Over $200 Million in Liquidations in the Crypto Market: What Caused the Flash Crash?

Last night, the previously stable price movements of cryptocurrencies like Bitcoin and Ethereum abruptly ended, with prices plunging. Bitcoin fell to its lowest level since the panic in early August, nearing $56,000. This drop triggered a new wave of crypto position liquidations, mainly of long positions, leading the market to turn predominantly red.

According to Coinglass, liquidations in the past 24 hours amounted to $222 million, with long positions accounting for $175 million. Of this, $161 million occurred in the last 12 hours alone. Bitcoin saw the highest liquidation amount, exceeding $79 million in the past day, followed by Ethereum, which saw around $70 million in liquidations.

The market has since seen some recovery, with Bitcoin trading around $58,000, Ethereum at $2,580, and SOL at $140.

Decline in Demand for Leveraged Long BTC Futures and Stablecoins May Be the Cause

At present, there seems to be no clear reason for the sharp decline. Following the release of the latest Consumer Price Index (CPI) report on Wednesday evening, U.S. stocks surged, while Bitcoin and Ethereum exhibited significant volatility. This suggests that the decline is unlikely to be related to macroeconomic factors. Some speculate that a decrease in demand for leveraged long BTC futures and stablecoins contributed to Bitcoin’s price drop.

Since August 8, Bitcoin has been trading within a narrow range, unable to break past $62,000 while solidifying support at $58,000. This consolidation reflects increasing uncertainty among traders, particularly as BTC futures funding rates remain negative, indicating low demand for leveraged buying.

Additionally, on August 15, the price of USDT in China dropped by 0.2%, marking the lowest level for this indicator in three months, indicating reduced demand for cryptocurrencies. This contrasts sharply with August 6, when traders were paying a 2% premium for USDT.

Given the BTC derivatives indicators and the declining demand for stablecoins in China, it seems unlikely that Bitcoin will regain support at $62,000. However, historical data suggests that retail traders often react to market movements rather than predicting them, so a breakout cannot be entirely ruled out.

Analysts Are Bearish on Ethereum

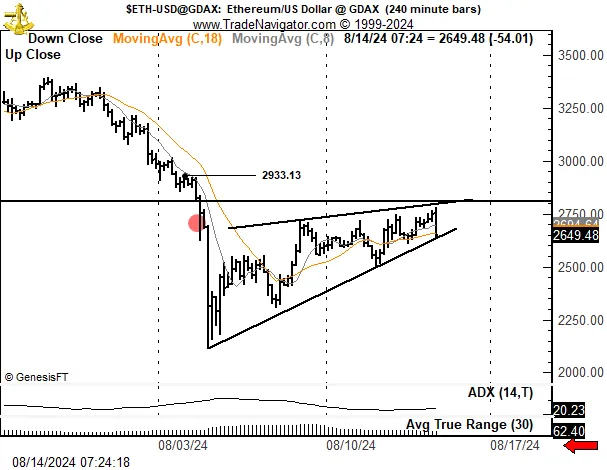

Coincidentally, some analysts had already turned bearish on Ethereum before the market crash, with some predicting a potential drop to a new low near $1,600.

McKenna, a partner at Arete Capital, wrote in an August 15 post on X: “I don’t think ETH will break through $2,800-2,900, but I expect it to range trade for parts of August and September.”

Meanwhile, analyst Peter Brandt suggested that based on two chart patterns, ETH’s price action presents two scenarios: a 5-month rectangle and a rising wedge. The first scenario sees ETH rising above $2,960. The second scenario sees the collapse of the rising wedge continuing the downtrend, with ETH falling to $1,650, the bearish target of the rectangle.

Bitcoin Exhibits a “Bearish Cross”

Anonymous crypto trader Mags noted in a post on X: “Bitcoin’s daily chart has formed a bearish cross, with the 50-day moving average crossing below the 200-day moving average, signaling short-term market weakness.” This is the second bearish cross since Bitcoin bottomed at $15,500. The last bearish cross occurred in September 2023, when the price was around $25,000. Afterward, the price consolidated for several weeks before recovering the MA, leading to a bullish cross and a strong upward rebound.

IG Market analyst Tony Sycamore added: “Bitcoin needs to reclaim the 200-day moving average to stabilize and test the resistance near $70,000 in the trend channel.”

However, trader Mags noted that the death cross might actually be a positive sign. When this occurred in the past, Bitcoin’s price increased by about 50% within four months on both occasions.

In September 2023, Bitcoin’s 50-day moving average crossed below the 200-day moving average when the price was $26,578. Just four months later, the price rose 49% to $39,518.

In July 2021, the 50-day moving average was at $34,671, while the 200-day moving average was at $44,680. Similarly, within four months of the cross, Bitcoin’s price rose by 54% to $54,813.

Despite the Downtrend, Positive Factors Are Emerging

Given the current situation, it’s understandable that bulls are frustrated with the recent market action, as positive catalysts continue to emerge, yet prices have not responded.

The first positive catalyst is the rebound in U.S. stocks. The stock market rally can be partly attributed to the now nearly certain easing cycle by the Federal Reserve. For over two weeks, the short-term rate market has priced in a 100% chance that the Fed’s first rate cut will come in September. Although past monetary easing has proven favorable for cryptocurrencies, prices have yet to respond in this cycle.

Moreover, U.S. inflation in July fell to 2.9%, the lowest annual inflation rate since 2021. Meanwhile, Morningstar’s chief U.S. economist Preston Caldwell stated in a Thursday report that several analysts predict the Fed will introduce “aggressive” rate cuts starting in September to stimulate the U.S. economy.

The U.S. market has also performed strongly recently, with the Nasdaq Composite Index rising 2.34% in the past 24 hours, while the S&P 500 and Dow Jones Industrial Average gained about 1.61% and 1.39%, respectively. Both the Nasdaq and S&P 500 are now back to pre-panic levels from early August.

Another seemingly positive catalyst is the accelerating adoption of Bitcoin by institutions. ETF Store President Nate Geraci noted that the latest batch of 13F filings (as of June 30) shows 1,924 institutional holders of spot Bitcoin ETFs. Geraci pointed out that despite the drop in Bitcoin prices from April to June, this number is still higher than the first quarter’s 1,479.

On the other hand, more publicly traded companies are willing to use capital markets to increase their Bitcoin holdings. Marathon Digital (MARA, already engaged in Bitcoin mining) raised $300 million this week through convertible bonds and immediately used the funds to purchase over 4,000 Bitcoins at around $59,000 each. Medical device manufacturer Semler Scientific (SMLR, which announced its Bitcoin funding plan a few months ago) received approval from the U.S. SEC this week to continue raising over $150 million, with proceeds to be used to purchase more Bitcoin.