In-depth Analysis of Prediction Markets: Polymarket, SX Bet, Pred X, and Azuro

Prediction markets are open markets that use financial incentive mechanisms to predict specific outcomes. These markets are trading platforms established to trade bets on the outcomes of various events. Market prices can reflect public perceptions of the likelihood of these events occurring.

A typical prediction market contract trades within a range of 0% to 100%. The most common form of prediction market is the binary options market, where the price at expiration is either 0% or 100%. Users can also sell options before the event occurs, exiting at the market price.

Through prediction markets, we can extract the public’s expectations for future outcomes from the value expressed by participants betting on an event. Traders with differing beliefs will reflect their confidence in possible outcomes through trading contracts, and the market price of these contracts is considered to aggregate collective belief.

The history of prediction markets is long, nearly as long as the history of human gambling. Prediction markets seem to have a historical connection with politics: in the Middle Ages, people were keen to bet on predicting the election of the Catholic pope.

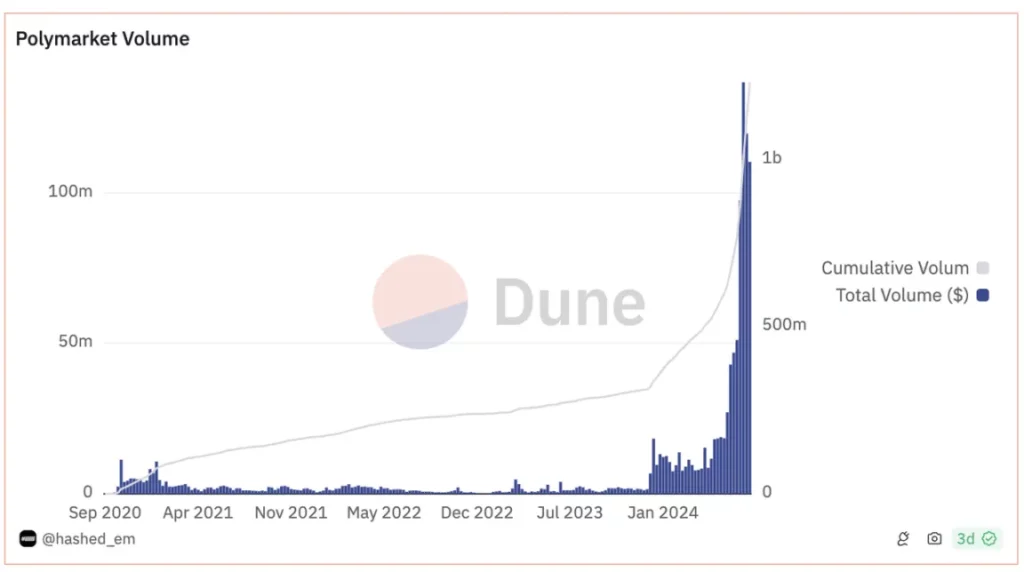

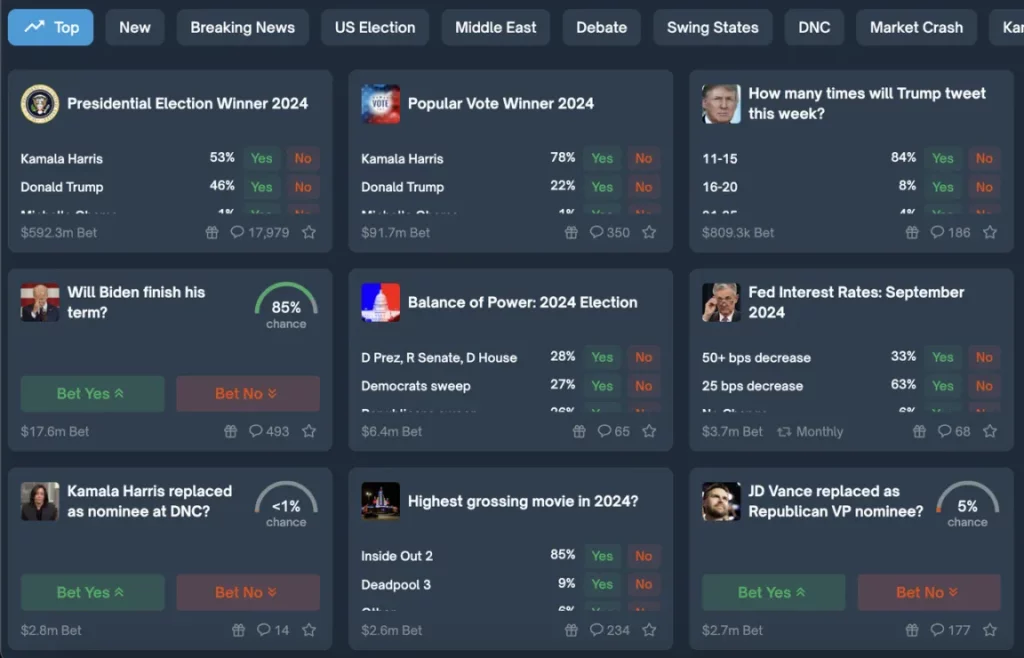

As the U.S. presidential election approaches, interest in political betting surged in July with events like Trump’s assassination attempt, Biden’s potential withdrawal, and the Democratic Party’s consideration of replacing Harris as the nominee. Prediction markets like Polymarket have gained widespread attention.

Polymarket: Order Book-Based Tradable Prediction Market

Polymarket is a decentralized prediction market project founded by Shayne Coplan in 2020, supported by renowned institutions and angel investors like Polychain Capital, Founders Fund, and Vitalik Buterin.

Polymarket allows users to trade on controversial global topics (e.g., politics, sports, pop culture) and build portfolios based on their predictions.

Unlike traditional sports betting, Polymarket allows users to freely trade shares while the market topic is still undecided, enabling speculators to participate flexibly in probability games.

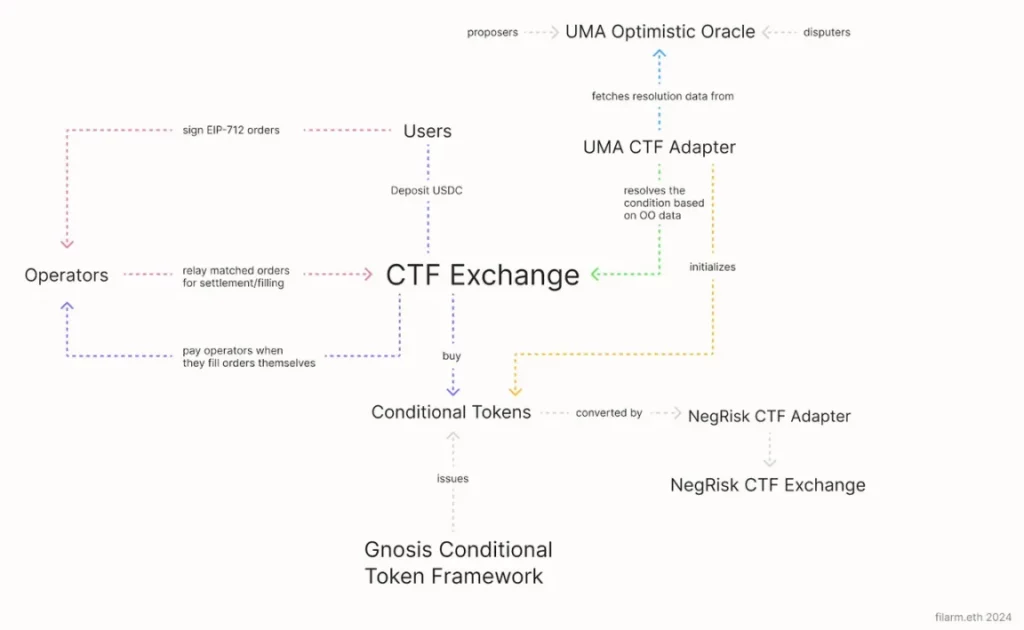

Polymarket uses the Conditional Tokens Framework (CTF) based on Gnosis. For every $1 of ERC20 tokens like USDC staked, two conditional tokens are created, representing the two possible outcomes of the event (Yes or No). The multi-outcome market aggregates multiple binary outcome markets.

The prices of these conditional tokens fluctuate due to trading demand in the market. Users can buy or sell through the order book at any time, or wait until the event concludes, where holders of the correct token receive the entire $1 payout.

Since the two tokens trade independently in a market similar to a centralized exchange (CEX), their combined price may not equal $1. This discrepancy necessitates the involvement of market makers to equalize the difference. Therefore, at any time before the event concludes, users can redeem $1 by exchanging one of each token in the contract.

Polymarket’s prediction market is generally composed of the following components:

- Market Topic: Each prediction on Polymarket focuses on a specific topic or event. While users can submit new market proposals via Polymarket’s Discord, Polymarket has discretion over which markets to create due to the complexity of wording.

- Oracle: The outcome of an event usually requires human input into the oracle. Polymarket uses the UMA Optimistic Oracle, allowing anyone to submit a resolution. If no one challenges the resolution within a certain time, it is accepted as fact. In rare cases, when disputes arise, the oracle’s decision is made by UMA token holders.

- Conditional Tokens: As mentioned earlier, by locking $1, users receive “Yes” and “No” conditional tokens. At market settlement, holders of the winning token receive the entire $1. The “Yes” and “No” tokens are freely tradable in the market, with prices indicating probabilities. Polymarket uses the Conditional Tokens Framework (CTF) developed by Gnosis, built on the ERC1155 token standard.

- Order Book Market: Polymarket’s market is a hybrid on-chain order book trading mechanism, similar to dYdX v3. Users authorize transactions via signatures, with operators matching orders off-chain and interacting with contracts on-chain. Contracts handle non-custodial settlement, performing atomic swaps between binary result tokens and collateral assets, ensuring that operators do not control the staked $1.

- Liquidity Providers: Unlike sports betting, Polymarket allows free trading of conditional tokens before the outcome is decided, with prices determined by supply and demand rather than mechanisms. Token prices may deviate (the sum of the two token prices may not equal $1). Therefore, anyone can profit by placing limit orders and earning fees from the bid-ask spread. Polymarket also provides additional USDC incentives.

Polymarket has not indicated plans to issue tokens or actively incentivize users through a points program. Nonetheless, Polymarket has distributed over $3 million in USDC this year through its liquidity reward program to incentivize market-making activities, aiming to improve overall platform liquidity. Currently, the highest-volume markets pay around 600 USDC daily to liquidity providers.

SX Bet: Single Bet Prediction Platform

SX Bet is an Ethereum-based sports betting platform founded in 2019, currently operating on the SX Chain built on Arbitrum Orbit Rollup.

SX Bet mainly supports betting markets focused on sports topics, including major events in tennis, football, baseball, and basketball. Recently, new betting categories have been added, including Crypto, Degen Crypto, and Politics, with bets centered around the price trends of mainstream crypto assets, on-chain meme coins, and the outcome of the U.S. presidential election.

Unlike Polymarket, SX Bet only supports single bets, following the traditional sports betting model, with no free trading of bets before the outcome is determined.

SX Bet’s innovation lies in its introduction of a parlay betting system, where users can predict a series of events and win payouts only if all predictions are correct. Parlay payouts are often substantial, acting as leverage in prediction markets. SX Bet’s market acts as the counterparty to these trades.

This type of parlay betting resembles a lottery, often offering returns up to tens of thousands of times the initial bet. The success stories can easily go viral, making this the most exciting aspect of traditional sports prediction markets.

Clearly, Polymarket and all prediction markets based on the “dual-token” conditional framework cannot achieve parlay betting. This is because contracts cannot mint a conditional token for every possible result combination and ensure it can be freely traded with sufficient liquidity. The limited odds in prediction markets with only two outcomes may not attract users as much.

Pred X: AI-Driven Prediction Market

Pred X is a prediction market initially based on the Sei blockchain, covering various topics such as politics, cryptocurrency price predictions, and popular events. Currently, the platform supports betting with USDC on multiple blockchains like Base, Linea, Sei, and Bitlayer, and has launched a corresponding Telegram mini-app.

The PredXFun (@PredxFantasyBot) Telegram app offers two modes: a game mode where users earn points by predicting the probability of hot events and a real mode where users can link their wallets to participate in similar topics on the official website.

Unlike Polymarket, where prediction market topics are mainly generated by user proposals in Discord, most of Pred X’s prediction topics are automatically generated by Aimelia AI, which crawls popular news and market sentiment indices from the internet and pushes them to the Pred X website, where users spontaneously form trading markets.

Despite supporting multiple blockchains, Pred X is not a fully decentralized prediction market application. The prices corresponding to different outcomes for each prediction topic are determined by the platform’s centralized order book, while the ordering process and each prediction topic’s market are implemented according to smart contract rules.

Objectively, Pred X is still an immature platform compared to other prediction markets. The order book depth and betting volume for available topics on the site are far below that of Polymarket and SX Bet.

As a prediction market, it should support free trading of tokens for different outcomes before the event is revealed. Unfortunately, Pred X’s order book does not allow users to place orders freely. In most markets lacking market makers, users cannot freely trade result tokens.

Moreover, the documentation does not clearly explain how consistency across different chain-based market contracts is ensured or how sufficient liquidity for all probability result tokens across chains is guaranteed.

When trading in the “real mode” by connecting a wallet in the Telegram mini-app, there are price discrepancies between the same topic’s prediction market and the official website.

These conditions raise doubts about the practical usability and reliability of Pred X. Overall, this product currently feels more like a half-finished product.

Azuro: Liquidity Pool-Based Betting Protocol

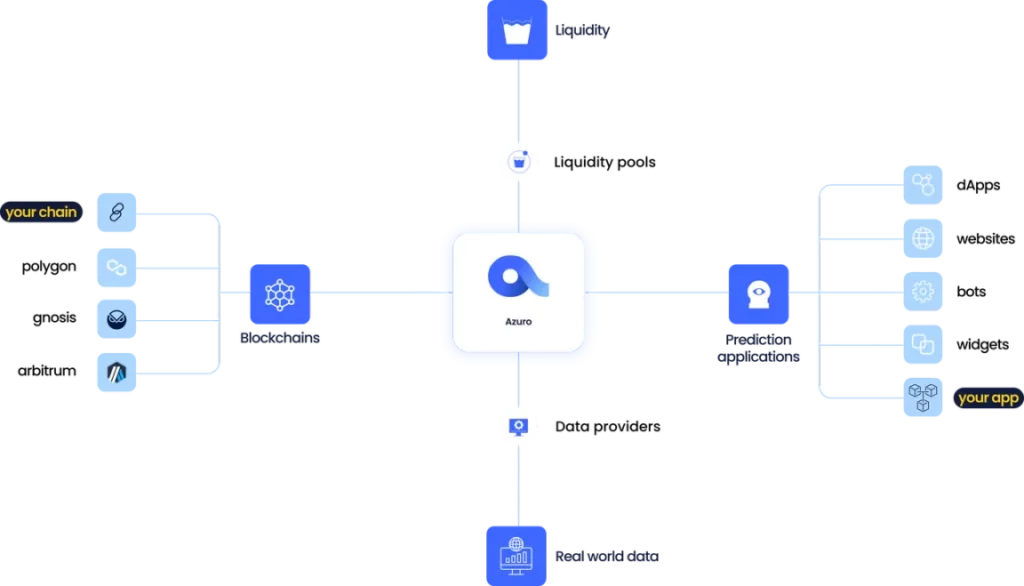

Azuro is not a prediction market itself but a foundational protocol for creating on-chain prediction markets. This permissionless infrastructure includes on-chain smart contracts and web components, allowing multiple prediction market applications to be built on Azuro. All betting platforms built on Azuro can be found on its website.

Azuro only supports single bets and does not allow free trading of “Yes” and “No” tokens like Polymarket. Users can only receive payouts after the result is announced.

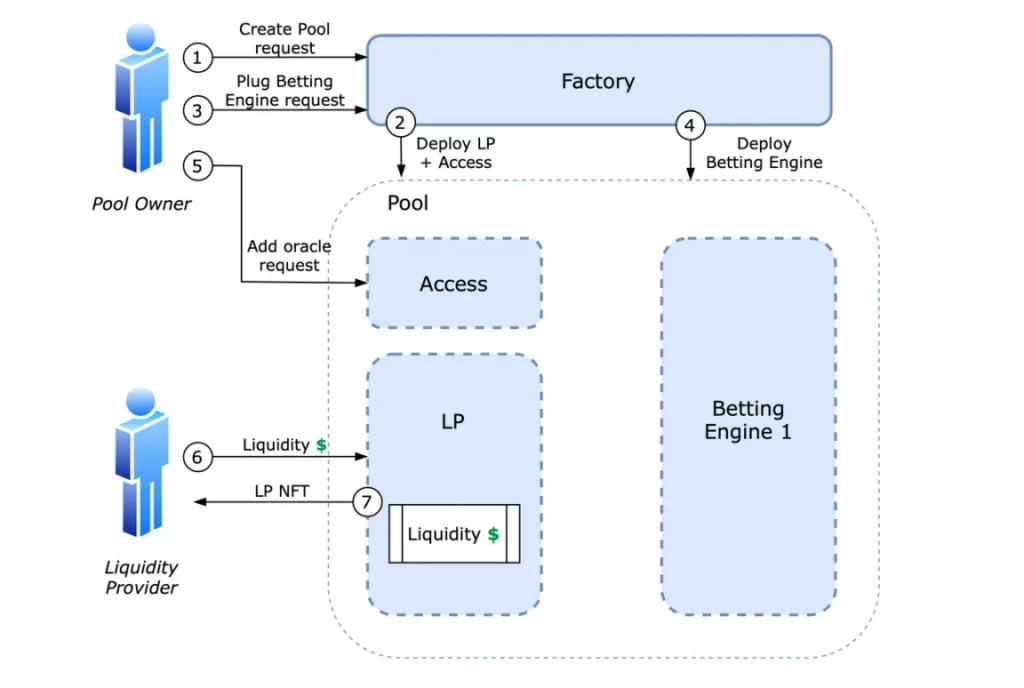

The Azuro system is built around liquidity pools, allowing anyone to deploy their own liquidity pool by interacting with Azuro’s factory contract. Multiple betting platforms can be created under one liquidity pool, and multiple possible events can be established under different prediction topics within each platform for betting.

In prediction markets like Polymarket, where liquidity is isolated and segmented across multiple different prediction events, Azuro introduces the concept of a liquidity tree, where multiple events under a prediction topic, and even multiple topics across multiple betting platforms, can share the same liquidity pool.

The liquidity tree offers a hierarchical structure, with different possible events delineating liquidity ranges, such as multiple possible scores in a football match.

These liquidity funds ensure the platform’s ability to act as a counterparty to bettors at different odds. With adequate liquidity, the platform can absorb a significant portion of the risk posed by predictions with large payouts.

An innovative aspect of Azuro is the introduction of oracles such as Chainlink and Witnet, allowing for decentralized resolution of event outcomes.

If the event’s result is not within the scope of the oracle’s ability, Azuro encourages betting platforms to establish an unbiased DAO-like governance system to resolve the result. Although not ideal, it minimizes the need for direct centralized intervention in determining outcomes.

Conclusion: Innovation and Diversification in Prediction Markets

Prediction markets are evolving, with various platforms offering different mechanisms, from Polymarket’s free trading system to SX Bet’s traditional single-bet approach and Azuro’s liquidity pool-based protocol. Each platform has its unique strengths, catering to different types of users, from serious traders to casual bettors. As the space matures, we can expect more innovation, particularly in areas like decentralized oracles and AI-driven markets.