Celestia’s Controversial Financing Announcement

Recently, the modular blockchain Celestia has found itself embroiled in a trust crisis, as a disclosed $100 million financing round has been criticized as a veiled OTC token sale, coinciding with a major token unlock. This sequence of events has put Celestia, a leading player in the modular blockchain space, under scrutiny.

Community members have raised concerns that Celestia may be colluding with venture capitalists or institutions to artificially inflate the token price before a large unlock. By framing an OTC token sale as new financing, the project could mislead investors and potentially manipulate market perceptions.

Critics argue that the Celestia Foundation failed to provide necessary transparency regarding this off-market transaction, misleading investors and igniting a trust crisis. As of now, Celestia has not responded to these allegations.

The $100 Million Financing and Its Timing

On September 24, Celestia announced it had completed a $100 million financing round led by Bain Capital Crypto, with participation from Syncracy Capital and others, bringing total funds raised to $155 million. Following this announcement, Celestia’s native token, TIA, surged from $5.60 to a high of $6.90, representing a gain of over 20%, before stabilizing around $6.50.

However, crypto investor Sisyphus claimed on social media that this so-called financing was actually an OTC sale conducted months prior, at a valuation of $3.5 billion. He suggested that these tokens might unlock in October, casting doubt on the integrity of the financing announcement.

Sisyphus noted that if institutions sold their unlocked assets at $7.50, they would break even. His identity has been linked to Kevin Pawla, former head of OpenSea Ventures.

Community Backlash and Concerns

The initial positive reception of the financing announcement quickly soured as the community perceived it as a strategic move to mislead investors. Critics believe that presenting an OTC transaction as new financing, especially before a significant unlock, could artificially inflate the token price and mislead retail investors into buying in.

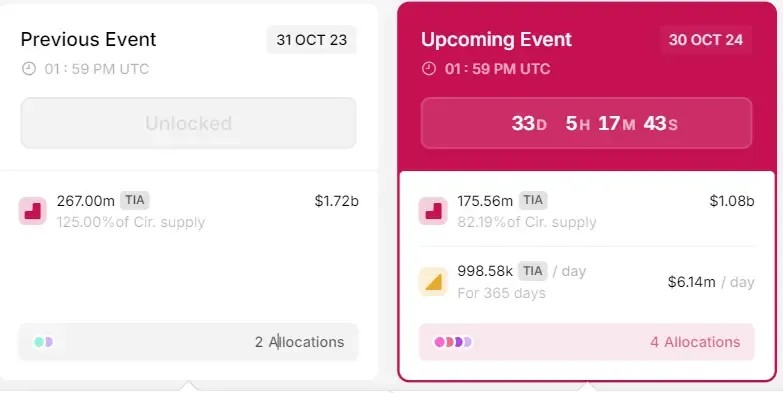

Data from Token Unlock indicates that over 175 million TIA tokens will unlock on October 30, accounting for 17.68% of the total supply, valued at approximately $1.08 billion. Such a substantial influx could lead to significant price volatility, as historical data suggests that major token unlocks often exert downward pressure on prices.

The timing of the financing announcement—revealed just weeks before a large unlock—raises questions about the motivations behind the decision, suggesting a potential scheme to profit from elevated prices.

Evaluating Celestia’s Valuation and Revenue Discrepancy

Celestia, designed for data availability, significantly reduces data costs compared to Ethereum’s mainnet. Despite a peak token price exceeding $21 earlier this year, TIA has seen a substantial drop, falling to around $3.70.

The financing controversy has highlighted a broader issue within the crypto space: a disconnect between project valuations and actual revenue. Celestia’s valuation sits at $3.5 billion, yet its potential annual revenue is reportedly just over $500,000, revealing a significant gap between market perception and operational reality.

Sisyphus previously pointed out that a valuation based on such limited revenue isn’t a sound investment. The disparity between Celestia’s lofty valuation and its current revenue has led to renewed scrutiny of how the crypto industry assesses value.

Conclusion: The Need for Transparency and Maturity in Valuation

The Celestia situation underscores the crypto community’s call for transparency and accountability from projects, particularly regarding funding sources. While OTC transactions are commonplace, they should be disclosed clearly to avoid misleading investors.

The lack of a mature valuation framework in the crypto industry often leads to inflated expectations based on speculative potential rather than actual performance. This highlights the need for a more nuanced approach to evaluating projects, focusing on operational metrics rather than hype. Until such frameworks are established, the potential for misrepresentation and market manipulation will remain a critical issue in the crypto landscape.