Orderly Network: The Dream and Reality of Cross-Chain Derivative Liquidity

In the vision laid out by various PerpDEX projects, the market is a trillion-dollar industry. However, in the harsh reality of the current market, PerpDEX remains a niche segment within DeFi. Despite several iterations—from AppChain CLOBs to generalized L2 AMMs and modular CLOBs—PerpDEX has yet to break through in the same way that spot DEXs have challenged centralized exchanges (CEXs). Even the most successful PerpDEXs can barely maintain their existence.

The Underlying Dilemma: Order Flow Isolation and Fragmented Liquidity

Before the advent of cross-chain solutions, every L1/L2 network functioned as an isolated island. Each emerging network typically integrates at least one PerpDEX, leading to the isolation of order flows and fragmented liquidity. Each network has its own order flow and liquidity pool, making it difficult to share resources.

Moreover, a strong “Matthew Effect” means that networks with abundant order flow and liquidity attract even more of both. This causes rational traders to favor high-volume trading pairs like BTC-USD-Perp and ETH-USD-Perp, while rational investors opt to provide liquidity for these pairs.

Free market proponents might argue that this is a natural market outcome, and thus intervention isn’t necessary. However, the combined effects of order flow isolation and fragmented liquidity result in significant issues:

- Inefficient Liquidity: When liquidity is spread across multiple isolated platforms, overall capital efficiency diminishes.

- Increased Trading Costs: Slippage in PerpDEX’s Altcoin-Perp pairs is often much higher than in CEX contracts, affecting user experience and deterring institutional investors.

- Reduced Price Discovery Efficiency: With order flows split among various platforms, the price discovery mechanisms of PerpDEXs suffer. They often rely heavily on oracle feeds, limiting their flexibility to list new assets.

- Lack of Scale Economies: Due to market fragmentation, each PerpDEX struggles to achieve true scale, leading to high operational costs that hinder competitive rates and services.

- Stifled Innovation: Smaller PerpDEX projects, which could bring innovative ideas, often lack sufficient order flow and liquidity to validate their concepts, reducing the overall innovation in the sector.

These challenges prevent PerpDEXs from realizing the key characteristics that have made spot DEXs successful: the freedom to list new assets and provide liquidity.

Orderly Network: Building a Cross-Chain Liquidity Layer for PerpDEXs

In light of these challenges, Orderly Network proposes a “Cross-Chain Liquidity Layer” aimed at reversing the trend of isolation among L1/L2 networks. If successful, this initiative could lead to revolutionary changes:

- Lower Trading Costs: By aggregating liquidity across networks, slippage could be significantly reduced.

- Enhanced Capital Efficiency: Liquidity providers can cover more trading demand with less capital, boosting efficiency.

- Improved User Experience: Traders would no longer need to switch between multiple platforms but could operate from a unified interface.

- Broader Innovation Opportunities: Developers could leverage this unified liquidity layer to create more innovative financial products.

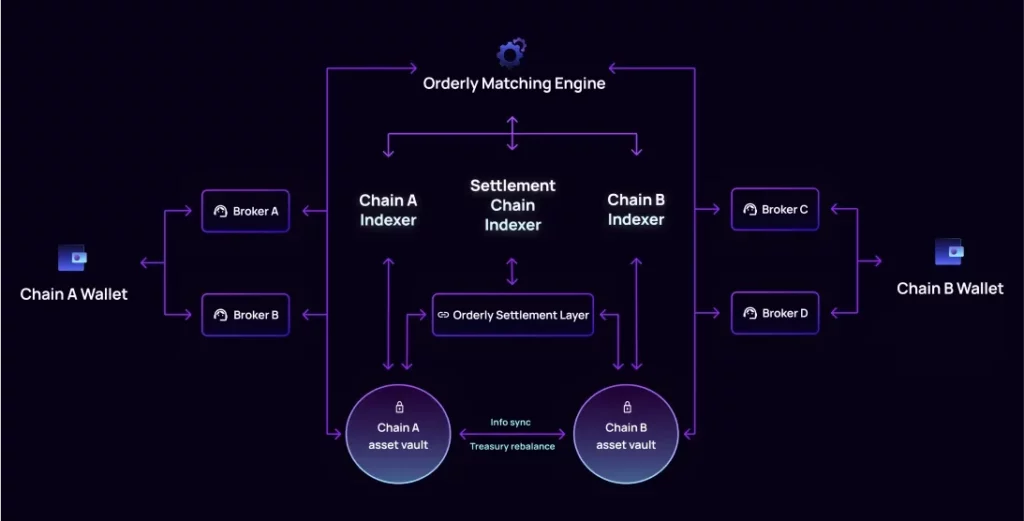

Orderly Network’s solution includes several key components:

- Unified Order Book: Orders from all chains are consolidated into a central order book for optimal price discovery and matching.

- Cross-Chain Settlement Layer: Built on OP Stack, Orderly Chain manages cross-chain asset settlements and ledger records.

- Multi-Chain Asset Custody: Funds are securely held across different chains, ensuring asset safety and decentralization.

- Developer-Friendly SDK: An easy-to-use SDK enables developers to quickly integrate into Orderly’s liquidity network.

This design seeks a balance between centralized efficiency and decentralized security, achieving high-order matching efficiency while ensuring safety.

Orderly Network’s Performance and New Challenges

According to data from Dune, Orderly Network has shown impressive operational performance:

- Substantial Market Scale: Orderly Network has achieved a remarkable cumulative trading volume of $83.7 billion.

- Strong User Base: With 429,499 total accounts and 298,464 unique wallet addresses, it has built a large and diverse user community.

- Notable Revenue Generation: The platform has generated a net income of $7.8 million, indicating substantial profitability.

- Multi-Chain Strategy: With a total locked value (TVL) of $18.43 million across major chains like Optimism, Arbitrum, and Base, this diversification minimizes risk and expands market potential.

- Active Ecosystem: Currently hosting 29 active builders and 59 Perp trading pairs, Orderly Network has fostered a thriving ecosystem attracting various developers and projects.

However, Orderly Network now faces several new challenges:

- Disruption from the Meme Coin Market: The recent meme coin surge has drawn attention away from PerpDEX trading markets, as meme coins offer lower risk and more controllable volatility.

- Matthew Effect in PerpDEX Markets: Most PerpDEXs built on Orderly Network are in the market’s tail, with trading volume concentrated in a few well-known platforms.

- Post-Airdrop Decline: Like other projects, Orderly Network is experiencing a decline in TVL, trading volume, and active users following its token airdrop.

- User Retention Issues: User loyalty in crypto is notoriously low, posing a significant challenge for Orderly Network to retain users amidst fierce competition.

Orderly Network’s Strategies for Breakthrough

To address these challenges, Orderly Network has implemented several strategies:

- VALOR Staking Mechanism: By incentivizing users to stake native tokens ORDER and VeORDER for VALOR, Orderly Network aims to lock in liquidity and boost token market prices. Over 76 million ORDER tokens have already been staked, achieving an annual yield of up to 22%.

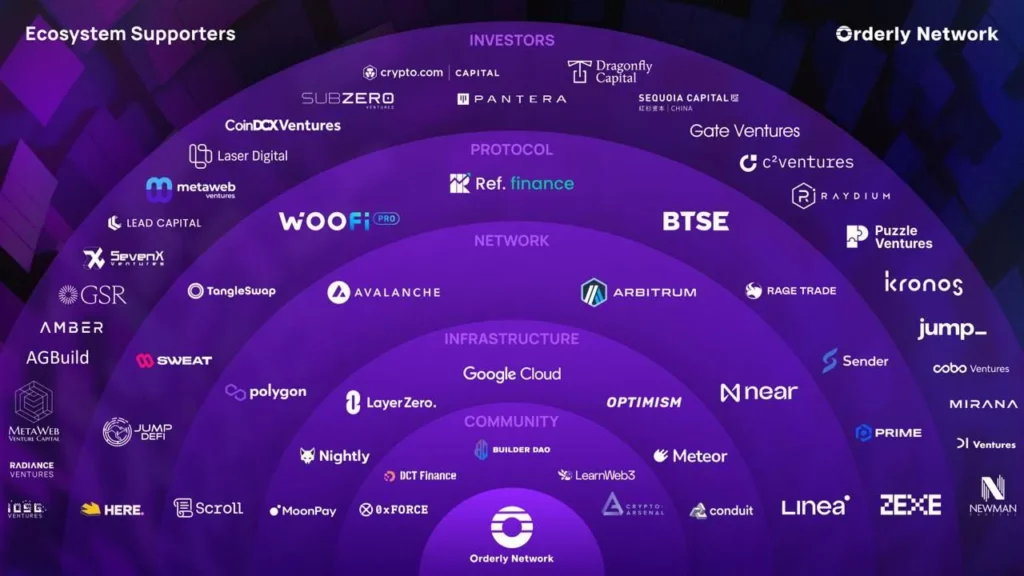

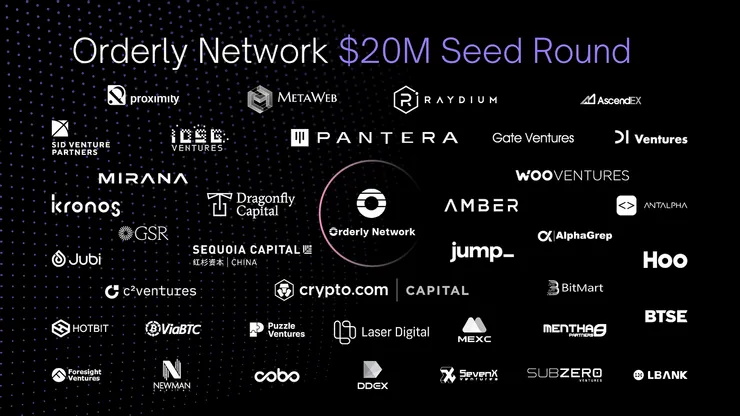

- Strategic Funding and Partnerships: The recent $5 million investment led by OKX Ventures not only brings financial support but also opens doors for deep collaborations with industry leaders in derivatives.

- Continuous Ecosystem Expansion: Orderly Network is actively seeking to expand support for more public chains, enhancing its competitive edge.

- Technological Innovation: Leveraging OP Stack for Orderly Chain and incorporating Celestia’s data availability and LayerZero’s cross-chain protocol positions the platform for future scalability and efficiency improvements.

Conclusion

The vision of Orderly Network’s Cross-Chain Liquidity Layer is undoubtedly exciting for the market, aiming to address a core pain point in the PerpDEX landscape. However, the path from vision to reality is rarely straightforward. Whether Orderly Network can truly become a hub for cross-chain derivative liquidity remains to be seen, and it may take time to find out.