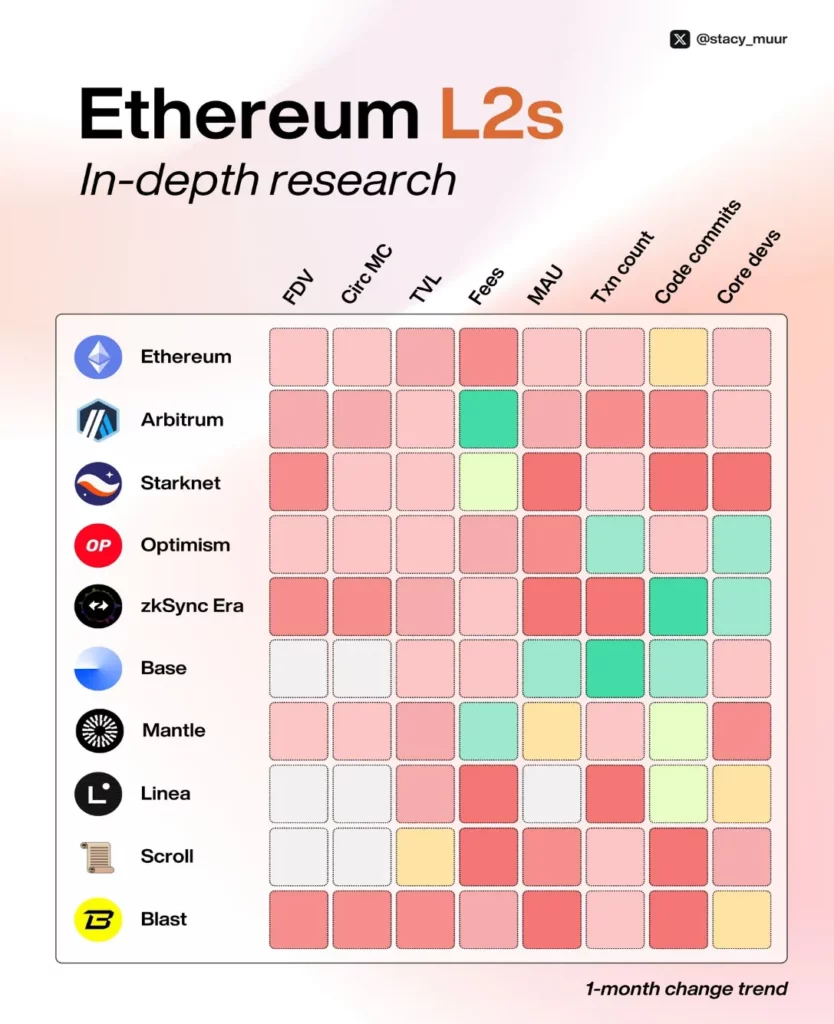

Six Key Metrics to Examine the State of Ethereum L2s

The bear market serves as the ultimate stress test for protocols, revealing where real users are. This article presents a deep dive into the current status of Ethereum Layer 2 (L2) solutions, supported by on-chain data visualizations.

Since 2023, Ethereum has seen a surge in new L2 solutions. L2Beat currently tracks 74 L2s and 30 L3s. However, only a few general-purpose Rollups have gained mainstream attention, drawing significant TVL (Total Value Locked) and user activity. This analysis focuses on the nine largest L2s.

1. Market Capitalization: Circulating vs. Fully Diluted Market Cap

Most L2s currently have a Fully Diluted Valuation (FDV) in the billions, while their circulating market cap remains below $1 billion. This suggests that a large portion of their tokens has yet to enter circulation.

The only exception is Mantle (@0xMantle), where 52% of its token supply has already been unlocked, making it the only L2 with a circulating market cap exceeding $1 billion.

This disparity between high FDV and low circulating supply is one reason why many recent airdrops have failed to meet user expectations. Estimating current valuations is challenging, with uncertainty surrounding potential downward trends in the future.

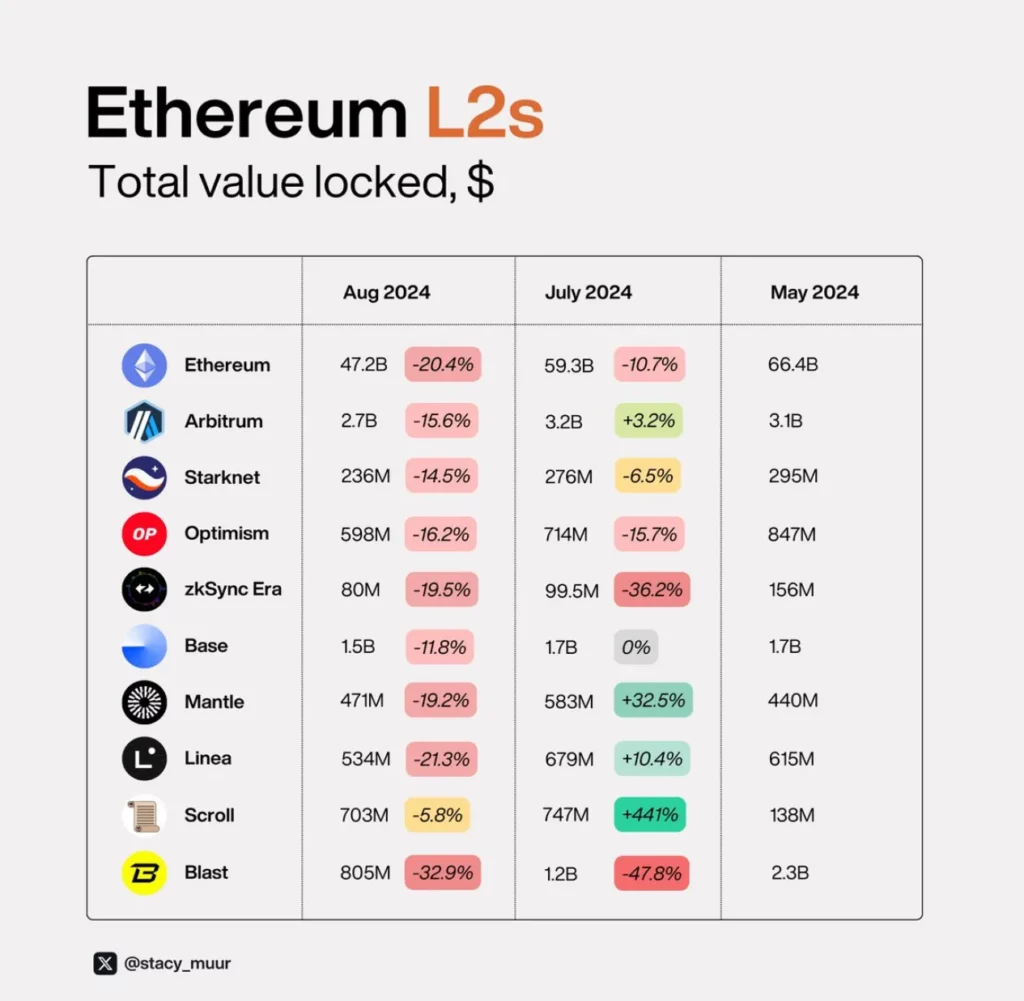

2. Total Value Locked (TVL)

In terms of TVL, most chains experienced a difficult summer, except for those like Scroll (@Scroll_ZKP), Linea (@LineaBuild), and Mantle (@0xMantle), which have ongoing incentive programs.

However, Linea‘s airdrop program has been running for nearly a year, and community interest has waned compared to newer initiatives, such as Scroll’s.

During the bear market, zkSync (@zksync) and Blast (@blast) were hit hardest. Both chains issued tokens this year, leading to liquidity migrating to more attractive platforms.

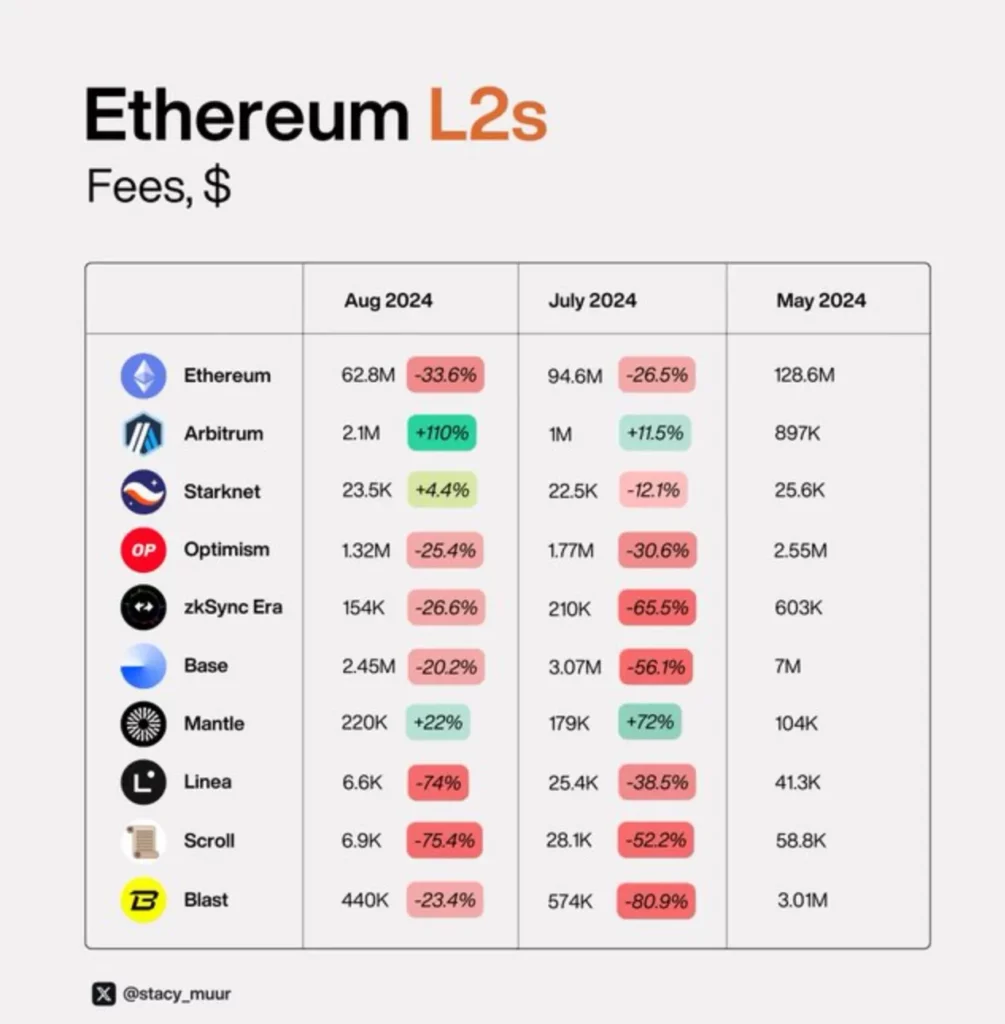

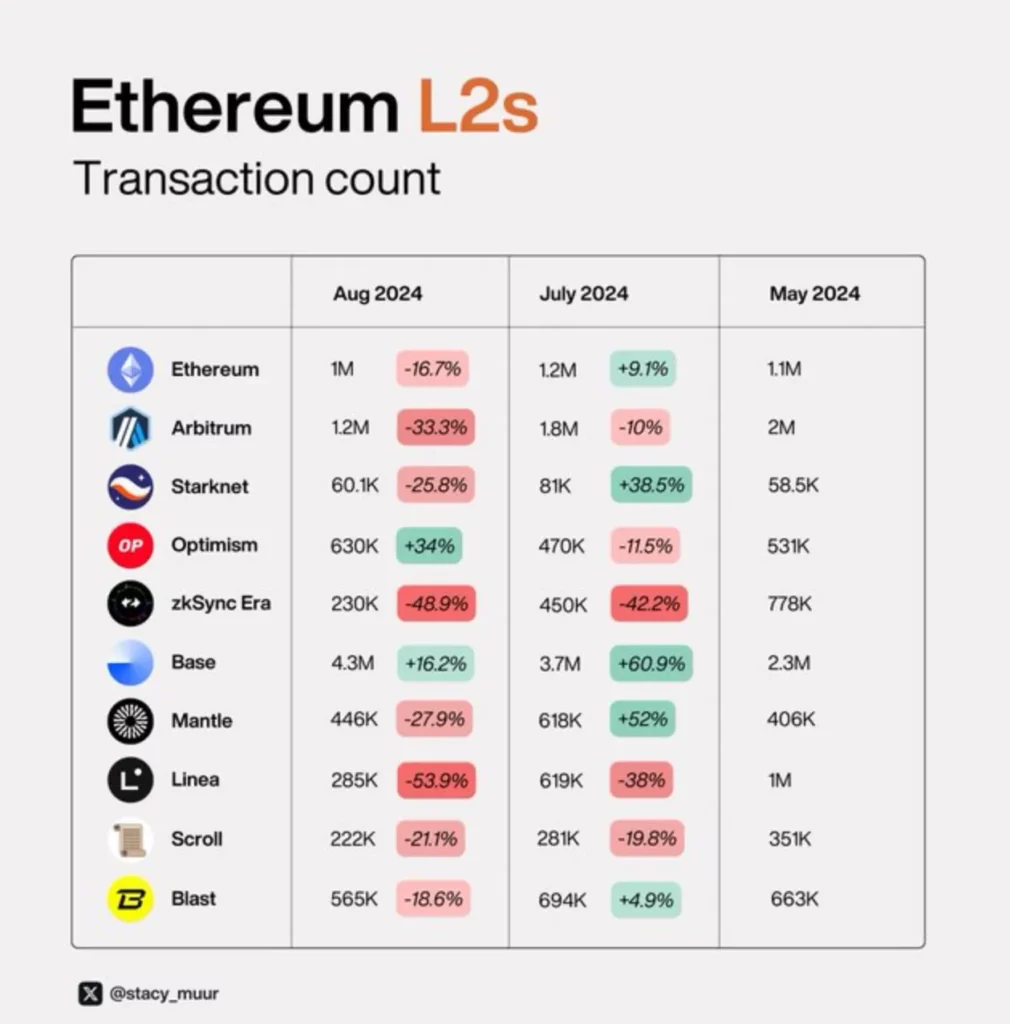

3. Fees and Transaction Activity

Since the Dencun upgrade, data availability (DA) no longer has a significant impact on Ethereum’s economy, affecting fees on both Ethereum and L2s. This makes it essential to study the relationship between fee dynamics and transaction activity.

Due to speculative demand and its status as the preferred platform for new memecoin launches on Ethereum L2s, Base (@base) has shown strong growth with steadily increasing transaction volume.

In contrast, despite Linea‘s ongoing incentives, zkSync and, surprisingly, Linea have underperformed.

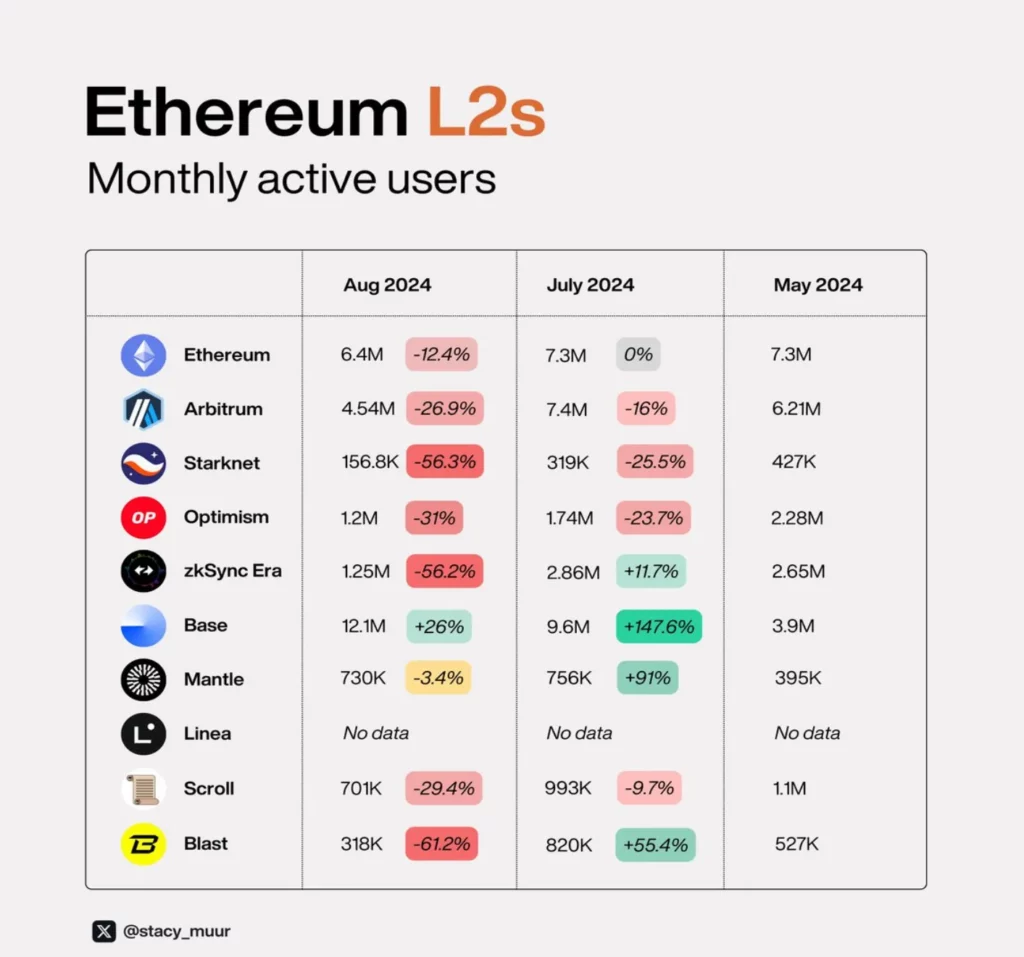

4. Monthly Active Users (MAU)

MAU dynamics are a key indicator of user retention on L2 chains and reveal similar trends. Mantle (@0xMantle) and Base (@base) performed best, while Starknet (@StarknetFndn), zkSync (@zksync), and Blast (@blast) lagged behind.

When comparing MAU data with FDV, it’s clear that Starknet is significantly overvalued compared to Arbitrum, Optimism, and even zkSync.

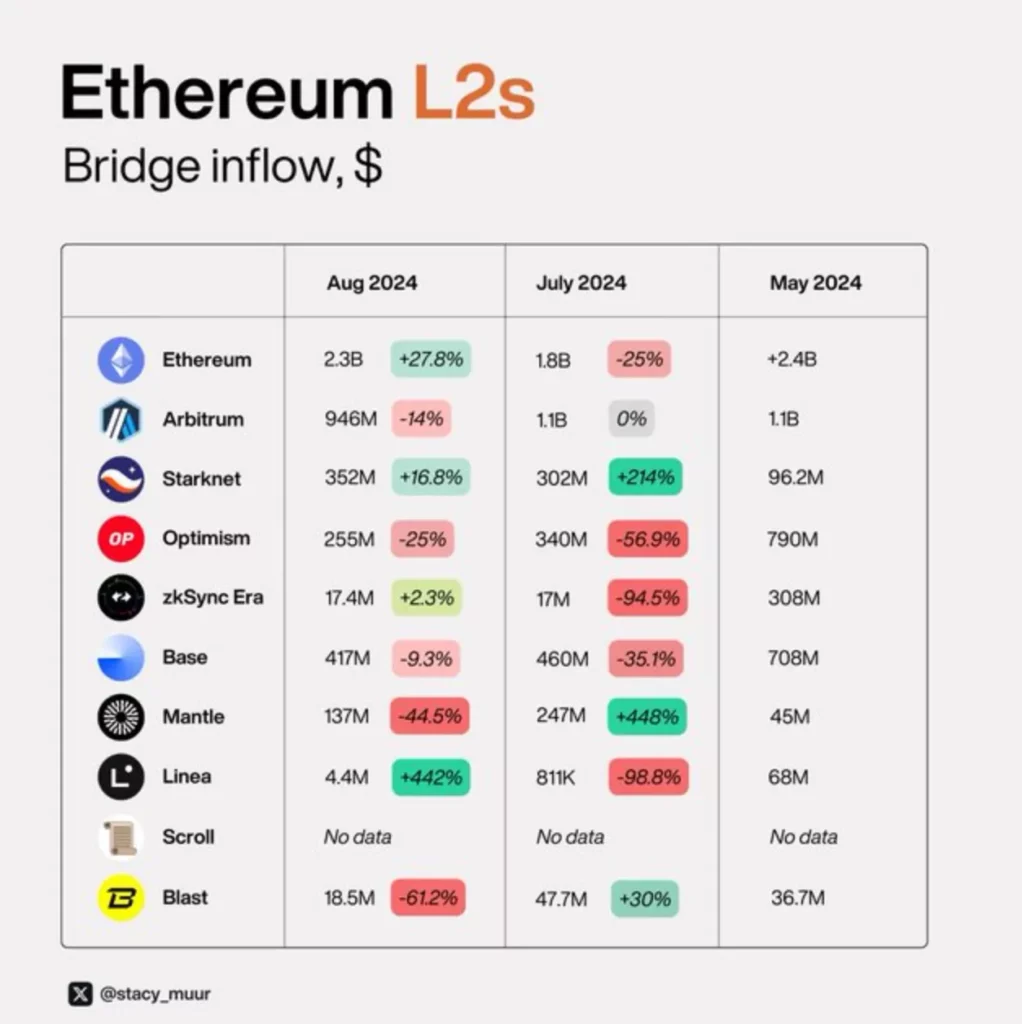

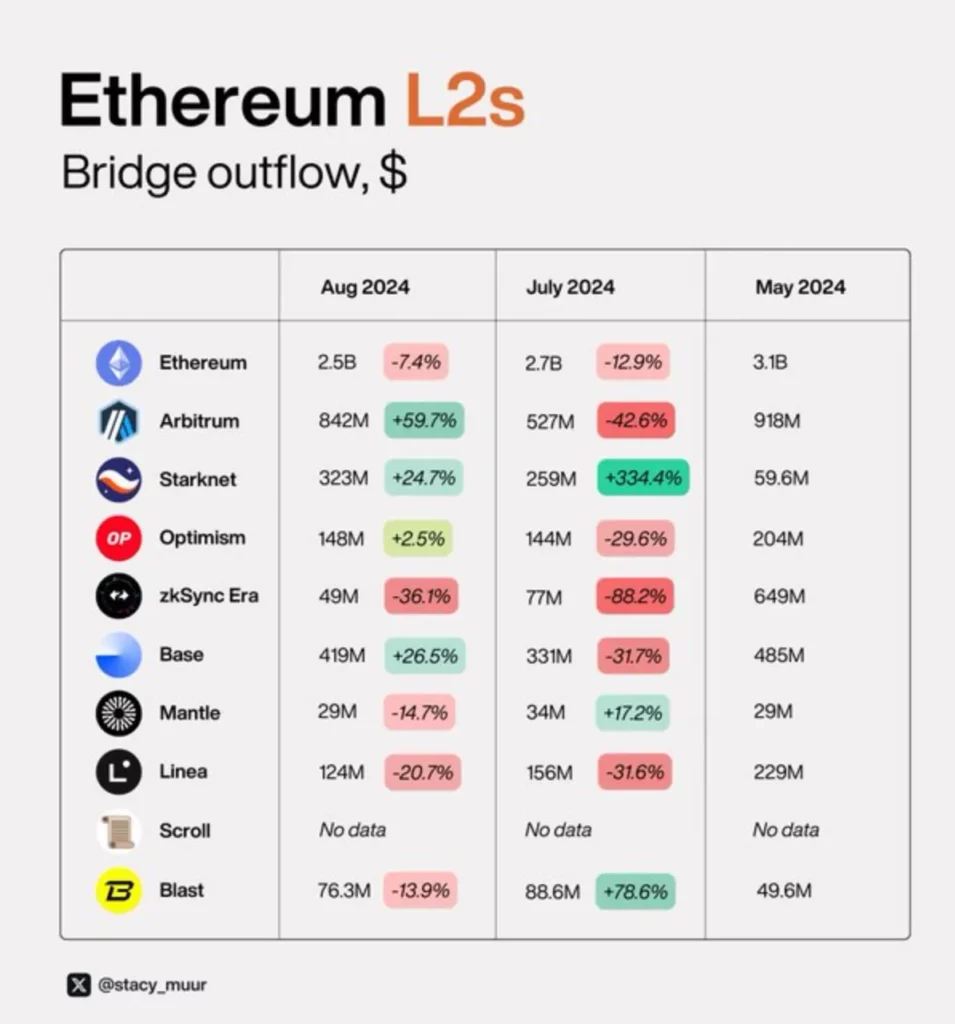

5. Bridge Inflows and Outflows

Net bridge flow, which measures the flow of assets in and out of a chain, is a key metric for assessing new user and capital inflows. Among the L2s, Arbitrum (@Arbitrum), Starknet (@StarknetFndn), Optimism (@Optimism), Base (@base), and Mantle (@0xMantle) have positive net flows, with Mantle showing the largest gap between inflows and outflows.

In contrast, Linea (@LineaBuild), zkSync (@zksync), and Blast (@blast) have shown negative net flows.

The most surprising case here is Blast (@blast), which now boasts over 300 core developers (most L2s typically have 30-50). This large team is also submitting a significant amount of code. What exactly are they working on? So far, no details have been revealed.