The Hidden Crypto Beneficiaries of the U.S. Election

On November 6, 2024, the most dramatic U.S. election in history came to a close. With Donald Trump, dubbed the “crypto president,” successfully elected, this could signify that crypto has officially entered the White House. Meanwhile, Bitcoin surged past the $75,000 mark, setting a new all-time high. Behind these developments, the groups and beneficiaries quietly profiting from the crypto movement will gradually come into focus.

Crypto Lobbying: Real Money Moving from Legislators to the President

On May 22, the U.S. House of Representatives passed the Financial Innovation and Technology for the 21st Century Act (FIT21) with a significant vote of 279 to 136. The bill, spearheaded by the Republican Party, aims to amend current securities and commodities regulations to establish a regulatory framework for digital assets, thereby fostering the growth of the crypto industry.

The passage of FIT21 was not without substantial financial backing from the crypto community, which poured large sums into lobbying lawmakers.

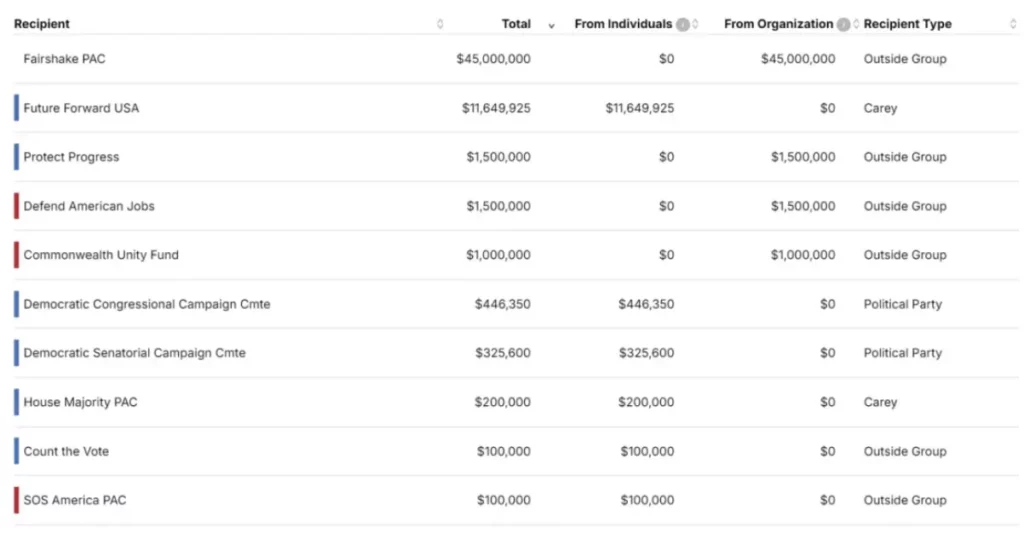

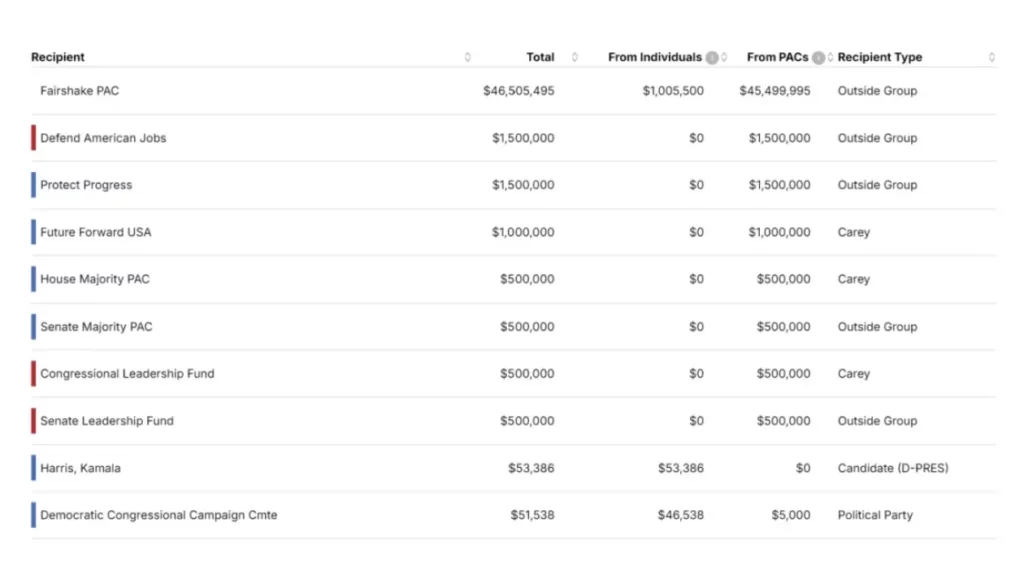

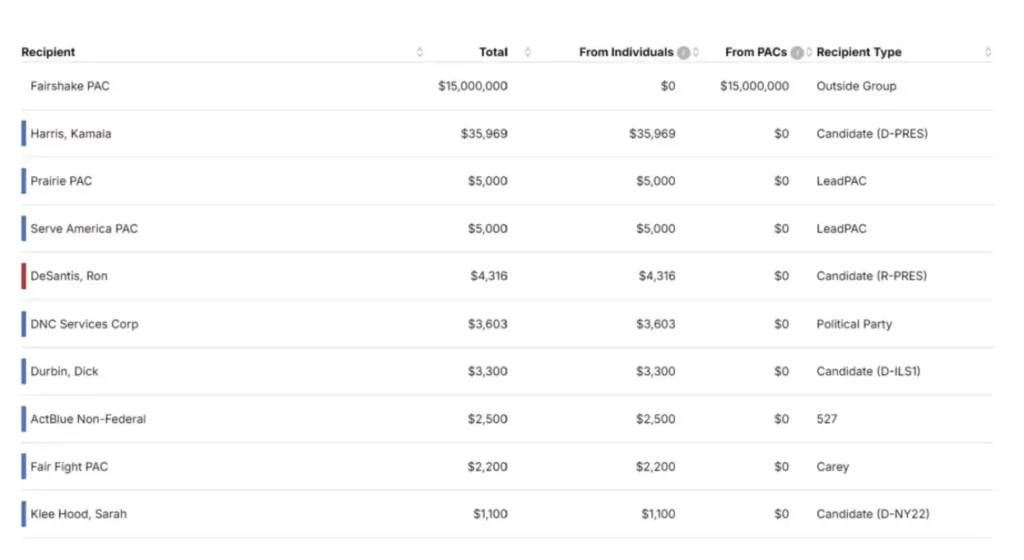

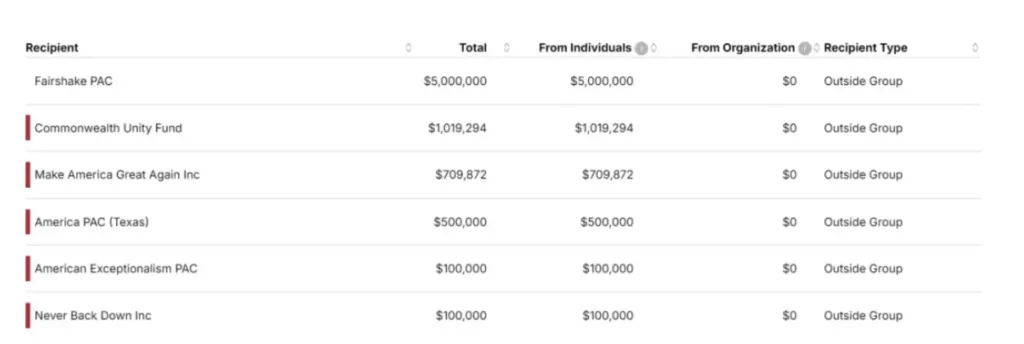

In addition, political action committees (PACs) played a key role in influencing election outcomes, subsequently affecting the introduction and passage of this bill. According to political fundraising tracking platform OpenSecrets, crypto-friendly PACs have invested over $133 million into elections. These efforts have intervened in 51 campaigns, largely to support candidates who pledged not to impose stringent regulations on cryptocurrencies. The top three PACs in this effort are Fairshake, Protect Progress, and Defend American Jobs.

The rise of Super PACs is a result of the 2010 U.S. Supreme Court ruling in Citizens United v. FEC, which allowed unlimited spending by corporations and unions on political activities. This was further solidified by the Speechnow v. FEC ruling, which legalized the creation of Super PACs—organizations that can receive and spend unlimited donations, as long as they do not coordinate directly with candidates or political parties. This legal framework is why the crypto industry was able to pour $133 million into this election cycle.

For example, Fairshake spent over $10 million to help California Representative Katie Porter (D-CA) lose her Senate bid, and over $2 million to support the re-election of Representative Jamaal Bowman (D-NY). Despite both of Fairshake’s target candidates losing in their respective primaries, the Super PAC has refocused its efforts and resources on supporting bipartisan candidates, including newly elected California Representative Michelle Steel and North Carolina Representative Don Davis.

In Ohio’s most expensive election ever, Defend American Jobs spent over $40 million to support Republican candidate Bernie Moreno’s bid for Ohio’s Senate seat, challenging long-time incumbent Democratic Senator Sherrod Brown. Moreno’s defeat could shift the Senate towards the Republicans.

Reagan McCarthy, a spokesperson for Moreno, told The Washington Post: “Bernie is unlike Sherrod Brown—he understands the difference between blockchain and chainsaws, and Bernie has a deep understanding of this technology. He knows how to ensure it thrives in the U.S. and will work to make America a global leader in blockchain technology.”

Protect Progress has spent over $10 million supporting the campaign of Representative Elissa Slotkin (D-MI), who voted in favor of the FIT21 bill, which aims to establish a digital asset regulatory framework. This Super PAC also spent $10 million on behalf of Representative Ruben Gallego (D-AZ), who believes that “cryptocurrency is crucial for driving technological innovation, economic growth, and job creation” and requires “comprehensible regulations to provide clarity and encourage responsible innovation.”

Coinbase’s Brian Armstrong recently stated in an interview with CNBC, “No matter what happens in this election, this will be the most crypto-friendly Congress we’ve ever had.”

Which Crypto Firms Contributed to Political Donations?

Political donation data reveals some of the key financial backers behind these political campaigns. For example, Trump’s political action committee, Trump 47, raised a total of $327.47 million in 2024. Among the donors contributing $1 million or more, Winklevoss Capital Management donated approximately $2.366 million, making it the second-largest donor. The founders of this firm are Tyler Winklevoss and Cameron Winklevoss, who are also the founders of the cryptocurrency exchange Gemini.

Another PAC, Right For America, raised $68.46 million this year, with A16Z founders Marc Andreessen and Ben Horowitz each donating $5 million. Of course, crypto donations are not limited to Republican supporters. Most of the major backers of the three crypto-friendly Super PACs remain politically neutral. Their main objective is to elect politicians who are friendly to cryptocurrency.

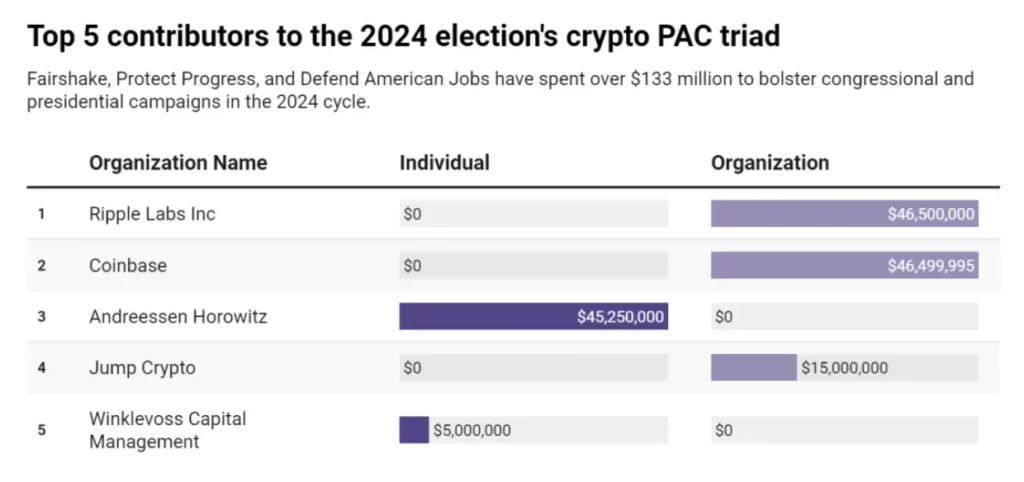

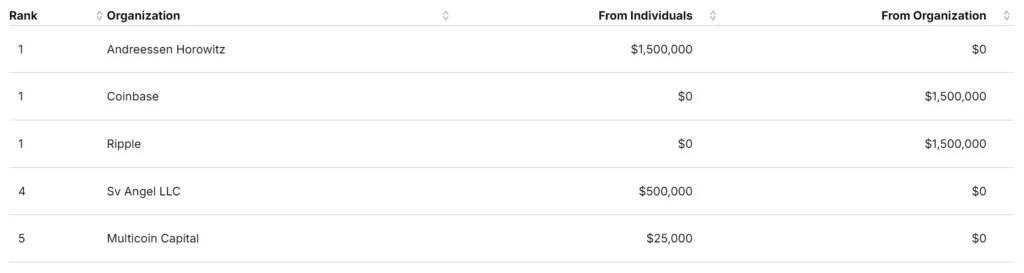

Institutionally, the bulk of donations came from major cryptocurrency exchanges such as Coinbase, Ripple, and Jump Crypto, which contributed $46.5 million, $46.5 million, and $15 million, respectively, for a total of approximately $108 million. A16Z also contributed $45.2 million.

A recent report from the non-profit oversight group Public Citizen revealed that nearly half of the corporate funds flowing into the election came from the cryptocurrency industry.

The Aftermath: Who’s Already Positioned for the Next Move?

The U.S. is bound to gradually refine its regulatory framework for cryptocurrencies, and as the voices in politicians’ ears grow louder, it will likely pass through multiple lobbying channels. Leading exchanges, venture capital firms, and foundations have already made strategic moves.

The chart below summarizes the list of donors to the three Super PACs, which investors should pay attention to.

In addition to A16Z, Coinbase, and Ripple, Multicoin, which contributed just $25,000, also appears on the donor list for multiple PACs—something worth noting. With decentralization still a dream for many in the crypto community, the ongoing tug-of-war between cryptocurrencies and regulation remains a long and winding road ahead.