From Versions to Impact: How UNI Shaped Blockchain

In the realm of Web3, three pivotal moments stand out: the inception of Bitcoin that introduced decentralized blockchain systems, Ethereum’s smart contracts that expanded blockchain’s potential beyond payments, and UNI’s democratization of financial privileges, heralding the golden age of blockchain.

As we explore the evolution from UNI V1 to V4, and the introduction of UNIChain, we ask: how far is UNI from being the ultimate solution for DEXs?

UNI V1: Prelude to the Golden Age

Before UNI, decentralized exchanges (DEXs) existed, but none truly defined the genre until UNI emerged. Many attribute UNI’s success to its simplicity, security, and privacy. However, its uniqueness lies not just in these attributes but in its embodiment of the DeFi ethos. Unlike Bancor, an early contender, UNI was the first DEX to meet the defining characteristics of decentralized finance. While Bancor offered AMM functionalities, it remained tethered to centralized control, requiring permission for token listings and imposing fees.

Early versions of UNI had their shortcomings: high volatility, gas costs, and lack of sophisticated features made it less user-friendly. Yet, it marked a historic shift—democratizing finance by removing listing barriers and enabling community-driven liquidity sources. This laid the groundwork for the widespread popularity of meme tokens and allowed projects without elite backing to thrive.

UNI V2: The DeFi Summer

Launched in May 2020, UNI V2 focused on addressing the limitations of its predecessor, particularly around price manipulation and token swaps. By implementing block-end price determination and time-weighted average pricing (TWAP), UNI significantly enhanced its resilience against attacks.

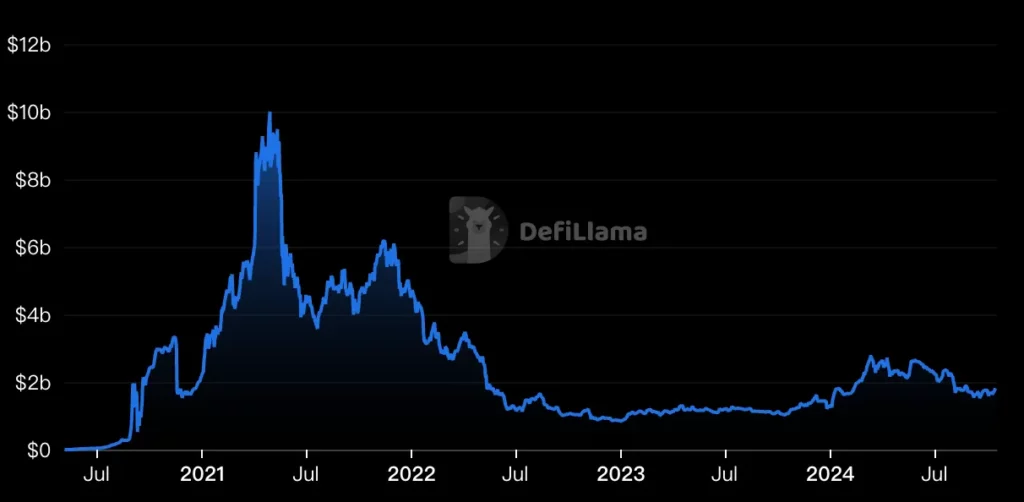

The rise of yield farming, ignited by Compound Finance’s COMP token launch in June 2020, created a rush of liquidity into the DeFi ecosystem. UNI V2 became the go-to platform for liquidity miners, reaching a peak Total Value Locked (TVL) of over $10 billion by April 2021. This period solidified DeFi’s reputation, pushing blockchain into the mainstream.

UNI V3: The Struggle Against CEXs

By V2, UNI had set the standard for AMM DEXs, but it faced new challenges from centralized exchanges (CEXs). While AMMs offered a user-friendly experience, their capital efficiency was low, exposing users to impermanent loss risks.

V3 introduced concentrated liquidity, allowing liquidity providers (LPs) to allocate their funds within specific price ranges, thus optimizing liquidity use. However, most LPs flocked to high-volatility ranges, leading to uneven liquidity distribution. Despite some improvements, UNI struggled against competing models like Trader Joe and Curve, which offered more effective liquidity solutions.

UNI V4: A New Chapter

Two years after V3, UNI V4 emerged, prioritizing customization and efficiency. Its introduction of Hooks—smart contracts allowing developers to insert custom logic at various points in the liquidity pool lifecycle—represented a significant evolution.

This version replaced the Factory-Pool architecture with a Singleton structure, reducing gas costs significantly. Although it positioned UNI favorably against its competitors, the increased complexity also risked market fragmentation and security vulnerabilities.

UNIChain: A New Direction

UNIChain, a recent major update, symbolizes a potential future where DEXs evolve into full-fledged public chains. Built on Optimism’s OP Stack, UNIChain aims to enhance transaction speed and security while benefiting UNI token holders. Key innovations include:

- Verifiable Block Construction: Utilizing Rollup-Boost technology for faster, secure block building while minimizing MEV risks.

- UNIchain Verification Network (UVN): Incentivizing validators through UNI token staking, promoting decentralization and security.

- Intent-Driven Interaction Model (ERC-7683): Simplifying user experience and streamlining cross-chain transactions.

In essence, UNIChain could reinforce the power of the OP Alliance while posing short-term challenges for Ethereum’s ecosystem.

Conclusion

As DeFi applications grow increasingly sophisticated, many DEXs are gravitating toward order book models, questioning the long-term viability of AMMs. While some view AMMs as a relic of a bygone era, they remain a vital part of Web3’s identity. UNI’s evolution reflects both progress and challenges, with questions about centralization and governance emerging as it matures.

The path ahead requires careful consideration of how to coexist with rapidly growing entities in the Web3 landscape. Ultimately, UNI’s journey will shape the future of decentralized finance and its enduring legacy in blockchain.