Poor Performance of Altcoins? Lack of Liquidity and Token Proliferation Might Be the Culprits

The fundamental flaws of cryptocurrencies are becoming evident, which is the primary reason for the poor performance of altcoins in this cycle. Currently, there seems to be no solution, and the data I’ve uncovered is shocking.

This article aims to provide more insight into the biggest issues facing cryptocurrencies. It will explain exactly how we got here, why prices are behaving the way they are, and the path forward.

The Golden Age of Opportunists

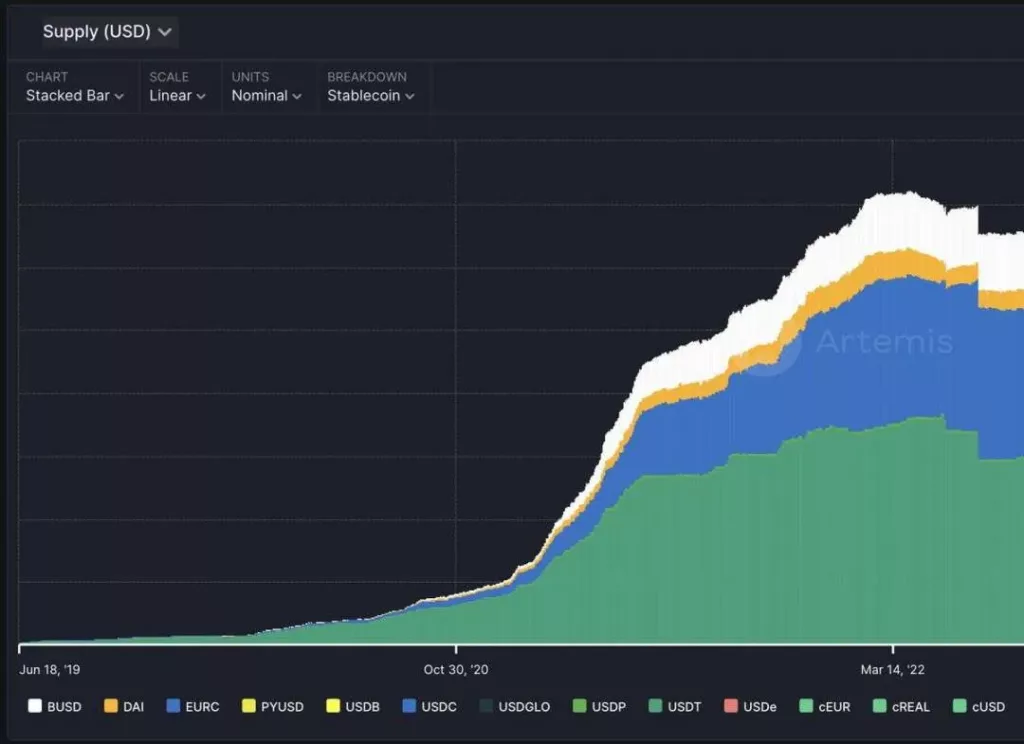

Let me take you back to 2021 when the market was in a frenzy. New liquidity was pouring into the market rapidly, mainly driven by new retail investors. The bull market seemed unstoppable, with risk appetite at its peak.

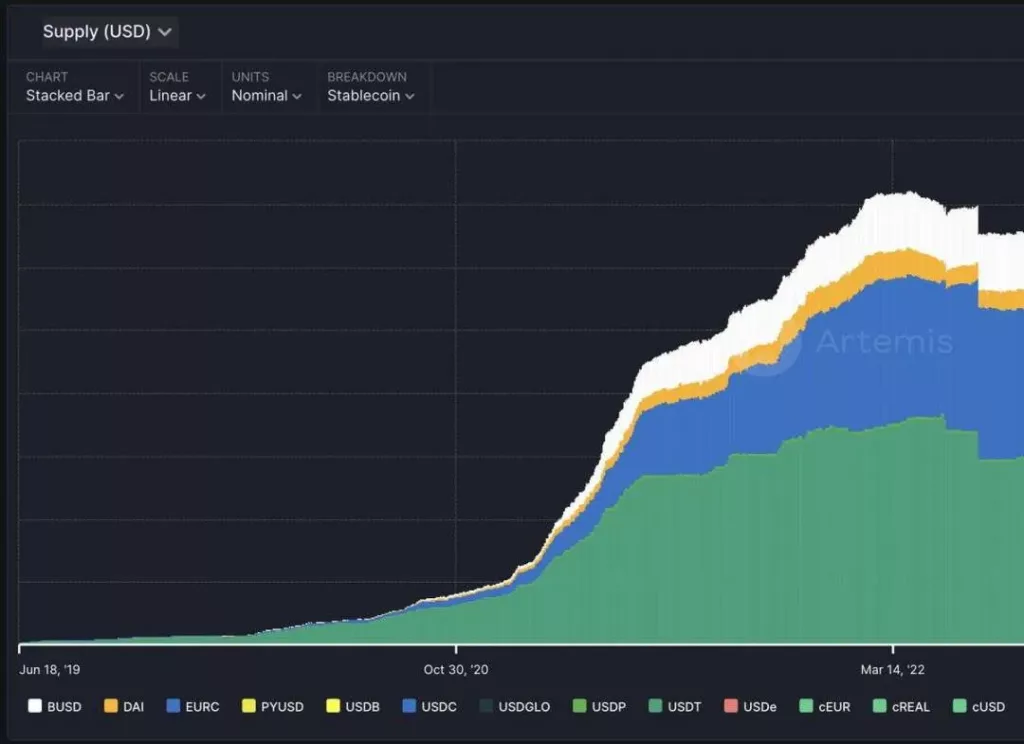

During this period, venture capital firms began pouring unprecedented amounts of money into the space.

Founders and venture capitalists, like retail investors, are opportunists.

The increase in investment was a natural capitalist response to market conditions.

For those unfamiliar with the private market, venture capital firms typically invest in projects at an early stage (usually 6 months to 2 years before launch) at low valuations (with vesting schedules). This investment helps fund the development of the project, and venture capital firms often provide additional services and contacts to help launch the project.

Interestingly, the first quarter of 2022 saw the highest amount of venture capital funding ever ($12 billion). This marked the beginning of the “bear market” (yes, venture capital firms timed it well).

But remember, venture capitalists are just investors, and the increase in the number of deals came from the increase in the number of projects being created.

The low entry barriers, combined with the high upside potential seen in cryptocurrencies during a bull market, made Web3 a hotbed for new startups. New tokens sprang up, leading to a doubling of the total number of cryptocurrency tokens between 2021 and 2022.

Frantic Expansion of Altcoins

But soon after, the party stopped. A series of contagions, starting with LUNA and ending with FTX, destroyed the market. So, what did these projects do with all the funds raised earlier this year?

They delayed, repeatedly postponing. Launching a project in a bear market is akin to a death sentence; low liquidity, bad sentiment, and lack of interest meant many new bear market launches were dead on arrival. Thus, founders decided to wait for a reversal. It took a while, but eventually—in Q4 2023—they got it. (Remember, the peak of venture capital investment was in Q1 2022, 18 months ago).

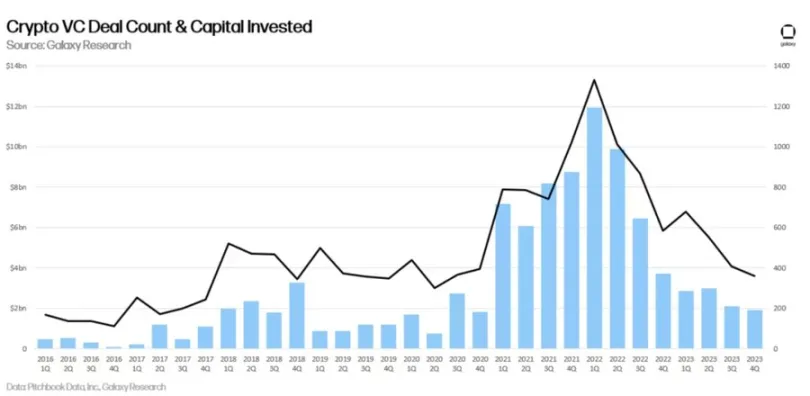

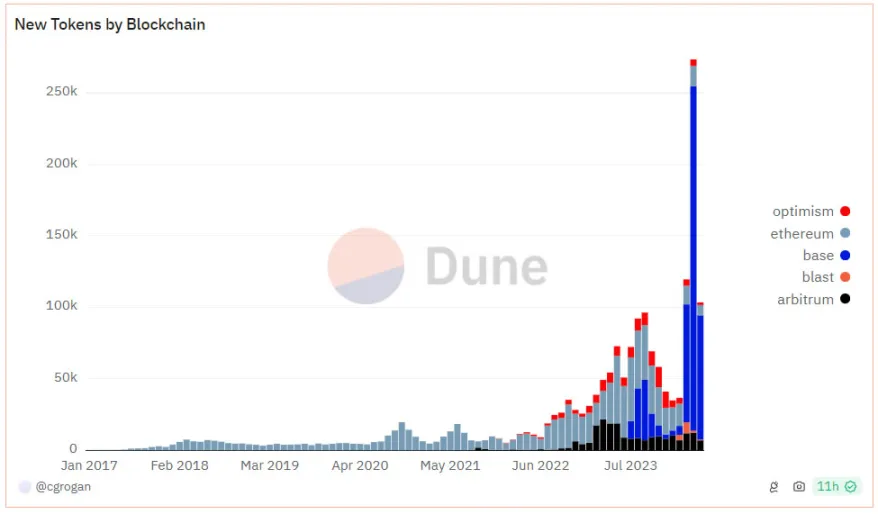

After months of delay, they could finally launch their tokens under better conditions, and they did, one after another.

It wasn’t just old projects deciding to launch. Many new players also saw the new bull market conditions as an opportunity to launch projects and make quick money. Consequently, 2024 saw a record number of new products.

Here are some statistics that are simply unbelievable. Since April, over 1 million new cryptocurrency tokens have been launched. (Half of them are meme coins created on the Solana network).

You might say these numbers are exaggerated due to the ease of deploying meme coins on-chain. This is true, but it’s still a crazy number.

For a more accurate count, see the data from CoinGecko below, which excludes many smaller meme coins.

We now have 5.7 times more cryptocurrency tokens than at the peak of the 2021 bull market.

This is a major issue and one of the main reasons why cryptocurrencies have struggled this year, despite $BTC hitting new all-time highs.

Why?

Because the more tokens that are released, the greater the cumulative supply pressure on the market, which is “stacked.”

Many projects from 2021 are still unlocking, with supply pressure stacking each subsequent year (2022, 2023, 2024).

Current estimates suggest around $150 million to $200 million of new supply pressure daily. This sustained selling pressure has a significant impact on the market.

Think of token dilution as inflation. If the government prints more dollars, it proportionally reduces the purchasing power of dollars relative to the cost of goods and services.

It’s the same in cryptocurrencies. If you print more tokens, it proportionally reduces the purchasing power of cryptocurrencies relative to other currencies like the dollar.

The dispersion of altcoins is essentially the cryptocurrency version of inflation. It’s not just the number of token issuances that’s an issue; many new projects with low FDV/high circulation mechanisms are also a big problem.

This leads to : high dispersion and sustained supply pressure.

All this new issuance and supply are manageable if new liquidity enters the market. In 2021, hundreds of new projects launched daily, and everything was going up. However, that’s not the case now. So we find ourselves in the following situation:

- Not enough new liquidity entering the market.

- Significant dilution/selling pressure from unlocks.

Now that you know what the problem is, let’s discuss the current issues.

So how can things improve?

First, I must emphasize that cryptocurrencies need more liquid capital.

There are relatively too many venture capital firms. The imbalance in the private market is one of the biggest (and most destructive) problems in crypto, especially compared to other markets like stocks and real estate. This imbalance becomes an issue because retail investors feel they can’t win. If they feel they can’t win, they won’t play the game.

Why do you think meme coins have dominated this year? It’s the only way retail investors feel they have a fighting chance.

Since many high FDV tokens’ price discovery happens in the private market, retail investors have no opportunity to achieve 10x, 20x, or 50x returns like venture capital firms.

In 2021, you could buy a launchpad token and get a 100x return. This time around, tokens are launching with valuations of $5 billion, $10 billion, or more, leaving no room for price discovery in the public market.

Then they start unlocking, and the price keeps dropping. I don’t have the answer to this problem. It’s a complex issue with many participants capable of making changes.

However, I do have some ideas.

Exchanges could implement better token allocation.

Teams could prioritize community allocation and larger pools for actual users.

A higher percentage could be unlocked at launch (possibly implementing measures like staggered sell taxes to prevent dumping).

Even if insiders don’t enforce change, the market eventually will. Markets always self-correct and adjust, and the waning effectiveness of current meta data and public response might change the landscape in the future.

Ultimately, a more retail-friendly market benefits everyone. Projects, venture capital firms, and exchanges benefit from more users.

Most of the current problems stem from shortsightedness (and the industry’s early stage). Additionally, on the exchange side, I’d like to see exchanges be more pragmatic. A way to offset the massive new listings/dilution is to delist just as ruthlessly. Let’s clear out the 10,000 dead projects still soaking up valuable liquidity.

The market needs to give retail investors a reason to return, which would solve at least half of the problems. Whether it’s a $BTC rally, $ETH ETF, macro changes, or a killer app that people genuinely want to use, there are still plenty of potential catalysts.

I hope I’ve clarified recent events for those puzzled by recent price movements. Dispersion isn’t the only problem, but it’s certainly a major one and needs to be discussed.