Why High FDV Is Prevalent and How to Address It

In Greek mythology, Icarus and his father Daedalus crafted wings made of feathers and wax to escape from the labyrinth of King Minos. Daedalus warned his son: flying too low would wet the wings, and flying too high would cause the sun to melt the wax.

Ignoring his father’s advice, Icarus soared higher, exhilarated by flight, only to have his wings melt from the sun’s heat, leading to his fall into the sea. The moral of this story is that excessive arrogance often results in failure.

A similar scenario is unfolding in the current cryptocurrency cycle. Like Icarus, many crypto projects are drawn to the allure of inflated valuations. Both Icarus and these projects fall victim to unsustainable promises and exaggerated valuations, leading to their eventual downfall.

Why FDV Is Popular

Several factors contribute to the prevalence of Fully Diluted Valuations (FDV) in the crypto space:

- Anchoring Bias: This cognitive bias leads decision-makers to base their judgments on an initial reference point. If project founders believe their venture is worth $1 billion, they might launch it with a $10 billion FDV, creating an anchored perception of value in the market. Even if the token price drops by 90%, it’s still considered within their expected range.

- Venture Capital (VC) Valuations: The influx of VC funding in 2021-2022 led to inflated private market valuations. VCs entered at high valuations, but the public market often rejected these figures. To avoid launching tokens below the last round’s valuation, projects sought higher FDV at the token’s public launch.

- Incentives and Treasury: A $10 billion FDV provides a project with the resources to attract top talent, offer ecosystem grants, and partner with other projects by using this “paper wealth” to drive growth.

- Supply Distribution: Regulatory crackdowns, particularly from the SEC, have made token distribution to communities more challenging. Airdrops and incentive mechanisms struggle to allocate significant portions of token supply early on, which remains a key obstacle in the industry.

- OTC Trading and Hedging: While large-scale operations are complex, inflated valuations can lead to over-the-counter (OTC) trading discounts or hedging to cash out.

- Illusion of Success: There’s a psychological tendency to associate higher valuations with success. A higher FDV creates an “illusion of success,” attracting more participants.

These factors collectively drive the trend of low circulating supply but high FDV in crypto projects.

How High FDV Happens

If you create a token, say Token A with a supply of 1 billion, and pair it with 1 USDC on a Uniswap pool, its technical price is $1, resulting in a $1 billion FDV. However, this valuation is purely artificial; the token’s real value is still minimal.

This principle also applies to high FDV tokens, where only a small portion of the total supply is in circulation. After the initial airdrop, the remaining supply is held by market makers and large investors who can influence the price. Thus, even a small capital can result in a $1 billion FDV.

Drawbacks of High FDV

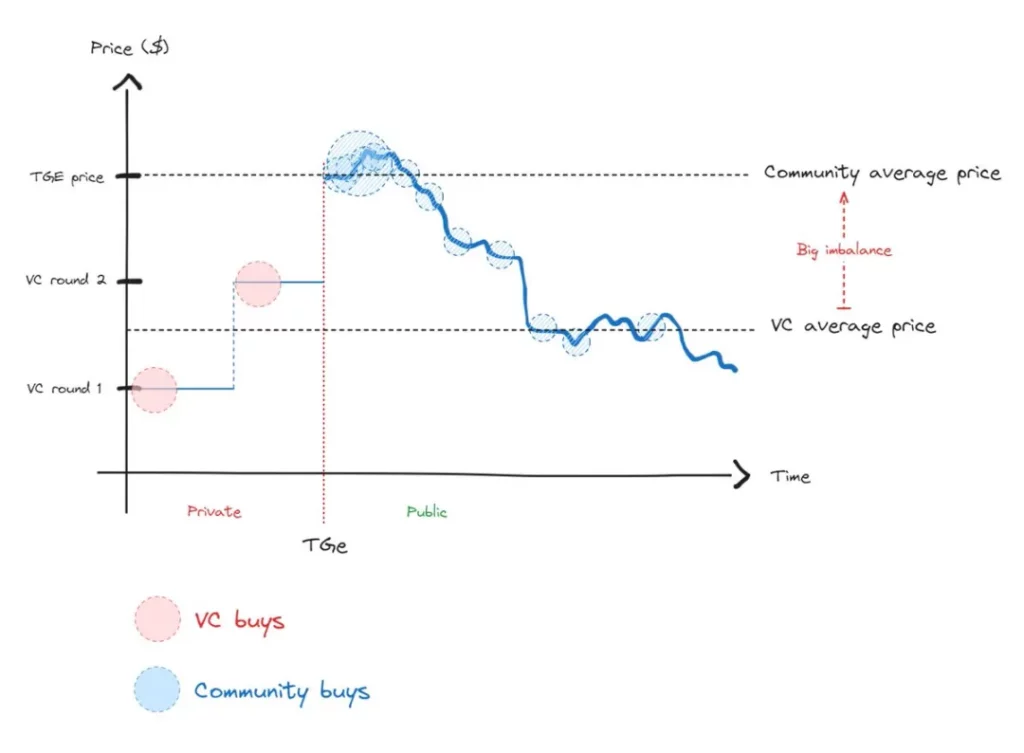

High FDV creates a significant imbalance between token buyers at Token Generation Event (TGE) and private investors, leading to persistent tensions until a mean reversion occurs.

TGE buyers often find themselves at a loss immediately after purchase, while VCs are incentivized to sell once their tokens unlock. This pattern, once recognized by community buyers, leads to disinterest, explaining why there has been a lack of enthusiasm for new altcoins recently.

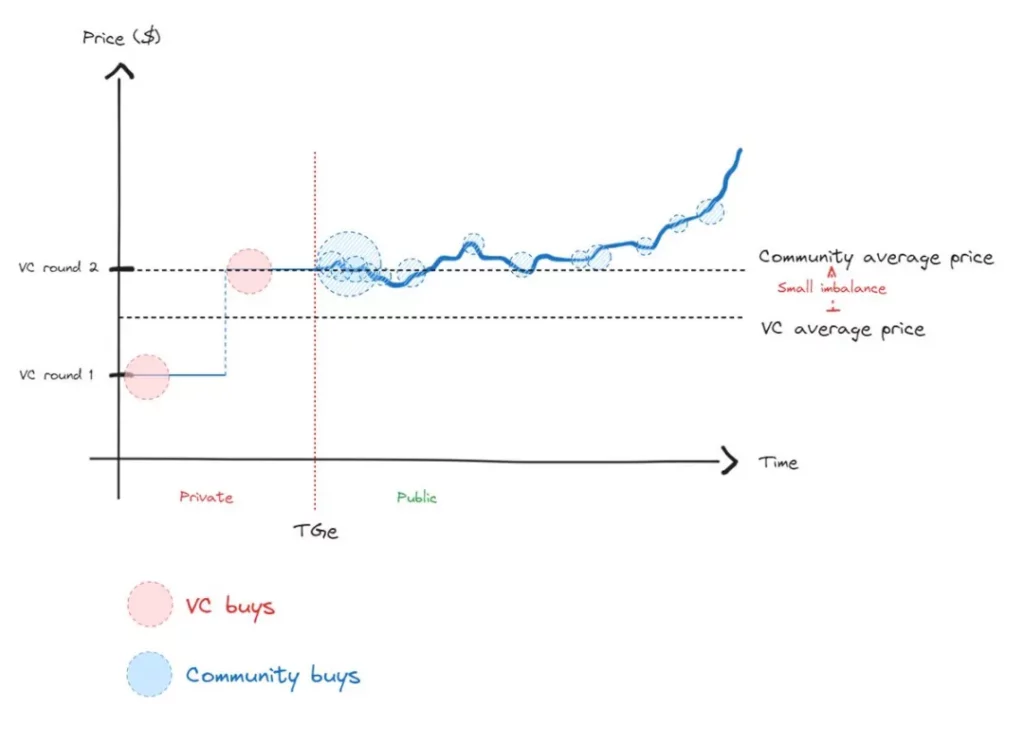

A healthier scenario would be one where the price disparity between community members and VCs is smaller, allowing for genuine price discovery.

In an efficient market, price discovery is essential. While prices can be manipulated temporarily, they will inevitably return to their true value. However, this path dependence means that the journey back to equilibrium can be prolonged and more painful than starting from a balanced state.

Takeaways

From the myth of Icarus, one crucial lesson is to avoid flying too low. Just as flying too low could have dampened his wings, launching a token at an undervalued price can hinder its growth potential.

It may deter partners, make it difficult to retain talent, and reduce the chances of success. Waiting until a project is mature before launching a token is just as important as avoiding a high FDV.

Key Points

- FDV Isn’t a Gimmick: Avoid launching tokens with an inflated FDV. Like Icarus, trying to manipulate the game with artificial valuations can backfire in the long run. For liquid investors, high FDV tokens are often seen as a red flag—they tend to avoid or even short over-inflated assets.

- Raise VC Funds Wisely: Only raise capital when necessary, and align it with your growth strategy. Choose VCs based on their partnership potential, not just the highest valuation. Avoid the pressure of unsustainable valuations.

- Don’t Launch Tokens Prematurely: Ensure that there are clear signals of product-market fit (PMF) before launching a token. Don’t launch solely for a high FDV in private markets.

- Token Distribution: To enable effective price discovery, maximize the circulating supply at launch. Aim for 20% to 50% of the total supply, rather than just 5%. However, current regulatory challenges might make this target difficult to achieve.

- Engage with Liquidity Funds: Liquidity funds play a critical role in price discovery post-TGE, as they take on the project’s risk after launch—not VCs. Their involvement is essential for a balanced and sustainable market.

By addressing the issues of high FDV, crypto projects can avoid the fate of Icarus and create more sustainable ecosystems for long-term success.