From Graham to Satoshi: A Value Investing Guide to Bitcoin

The Origins of Value Investing

The emergence of the “value investing” concept in the late 1920s was not a coincidence. This school of thought, pioneered by Benjamin Graham and David Dodd at Columbia Business School (CBS), was largely a response to the unchecked financial frenzy that triggered the Wall Street Crash of 1929 and subsequently led to the Great Depression.

The Roaring Twenties were a time of post-war optimism, rapid industrial growth, urban expansion, and technological advancements. These transformative social changes were partly catalyzed by an increasingly financialized economy and a surge in stock market participation.

As businesses flourished and the general public experienced unprecedented prosperity, the belief that “stocks only go up” became firmly entrenched in the public consciousness.

However, this trajectory, fueled by a lax monetary environment and excessive leverage, was unsustainable. Moreover, the lack of regulation and standardized corporate financial statements made it impossible for most investors to implement disciplined investment strategies.

Insider trading was legal, and deceptive accounting practices went unchecked, making it extremely difficult to determine whether a stock was a sound investment. Consequently, the prevailing mode of investment at the time was essentially speculative and driven by herd mentality, leading to a severely overvalued market and eventually, a spectacular crash.

The Father of Value Investing

Graham—considered the father of value investing—witnessed this turbulent period firsthand and suffered significant losses during the Great Depression, prompting him to rethink his investment approach from fundamental principles.

In the process, he created a detailed framework for determining a stock’s true or intrinsic value through fundamental research and analysis. Unlike the speculative bubbles of the 1920s, value investing is based on the idea that the market price of a particular asset does not always reflect its true underlying value.

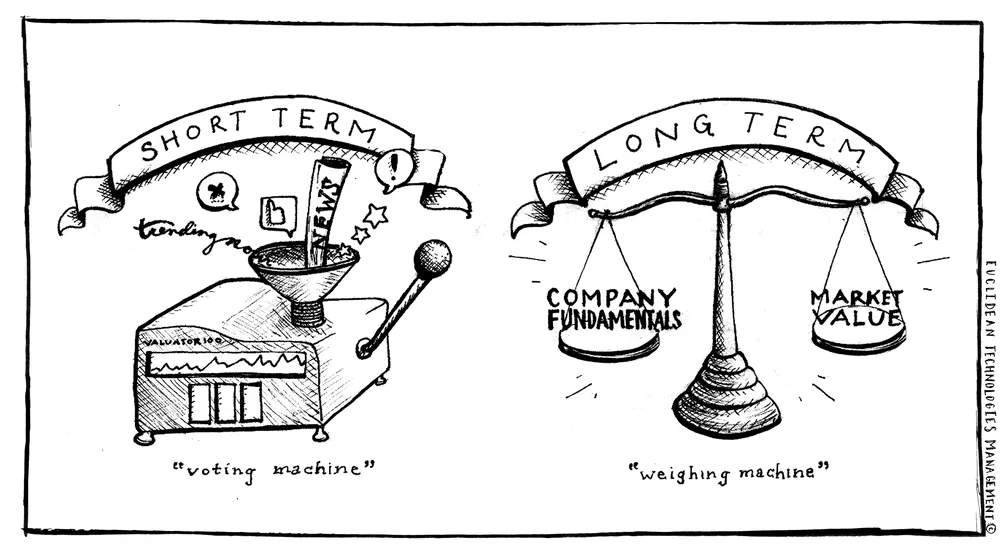

Instead, Graham viewed the market as an unstable pricing mechanism driven by investor sentiment, a concept he famously illustrated by likening the market to an investment partner named “Mr. Market,” who is willing to buy or sell company shares at different prices each day, depending on his mood. In other words, the market is a short-term voting machine but a long-term weighing machine.

Mr. Market’s job is to provide you with prices; your job is to decide whether it is to your advantage to act on them.

– Benjamin Graham, The Intelligent Investor (1949)

The Evolving Framework

In essence, value investing involves buying something at a price below its actual worth. Since Graham’s initial thinking, this fundamental concept has become a core tenet of professional investing for nearly a century.

His teachings inspired individuals like Warren Buffett, who was a student of Graham at Columbia Business School in the early 1950s and later created one of the most remarkable records in investment management history. Over time, however, the elements of the value investing framework have evolved and adapted to the changing financial landscape.

For instance, Buffett’s approach to value investing prioritizes more qualitative factors—not just the purely quantitative metrics Graham relied on—such as competitive barriers, barriers to entry, and excellent management.

Bitcoin represents a significantly undervalued investment opportunity

All these principles are rooted in long-term fundamentals, most commonly applied in the realm of traditional equities. However, it is worth considering how these principles can be applied to newer asset classes.

Although Bitcoin is not a traditional security, it presents a compelling case study for analysis within this framework. By understanding the fundamental supports of the asset and the potential development trajectory of the network, there is a strong argument to be made that Bitcoin represents a significantly undervalued investment opportunity, one whose investment thesis can be understood through the lens of value investing.

Applying the Value Investing Framework to Bitcoin

We believe that holding Bitcoin for the long term represents a modern, rational interpretation of value investing. Although this may seem counterintuitive to some, many fundamental elements of value investing can be directly applied to Bitcoin’s investment case.

Let’s explore how value investing concepts align deeply with the Bitcoin thesis:

1. Long-Term Investment Perspective:

Value investing requires investors to overlook volatility and be willing to wait for the market to recognize an asset’s true value. The best investments are those that can be held indefinitely.

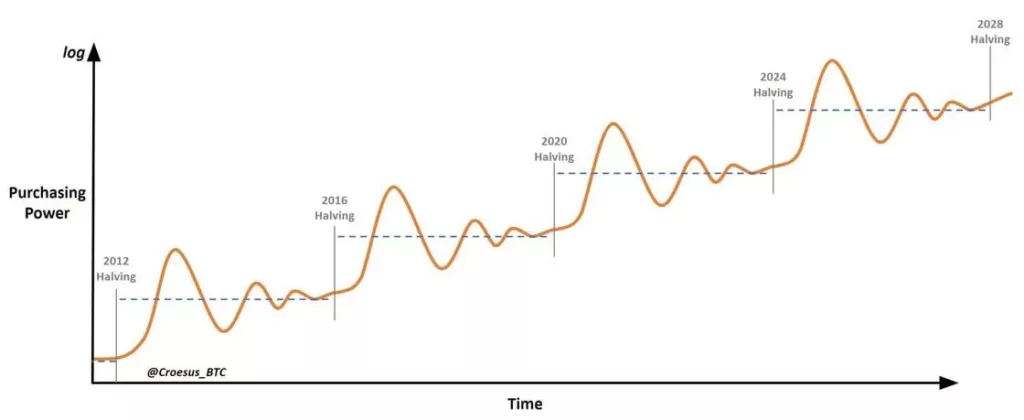

Within the value investing framework, Bitcoin’s historical volatility should not be viewed as a risk but as an opportunity to be captured by maintaining a long-term investment perspective and filtering out short-term noise.

The stock market is designed to transfer money from the Active to the Patient. … Uncertainty actually is the friend of the buyer of long-term values.

— Warren Buffett

2. Contrarian Thinking:

Following the crowd and chasing performance is contrary to the value investing philosophy. Instead, investment decisions should be made from first principles by identifying informational asymmetries.

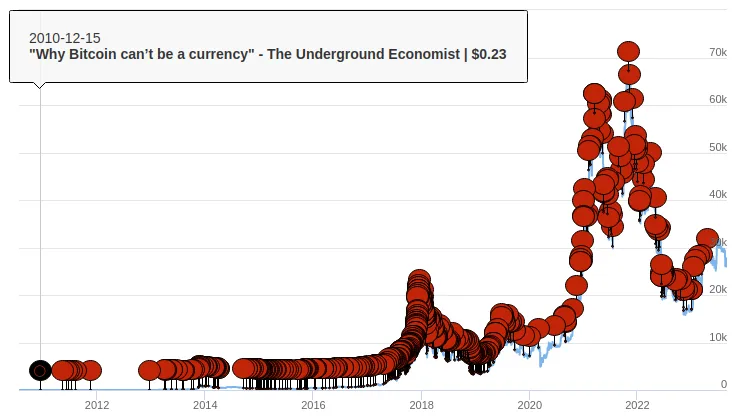

The widespread misunderstanding and lack of knowledge about Bitcoin (and our existing monetary system) have kept it in a contrarian investment position.

Going against the grain is always the hardest thing to do; and it sometimes takes a lot of courage and conviction to stand apart from the crowd. However, straying from the crowd is an essential component of long-term investing success.

— Seth Klarman

3. The Power of Compounding Returns:

The concept of compounding in value investing is akin to a snowball rolling down a hill; with time and patience, small gains can accumulate and multiply the value of an investment.

Importantly, this mathematical concept can also be applied to the hidden devaluation of currency—understanding that inflation erodes purchasing power slowly and insidiously is key to grasping Bitcoin’s value proposition.

It’s obvious that small differences in the rate of compound return will make an enormous difference in the success of an investment program. What may seem insignificant in a short period of time becomes utterly decisive over a long period of time.

— Warren Buffett

4. Comfort with Concentrated Investments:

A less conventional idea in value investing is that investors should embrace concentrated investments rather than subscribing to the widely-held belief that portfolio diversification is crucial. When investors truly understand an asset’s intrinsic value, they should size their positions according to this conviction, even if it leads to a more concentrated portfolio.

In the context of Bitcoin, a deep understanding of the technology, its unique properties as a digital store of value, and its overall adoption trajectory could lead to an outsized investment.

Diversification is protection against ignorance. It makes little sense if you know what you are doing.

— Warren Buffett

5. Excellence in Management:

A core principle of value investing is the excellence and integrity of the company’s management team. Investors should closely monitor the leadership to ensure that those managing their capital are both capable and trustworthy.

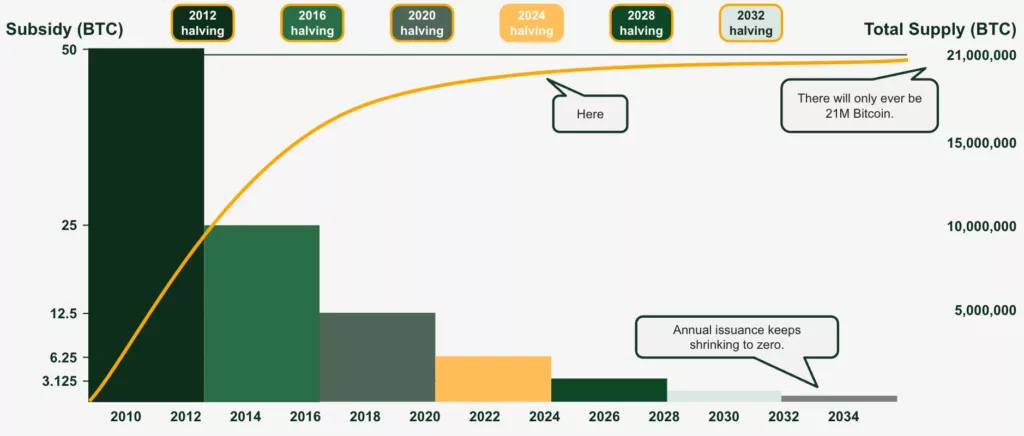

When this view is compared to Bitcoin, an interesting parallel emerges. Bitcoin’s foundation is not a tangible executive team but meticulously written code and an immutable monetary policy. Trust is placed not in fallible humans but in the absolute mathematical principles governing the protocol.

Therefore, Bitcoin’s appeal in the “excellence in management” realm lies in its lack of human intervention, offering investors a transparent and predictable financial tool.

Modern life has created the successful bureaucrat, and the successful bureaucrat is a real failure and a true idiot.

— Charlie Munger

6. Competitive Barriers and Barriers to Entry:

Value investing places great emphasis on competitive advantages, ensuring that companies maintain their edge and defend their market position. Bitcoin’s origin, often referred to as “immaculate conception,” represents a profound first-mover advantage in creating digital scarcity.

Bitcoin’s growing network effects, coupled with its unmatched degree of decentralization, underpin its dominant market position. As a result, any new entrants attempting to replicate or introduce similar digital scarcity will face insurmountable barriers, reinforcing Bitcoin’s intrinsic value proposition.

The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.

— Warren Buffett

Value Investing Is Not Dead

Just as mainstream media has frequently proclaimed “Bitcoin is dead” throughout its history, “value investing is dead” has also been declared countless times over the past few decades.

In reality, the mantra “growth at any cost” has dominated the markets in the 21st century, and the ongoing shift from “active” to “passive” index investing has played a role in the perception that value investing is invalid, as stock market performance has become increasingly concentrated in a few mega-cap growth stocks.

That being said, due to the behavioral tendencies of humans to chase performance, value investing will always be somewhat out of favor.

Value investing has no appeal to the crowd. If it had appeal, you would never be able to buy anything cheap.

— Arnold Van Den Berg

Furthermore, the phenomenon of continued currency devaluation through money printing and artificially low capital costs over the past few decades has contributed to the preference for growth stocks over value stocks.

However, despite the underperformance of “value” strategies in the stock market relative to “growth” strategies, the fundamental principles of value investing hold enduring merit.

Value investing represents the ability to foresee future growth in an asset’s financials or potential before the market realizes its true value.

Opportunity lies in the gap between perception and reality.

— Francois Rochon

Just like Bitcoin, value investing will never die. They may remain out of favor for long periods, but for those willing to delve into the full value potential of a digitally native, energy-backed, cryptographically secure, open-source, fairly distributed, scarce commodity, there are asymmetric opportunities.

Benjamin Graham, Warren Buffett, and many of their disciples may not yet realize it, but they have provided a useful toolkit for understanding the investment case for Bitcoin.