Impending Bitcoin Supply Shock: How Will It Affect the Price Surge?

The cryptocurrency market is on the brink of concluding an impressive first quarter of the year. Furthermore, despite bearish pressures, market sentiment remains bullish as tokens approach their highs. Despite growing optimism about Bitcoin’s price, technical indicators suggest the token could once again fall prey to bears.

The question is, can the bulls maintain momentum above critical support levels? To understand this, let’s delve into the demand and supply dynamics of Bitcoin!

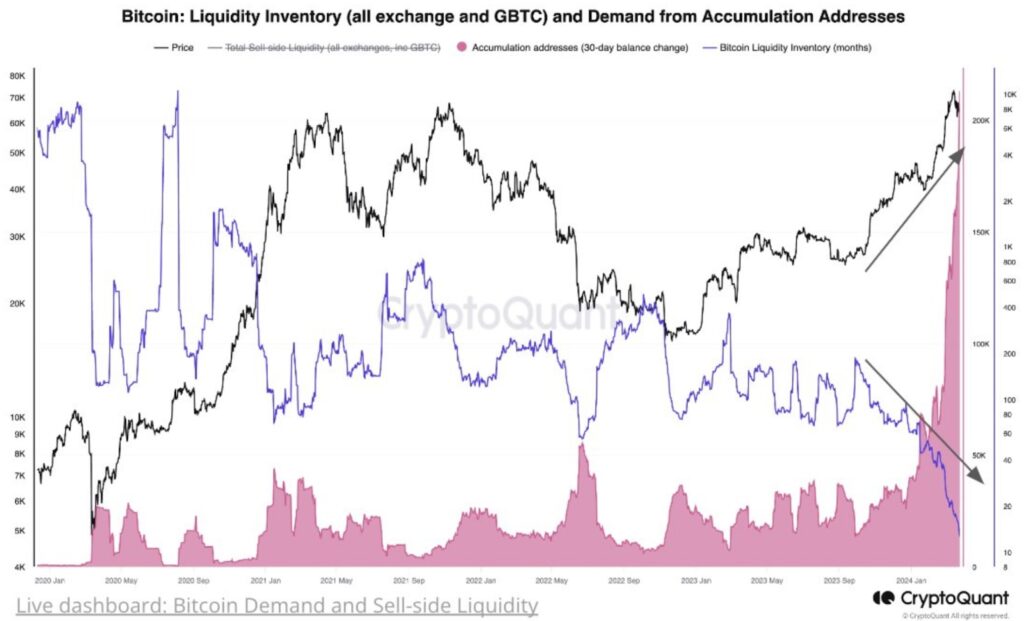

This year has seen a surge in demand for Bitcoin, thanks largely to the launch of spot ETFs earlier in the year. According to analysis by CryptoQuant, Bitcoin’s supply and demand dynamics are expected to undergo significant changes by the first quarter of 2025. Additionally, popular on-chain platforms indicate that seller liquidity has drastically decreased with rising demand, bringing liquidity inventories to their lowest levels.

Data from CryptoQuant shows that the total Bitcoin reserves on all exchanges have reached 1.92 million Bitcoin, hitting a new low for the past three years. In other words, Bitcoin’s price may still have more room to run as the supply of Bitcoin on exchanges is at a historic low, while the demand for exchange-traded funds (ETFs) has attracted billions of dollars in capital inflows.

This suggests that the current supply may not meet the demand in the coming months, as exchanges continue to run out of stock. Recently, there was a significant drop in BTC reserves on Coinbase, and other exchanges may follow suit. Therefore, with the decrease in supply and increase in demand, Bitcoin’s price is expected to rise.

Since the previous day’s trading, Bitcoin’s price has been hovering within a narrow range, with equal participation from both bulls and bears. From a broader perspective, the price seems to be testing new highs near $74,000. If the bulls can withstand some bearish pressure, then the token may continue to rise.

Otherwise, the rejection here could lead to the formation of a double-top pattern, which is unfavorable for bullish scenarios.