infinity Sparks the “Play-to-Earn” Craze

Unlike all previous blockchain games, Axie Infinity was the first to combine the concept of “play-to-earn” with complex financial mechanisms, creating an engaging world of NFT creatures where players can collect, breed, battle, and trade creatures called Axies.

- Early Stage (2018): Axie Infinity was launched by the Vietnamese startup Sky Mavis, inspired by Pokémon and CryptoKitties. The team aimed to create a player-governed world of creatures.

- Initial Development (2019-2020): Axie Infinity officially launched on the Ethereum blockchain, allowing players to purchase and breed Axies and sell them in the marketplace. The game later introduced PvP mode and adventure systems, enhancing playability.

- Boom Period (2021): Due to its “play-to-earn” model, Axie Infinity attracted a massive player base. The documentary “Play-to-Earn: NFT Gaming in the Philippines” highlighted its potential to a broader audience.

- Expansion Phase (2022-Present): Axie Infinity has continued to evolve, now encompassing six main segments: Axie Infinity Origins, Axie Infinity: Homeland, Axie Classic, Axie Infinity: Raylights, Defenders of Lunacian, and Project T prototype.

In the Axie Classic version, users start by purchasing three Axies to engage in battles or breeding. Each Axie is unique and fully owned by the player. Axies are born with randomly assigned attributes such as health, skills, speed, and morale, and possess different racial traits that offer certain combat advantages. The game’s detailed mechanics are numerous and won’t be elaborated on here.

Axie Infinity Token Governance Model: Dual-Token System

AXS (Governance Token):

- AXS holders have voting rights on governance decisions within the Axie Infinity ecosystem, including the game’s future direction and major decisions.

- Players can stake AXS tokens to earn rewards.

- AXS is required for breeding Axies.

- AXS is also used as a reward token in in-game events.

SLP (In-Game Token):

- SLP is primarily used for breeding Axies, with the required amount increasing with each breeding instance.

- Players can earn SLP through daily quests, PvE (adventure mode), and PvP (arena mode).

Unique Scholarship Mechanism

Axie Infinity features a unique scholarship mechanism where Axie owners can lend their Axies to scholars, who then use them to earn SLP in battles. Owners receive a share of the earnings. This mechanism allows diligent and knowledgeable players to enter the game without any upfront investment and continuously earn AXS and SLP to expand their Axie teams. During the pandemic, many Filipinos sustained their basic livelihood through Axie, making it a rare blockchain project that genuinely improved people’s lives.

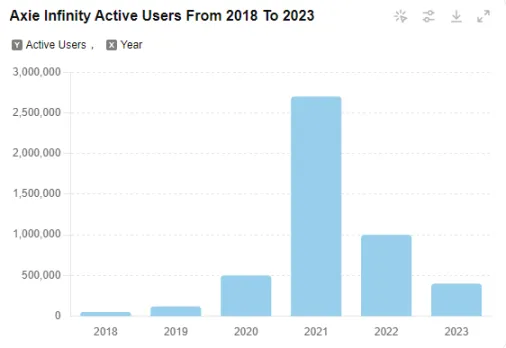

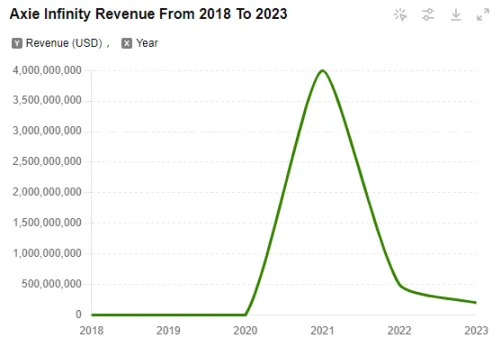

Axie Infinity’s innovative achievements are also reflected in its MAU (monthly active users), transaction volume, and revenue. In August 2021, Axie Infinity’s total transaction volume exceeded $2 billion, with a monthly income of $364 million, surpassing “Honor of Kings” for the first time. By the end of the same year, monthly active users surpassed 2 million.

Despite its groundbreaking success, Axie Infinity has also faced economic bubbles and overall market downturns. Its active user count dropped from a peak of 2.7 million in 2021 to 400,000 in 2023, with current monthly users around 100,000, and transaction volumes falling from $4 billion in 2021 to $200 million in 2023.

Even though Axie Infinity experienced significant economic bubbles, it withstood the turmoil and remains a leading GameFi project. In the past 30 days, Axie has recorded 387,232 transactions and sales amounting to 1,083.3 ETH (approximately $4 million), impressive numbers for a six-year-old game.

Axie Infinity successfully implemented the GameFi concept and model through its “play-to-earn” approach, attracting genuine fans through its PvE and PvP modes, making it a successful example in the GameFi space.

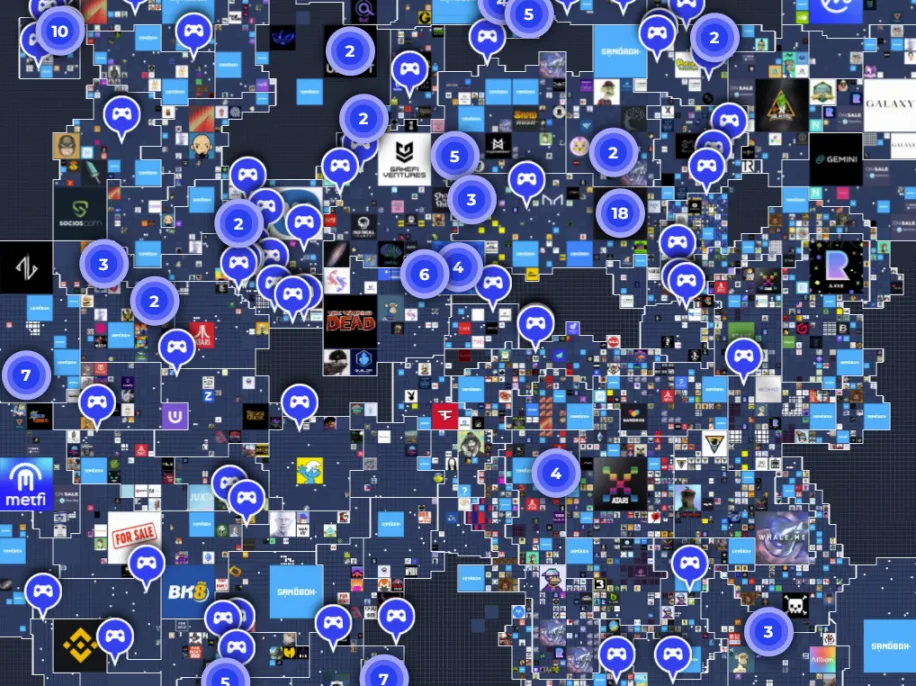

The Sandbox: Crafting a Virtual World

If Axie Infinity is a casual GameFi game, then The Sandbox is a grand epic. The Sandbox originates from two popular sandbox games, “Sandbox” and “Sandbox Evolution,” which collectively exceeded 40 million downloads on iOS and Android systems. In 2018, the publisher Pixowl decided to bring this successful UGC (user-generated content) game IP and its vast creator community into the blockchain ecosystem, offering creators genuine intellectual property protection through NFTs and rewarding their community contributions with tokens. Thus, The Sandbox was born.

- Technically: The Sandbox inherits the UGC ecosystem from previous sandbox games, offering three integrated functions—VoxEdit, Marketplace, and Game Maker—to provide users with a comprehensive design experience, while supporting blockchain and smart contracts for copyright protection.

- Token Model: The Sandbox offers three types of tokens to ensure in-game economic circulation: SAND, LAND, and ASSETS.

- SAND: An ERC-20 token used for acquiring assets, purchasing land, and publishing content within The Sandbox. SAND also has governance functions and can be staked for rewards.

- LAND: An ERC-721 token representing land assets in the game, each measuring 96×96. Players can add games and assets to their LAND and set their own game rules. Multiple LANDs can form larger ESTATEs, suitable for creating richer sandbox games.

- ASSETS: An ERC-1155 token representing user-generated content, which can be sold on The Sandbox’s front-end marketplace.

With strong IP effects, innovative game concepts, and an open financial system, The Sandbox has been highly sought after by investors. In 2018, Animoca Brands acquired Pixowl and provided long-term support for The Sandbox development. In 2019, The Sandbox secured $2.5 million in seed funding led by Hashed. In 2020, it raised $3 million in a Series A round from True Global Ventures, Square Enix, and others. In 2021, its robust ecosystem, distinguishing it from inferior blockchain games, attracted SoftBank, leading to $93 million in Series B funding.

The Sandbox has not disappointed its investors. Since the LAND sale began, prices have consistently risen, with the current floor price still high at 0.12 ETH on OpenSea.

Additionally, prime LAND locations have sold for sky-high prices. In November 2021, virtual real estate investment company Republic Realm purchased a virtual land in The Sandbox for $4.3 million. The following month, a neighboring LAND owned by Snoop Dogg sold for around $450,000.

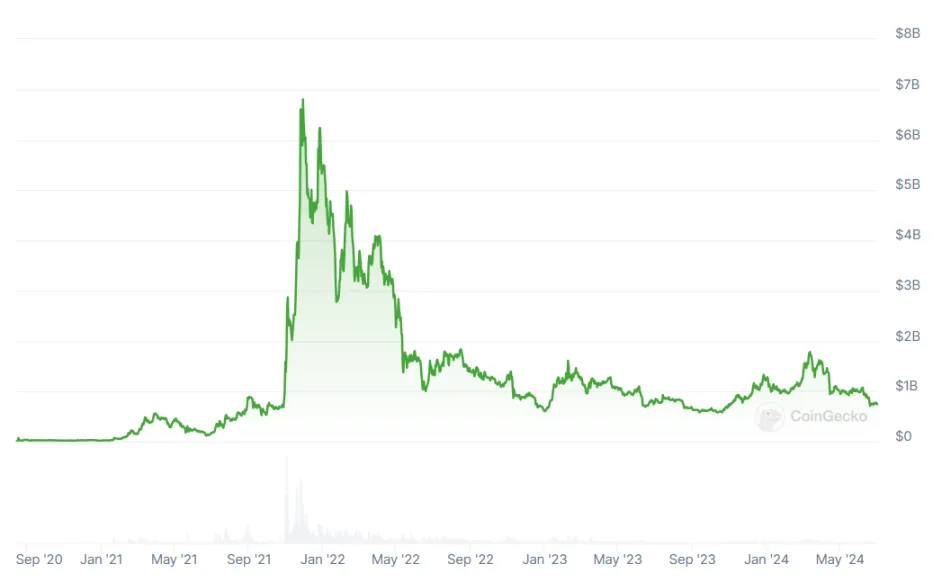

Since its ICO, The Sandbox’s market cap has experienced significant fluctuations, peaking at $6.8 billion and currently standing at $700 million, yielding immense profits for venture capital firms that invested in The Sandbox.

Overall, The Sandbox exemplifies the integration of traditional IP with blockchain technology and demonstrates the powerful wealth-aggregating effect of high-quality GameFi.

GameFi 3.0 Era: Exploring the Future of the GameFi Market

Mini Games are Not GameFi

Recently, Telegram mini-games like Not and Hamster have become highly popular, allowing users to earn tokens with simple finger movements. This simplicity has led to viral community growth, attracting millions of users in a short time. Since its launch in January 2024, Not game has had over 30 million participants, with daily active users reaching 5 million. Subsequently, Notcoin successfully conducted an ICO on exchanges including Binance, with a 400% increase within seven days.

However, these games, built on Telegram, can only be considered mini-games. They lack a complete financial system and are deficient in IP effects and playability. Their popularity is primarily driven by the “fair launch” concept. Unlike similar WeChat mini-games, Telegram mini-games are not platform-restricted, and their gains can be seen as an extension of Web2 to Web3 benefits.

Reevaluating GameFi

Diverse Game Forms with a Blue Ocean Market

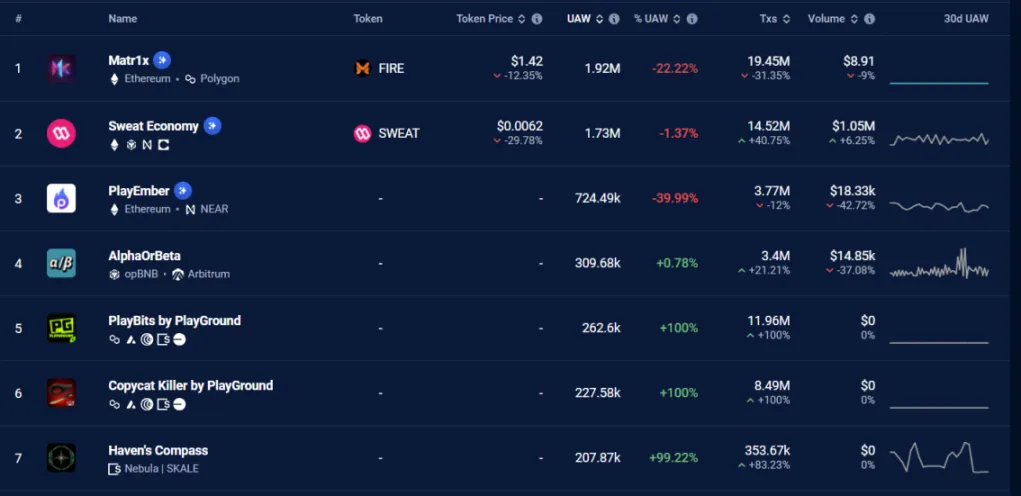

The years 2023 to 2024 saw rapid development in GameFi’s game forms, currently covering Farming/Mining Games, Card Games, Move-to-earn Games, MMORPGs, Metaverse Games, Auto Battlers, and more.

On DAppradar, Matr1x, an MMORPG-type game, ranks first in UAW (unique active wallets), with 1.92 million active users in the past 30 days, despite a market cap of only $49 million. The current market focus is mainly on foundational areas like Layer 1 and Layer 2 construction, while GameFi leans towards integrated application of technology. As foundational areas break through, GameFi still has the potential for a resurgence.

On-Chain Games

On-chain games operate all logic, data, and assets on the blockchain. During the GameFi 1.0 to GameFi 2.0 periods, most games only had assets or partial logic on-chain. On-chain games emphasize full decentralization and transparency, perfectly avoiding issues like game cheating. Autonomous Worlds can be seen as a significant manifestation of on-chain games, building virtual worlds based on blockchain technology, making the entire world’s rules and operations auditable. The future goal of GameFi development is inevitably on-chain games.

GameFi+?

In the current market, single GameFi projects struggle to gain attention.

Combining with AI, IoT, and other technologies might be the way to break through. Several GameFi+AI projects, such as Colony, Nimnetwork, Futureverse, Palio, and Ultiverse, have broken the deadlock. Palio, for example, received a $15 million investment from Binance Labs to develop and integrate AI technology, showcasing the recognition and enthusiasm of major VCs for GameFi+AI projects. Additionally, combining GameFi with IoT, cloud computing, and other hot trends is also a significant development path.

From Technology, IP Effects, and Playability Perspective

Axie Infinity draws inspiration from Pokémon to develop a pet battle game on the blockchain, while The Sandbox is a blockchain migration of “Sand” and “Sand Evolution,” indicating the limitless development potential of traditional IPs on the blockchain. Despite experiencing severe economic bubbles, Axie Infinity and The Sandbox still have market caps of $800 million and $700 million, respectively, proving their ability to attract genuine users.

Moreover, several game companies plan to introduce blockchain technology into classic games.

- Atari collaborates with The Sandbox to bring classic games like “Centipede” and “Pong” to the metaverse platform, allowing players to use SAND tokens to participate and create experiences based on these classic games.

- Square Enix announced plans to bring its famous game IPs “Final Fantasy” and “Dragon Quest” to the blockchain platform.

- Capcom announced exploration of ways to bring its renowned games “Street Fighter” and “Resident Evil” into the blockchain game field.

In the traditional gaming sector, MOBA games like “League of Legends” and “Honor of Kings” often signify peak stages of game development. In the GameFi field, the breakthrough method is to create a highly playable game with a complete financial system. Whoever can introduce an outstanding game IP first will likely gain a first-mover advantage.

Conclusion

GameFi essentially combines DeFi, NFT, and blockchain games, representing a new stage in the development of blockchain technology and gaming.

- GameFi has evolved through 1.0 and 2.0 eras, transitioning from Ponzi schemes to game ecosystems that attract real users.

- Current blockchain industry hotspots are focused on foundational ecosystem construction like Layer 1 and Layer 2, while GameFi is still gathering momentum.

- The future trends of GameFi 3.0 include “on-chain games” and “GameFi+?”.

- Investing in GameFi requires attention to its IP, playability, and technical aspects, as only GameFi that can genuinely attract players has the potential for long-term development.