Layer2 Shift, What Are the Highlights of the Base Ecosystem?

In the fiercely competitive Layer2 arena, Arbitrum and Optimism, once dominant, seem to face unprecedented variables.

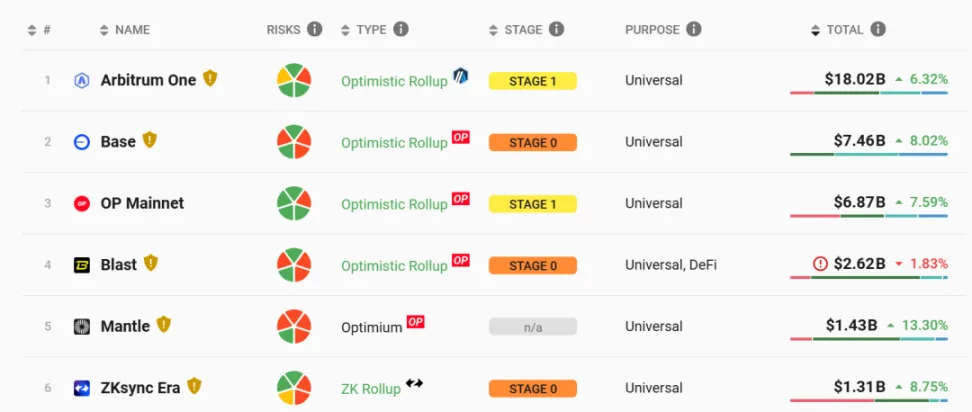

According to L2BEAT data as of July 23rd, Base’s TVL has surged to nearly $7.5 billion, surpassing Optimism’s $6.87 billion, securing the second position behind Arbitrum as the second-largest L2 network.

Considering Base itself is based on the OP Stack launched super chain, this “student surpasses the master” narrative seems filled with destiny.

So why has Base risen so suddenly? What connections and secrets does it have with Web3 giants like Coinbase? And which projects in the current Base ecosystem deserve attention?

Base: The OP Stack-based L2 “rising star”

To sum up Base in a sentence: backed by Coinbase and leveraging OP Stack, it has thrived on the wealth creation myth of memes and the traffic from social applications.

Previously, Forbes introduced Coinbase’s seven influential figures, among whom Base founder Jesse Pollak (the PUNK avatar below) prominently featured, joining Coinbase in 2017, a true veteran.

According to Fortune’s interview, in 2021, while overseeing Coinbase’s consumer products, Pollak conceived the idea for Base. To retain him, Coinbase CEO Brian Armstrong (C below) tasked him with bringing Coinbase onto the blockchain, the initial opportunity for Base’s creation (possibly explaining Base’s innate consumer application genes).

On August 9, 2023, Coinbase officially launched the Base mainnet, technically relying on Optimism’s open-source modular toolkit OP Stack. OP Stack allows developers and projects to customize L2 networks based on their specific needs, integrating with the Ethereum network for shared security and resources.

Consequently, Base and Optimism jointly launched governance and revenue-sharing frameworks:

- The larger of 2.5% of Base Sequencer total revenue or 15% of Base chain’s net revenue (L2 transaction revenue minus L1 data submission costs) goes to the Optimism Collective governance system.

- The Optimism Foundation also offers Base the opportunity to earn up to approximately 118 million OP Tokens over the next six years.

In less than a year, Base has not only dominated the OP super chain ecosystem but also surpassed numerous Ethereum L2 networks including Optimism, achieving remarkable success.

Although currently lacking executive titles at Coinbase, Base, responsible for its launch, is arguably one of Coinbase’s most successful products in recent years within the cryptocurrency sector, underscoring its significant influence at Coinbase.

Of course, being the sole Sequencer on the Base network, Coinbase has also reaped substantial benefits. For example, in Q1 of 2024, users paid $27.4 million in transaction fees to Base (all fees included), with Coinbase receiving $15.5 million.

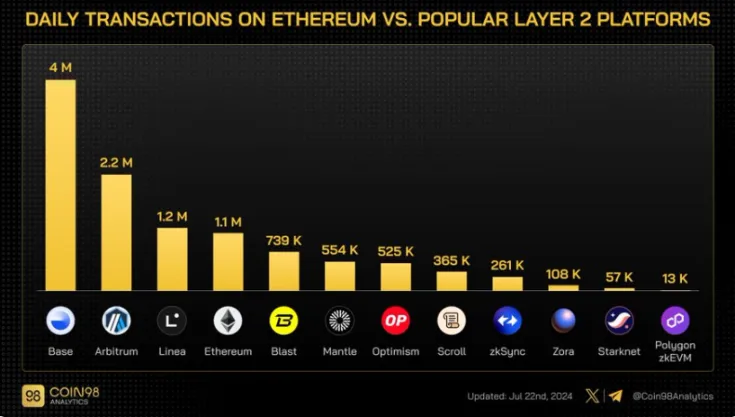

According to Coin98 statistics, besides surging TVL, second only to Arbitrum, Base’s daily transaction volume has also surpassed Arbitrum, nearly doubling it—data as of July 22nd shows Base reaching a historical high of over 4 million daily transactions, demonstrating its unmatched performance.

Such active on-chain performance is not unfounded; understanding Base reveals its mature consumer genes, excelling in both the “Meme” and “SocialFi” realms, making it a highly competitive network in the L2 field even without an expected token issuance.

Walking on two legs: Meme and SocialFi

Firstly, in the Meme sector, Base has leveraged periodic wealth creation myths to attract substantial funds and users as a savvy marketing and customer acquisition strategy.

From TYBG and Degen to Brett and more, Base frequently hosts “god tokens” with massive wealth effects, attracting significant short-term traffic spikes and even migrations of several Ethereum mainnet Meme projects to Base.

Moreover, besides Meme, Base is also known for its “SocialFi” initiatives.

In September 2023, friend.tech brought valuable explosive community traffic through its bonding with X. Users can purchase shares of friend.tech users through ETH on the Base chain, gaining the right to interact directly and potentially profit, boosting Base’s position in social applications.

Subsequently, Farcaster solidified Base’s position as an L2 “social newcomer,” leading in Web3/social applications with $150 million in financing from top-tier investors like Paradigm and a16z.

Vitalik also endorsed Farcaster, his X account hacked in September 2023, stating his Twitter account was SIM swapped and he had uninstalled Twitter, joining Farcaster to regain control via Ethereum addresses.

As of now, Farcaster has become Vitalik’s preferred social media hub, positioning itself as the preferred social platform for Ethereum OGs.

Leading projects roundup

Beyond technology and hits, ecosystem development is crucial for an L2’s long-term sustainability.

To what extent has the L2 ecosystem evolved, and which exclusive leading projects are worth noting? (Excluding friend.tech and Farcaster, prominent multi-chain players like Uniswap and Aave are not discussed.)

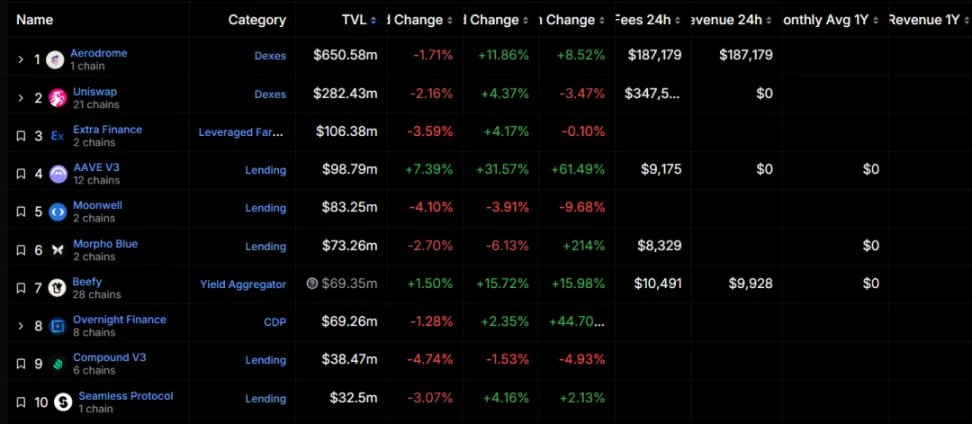

According to DefiLlama data, DeFi TVL on Base is $1.74 billion, with several (semi-)native DeFi projects dominating, including Aerodrome ($650 million), Extra Finance ($106 million), Moonwell ($83.25 million), and Morpho Blue ($73.26 million).

Aerodrome

Aerodrome, as a “MetaDEX” on Base, is currently the highest TVL DApp, driving the core ecosystem with over $650 million in total locked value, more than double the second-ranked Uniswap ($282 million).

Combining elements from Uniswap V2/V3, Curve, Convex, and Votium, Aerodrome’s unique architecture adjusts incentives among protocol participants, including traders, LPs, and those seeking liquidity for tokens, using its Ve governance model.

Participants must lock AERO tokens to collect fees, and veAERO locks allow users to direct token emissions to specific pools, earning 100% fees and emissions, incentivizing voters to direct emissions to pools with the highest trading volume, enhancing LP attraction and improving trading experiences with low slippage.

Extra Finance

Extra Finance offers decentralized borrowing, leveraged farming up to 3x, long/short, neutral strategies, strategy vaults, and other products on Optimism, employing ve tokenomics like Aerodrome.

veEXTRA holders unlock benefits like annual rate rewards, higher leverage for liquidity mining pools, high utilization of loan pools, and priority access to upcoming features and advantages.

Other launched borrowing protocols such as Moonwell and Morpho Blue also operate at the million-dollar TVL level.

Beyond DeFi, DApps in consumer sectors like social and gaming on Base also deserve attention.

Warpcast

Warpcast, the decentralized social protocol client for Farcaster, supports NFTs displayed on Ethereum, Base, and ZORA.

Blackbird

Blackbird, a Web3 platform tailored for the hospitality industry, aims to establish direct relationships with guests through loyalty and membership services. In October 2022, Blackbird completed a $11 million seed round with Union Square Ventures, Shine Capital, and Multicoin Capital leading, alongside Variant, Circle Ventures, and IAC.

Other social networks supporting Base include Friends With Benefits (FWB), Web3 community event platform Galxe, and more.

According to Base’s official information, ecosystem companies or projects include Animoca Brands, Game7 DAO, Web3 gaming solutions provider ChainSafe Gaming, blockchain gaming companies Faraway, NFT sci-fi card game Parallel, adventure and competitive game Pixelmon, puzzle game Words3, and Yield Guild Games.

Conclusion

In less than a year, rising from zero to L2 runner-up with $7.5 billion TVL, Base’s achievements without issuing a native token are truly impressive.

As a standout in the new L2 network, Base highlights the unique advantages of Web3 consumer applications, suggesting that whoever seizes the future hits of Web3 consumer applications may command explosive growth and widespread adoption in crypto.

History serves as a prologue; for those aiming to emerge in Web3 mass adoption, Base serves as a valuable reference.