Has the Window of Opportunity for Infrastructure Passed?

In previous crypto cycles, the most lucrative returns on investment were often achieved by betting early on new foundational infrastructure primitives like PoW, smart contracts, PoS, high throughput, and modular systems. A look at the top 25 tokens on CoinGecko shows that only two aren’t native tokens of Layer 1 (L1) blockchains: Uniswap and Shiba Inu.

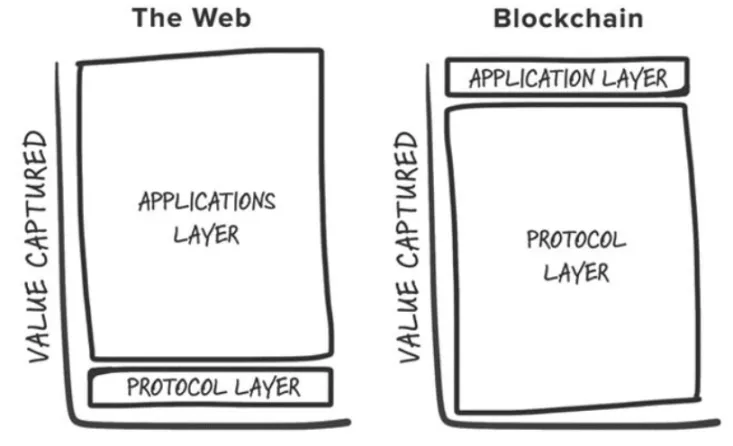

This observation aligns with Joel Monegro’s 2016 “Fat Protocol Theory,” which suggested that in Web3, the foundational layers accumulate more value than the applications built on them. This value accumulation occurs because:

- Blockchains share a common data layer where transactions are settled, promoting positive-sum competition and permissionless composability.

- Token appreciation attracts speculative participants, who turn into users, which in turn draws developers, creating a positive feedback loop.

Fast forward to 2024, and the original thesis has faced challenges due to shifts in the industry. These developments question whether the “Fat Protocol” model still holds.

1. The Commoditization of Block Space

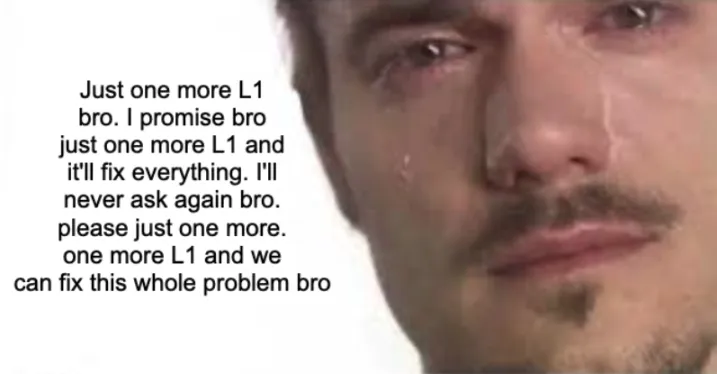

With the premium on Ethereum block space, competitive L1s have emerged and defined their own market category. These L1s often achieve billion-dollar valuations and attract builders and investors in every cycle, offering new “differentiated” blockchains.

However, many ultimately turn into “ghost chains,” like Cardano. Despite some exceptions, this trend has led to an oversupply of block space without enough users or applications to support it.

2. Modularization of the Base Layer

As modular components multiply, defining the “base layer” becomes increasingly complex, as does understanding where value accumulates within the stack. Modular blockchains spread value across the stack, and individual components, such as Celestia, must achieve higher valuations by becoming the most valuable component in the stack (e.g., Data Availability) and drawing more applications.

Additionally, competition between modular solutions has driven down execution and data availability costs, further reducing user fees.

3. The Move Toward a “Chain-Agnostic” Future

The modular nature of blockchain has created a fragmented ecosystem, leading to a cumbersome user experience. Developers face too many choices about where to deploy, and users encounter barriers when moving between different chains.

The future lies in a “chain-agnostic” model, where users interact with crypto applications without being aware of the underlying chain. But in such a future, where will value accumulate?

It’s becoming clearer that crypto applications stand to benefit most from this infrastructural shift. In particular, transaction supply chains centered on user intent, exclusive order flow, and intangible assets like user experience and brand will become the new moats for killer apps, enabling more efficient monetization.

Exclusive Order Flow

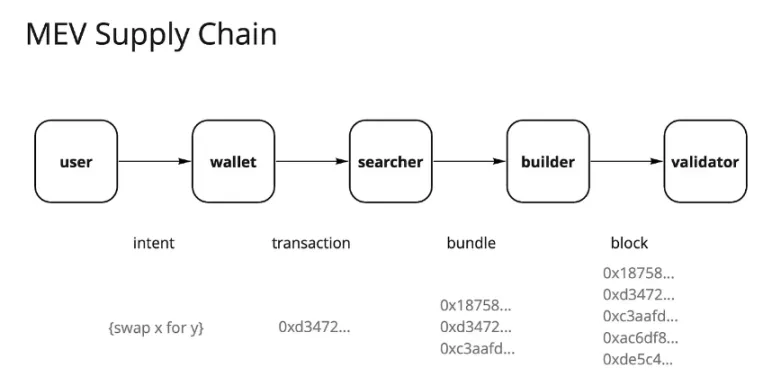

Since Ethereum’s Merge and the introduction of Flashbots and MEV-Boost, the landscape of Maximal Extractable Value (MEV) has changed dramatically. Once dominated by searchers in the “dark forest,” it has now evolved into a partially commoditized order flow market, primarily controlled by validators. Validators capture roughly 90% of the MEV as bids from other participants in the supply chain.

This centralization of value capture within validators has caused discontent among many other players in the transaction supply chain. Users want compensation for generating order flow, apps aim to retain value from their users’ order flows, and searchers and builders seek higher profits.

As a result, these actors have adapted by implementing various strategies to extract alpha. One such strategy is the searcher-builder integration. The more certainty searchers have that their block will be included, the more profit they generate. Data shows that exclusivity is key to capturing value in competitive markets, and applications with the most valuable order flows hold pricing power.

This is similar to Robinhood’s business model. Robinhood sells order flow to market makers in exchange for rebates, enabling its “zero-fee” trading model. Market makers like Citadel are willing to pay for order flow because they profit from arbitrage and information asymmetry.

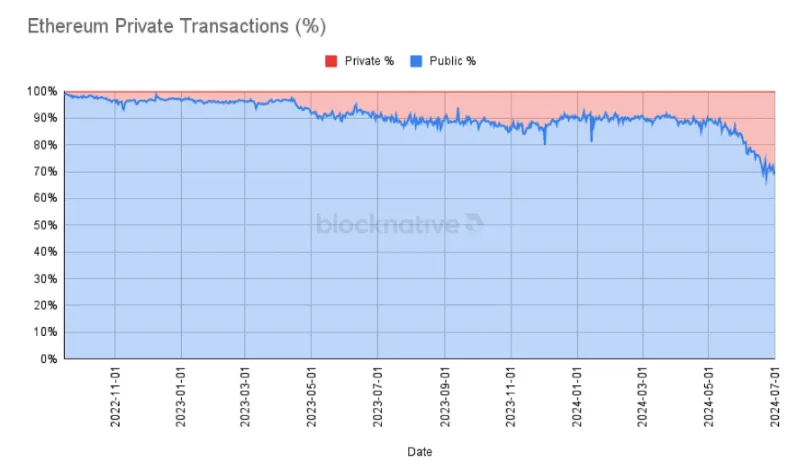

More and more transactions are now routed through private mempools, recently reaching a historic high of 30% on Ethereum. Applications are beginning to realize that user order flow has significant value, and private transactions allow for greater customization and monetization around sticky users.

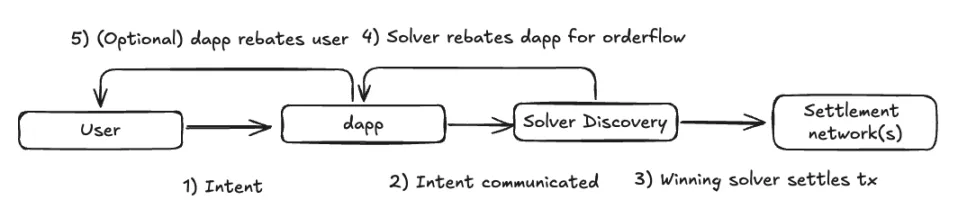

As we move into a chain-agnostic future, this trend is likely to continue. In an intent-driven execution model, the transaction supply chain may become even more decentralized. Applications could route their order flows to resolver networks offering the most competitive execution, driving competition between resolvers and lowering profit margins.

However, most value will likely shift from the base layer (validators) to the user-facing layer, where middleware components remain valuable but have thinner profit margins. Frontends and applications generating valuable order flows will hold pricing power over searchers and resolvers.

We are already seeing this trend with niche forms of order flow, such as Oracle Extractable Value (OEV) auctions from protocols like Pyth, API3, and UMA Oval, where lending protocols are reclaiming liquidation bid order flow that would otherwise flow to validators.

User Experience and Brand as Sustainable Moats

When analyzing the 30% of private transactions mentioned above, they mostly originate from frontends like Telegram bots, decentralized exchanges (DEXs), and wallets.

Although crypto-native users are often assumed to be highly fickle, we’re starting to see some degree of user retention, proving that both user experience (UX) and brand can serve as meaningful moats.

- User Experience: Alternative frontends that offer a unique user experience by connecting wallets through web applications are drawing the attention of users who prefer specific features. A good example is Telegram bots like BananaGun and BONKbot, which have generated over $150 million in fees, allowing users to trade meme coins comfortably within Telegram chats.

- Brand: Established brands in crypto can leverage their reputation to command higher fees. For instance, in-wallet swaps, despite being known for their high fees, remain a killer business model because users are willing to pay for convenience. MetaMask swaps generate over $200 million in annual fees. Uniswap Labs’ frontend fees have earned $50 million since launch, despite users being able to interact with Uniswap contracts through alternative methods without paying these fees.

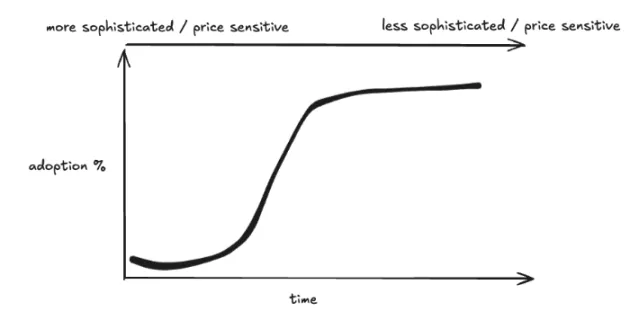

This suggests that the Lindy effect (the longer something has survived, the longer it is likely to survive) applies to applications, potentially even more so than infrastructure. As crypto adoption follows the S-curve from early adopters to mainstream users, the next wave of users will likely be less savvy and more sensitive to user experience than price, allowing brands that reach critical mass to monetize in creative ways.

Conclusion

As a crypto practitioner focused primarily on infrastructure research and investment, this article is not intended to diminish the value of infrastructure as an investable asset class. Rather, it highlights a shift in thinking when considering new infrastructure categories. These infrastructure layers will enable the next generation of applications to serve users climbing the adoption S-curve.

New infrastructure primitives need to unlock novel use cases at the application layer to capture enough attention. At the same time, there’s growing evidence of sustainable business models at the application level, where user ownership directly drives value accumulation. We may be past the phase where betting on every shiny new L1 generates exponential returns, although those with meaningful differentiation could still be worth investing in.

That said, I continue to devote significant thought to understanding various infrastructure layers:

- AI: The emerging agent economy that automates and enhances end-user experiences, computation and reasoning markets for optimizing resource allocation, and the validation stack for expanding blockchain VM compute capabilities.

- The CAKE Stack: I strongly believe we should be moving toward a chain-agnostic future, as discussed in many of my points above. There are still significant design choices to be made around most components of the stack. As infrastructure supports chain abstraction, the design space for applications naturally expands, blurring the lines between applications and infrastructure.

- DePIN: For a while now, I’ve viewed DePIN as a killer real-world use case for crypto (second only to stablecoins). DePIN leverages everything crypto excels at—permissionless coordination of resources via incentives, marketplace creation, and decentralized ownership. While there are still challenges unique to each type of DePIN network, solving the cold-start problem is a massive opportunity, and I’m excited to see founders with industry expertise bringing their products to the crypto space.