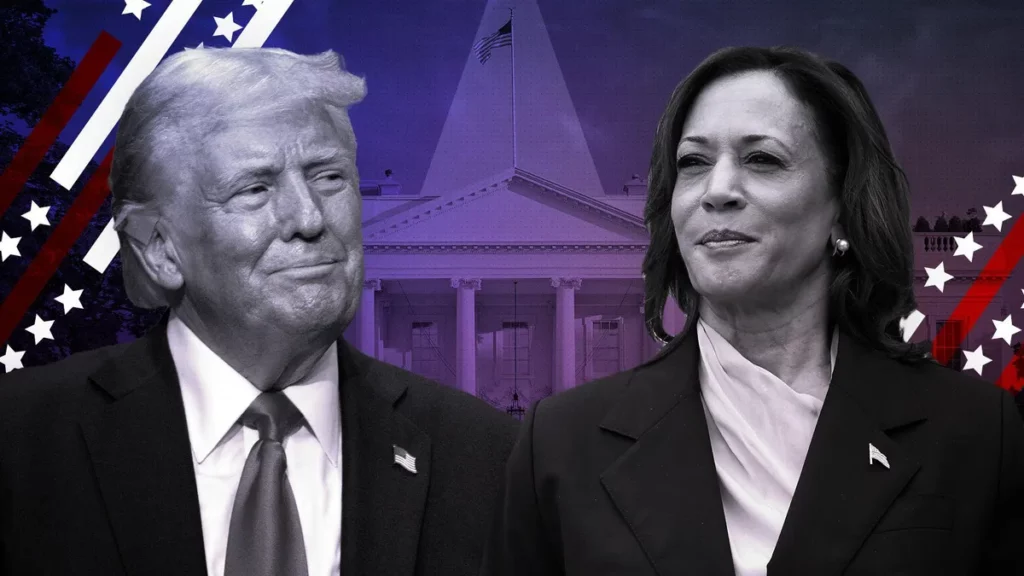

As the 2024 U.S. presidential election approaches its climax, the question remains: who will take the White House? Will it be the historic first female president, Kamala Harris, or the comeback king, Donald Trump? The stakes are high, and the outcome remains uncertain.

Interestingly, cryptocurrency has emerged as a new battleground in this election. Trump’s statements have frequently influenced Bitcoin’s price fluctuations, while Elon Musk, a prominent supporter of Dogecoin, has also thrown his weight behind Trump’s campaign. It seems that Bitcoin and the virtual asset market are tightly intertwined with this political-business alliance. With Bitcoin’s price oscillating around $70,000, the critical question is whether Trump’s campaign could serve as a catalyst for Bitcoin’s breakthrough.

Pre-Election Betting on Trump

Market participants have already begun to place bets on a potential Trump victory, with this expectation manifesting across various sectors, including the stock market, bonds, precious metals, and cryptocurrencies. In the past month, Bitcoin’s movements have closely mirrored Trump’s electoral prospects, making the outcomes in seven key battleground states pivotal for market direction.

From Wall Street to Silicon Valley, traders are strategizing their investments based on these expectations. However, elections are notoriously unpredictable, and any “surprise” event could lead to significant market volatility. Investors must prepare for a range of scenarios.

Potential Impacts if Trump Wins

If Trump emerges victorious, several effects on the traditional financial market could be anticipated:

- Monetary Policy: Trump is expected to maintain a liquidity-friendly monetary environment, which could favor risk assets like stocks, particularly in industrial and traditional energy sectors. Bond yields are also likely to rise.

- Tax Policy: The Trump administration plans to lower corporate tax rates while imposing higher tariffs on foreign goods. This industrial policy could boost prices for commodities like copper and oil, benefiting sectors reliant on industrial consumption.

- International Relations: Trump has pledged to end the Russia-Ukraine conflict shortly after taking office, while also committing to continued investment in the Middle East. Such shifts in foreign policy may affect defense stocks but could generally stabilize the market.

In the digital currency sphere, a Trump victory could yield the following impacts:

- Bitcoin Breakthrough: Given the strong association between Trump and Bitcoin, coupled with his past support for the cryptocurrency (including promises to include it in national reserves and replace the current SEC chair), there is potential for Bitcoin to reach new highs under his administration.

- Dogecoin Opportunities: Musk’s longstanding connection to Dogecoin could see the cryptocurrency regain prominence if Trump wins, leveraging his political influence.

- WLF and DeFi Growth: The World Liberty Financial (WLF), supported by the Trump family, may become a new focal point in the market, potentially enhancing the entire DeFi ecosystem and driving up Ethereum prices.

Despite the current likelihood of a Trump win, the possibility of “special” events occurring during the election must not be overlooked. According to the latest data from PolyMarket, Trump’s support stands at 56.2%, down from a peak of 65% last week, indicating a tight race. If Harris secures victory, existing market expectations will be shattered, leading to significant reversals.

Potential Impacts if Harris Wins

Should Harris win, the traditional financial market may experience:

- Tax Policy Changes: Harris advocates for higher taxes on the wealthy and corporations, proposing to raise the corporate tax rate from 21% to 35%. This could negatively affect overall corporate profitability while benefiting sectors reliant on public funding.

- Fiscal Spending: Support for universal healthcare, expanded social welfare, and a $10 trillion climate plan could significantly bolster the healthcare and renewable energy sectors.

- Market Volatility: A surprise win for Harris could trigger considerable fluctuations in the stock market, requiring time for investors to realign their expectations and find new directions.

In the cryptocurrency realm, a Harris administration might lead to:

- Regulatory Environment: Harris is likely to continue the Biden administration’s stringent regulatory approach, maintaining a tough stance from the SEC that could hinder the institutionalization of cryptocurrencies.

- Market Dynamics: With the market already pricing in a Trump victory, any deviation from this expectation could lead to significant downturns, with Bernstein predicting a potential 10% drop in Bitcoin prices by year-end.

- Delayed Institutional Involvement: Harris’s ambiguous stance on cryptocurrencies may sow uncertainty among investors, potentially delaying institutional engagement.

The Future of the Crypto Market Under Trump

If Trump successfully takes office, the 2025 crypto market could see:

- Positive Developments: Supportive policies for cryptocurrencies, including incorporating them into national reserves and restructuring SEC oversight, could drive the market higher and lead to new peaks.

- Negative Trends: A weakening short-term financial stimulus might plunge the U.S. economy into recession or stagflation, leading market funds to chase the most volatile and liquid assets—like Bitcoin—despite their lower practical utility.

- Potential Risks: If unexpected events occur during Trump’s presidency, the crypto market could experience dramatic downturns. Over-reliance on a single political figure could pose risks, providing short-term gains but leading to painful adjustments when distancing from that influence.

As the U.S. election unfolds, the rhetoric from both candidates is closely monitored by the markets. Regardless of the outcome, investors must stay vigilant, closely tracking policy developments and market expectations while effectively managing risks to avoid being swayed by short-term market emotions.