Story Raises $140M: Why Is It a16z’s New Favorite?

On August 21, Story, an L1 platform focused on intellectual property (IP), announced the completion of its $80 million Series B funding round, led by a16z. Other participants included Polychain Capital, as well as individual investors like Stability AI’s SVP and board member Scott Trowbridge, K11 founder and billionaire Adrian Cheng, and digital art collector Cozomo de’ Medici. With this round, added to the $29.3 million seed round and $25 million Series A—both also led by a16z—Story’s total funding has reached $140 million.

This massive funding amount has shocked many in the industry, leading to some skepticism. As X user @wsjack_eth questioned, “Can an ERC-6551 protocol really support such a grand narrative?” In the current tough primary market, is Story’s emergence a true signal of change or just a product of capital orchestration?

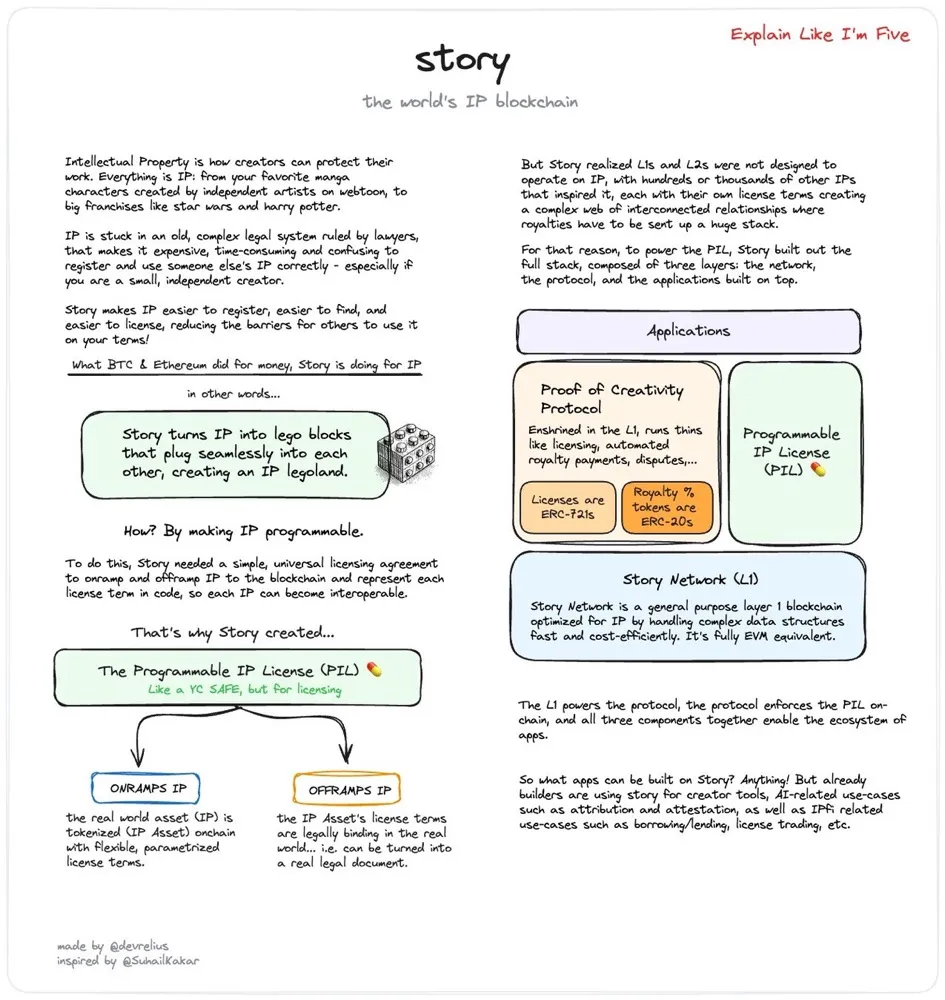

Story’s Technology Stack

To better understand, I reviewed Story’s technical documentation. In summary, Story plans to improve the time-consuming and costly reliance on traditional legal systems for IP in the Web2 world through three technological layers: the Story Network (L1), Proof-of-Creativity Protocol (smart contracts), and Programmable IP Licensing, aiming to achieve its ultimate goal of “IP Lego.”

Specifically, the Story Network is an EVM-compatible L1 designed to process complex data structures like IP quickly and cost-effectively. It uses precompiled primitives to traverse these structures in seconds at marginal costs and ensures fast finality and low-cost transactions through a consensus layer based on the mature CometBFT protocol stack.

The Proof-of-Creativity Protocol consists of various smart contracts that handle modules related to IP licensing, royalties, and disputes. This protocol is natively deployed on the Story Network, allowing creators to register their IP as “IP Assets” (IPA), each composed of an on-chain NFT and an associated IP account, which is based on ERC-6551 (token-bound accounts).

Additionally, Programmable IP Licensing (PIL) aims to create a mapping between on-chain contracts and real-world legal terms, allowing creators to move tokenized IP into off-chain legal systems and write specific terms, such as how their IP can be mixed, monetized, and used to create derivatives.

Many industry insiders have pointed out that Story’s technology stack is not particularly complex and does not introduce any new concepts. So, what has allowed Story to secure such massive funding? Some insights can be gleaned from an investment article by a16z partner Chris Dixon.

Investing in People

First is the background of the Story team. According to Chris Dixon, the Story founding team “possesses deep expertise in both technology and creativity.” The a16z team was “impressed by the visionary insight and world-class tactical execution” of CEO and co-founder Seung Yoon Lee when they first met him three years ago.

Information from the Berggruen Institute indicates that Seung Yoon Lee graduated from Oxford University and was the first Asian president of the Oxford Union. He also created the mobile novel app Radish Fiction, which received backing from SoftBank, UTA, and Bertelsmann before being acquired by South Korea’s Kakao for $440 million in 2021.

Lee then served as Kakao’s Global Strategy Officer, overseeing global investments and M&A activities. Additionally, Lee is a venture partner at Hashed, the largest blockchain fund in Korea, and a fellow of both the Asia 21 Young Leaders and the Trilateral Commission. In 2016, Lee was selected as a Forbes Asia 30 Under 30 inaugural member and later named an All-Star alum.

According to @jason_chen998, Seung Yoon Lee also worked in both the South Korean National Assembly and the U.S. House of Representatives, and for two newspapers, “holding cards in government, media, and capital.”

Another co-founder, Jason Zhao, who currently leads Story’s technical development, also has an impressive resume. He graduated from Stanford University with a degree in computer science and later worked at DeepMind.

The saying “invest in people” certainly applies here. Besides the strong background of the founding team, a16z’s investment philosophy also plays a role in their decision to back Story.

Ownership: A Shared Focus for Story and a16z

As a leader in Web3 narratives, a16z has published many deep insights on the subject. From Chris Dixon’s descriptions of Web3 as “read, write, and own,” it’s clear that they place a high value on ownership. Dixon notes in his investment article that “for decades, the internet maintained an implicit economic contract between creators and platforms—creators supply the content, and platforms provide demand.”

However, “the development of generative AI could break this contract,” significantly harming creators’ interests. Story, with its goal of protecting creators’ ownership rights, may have resonated with Dixon’s values. As Jason Zhao explained when discussing why they built Story as an L1, “the next generation of blockchain infrastructure needs to be ‘purpose-built’,” and a16z values Story’s vision more than its technology.

Other Possible Factors

Aside from its tech stack, founding team, and investment philosophy, other factors could also be at play. @akiaeki suggests that Story likely holds strong connections in the Korean entertainment industry. Given the global influence of “K-pop” (though they jokingly add that “C-pop is actually the best”), if Story can bring various K-pop IPs into the crypto world, its impact would be significant.

As @jason_chen998 speculated during Story’s Series A, the traditionally fervent Korean crypto traders may crown a new king after Do Kwon’s downfall.

The Power of IP

As is common in the crypto industry, whether Story’s $140 million in funding is inflated remains uncertain. However, considering the vast potential of the IP industry, a valuation of $2.25 billion might be reasonable if Story succeeds—after all, “one Iron Man can save the entire Marvel universe.”

According to data from Wiki&Mili, the top 50 most profitable IPs globally in 2023 generated significant revenues, with the “Pokémon” IP bringing in $88 billion for The Pokémon Company and Nintendo.

However, in an interview with Fortune, Jason Zhao mentioned that Story is unlikely to attract IP giants like Disney. The platform is designed to appeal to “secondary IP” creators. Zhao stated, “This generation of creators using AI tools are like influencers who weren’t initially valued by traditional brands.” “It’s similar to YouTube, which didn’t rely on big directors like Spielberg, but on YouTubers uploading videos from their phones. Fifteen years later, YouTube produced ‘MrBeast’.”

Whether Story can become the “YouTube” that Jason envisions remains to be seen. Notably, after the funding announcement, the floor price of the NFT that Story released in honor of ETHDenver 2024 multiplied several times. Jason Zhao told The Block that Story’s mainnet is expected to launch later this year. When asked whether they would issue a token alongside the mainnet launch, Zhao declined to comment.