Why Polymarket Surpassed Traditional Polls in Election Predictions

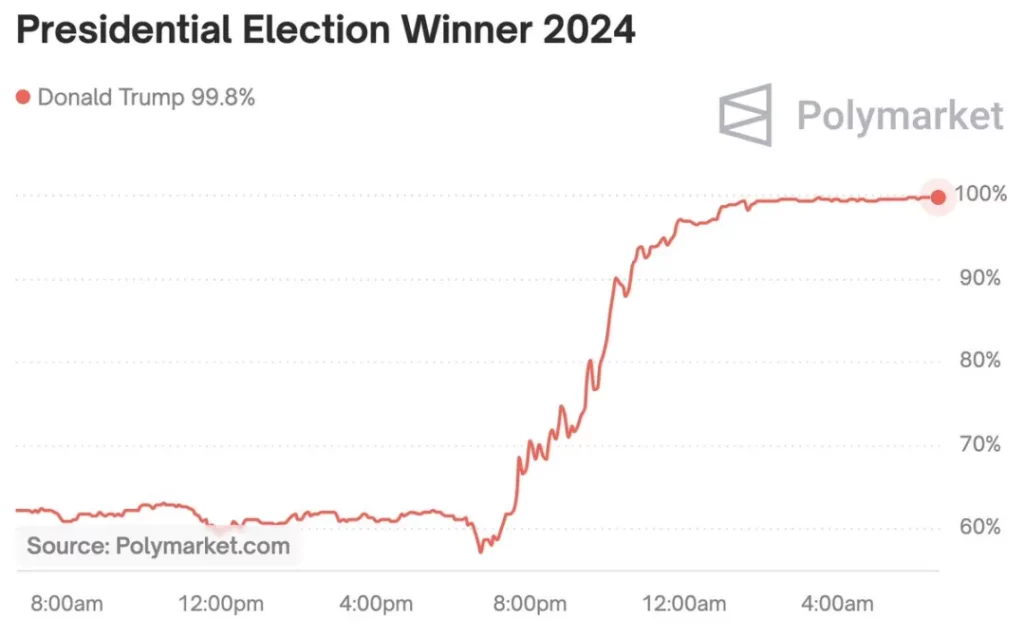

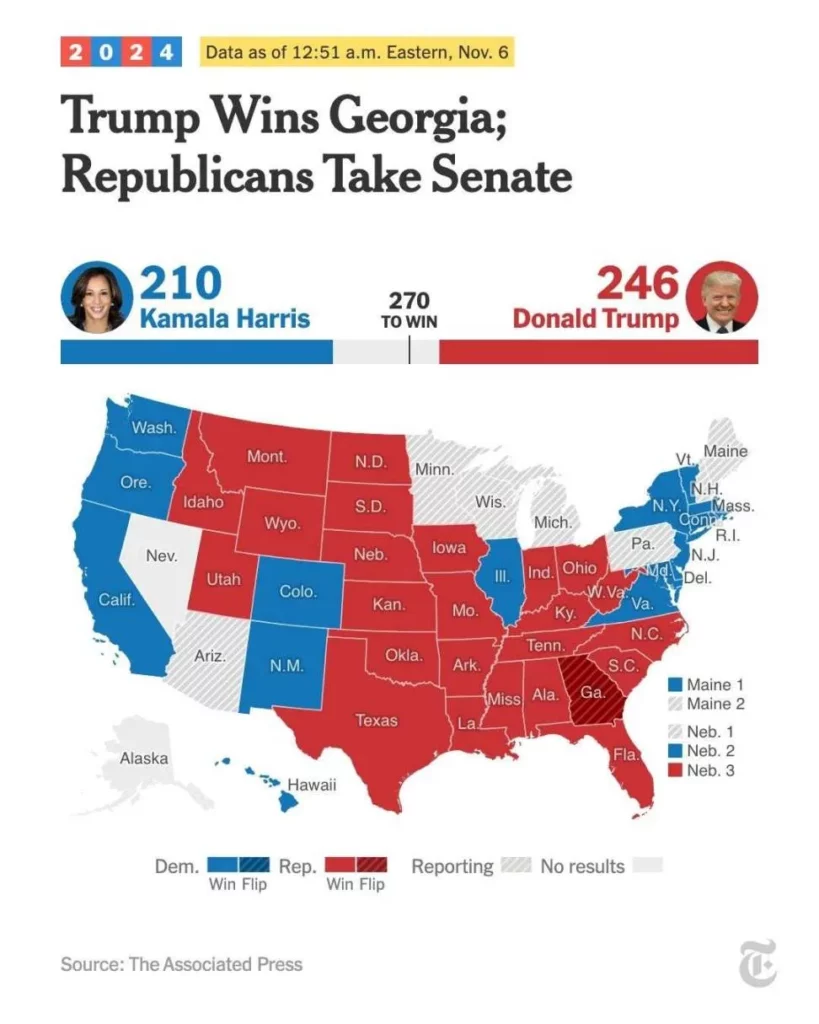

As the dust settles on the election, there’s one story that hasn’t been covered by The Wall Street Journal or The New York Times. While mainstream media were busy reporting on the spectacle of the night and hesitating to predict the results in crucial swing states, Polymarket, the world’s largest prediction market, had already made its judgment by midnight Eastern Time, stating that the probability of Trump winning was 97%. This was even before any swing state results had been announced by the media.

1. Polymarket Stayed Ahead Throughout the Election

Let me explain why this happened, as from the feedback I received on Twitter last night, most people seem to misunderstand this situation.

Polymarket outperformed the media in two fundamental ways.

First, Polymarket’s pre-election predictions were more accurate. Let’s look at the polling agencies and analysts. Election models based on polls claimed that the race was a toss-up, while Polymarket gave Trump a clear advantage—his chances of winning were set at about 62% before the election began.

If you remember, mainstream media ridiculed Polymarket’s differing views. They thought Polymarket should align with the models of those pollsters! Clearly, this discrepancy meant that Polymarket couldn’t be trusted. They assumed that Polymarket’s pricing was skewed by the large number of Trump-supporting crypto enthusiasts in its user base. It was backed by Peter Thiel, had mostly foreign traders, and was unregulated. They assumed it must be manipulated, with big money driving up Trump’s price. These criticisms were endless.

These critiques implicitly expressed a profound distrust of the market. It was as if markets couldn’t be trusted unless there was clear proof of their reliability. Of course, if you truly trust the market, you might stop trusting the media. And the business model of the media is based on making you distrust other sources of information—otherwise, why would you keep clicking on their endless clickbait articles?

But anyone with market experience knows that the composition of a market doesn’t matter—whether it’s made up of Republicans, Democrats, foreigners, or anyone else. In fact, we know that JP Morgan uses Polymarket, as do some of the world’s largest hedge funds (most of which have non-US subsidiaries). It’s integrated into Bloomberg Terminal and even quoted on CNN. However, when the media talks about Polymarket, it seems to treat it like just another 4chan-like platform.

Polymarket saw $3.6 billion in trading volume during the presidential election. This was the largest-ever election betting market by volume, dwarfing every other market by an order of magnitude. In comparison, this was far more significant than the career prospects of any individual pollster. The market is effective because so much depends on getting the answer right.

The supposed biases—such as crypto enthusiasts or foreigners supporting Trump—did not affect the accuracy of the market. (In hindsight, foreigners might have been more calm in predicting the election outcome.)

But the identities of the participants don’t matter. Prediction markets aggregate information from a wide array of participants to derive prices that transcend biases. Markets don’t care about ideology; they only care about getting the right results.

The reality is, Polymarket was more accurate than any polling organization or model maker.

Now, let me be clear: the difference between 60/40 and 50/50 might sound significant, but it’s actually not. Elections are inherently full of uncertainty. According to high school statistics, if you want to determine whether a coin is biased 60/40 instead of 50/50, you need to flip it over 100 times to have 90% confidence. The result of “Trump winning the election” doesn’t tell you whether the coin is 60/40 or 50/50.

What I’m getting at is not that Polymarket was completely right and the predictive models were completely wrong. In fact, the difference between them wasn’t all that large. What I want to emphasize is that Polymarket consistently set Trump’s chances higher than the polling models. The market knew about the polls and analysts’ conclusions, but Polymarket’s pricing diverged from those models. The analysts could only think of one explanation: Polymarket had a bias.

They didn’t have the humility to consider that perhaps Polymarket had captured some information that the polls missed.

Polls are far less accurate than they used to be. This is now crystal clear. Before the internet, polls were much more accurate. Back then, phone polls had response rates of over 60%. Today, that number is around 5%. This means polling organizations face huge sampling biases that cannot be corrected by simple statistical adjustments. (Furthermore, polling firms—being sellers of products that need to maintain their reputation—often tend to converge their predictions to avoid being outliers, affecting the overall accuracy.)

Moreover, Trump is a unique and polarizing figure in American politics. As a result, we’ve seen serious underestimation of his support in the polls across three consecutive elections, which is known as the “shy Trump voter” effect.

Polymarket might have believed the polls missed some important information. Polling agencies argued they had updated their models and made adjustments. Polymarket’s response was: “I don’t believe it.” And as it turned out, Polymarket was right.

Let me reiterate! Polymarket did not claim that Trump had a 90% chance of winning. 62% isn’t an absolute number because elections are full of uncertainty. What confuses me is that the media never seemed curious about this discrepancy. Maybe Polymarket knew something we didn’t? Or maybe there was information we missed that wasn’t reflected in the polls?

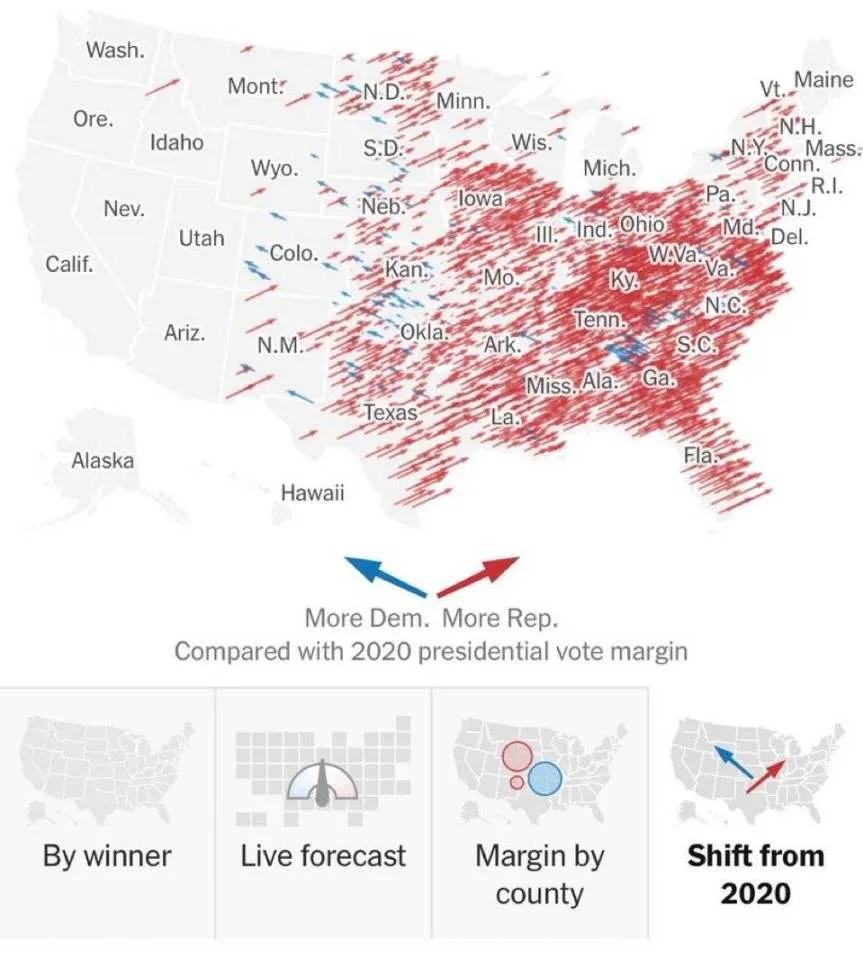

Remember, Trump’s performance nationally outstripped polling expectations, whether in Republican or Democrat states. He won every swing state and even the popular vote, which seemed impossible to most.

Do you really have confidence that there’s no other way to uncover the true feelings of millions of Americans without relying on traditional polling firms and outdated internet surveys?

This is what markets teach us. Markets are smart, but they don’t explain why—they just show the results.

2. Polymarket’s Advantage Over the Media

Polymarket predicted the election outcome in real time before the media. On election night, the market’s unpredictability fully manifested. Polymarket reacted quickly and decisively to every swing state result before the media did. According to Polymarket, the election was decided by midnight, while mainstream media didn’t announce the result until 6 AM the next morning. Why?

First, Polymarket detected an important correlation that the mainstream media was unwilling to explain to their audience. Polling errors are rarely random; they tend to be correlated across states. So, when traders saw Trump significantly outperforming expectations in states with little competition, like New York (a typical Democrat state) or Florida (a typical Republican state), it meant that polling errors nationwide could be significant.

Polymarket quickly picked up on this and realized the swing states were no longer competitive. By 11:30 PM, Polymarket had set Trump’s chances of winning Pennsylvania at 90%, even though only a small portion of Pennsylvania’s votes had been counted.

Prediction markets don’t wait for procedural formalities or pundit analysis. They don’t care about breaking with the traditional ceremony of waiting for votes to be counted. Remember the uproar when Fox News prematurely called Arizona in 2020 (which turned out to be correct)? Trump even threatened to boycott the channel. That reinforced a lesson—mainstream media must count the votes properly, without trying to outsmart the process.

However, the market doesn’t care about the dramatized process; they just care about the result. Clearly, explaining to CNN’s audience that the election is over, that polling errors in non-competitive states were too large, and that Kamala’s prospects were grim while the swing state results are still pending, is a very hard task. This runs counter to the narrative the media had been pushing for months. The public needs a simple, easily understood story where everyone knows how things are going—wait until the swing state results come in and some color bar crosses the 270-vote threshold.

At 12:51 AM, The New York Times was still displaying dramatic graphs and headlines. By then, Polymarket had already set Trump’s chances at 98%.

So, election watchers stayed up all night, only to watch the media perform their meaningless color bar ritual.

Polymarket traders are not bound by narratives, nor do they have to hype up drama for ratings—they simply make judgments directly.

Polymarket’s founder, @shayne_coplan, stated that Trump’s campaign team was following Polymarket to better understand how to interpret the odds. The media even dared to complain when Trump declared victory at 267 electoral votes—by that point, Polymarket’s odds had already dropped to show 100%.

The allure of the market is that it can react quickly to new information. The traders who can integrate information the fastest are rewarded—with profits. Traditional media cannot do this because they need to process events through multi-layered explanations, narrative construction, and internal politics (like Murdoch’s interference with Fox News on Arizona’s result in 2020).

Polymarket’s decentralized nature bypasses all this bureaucracy, allowing information to flow freely without interference.

Last night’s events were thought-provoking. This election was a strong warning to the Democratic Party, a repudiation of the expert class, and an immune reaction against the arrogant media.

However, for Polymarket, that night was a perfect validation of its value. For me, the takeaway is: when something important happens in the world, it’s worth skipping over those opinion pieces and checking Polymarket’s odds directly. Full disclosure: I’m an investor in Polymarket. I’ve always been passionate about prediction markets, and now their value has been recognized, which I’m very pleased about. Also, I’m extremely tired now, so I may have made some errors in the details, but you should get the gist of what I mean.

This article is written for some people I know who are skeptical of prediction markets and believe the media’s dismissal of Polymarket. If you know anyone who’s doubtful about prediction markets, feel free to forward this article to them.