Is Eigen’s Unlock Approaching? A Deep Dive into EigenLayer

In recent days, EigenLayer, the pioneer of the restaking sector, has made two major announcements regarding its EIGEN token.

First, the Season 2 airdrop is now open for claiming, with a window extending until March 16, 2025. Second, a Programmatic Incentives V1 will launch in October (retroactive to August 15), distributing weekly EIGEN rewards to eligible stakers and node operators. About 66.95 million EIGEN tokens, equivalent to 4% of the total initial supply, will be allocated in the first year.

Many observers believe these moves are a strategic buildup ahead of the EIGEN unlock event, designed to generate more market attention and engagement once the token becomes fully tradable.

When Will EIGEN Unlock?

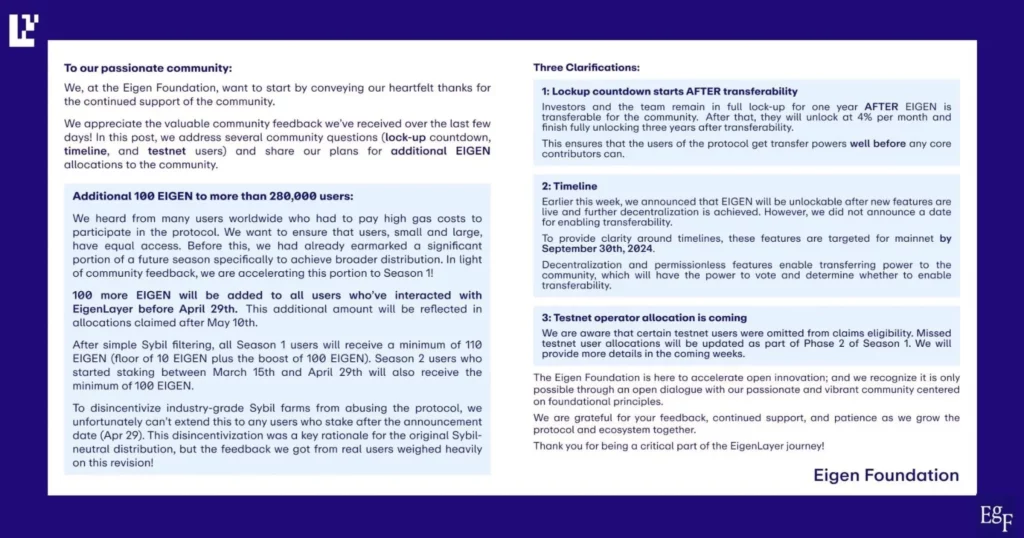

The EIGEN token has been in a non-transferable state since its Season 1 airdrop on May 10, which has somewhat tempered public discussions about EigenLayer. A common misconception is that September 30 marks the unlock date.

This confusion stems from an official Eigen Foundation document released in May, which mentioned this date but clarified that it was a target for enabling new features and achieving further decentralization.

The unlock will occur only after these milestones are met—September 30 is merely a deadline for these developments, not the token unlock date. While EigenLayer has launched several features, such as AVS rewards and the upcoming Programmatic Incentives, it’s unclear how the team evaluates their progress toward full decentralization.

However, the completion of the airdrop and incentives should accelerate token distribution, likely meaning that the unlock won’t be delayed much longer after the second season’s airdrop concludes.

EigenLayer’s Current Data and Valuation

According to DeFiLlama, EigenLayer currently boasts a Total Value Locked (TVL) of $10.79 billion, ranking third behind major protocols like Lido and Aave. The platform supports 16 Active Validation Services (AVS), ranging across multiple fields, including data availability (DA), oracles, privacy, decentralized infrastructure (DePin), gaming, and ZK validation.

Despite emerging competition from other restaking protocols, EigenLayer maintains the largest market share, fastest development pace, and strongest network effects.

EigenLayer’s strength lies in its ability to foster innovation within the Ethereum ecosystem, sparking a wave of projects like ether.fi, Renzo, and AltLayer, each finding its niche through EigenLayer’s infrastructure.

In terms of valuation, although EIGEN tokens are not yet transferable, some platforms, such as Aevo, have already started pre-market contract trading of the token. As of this writing, EIGEN is priced at $2.95, giving EigenLayer a fully diluted valuation (FDV) of approximately $4.93 billion.

Initial Circulating Market Cap

While EigenLayer hasn’t disclosed EIGEN’s initial circulating supply, we can estimate the total number of tokens based on airdrop data. During the Season 1 airdrop, around 87.89 million EIGEN tokens were claimed, and the Season 2 airdrop will distribute another 86 million tokens.

Assuming a similar claim rate to Season 1 (~78.6%), approximately 67.59 million tokens will be claimed in Season 2, bringing the total to 155 million EIGEN tokens.

At a price of $2.95, this would give the circulating supply a value of about $457 million.

Future Airdrops?

EigenLayer has committed to distributing 15% of the total supply (about 200 million EIGEN tokens) via airdrops, with 11.9% already allocated across Season 1 and Season 2. This leaves around 3.1% for potential future airdrops.

However, small-scale stakers may find it increasingly difficult to receive substantial allocations from future rounds, as most tokens have been distributed to whales, node operators, and community contributors—especially those who have provided original content related to EigenLayer. Future rounds are likely to follow a similar distribution model.

Incentives and Profit Expectations

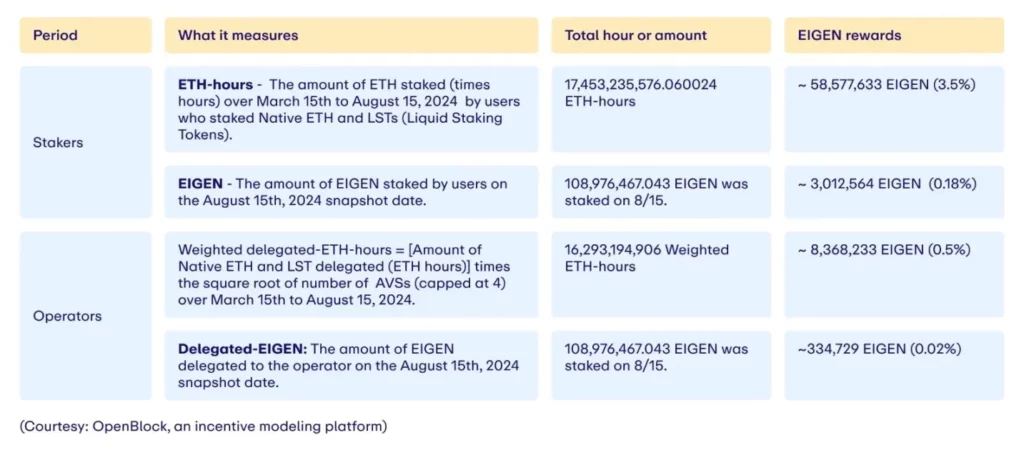

Apart from the airdrops, another way to earn EIGEN is through the incentive program, which will start in October. The program will retroactively reward stakers and node operators based on their activity since August 15, with weekly rewards being distributed.

In the first year, 66.95 million EIGEN tokens (4% of the initial supply) will be distributed. Based on the current price of $2.95, this amounts to $174 million in incentives. EigenLayer’s current TVL of $10.79 billion means that stakers can expect an annual yield of around 1.6% from this incentive program.

While the 1.6% yield may not seem significant, EigenLayer’s stakers are typically large, risk-averse investors prioritizing security and liquidity over high returns. Moreover, EigenLayer offers additional native staking yields of 3%, and with the potential appreciation of the EIGEN token, the protocol remains attractive for capital allocation.

In summary, EigenLayer’s upcoming developments and incentive programs position it as a critical player in the evolving restaking sector, offering both yield opportunities and potential for future value growth.