The Fed Cuts Interest Rates as Expected, Bitcoin Holds Steady Above $75,000

Amid global financial markets’ close attention, the Federal Reserve’s latest interest rate decision has once again catalyzed market fluctuations.

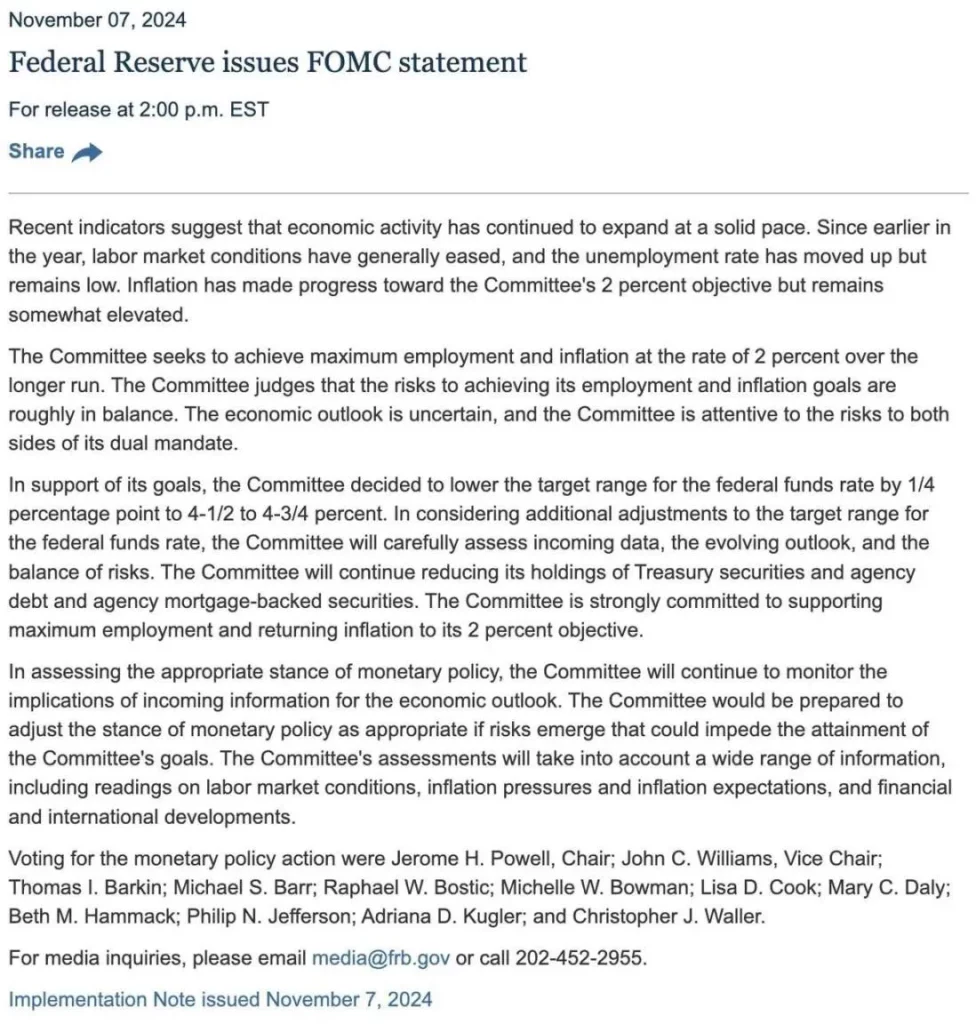

In the early hours of November 8, the Fed announced a 25-basis-point cut to the benchmark interest rate, further boosting market confidence and sparking a robust rally in both the cryptocurrency and U.S. stock markets.

Bitcoin Leads the Rally, Altcoins Follow Suit

The Fed’s rate cut not only lowered borrowing costs but also injected new liquidity into the market. In addition, the Bank of England implemented a similar accommodative monetary policy, cutting rates by 25 basis points to 4.75%, leading to a surge in UK bond prices. The Swedish central bank also cut rates by 50 basis points for the first time in a decade, aligning with expectations and hinting at the possibility of further easing to support the economy. These actions further reinforce expectations of a global liquidity boost.

Following the Fed’s rate cut announcement, Bitcoin briefly pulled back to a low of $74,500 but quickly rebounded, nearing the historic high of $77,000. At the time of writing, Bitcoin is trading at $75,869.

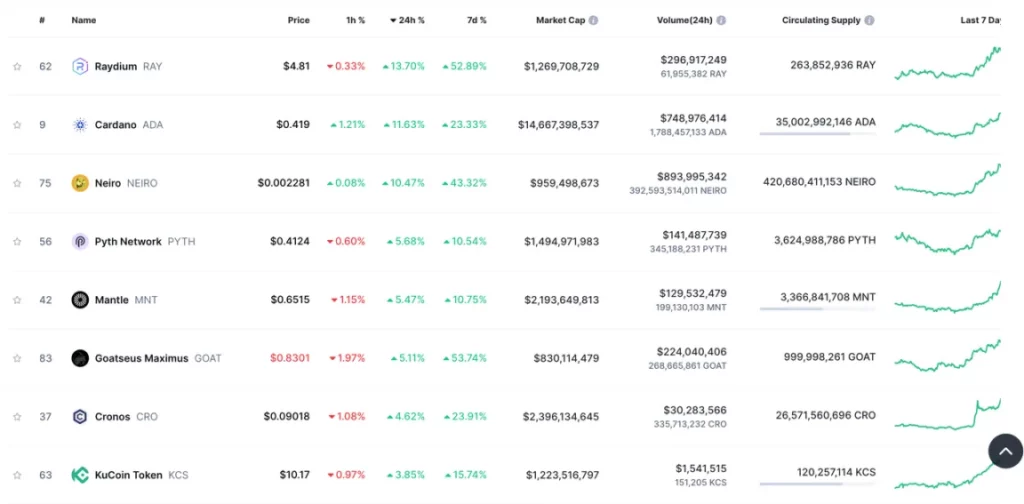

The altcoin market is also enjoying gains. Among the top 200 tokens by market cap, Raydium (RAY) led the charge with a 13.7% increase, followed by Cardano (ADA) and Neiro (NEIRO), with gains of 11.63% and 10.47%, respectively.

ETF Inflows Signal a Potential Uptrend

Bitcoin spot ETF data sheds light on the movements of off-exchange funds. A higher net inflow indicates increased buying pressure, raising the likelihood of Bitcoin price increases. According to SoSoValue, over the past two weeks, only four days saw net outflows, and those outflows were relatively minor. On October 30 alone, net inflows exceeded $890 million, with October 29 following closely at $870 million. Net inflows on October 15, 16, 17, and 28 all exceeded $450 million, highlighting strong buying interest from off-exchange funds.

Additionally, the Chicago Mercantile Exchange (CME) reported a record high daily trading volume of $13.15 billion in BTC futures, well above the 2024 average daily volume of $4.56 billion. Coinbase’s premium has also turned positive for the first time in weeks, indicating growing demand from institutional traders.

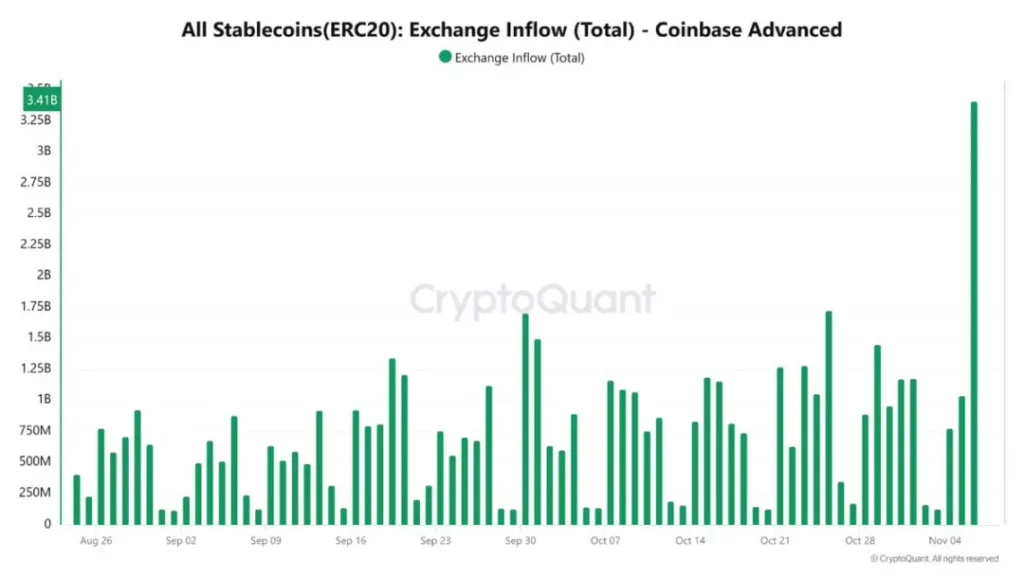

BTC Outflows from Exchanges Increase, Stablecoin Deposits Surge

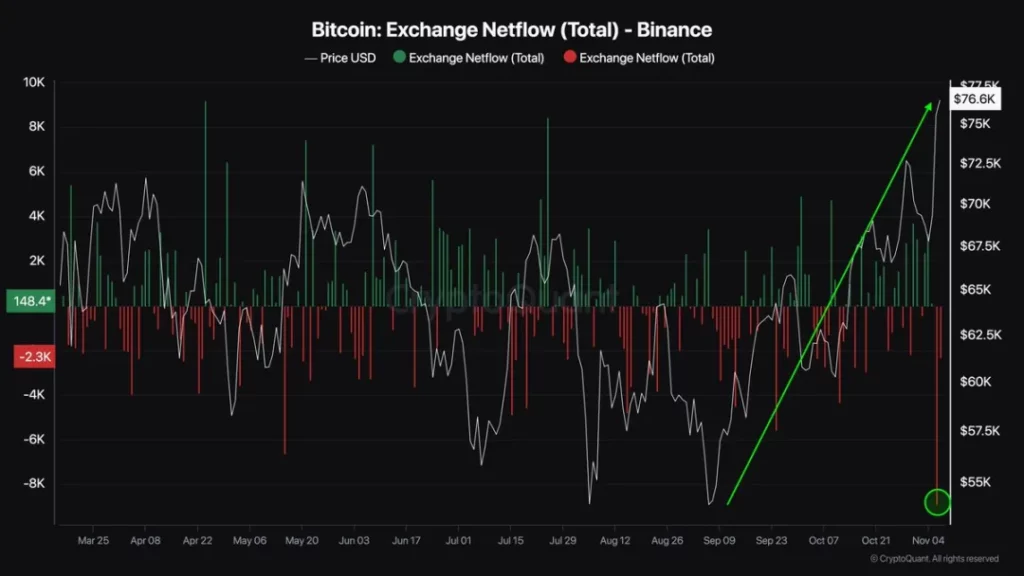

Bitcoin is being withdrawn from exchanges at the highest rate this year, which typically signals a reduction in selling pressure and a possible imminent market surge.

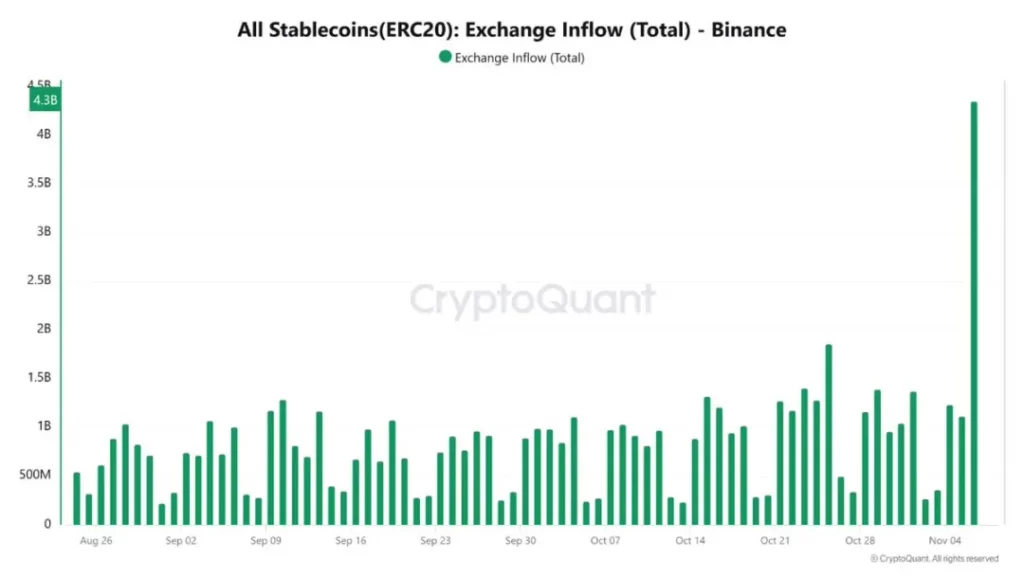

In contrast to the BTC outflows, stablecoin deposits on Coinbase and Binance have seen a significant uptick. Historically, similar trends from September 2020 to February 2021 led to upward rebounds. If the deposit trend continues, the crypto market could see another upward surge.

Analysts: Bitcoin Could Reach $150,000 After Short-Term Consolidation

According to traders, strong spot demand and increasing buy orders indicate a market shift toward continued support. Daily chart data shows major sell orders positioned between $77,000 and $78,000, with minimal resistance until $83,000 after that.

Analysts anticipate a possible short-term consolidation for Bitcoin, though some believe it could continue climbing to $77,500 or higher. CNBC has speculated that Bitcoin could reach $100,000 by the time of the presidential inauguration.

Long-term forecasts from analysts like Peter Brandt suggest Bitcoin is currently positioned at an optimal spot in the bull halving cycle, with a potential peak between $130,000 and $150,000 by the end of 2024. Market analyst CryptosRus also predicts that Bitcoin may hit $100,000 by early 2025, compared to previous cycles.

The Fed’s interest rate decision has injected new energy into the market, and this rebound trend is likely to continue.