Altcoins Keep Falling: It’s Time to Refocus on DeFi

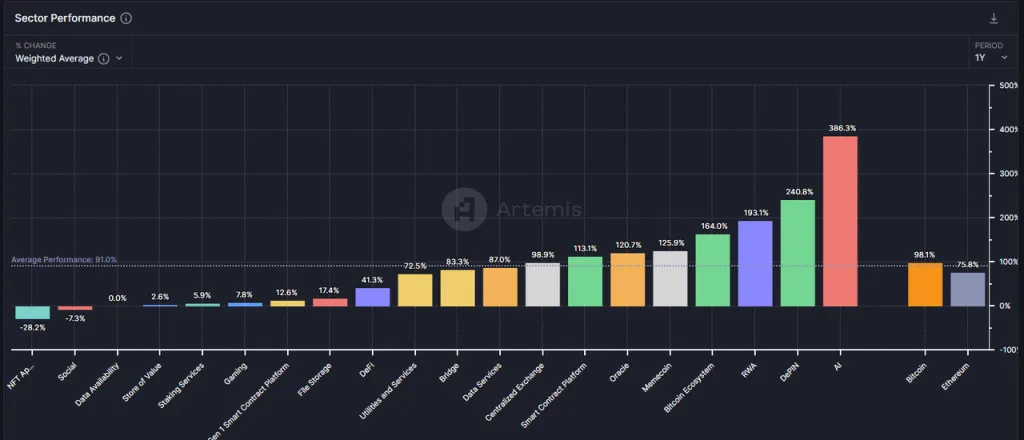

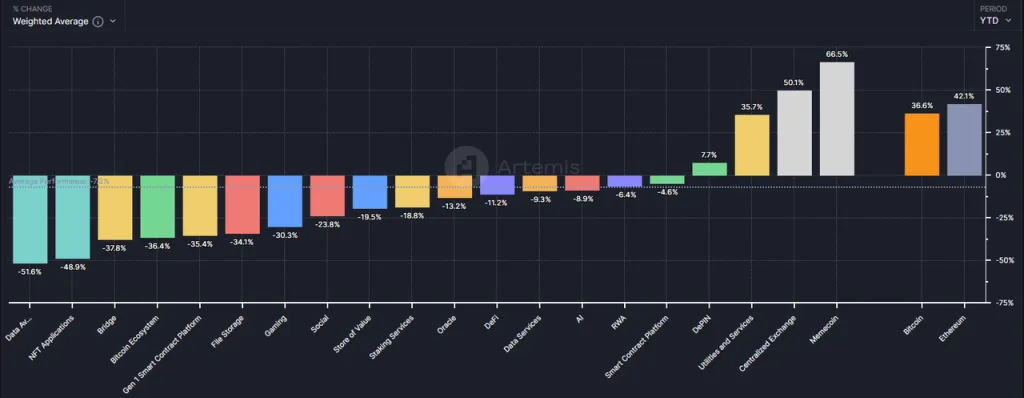

As one of the oldest tracks in the crypto field, the DeFi sector did not perform well in this bull market. The overall increase of the DeFi sector over the past year (41.3%) has not only lagged behind the average level (91%) but also Ethereum (75.8%).

Looking only at the data for 2024, the DeFi sector also performed poorly, with an overall decline of 11.2%.

However, amid the peculiar market backdrop where altcoins fell together after BTC hit a new high, the DeFi sector, especially the leading projects within it, might have reached the best layout moment since its inception.

Through this article, we hope to clarify the value of DeFi at the current moment by discussing the following issues:

- Reasons why altcoins significantly underperformed BTC and Ethereum in this round.

- Why now is the best time to focus on DeFi.

- Some DeFi projects worth paying attention to, their sources of value, and their risks.

This article does not encompass all DeFi projects with investment value, and the DeFi projects mentioned are only for illustrative analysis, not investment advice.

The Mystery of the Sharp Decline in Altcoin Prices

The underperformance of altcoin prices in this round mainly stems from three internal reasons in the crypto industry:

- Insufficient growth on the demand side: Lack of attractive new business models, with most tracks’ PMF (Product Market Fit) far from being realized.

- Excessive growth on the supply side: Further improvement in industry infrastructure and lower startup thresholds leading to over-issuance of new projects.

- Continuous unlocking waves: Continuous unlocking of low-circulation high FDV (Fully Diluted Value) projects’ tokens, bringing heavy selling pressure.

Let’s look at the background of these three reasons individually.

Insufficient Growth on the Demand Side: A Bull Market Lacking Innovation Narratives

This bull market lacks business innovations and narratives of the same magnitude as the 2021 DeFi boom or the 2017 ICO craze. Strategically, one should overweight BTC and ETH (benefiting from ETF-driven incremental funds) and control the allocation ratio of altcoins.

The absence of new business stories has led to a significant reduction in the influx of entrepreneurs, industrial investment, users, and funds, and more importantly, this situation has suppressed investors’ overall expectations for industry development.

When the market does not see stories like “DeFi will devour traditional finance,” “ICO is a new innovation and financing paradigm,” or “NFTs disrupt the content industry ecosystem,” investors naturally vote with their feet and turn to places with new stories, such as AI.

Although no attractive innovations have emerged in this round, infrastructure continues to improve:

- Significant reduction in block space fees across L1 and L2.

- Gradual completion of cross-chain communication solutions with a rich list of options.

- Upgraded user-friendly wallet experiences, such as Coinbase’s smart wallet supporting quick creation and recovery without private keys, direct calls to CEX balances, and no need for gas recharges, bringing users closer to Web2 product experiences.

- Solana’s introduction of Actions and Blinks features, allowing interactions with Solana’s on-chain environment to be published in any common internet environment, further shortening the user’s usage path.

These infrastructures, like water, electricity, and roads in the real world, are not the result of innovation but the soil from which innovation emerges.

Excessive Growth on the Supply Side: Over-Issuance of Projects and Continuous Unlocking of High Market Cap Tokens

In fact, from another perspective, although many altcoin prices have hit new lows this year, the total market cap of altcoins compared to BTC has not fallen drastically.

As of now, BTC’s price has dropped by about 18.4% from its peak, while the total market cap of altcoins (represented by Total3 in Trading View, indicating the total crypto market cap excluding BTC and ETH) has only dropped by -25.5%.

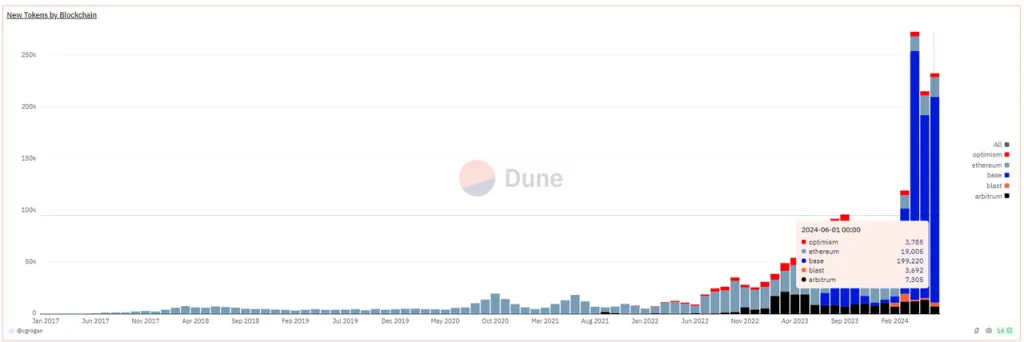

The limited decline in the total market cap of altcoins is set against the backdrop of a significant expansion in the total number and market cap of newly issued altcoins, as shown in the figure below, where we can see that the token issuance growth trend in this bull market is the most rapid in history.

It is worth noting that the above data only includes token issuance data on EVM chains, with more than 90% issued on the Base chain, while Solana contributes more newly issued tokens. Most of the new tokens on both Solana and Base are memes.

Representative high market cap memes in this bull market include:

- dogwifhat: $2.04 billion

- Brett: $1.66 billion

- Notcoin: $1.61 billion

- DOG•GO•TO•THE•MOON: $630 million

- Mog Coin: $560 million

- Popcat: $470 million

- Maga: $410 million

In addition to memes, many infrastructure tokens are being or will be listed this year, such as:

Layer 2 networks:

- Starknet: Circulating market cap $930 million, FDV $7.17 billion

- ZKsync: Circulating market cap $610 million, FDV $3.51 billion

- Manta Network: Circulating market cap $330 million, FDV $1.02 billion

- Taiko: Circulating market cap $120 million, FDV $1.9 billion

- Blast: Circulating market cap $480 million, FDV $2.81 billion

Cross-chain communication services:

- Wormhole: Circulating market cap $630 million, FDV $3.48 billion

- LayerZero: Circulating market cap $680 million, FDV $2.73 billion

- Zetachain: Circulating market cap $230 million, FDV $1.78 billion

- Omni Network: Circulating market cap $147 million, FDV $1.42 billion

Chain-building services:

- Altlayer: Circulating market cap $290 million, FDV $1.87 billion

- Dymension: Circulating market cap $300 million, FDV $1.59 billion

- Saga: Circulating market cap $140 million, FDV $1.5 billion

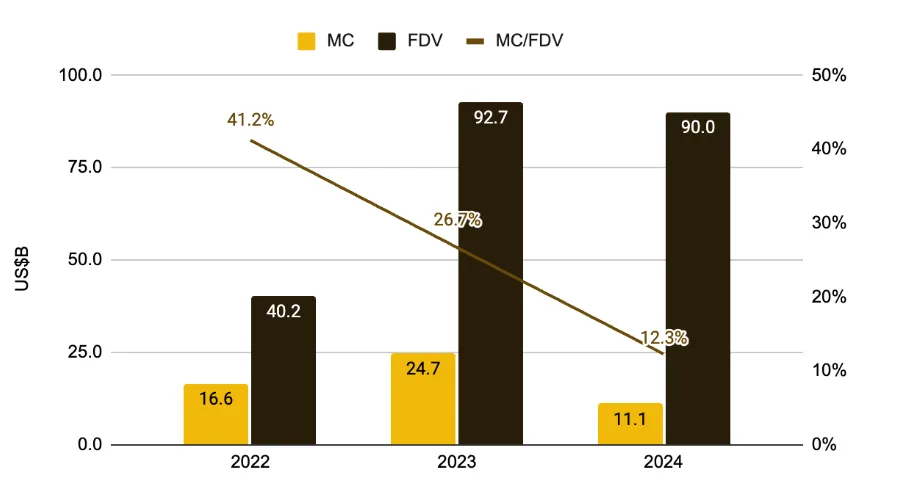

Additionally, many already listed tokens face massive unlocking, characterized by low circulation ratios, high FDV, and early institutional round financing with very low token costs.

The combination of weak demand and narratives in this cycle, along with excessive issuance on the supply side, is a first in the crypto cycle.

Although project teams have tried to maintain valuations by further reducing the circulation ratio of tokens at listing (from 41.2% in 2022 to 12.3%), and gradually selling to secondary investors, the resonance of these factors has ultimately led to an overall shift in the valuation center of these crypto projects. In 2024, only a few sectors such as memes, CEXs, and DePINs have maintained positive returns.

In my view, the collapse in the valuation center of these high-market-cap VC coins is a normal market response to various anomalies in the crypto space:

- Mass creation of ghost town Rollups with only TVL and bots but no users.

- Financing through rebranded terms that actually offer similar solutions, such as many cross-chain communication services.

- Entrepreneurship targeting hot trends rather than actual user needs, like many AI+Web3 projects.

- Failure to find or outright not looking for profitable models, resulting in tokens with no value capture.

The decline in the valuation center of these altcoins is the result of market self-correction, a healthy process of bubble bursting, and a self-rescue behavior of market clearing driven by funds.

The reality is that most VC coins are not entirely without value; they are just overpriced. The market eventually brought them back to their rightful place.

It’s Time to Focus on DeFi:

PMF Products Emerging from the Bubble Period.

Since 2020, DeFi has officially become a category within the altcoin cluster. In the first half of 2021, the Top 100 crypto market cap rankings were dominated by DeFi projects, with a wide array of categories aiming to redo every business model in traditional finance on the blockchain.

In that year, DeFi was the infrastructure of public chains. DEX, lending, stablecoins, and derivatives were the four essential projects for any new public chain.

However, with the over-issuance of homogeneous projects, numerous hacker attacks (sometimes internal), and TVL obtained through Ponzi models quickly collapsing, token prices spiraling up have plummeted.

In this bull market cycle, the price performance of most surviving DeFi projects has been unsatisfactory, and there has been a declining interest in primary investments in the DeFi field. As with the start of any bull market cycle, investors favor new stories that emerge in the cycle, and DeFi does not fall into this category.

But precisely because of this, DeFi projects emerging from the bubble seem more attractive than other altcoin projects. Specifically:

Business Aspect:

Mature Business Models and Profit Mechanisms, Leading Projects with Moats.

DEXs and derivatives earn transaction fees, lending collects interest spread income, stablecoin projects charge stability fees (interest), and staking services collect staking service fees. The profit models are clear.

The leading projects in each track have organic user demand, have largely passed the user subsidy phase, and some projects continue to achieve positive cash flow even after deducting token emissions.

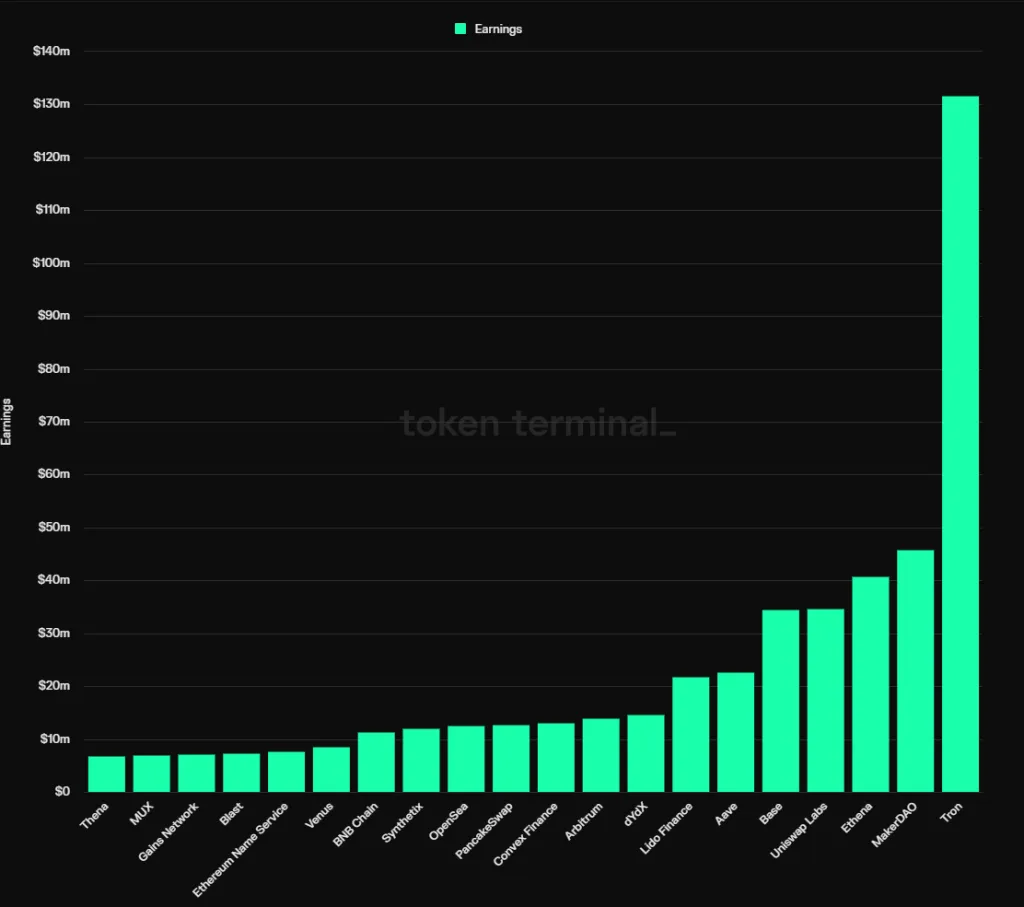

According to Tokenterminal’s statistics, as of 2024, 12 of the top 20 most profitable protocols are DeFi projects, categorized as follows:

- Stablecoins: MakerDAO, Ethena

- Lending: Aave, Venus

- Staking Services: Lido

- DEXs: Uniswap Labs, PancakeSwap, Thena (income from frontend fees)

- Derivatives: dYdX, Synthetix, MUX

- Yield Aggregators: Convex Finance

These projects have various types of moats, some from multilateral or bilateral network effects of services, some from user habits and brands, and others from special ecological resources.

However, the commonality among leading DeFi projects in their respective tracks is clear: market share stabilizes, fewer latecomers enter, and they have certain pricing power for services.

We will detail the moats of specific DeFi projects in the third section.

Supply Aspect:

Low Emissions, High Circulation Ratio, Small Scale of Unlocked Tokens.

In the previous section, we mentioned that one of the main reasons for the continued collapse of altcoin valuations in this cycle is the high issuance of many projects based on high valuations, combined with the massive unlocking of tokens entering the market.

Leading DeFi projects, having been around for a while, have largely passed their peak token emission phases, with institutional tokens mostly released, leading to very low future selling pressure. For example, Aave’s current token circulation ratio is 91%, Lido’s is 89%, Uniswap’s is 75.3%, MakerDAO’s is 95%, and Convex’s is 81.9%.

This indicates low future selling pressure and implies that anyone wanting to gain control of these projects would mostly need to purchase tokens from the market.

Valuation Aspect:

Market Attention and Business Data Divergence, Valuation Levels at Historical Lows.

Compared to new concepts like Meme, AI, Depin, Restaking, and Rollup services, DeFi’s attention in this bull market has been very sparse, with price performance flat.

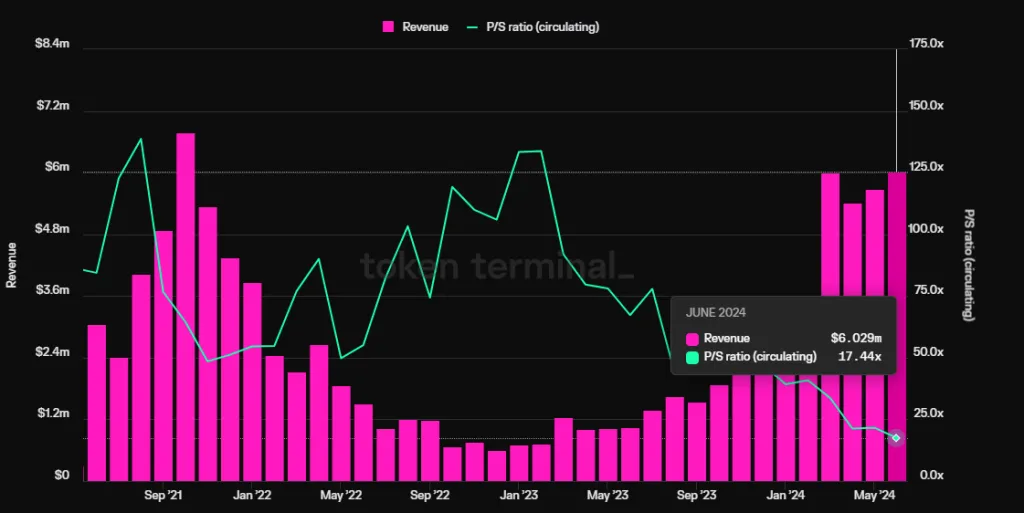

Meanwhile, the core business data of leading DeFi projects, such as transaction volume, lending scale, and profit levels, continue to grow, creating a divergence between price and business. As a result, the valuation levels of some leading DeFi projects have fallen to historical lows.

Take the lending protocol Aave as an example. Despite its quarterly revenue (net revenue, not overall protocol fees) surpassing the previous cycle’s peak and hitting new highs, its PS ratio (market cap/annualized revenue) has hit a historical low of just 17.4 times.

Policy Aspect:

FIT21 Act Favors DeFi Industry Compliance and Potential M&A.

The FIT21 Act, or the Financial Innovation and Technology for the 21st Century Act, aims to provide a clear federal regulatory framework for the digital asset market, strengthen consumer protection, and promote the United States’ leadership in the global digital asset market.

The act was proposed in May 2023 and passed in the House of Representatives on May 22 this year with a high vote. As this act clarifies regulatory frameworks and rules for market participants, it will make it easier for both startups and traditional finance to invest in DeFi projects once the act is formally passed.

Considering the embracing attitude of traditional financial institutions like BlackRock towards crypto assets in recent years (promoting ETF listings, issuing treasury assets on Ethereum), DeFi is likely to be a key focus for them in the coming years.

The involvement of traditional financial giants might make mergers and acquisitions one of the most convenient options, and any related signs, even mere intentions for M&A, would trigger a reevaluation of the leading DeFi projects’ values.

Conclusion

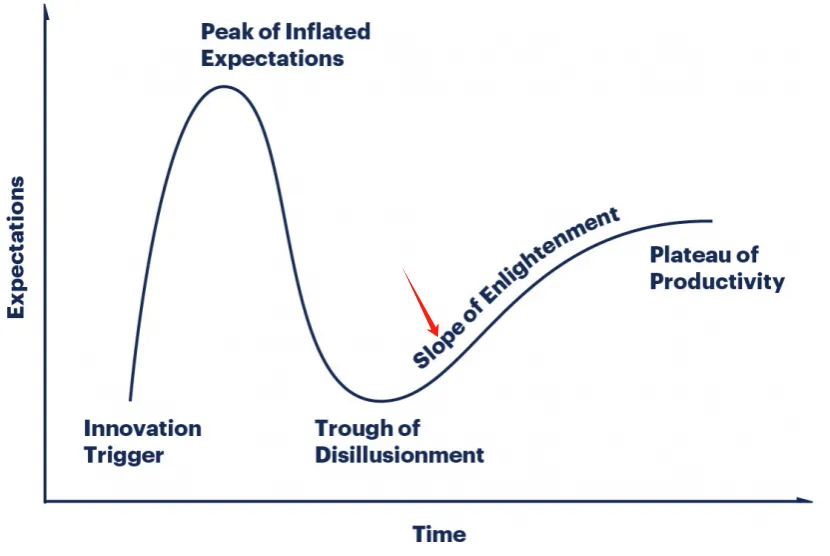

Like the development path of many revolutionary products, DeFi has gone through the narrative fermentation in 2020, rapid asset price bubble in 2021, disillusionment after the bear market bubble burst in 2022, and now, with sufficient verification of PMF (Product Market Fit), it is emerging from the narrative disillusionment phase, building its intrinsic value with actual business data.

I believe that as one of the few tracks in the crypto field with a mature business model and continuously growing market space, DeFi still holds long-term attention and investment value.