UpRock Insight: Decentralized Networking and the New Future of DePIN

On April 22nd, Jupiter Exchange officially announced the end of voting for the second phase of the LFG Launchpad, with Sanctum, the LST liquidity aggregation protocol, and UpRock, the idle bandwidth sharing network, securing the first and second positions with 64% and 20% of the votes respectively. The subsequent launch on the Launchpad is scheduled for May/June, and while it’s not surprising that Sanctum, a well-known DeFi project within the Solana ecosystem, made it to the selection, UpRock’s final inclusion carries somewhat of an underdog connotation. As one of the DePIN Track projects selected for both the first and second phases of the Jupiter LFG Launchpad, UpRock has finally “made it ashore.”

The project’s whitepaper explains this as the transition “from caveman’s rocks to the UpRock of sapiens.” This name also underscores the project’s ambitious goal of creating infrastructure products for the DePIN Track geared towards the future of AI internet. Specifically, UpRock aims to facilitate value exchange between user bandwidth resources and AI data network demands through a triad application model of “wallet AI Chatbot mining.” Based on this, various empowerment and deflationary controls are provided for the token UPT.

UpRock Product: Beta version already online, with low entry barrier and substantial user base

The project’s official account emphasizes the low entry barrier in its introduction: “Install the app within 2 minutes and start earning UPT tokens,” highlighting the DePIN project’s quick and positive feedback loop.

According to the latest data released by UpRock on April 16th, the product currently boasts over 800,000 Android installations and a high app store rating of 4.9. The MacOS version is also online, with iOS pre-registration open. Weekly new users reach up to 50,000, daily active users stand at 200,000, and monthly active users reach 650,000. Additionally, UpRock has over 280,000 followers on Twitter, 150,000 on Telegram, and 96,000 on Discord.

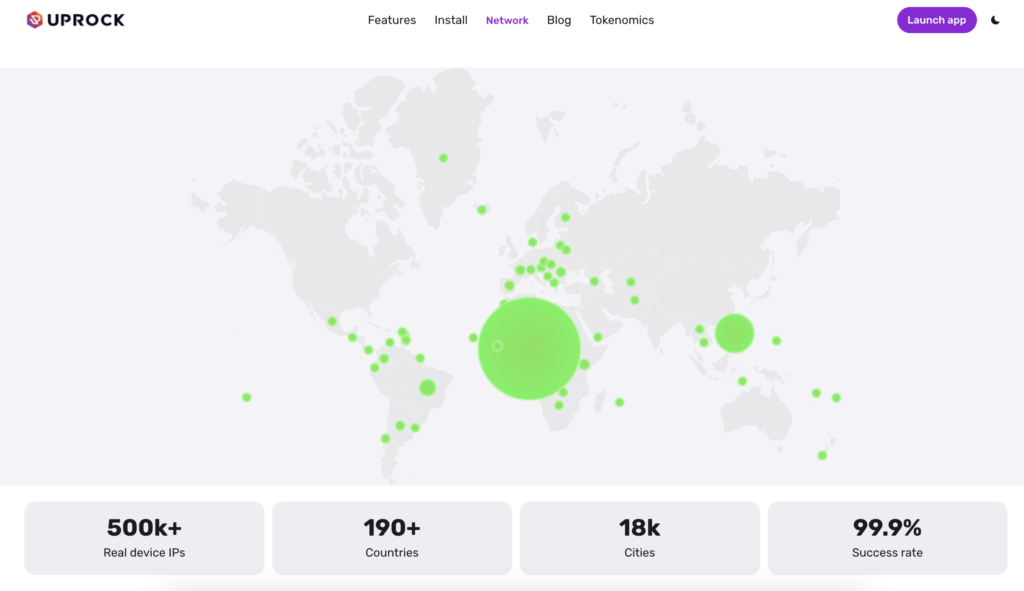

According to the official website, the number of IP addresses connected to the UpRock network has exceeded 500,000, with network bandwidth resources spanning over 18,000 cities in more than 190 countries and regions globally. The network resource heatmap shows primary coverage in Africa, Asia, Europe, and other regions.

With the aid of the Knowledge Acquisition Layer (KAL) built on real-world devices, UpRock’s products can leverage advantages such as decentralized networking, real-time data fetching, and diversified paid API interfaces to provide customized services for various fields, including content creation, market strategy, sports events, public sentiment, brand management, cryptocurrency market analysis, historical data archiving research, and international diplomatic cultural intelligence. While ensuring privacy and security, this maximizes the tool and analytical value of AI.

UpRock Token: Tokenomics determined, UPT token not yet online

In the project’s whitepaper, UpRock mentions that users can share network bandwidth and computing resources through project application products, receive AI insights services built on personal AI network crawlers through the AI Insight Exchange (AIX) panel (IaaS), and enjoy a transformative experience in the Open Source Intelligence (OSI) market with a market size of up to $77 billion. Moreover, there is potential to share a portion of the Business Intelligence (BI) and data API market with revenues exceeding $25 billion and $45 billion respectively by 2023.

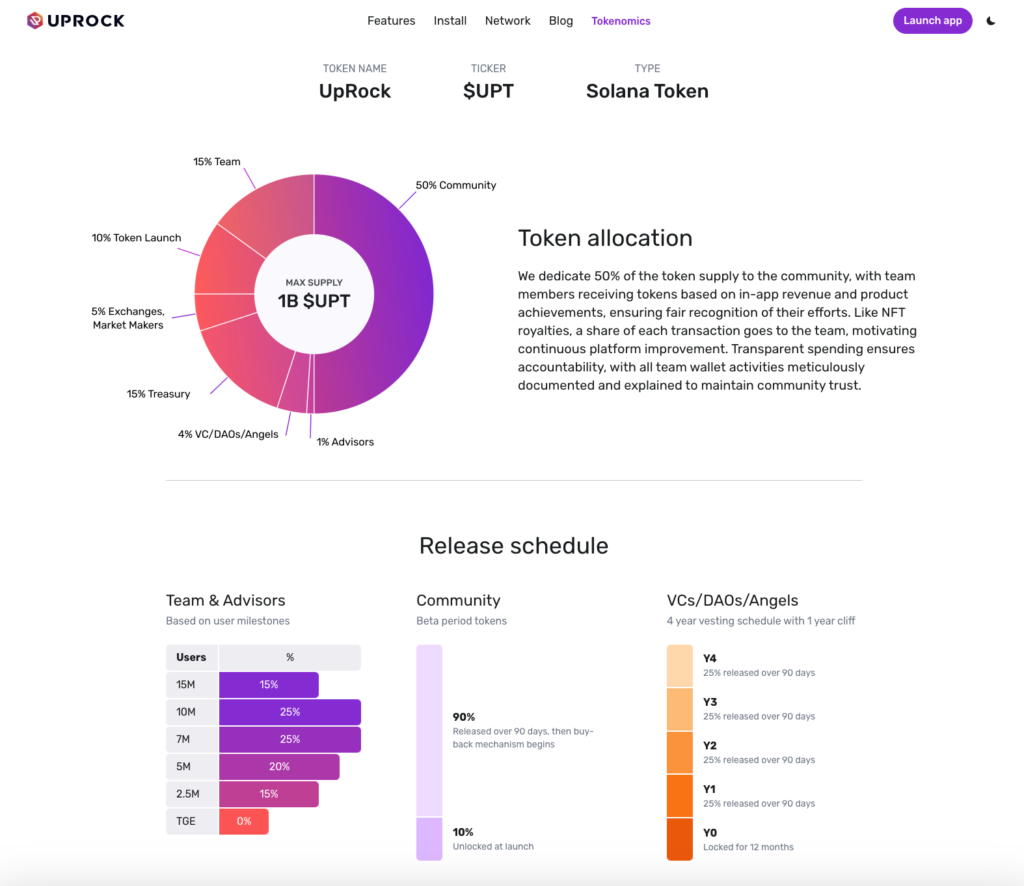

While the UPT token has not yet been launched, UpRock’s token economic model has been determined:

- Maximum token supply: 1 billion

- 15% allocated to the team, 1% to advisors (unlocked in batches based on user milestone)

- 50% to the community (10% unlocked upon token launch, 90% within 90 days with subsequent buyback mechanism)

- 4% to VC, DAO, and angel investors (initially locked for 12 months, subsequently unlocked in batches over 4 years)

- 5% to exchanges and market makers

- 15% to project treasury

- 10% for token issuance.

The whitepaper also mentions the project’s primary revenue sources.

For C-end users, the main revenues include:

- AI agent usage: 50% of UPT tokens are allocated to the treasury for further distribution with each payment made using UpRock’s AI products, while the remaining 50% are used for UPT token buyback and immediate destruction.

- Account management and services: A small fee is charged for any changes, management, and storage services related to the account. 50% of this fee is allocated to the treasury for redistribution, and the remaining 50% is injected into the LP liquidity pool through a buyback mechanism.

For B-end users, the main revenues include:

- Bandwidth sales: When teams sell user bandwidth, 20% of the revenue is used for UPT token buyback and redistribution, 40% is allocated to the treasury for future use, and the remaining 40% is directly allocated to network contributors.

- Other platform fees: All various fees generated in UPT form on the platform, 50% are immediately destroyed, and the remaining 50% are stored in the treasury for redistribution to contributors. Fees generated in other currencies (such as USDC, SOL, etc.) will allocate 50% for UPT token buyback, and 50% will be destroyed and recorded in the company’s wallet.

Currently, users’ mining income calculations are mainly based on the following model: Reward Rate = “Upload Speed Coefficient x Download Speed Coefficient x Connection Type Coefficient (Internet Connection Type, such as Home, 4G, or 5G) x Freedom Degree Coefficient (Freedom Score Factor of the user’s country/region calculated based on the network’s openness)” x Total Mining Time.

UpRock Team: Serial entrepreneurs from North America and Europe

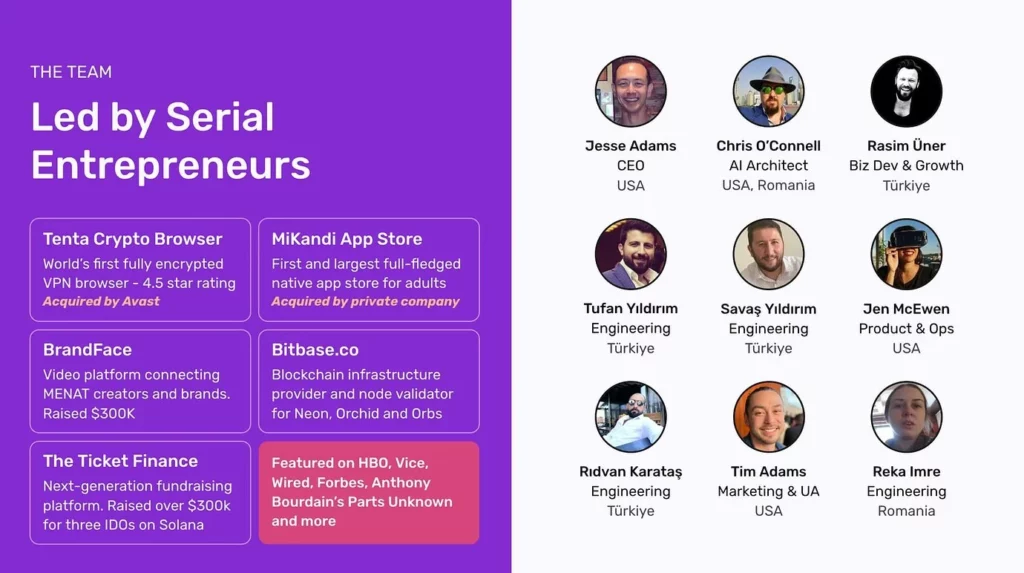

According to UpRock’s official disclosure, the project team members come from the United States, Turkey, and Romania and have previously completed multiple entrepreneurial projects, including: MiKandi App Store (an app store with millions of users, later acquired by a private company), Tenta encrypted browser (the world’s first all-encrypted browser with built-in VPN, later acquired by network security public company Avast), BrandFace (brand video platform), BitBase (providing verification services for blockchain platforms such as Solana, Neon, Orchid, and Orbs), The Ticket Finance (raising over $300,000 through IDO), and DePioneers NFT (aiming to support the most innovative DePIN projects, focusing on practical NFT concepts, which is the precursor of UpRock).

Furthermore, the UpRock team has also been featured on well-known media platforms such as HBO, Vice, Wired, Forbes, and Anthony Bourdain’s Parts Unknown.

It’s evident that while UpRock members may not be a Crypto Native Team, they belong to the category of “industry veterans.”

The project’s official website and previous introductions on the Jupiter Launchpad emphasize the real-world empowerment of the UPT token.

With UpRock‘s products, users can not only earn UPT tokens by sharing network bandwidth and computing resources but also enjoy a range of benefits including airdrops, exclusive discounts, travel rewards, passive income, and even free call time. In other words, in the UpRock project’s plan, UPT is not only a platform token but also an equity token with practical use cases.

In the project’s official website blog interface and official tweets, UpRock briefly introduces its current partners: based on a mobile-first growth strategy, UpRock’s current partners include Koii Network (a desktop network with over 15,000 nodes), Synesis One (a Train 2 Earn platform on Solana), DATS Project, and Cube Exchange, mainly serving the demand for accelerated network coverage.

Regarding offline equity cooperation resources, UpRock has not yet provided more specific details.

Conclusion: DePIN Track, Quantity and Quality are Indispensable

In summary, for DePIN Track projects including UpRock, the future development tests not only the number of resource nodes absorbed during project construction but also the continuous demands for allocation, usage, and efficient operation of existing centralized resources. Therefore, ensuring the stability of the project ecosystem and establishing positive externalities for token economic models may be the “lifelong questions” that all DePIN projects need to consider.