Understanding Puffer UniFi AVS: The Next Decade for Ethereum

On September 16, Puffer officially announced its Ethereum security infrastructure product, UniFi AVS, a proactive validation service (AVS) based on EigenLayer. This service addresses the challenges of pre-confirmations (Preconfs) in the Ethereum ecosystem, especially within the Based Rollup domain, aiming to unlock the full potential of Based Rollups.

While many users may associate Puffer solely with its liquidity re-staking platform, the company has evolved into a decentralized infrastructure provider for Ethereum since August. Its product architecture can be summarized as a “three-horse carriage”: the Based Rollup solution Puffer UniFi, the pre-confirmation technology solution UniFi AVS, and the re-staking product Puffer LRT.

This article delves into the functionalities of UniFi AVS, but first, it’s essential to clarify the concept of Based Rollups to appreciate UniFi AVS’s significance for Ethereum’s future.

Based Rollups: The Optimal Solution for Ethereum?

Based Rollup, introduced by Ethereum Foundation researcher Justin Drake in March 2023, aims to solve various challenges within the existing Rollup ecosystem. Since Vitalik Buterin released the “Rollup-Centric Ethereum Roadmap” in 2020, Ethereum has entered an era of multiple Rollups. As of now, there are 39 Layer 2 (L2) Rollups, including Optimistic Rollups and ZK Rollups. While these solutions partially alleviate Ethereum’s scaling issues, they also contribute to liquidity fragmentation.

At the core of this architecture is the sequencer, responsible for transaction ordering and bundling from L2 to L1. Most existing L2s use centralized sequencers controlled by a single entity or a small group, introducing potential risks such as transaction delays, data loss, and threats to asset security.

Theoretically, decentralized or shared sequencers could eliminate these risks, but their coordination and consensus mechanisms are complex, and no large-scale successful implementations exist yet, leaving them vulnerable to various attacks and flaws.

Therefore, Based Rollup removes the need for a separate sequencer network. It shifts transaction ordering responsibility from L2 to L1, assigning Ethereum L1 validators as block proposers. This approach enhances security by utilizing Ethereum’s decentralized node network, elevating it to the same level as the Ethereum mainnet.

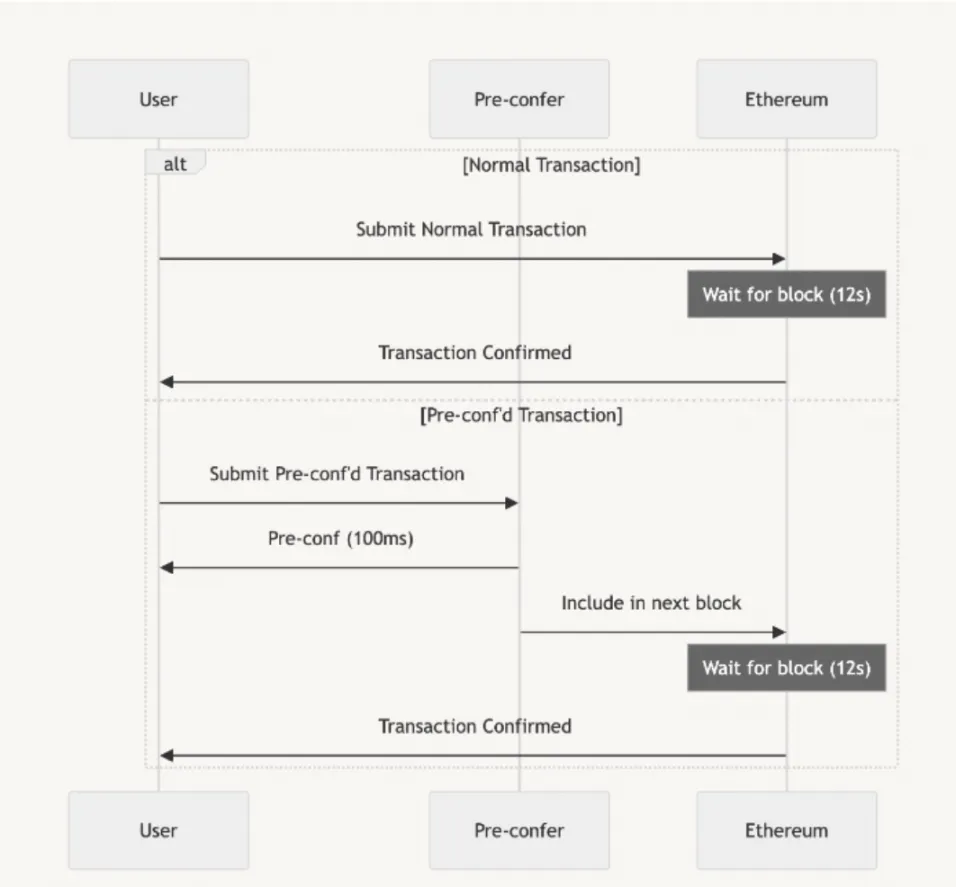

However, this comes with a trade-off: native Based Rollup networks struggle to achieve rapid transaction confirmations. Centralized sequencers can provide near-instant confirmation, while Based Rollup’s transaction ordering relies on L1 validator intervals, resulting in a confirmation time aligned with the mainnet’s block interval of about 12 seconds.

Based Rollups and the Need for Preconfs

Based Rollup achieves high security and decentralization at the cost of transaction confirmation speed. In fast-paced financial contexts, even a one-second delay can lead to significant risks and uncertainties. To address this, we introduce a “patch” in the form of pre-confirmations (Preconfs).

Pre-confirmations act as a preliminary confirmation signal, indicating that a transaction has been accepted and is being processed before formal submission to L1. This enables transactions that require immediacy to achieve millisecond-level response times (approximately 100 milliseconds), significantly enhancing user experience without changing Ethereum’s core protocol.

To maximize the potential of Based Rollups, a permissionless, neutral, and flexible pre-confirmation service is essential. A key question arises: who will be responsible for sorting transactions, providing pre-confirmations, and ensuring compliance with these commitments?

The Ethereum Foundation is developing a neutral registration contract for pre-confirmation validation, allowing any L1 proposer to register as a pre-confirmation validator. An economic penalty mechanism will ensure that validators adhere to their commitments, although this requires balancing capital efficiency and complexity.

Could EigenLayer’s AVS service leverage Ethereum’s mainnet economic security to solve the penalty issue? Puffer UniFi AVS aims to do just that, utilizing EigenLayer’s Restaking capabilities and potentially integrating with the Ethereum Foundation’s registration mechanism to create an ideal scenario for pre-confirmation services.

Puffer UniFi AVS: A Preconf Solution for Based Rollup

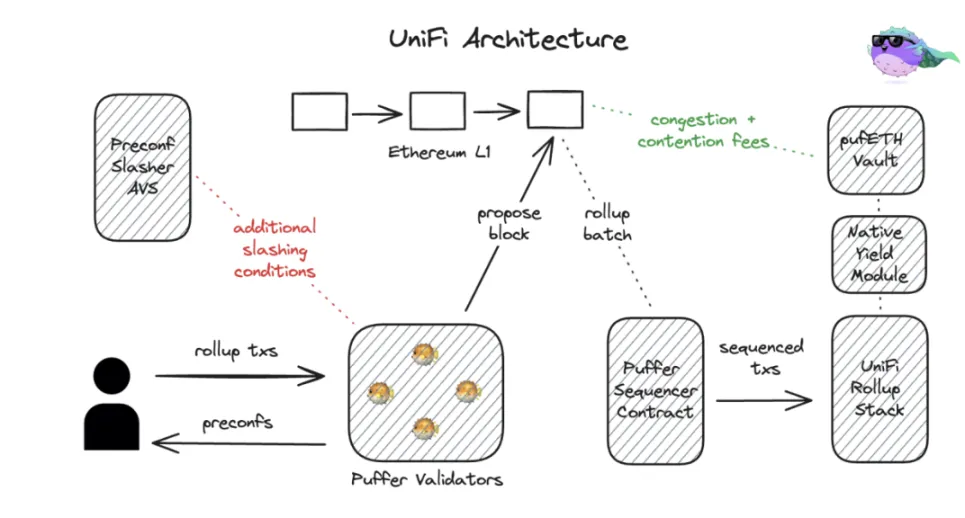

Puffer UniFi AVS includes three key components: EigenLayer integration, on-chain registration, and a penalty mechanism. The EigenLayer integration offers a competitive edge, allowing Puffer’s re-staked validator nodes to act as pre-confirmation validators without requiring additional deposits, enhancing capital efficiency.

Here’s a simplified outline of Puffer UniFi AVS’s pre-confirmation implementation:

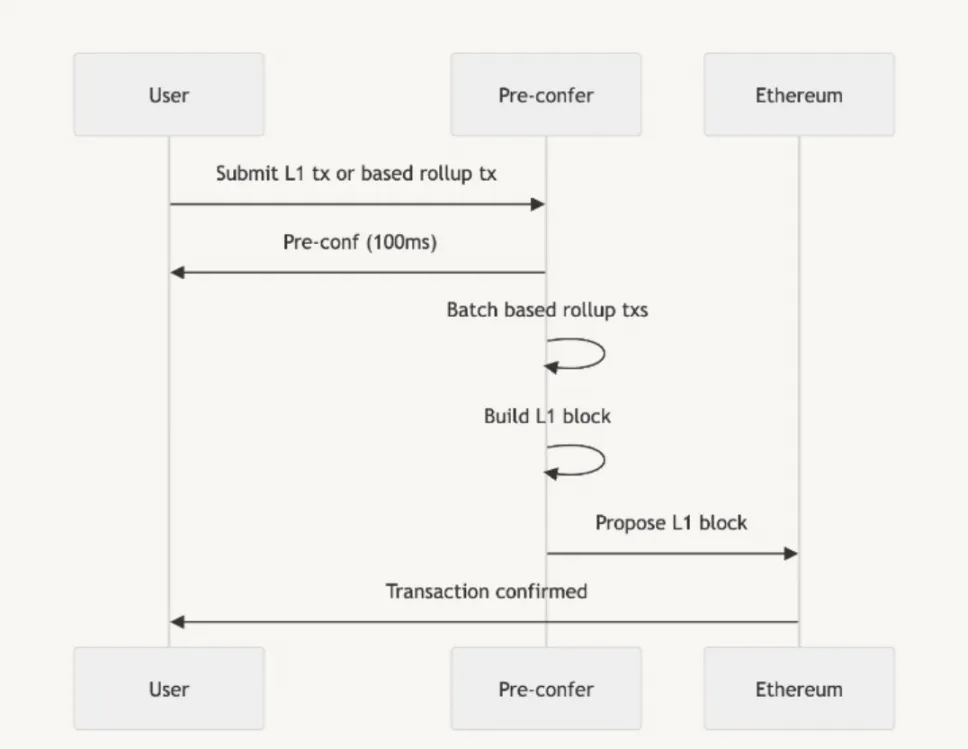

- Puffer’s validator nodes, registered as “Native Restaking” nodes on Ethereum, directly act as pre-confirmation validators when a user submits a transaction. They provide a pre-confirmation commitment within about 100 milliseconds.

- After providing pre-confirmations, the Puffer validator packages these transactions with others and submits them to Ethereum L1. The Puffer Sequencer Contract ensures that transaction states are confirmed and cannot be reverted.

- The on-chain registration and penalty mechanism plays a critical role: if a validator fails to honor their commitment, they face penalties, ensuring system reliability.

As of now, participation in Puffer UniFi AVS requires:

- EigenPod Ownership: Tools that facilitate interactions between Ethereum validators and EigenLayer.

- 32 ETH: Pre-confirmation validators must stake at least 32 ETH, allowing flexible participation forms.

- Commit-Boost Operation: Operators must run Commit-Boost software to ensure seamless communication.

Puffer UniFi AVS focuses on core functionalities like registration and penalty mechanisms, delivering efficient, standardized pre-confirmation services while adhering to Ethereum’s principles of decentralization and openness.

Who Needs Puffer’s UniFi AVS Service?

As the Based Rollup narrative expands, numerous projects will emerge, all requiring pre-confirmation services in complex market environments. A reliable pre-confirmation technology provider is essential for their success.

Puffer UniFi AVS effectively meets this demand by:

- Supply Side: Connecting re-staked validator nodes and enabling them to participate in UniFi AVS for additional income.

- Demand Side: Providing all projects building Based Rollups with easy access to pre-confirmation services, accelerating transaction processing.

In summary, Puffer UniFi AVS’s service model resembles EigenLayer’s matchmaking platform, optimizing resource allocation—much like ride-sharing services do—connecting re-staked validators to meet demand for Based Rollup pre-confirmations.

This approach accelerates innovation within the Based Rollup space and creates new revenue streams for Ethereum validators, invigorating the entire ecosystem.

Conclusion

Based Rollup, frequently highlighted by Vitalik Buterin, is set to play a crucial role in Ethereum’s evolution. Consequently, the pre-confirmation services integral to Based Rollup will become foundational infrastructure for Ethereum’s future.

Puffer UniFi AVS represents a significant step in the “Based Rollup + Preconfs” landscape. For users, it offers near-instant transaction confirmation experiences, enhancing satisfaction and laying a strong foundation for widespread adoption. For pre-confirmation service providers, it strengthens incentive structures through its mechanisms, boosting efficiency and trust. For L1 validators, it opens additional revenue channels, reinforcing the economic incentives within the Ethereum ecosystem.

Ultimately, Puffer UniFi AVS begins with Based Rollup but transcends it, aligning closely with Ethereum’s long-term vision. It achieves rapid pre-confirmations without altering core protocols, impacting not just the EigenLayer ecosystem but providing new paradigms for Ethereum innovation, benefiting users, validators, and the broader Ethereum community. This development promises to catalyze a series of positive effects, injecting new possibilities for Ethereum’s sustained growth.