Quick Overview of the Current KRC20 Market and Tools

Recently, the KDAO inscription, the largest KRC20 token on the Kas blockchain, began minting. The FOMO (Fear of Missing Out) surged around midday, leading to the quick completion of its total supply of 15 million inscriptions in just one day, causing network fees to rise over tenfold during this period.

Observations indicate that, aside from a few inscriptions on the Bitcoin mainnet, many users perceive the inscription ecosystems across various chains as “dead.” However, in September alone, several inscriptions on Kas emerged with market capitalizations exceeding ten million dollars, and KDAO itself surpassed this threshold last night. This article aims to provide an overview of the current KRC20 inscription market and the tools available, helping readers quickly understand this sector.

Market Overview

The leading KRC20 token is NACHO (Black Cat), with a current market cap of $67.2 million and a total supply of 10 million tokens. The official account for NACHO is @NachoWyborski.

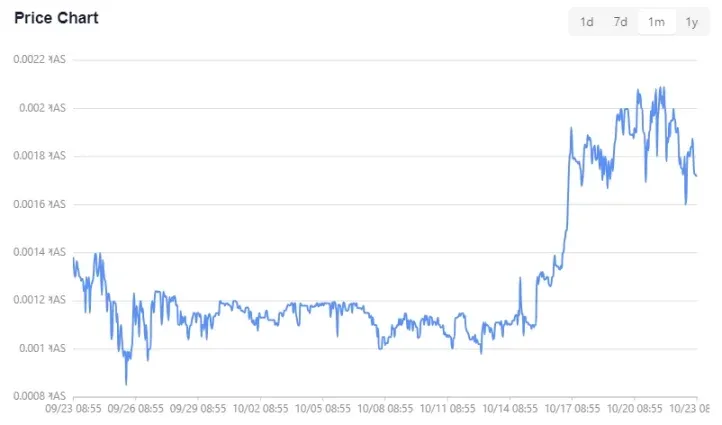

NACHO is inspired by the pet cat of Kas co-founder Shai. Although the token was initially deployed and prepared for minting on June 30, it was paused for several months due to issues on the Kas network and only reopened on September 15, starting with an initial market cap of about $2 million, which later peaked above $80 million.

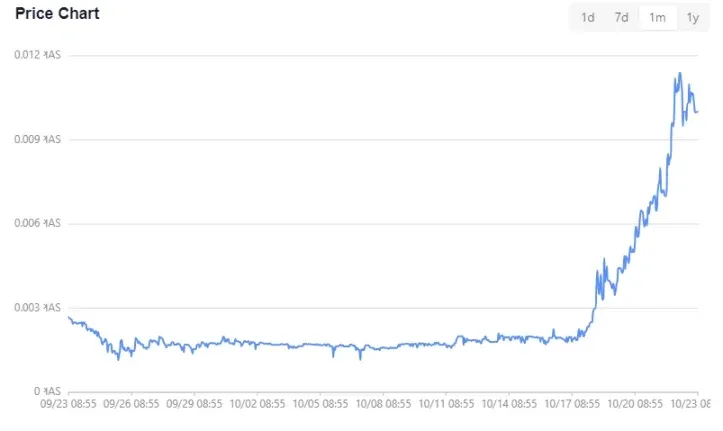

Another leading token is KASPER, with a market cap of $39 million and a total supply of 1 million tokens, represented by the official account @KasperCoin. KASPER also launched on September 15 and has already listed on exchanges like XT.com and CoinEx due to its smaller total supply compared to NACHO.

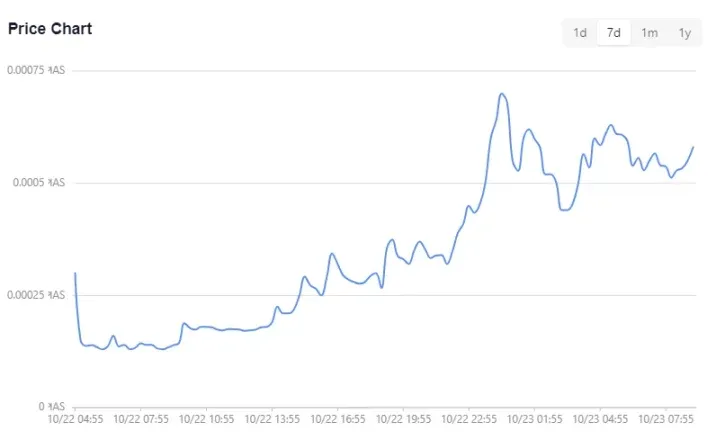

In addition to these two leading tokens, several others have market capitalizations exceeding $10 million. Notably, KDAO began minting at 4 AM yesterday. During the minting period, the trading price on the market consistently exceeded minting costs, attracting numerous “arbitrageurs” who sold their tokens immediately after minting for profit.

As KDAO’s popularity surged by midday, Kas network fees increased significantly, resulting in diminishing price spreads. The minting concluded by 10 PM, and prices continued to rise, currently sitting at $0.788 per token, reflecting a total market cap of $11.82 million.

KRC20 Tools Explained

KAS Withdrawals

Current exchanges supporting KAS spot trading include Bybit, Bitget, and Gate. However, many exchanges have paused KAS withdrawals for KDAO, so it’s advisable to prioritize withdrawals from Bybit, which charges a fee of 5 KAS (approximately $0.65) per transaction.

KRC20 Market Insights

For tracking prices and minting progress, users can utilize Kas.fyi, a tool that covers most data requirements.

Minting and Market Dynamics

The primary tool for KRC20 inscription minting is the KSPR Bot, with no direct competitors available. Users can see ten options on the main interface, corresponding to ten independent addresses (each Telegram account can create ten wallets for concurrent minting).

After creating a wallet and completing a transfer within the bot, users can initiate the minting process by entering commands for the inscription name, quantity, and network fees. The bot automates the minting until the predefined limit is reached or the user stops it manually. Network fees can be matched using Low, Medium, or High settings or input directly as a number. It’s important to note that while minting can technically occur with just 1 KAS in gas fees, the speed will be slower than normal.

KSPR follows a one-time payment model, settling tasks upon completion. The bot does not track whether the inscription limit has been reached, so users must manually stop the minting, settle the transactions, and reclaim any remaining KAS.

Trading Insights

The main trading market operates within the KSPR Bot, where users can enter via the /marketplace command to purchase listed orders. To sell, users can manage their listings through the /mylistings command.

Who is Driving the Market?

Currently, KRC20 remains under the radar in the Chinese community. The identities of those sustaining high market caps and trading volumes are unclear. Some users speculate it could be a “KAS miner conspiracy,” but perhaps this detail is less significant than recognizing leading trends and the profit potential in the market. Engaging before the opportunity evaporates is paramount.