A Comprehensive Analysis of Banana Gun

Successful projects often emerge from places that are easy to overlook. When people discuss notable investment successes, they frequently reference companies like Tesla, Apple, and Amazon. However, if we look closely at history, many investors found their first success in niche sectors such as insurance, auto parts, and pharmaceutical services. Ironically, it’s often these lesser-discussed early-stage ventures that can offer the greatest returns.

In a similar way, we believe that token markets present such opportunities, especially with a project like Banana Gun, a Telegram bot. Banana Gun is one of the most profitable ventures within the on-chain economy. It benefits from a user base that is insensitive to price, high-quality order flow, and the significant advantages of economies of scale.

The on-chain front-end market is one of the largest segments of the blockchain economy, and its fundamentals are often misunderstood, making Banana Gun relatively undervalued compared to other projects.

In this article, we’ll explore five essential but lesser-known aspects of Banana Gun that highlight its potential:

- High-value user base,

- Economies of scale as a key moat,

- Order flow quality enabling potential pricing power,

- Larger market opportunities than perceived,

- Strong fundamentals.

Banana Gun’s High-Value Users

Banana Gun is a Telegram bot that enables users to trade tokens across EVM (Ethereum Virtual Machine) and SVM (Solana Virtual Machine) chains. For frequent on-chain traders, platforms like Uniswap and Raydium, though decentralized, can still be inconvenient. Trading directly on these DEXs (Decentralized Exchanges) is akin to transacting on the New York Stock Exchange without intermediaries like Robinhood or Interactive Brokers.

Banana Gun simplifies this process by allowing users to trade directly from Telegram, along with features like sniping, copy trading, and anti-rug mechanisms—critical functionalities for Banana Gun’s core trader community.

The core users of Banana Gun are speculative traders willing to take on high risk in exchange for potentially massive returns. These users are highly valuable because they are both active (contributing to high trade volumes) and price-insensitive (due to higher disposable income). Many of them trade volatile memecoins in hopes of achieving a 100x return on their investments. These traders are capable of earning substantial profits within weeks and are relatively indifferent to paying high fees (around 75bps).

To illustrate, consider the following comparison:

- A memecoin trader managing $100,000 might frequently snipe trades and rotate positions weekly, potentially generating $2 million in trading volume over three months, resulting in $20,000 in fees.

- By contrast, a liquid token fund managing $30 million, but constrained by an investment committee, may generate $5 million in trading volume over the same period but only incur $10,000 in fees.

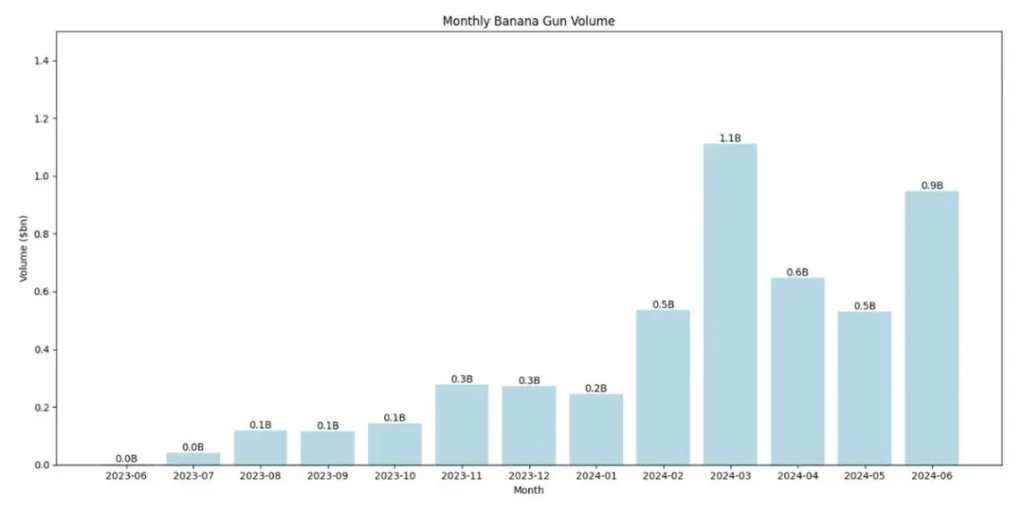

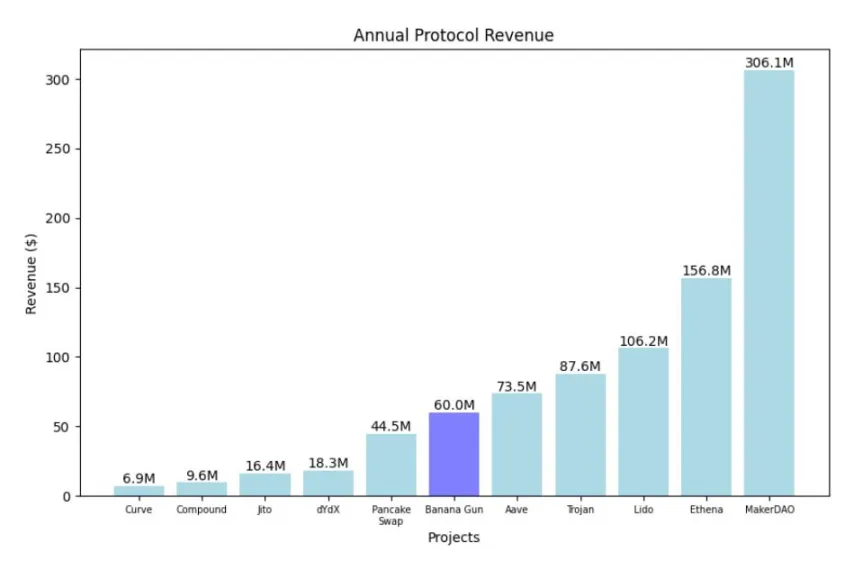

Banana Gun is expected to generate $7.8 billion in annual trade volume and approximately $60 million in cash flow, with a cumulative user base of 151,000 and around 5,000 daily active users. These statistics reflect the high value of Banana Gun’s user base.

Strong Economies of Scale as a Protective Moat

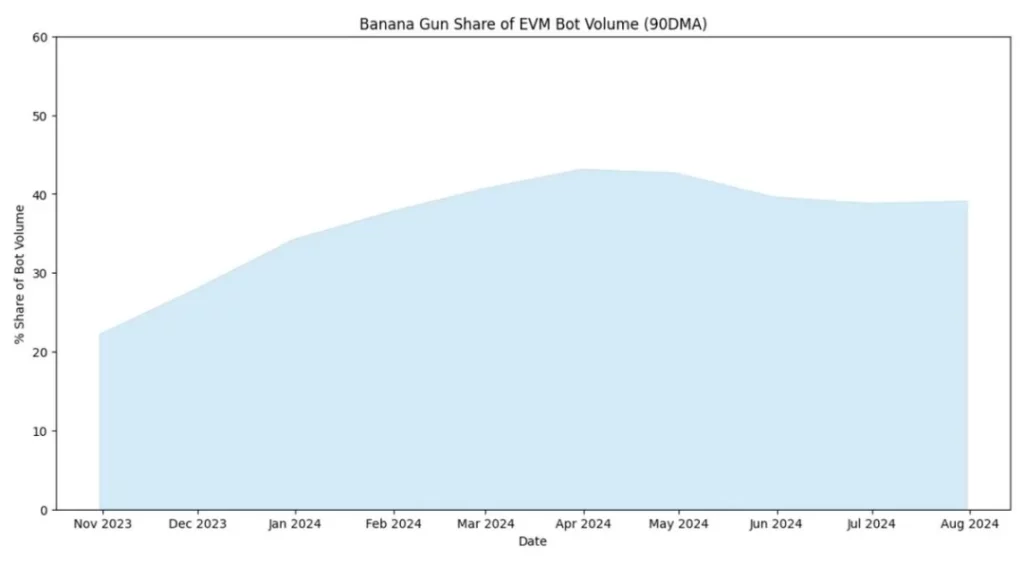

Banana Gun users prioritize functionality, user experience, and trade execution quality. Active traders are less inclined to switch between different Telegram bots, as they value convenience. This is why being the largest Telegram bot on EVM (Ethereum) is more achievable than dominating a smaller ecosystem like Solana.

Moreover, advanced features like sniping naturally lead to a monopoly for the largest bot. Only one bot can successfully execute a snipe, and it’s almost always the one with the highest resources. Banana Gun currently wins 88% of snipes, demonstrating that smaller competitors have little chance to outperform it.

These features require significant infrastructure investment to ensure low latency and high-speed execution. Banana Gun also needs additional resources for its anti-rug functionality, which scans mempools to check for liquidity withdrawals by token issuers and places user sell orders ahead of them in the next block. Estimates suggest Banana Gun spends about $3.6 million annually on infrastructure, a figure unsustainable for smaller competitors.

Banana Gun’s early establishment in this sector gives it a substantial moat. Many well-funded projects with excellent leadership have entered this space, but none have managed to capture market share from Banana Gun.

Order Flow Quality and Potential Pricing Power

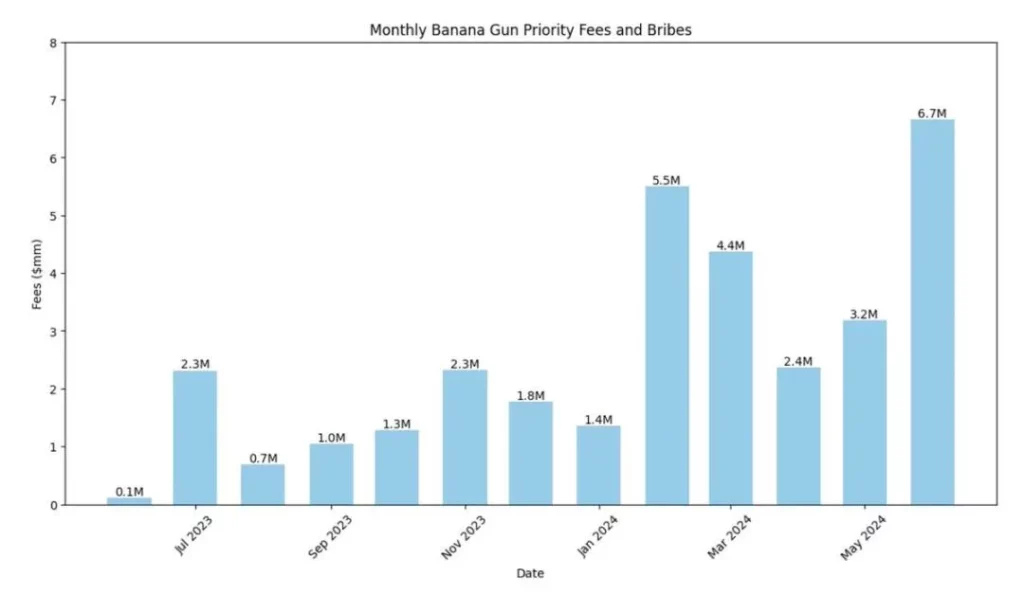

Banana Gun is a key player in the order flow sector. It is projected to send $50 million in priority fees and bribes to miners in 2024. According to Yang’s Decentralization of Ethereum’s Builder Market (2024), Banana Gun plays a crucial role in about 40% of MEV Boost auctions. Additionally, Markovich’s Decentralizing Monopolistic Power in DeFi (2024) highlights Banana Gun’s order flow as the largest profit driver for Titan, the second-largest miner on Ethereum.

While Banana Gun currently does not charge for order flow, we anticipate this will change over time. Whether through direct order flow auctions built into the Ethereum protocol or deals with miners, this $50 million flow could be redirected to Banana Gun users. In essence, Banana Gun not only generates profits but also plays a systemically important role in the Ethereum ecosystem.

The Solana and Web Expansion = Enormous Market Opportunity

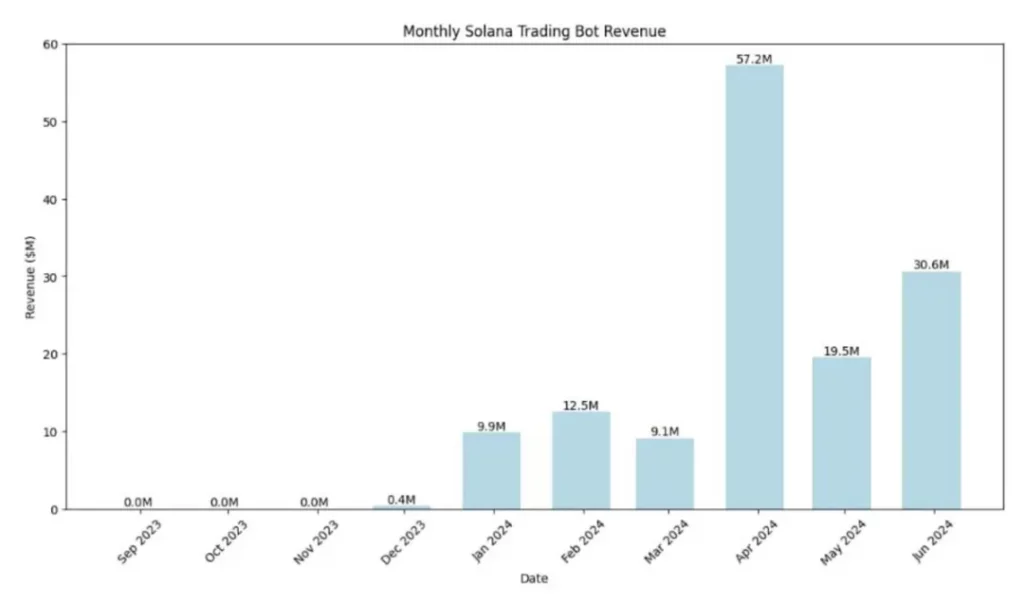

Banana Gun is now launching its Solana features, entering a less competitive but more profitable market. The annualized YTD market potential on Solana is estimated to be $280 million. Trojan, a similar operator that entered Solana earlier in 2024, is projected to earn over $100 million in revenue. While it’s challenging to replicate Trojan’s success fully, Banana Gun is poised to carve out its share of the Solana market.

In addition, Banana Gun is developing its own web application, envisioned as a decentralized exchange resembling Binance but running entirely on-chain. Though full development will take years, the team has already begun deploying enhanced token-trading features through a web app. This is a significant opportunity, and we expect the web app to benefit from the high-value user base and order flow already discussed.

Strong Fundamentals

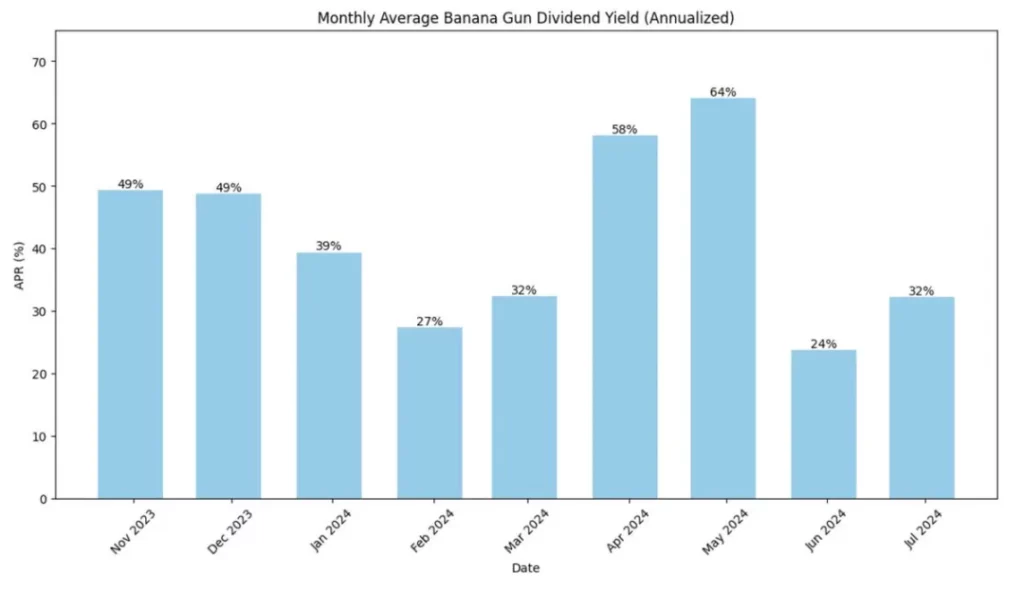

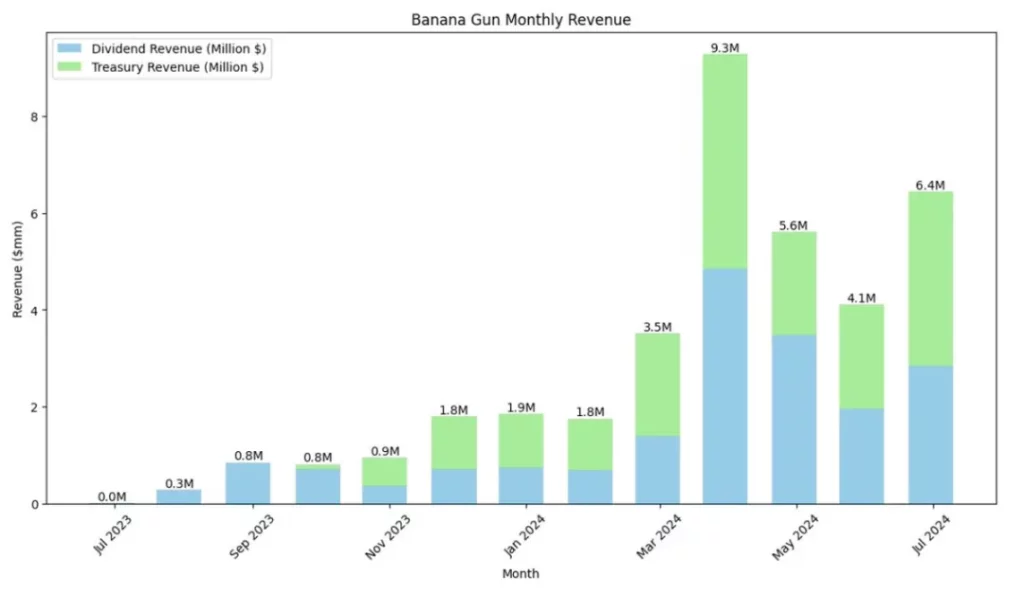

Banana Gun’s financial prudence is evident in its revenue distribution model. The company generates $60 million annually, with 40% distributed as dividends to token holders and the remaining 60% reinvested for growth and operational costs. However, as the team continues to accumulate funds, it is likely that more rewards will be returned to users.

The design of its TGE (Token Generation Event) also reflects Banana Gun’s long-term vision. The team retains 10% of the token supply, with half locked for five years and the other half locked for eleven years. This ensures that the team remains committed to the project’s growth over the long term. Additionally, a portion of these tokens earns revenue, incentivizing the team to increase revenue and distribute profits to token holders.

Valuation Perspective

Banana Gun’s fully diluted market cap stands at $690 million, but this includes approximately 64% of tokens issued to the treasury. These funds were allocated during Banana Gun’s early stages as strategic reserves. The team has already committed to burning tokens upon unlocking, with 26% of tokens permanently destroyed to date.

After adjusting for this, Banana Gun’s market cap should be viewed as $345 million, resulting in a P/E ratio of approximately 5.75x based on $60 million in earnings. This positions the project for significant price appreciation post-listing on Binance.