What Has Aerodrome Done Right to Surpass Uniswap on Base?

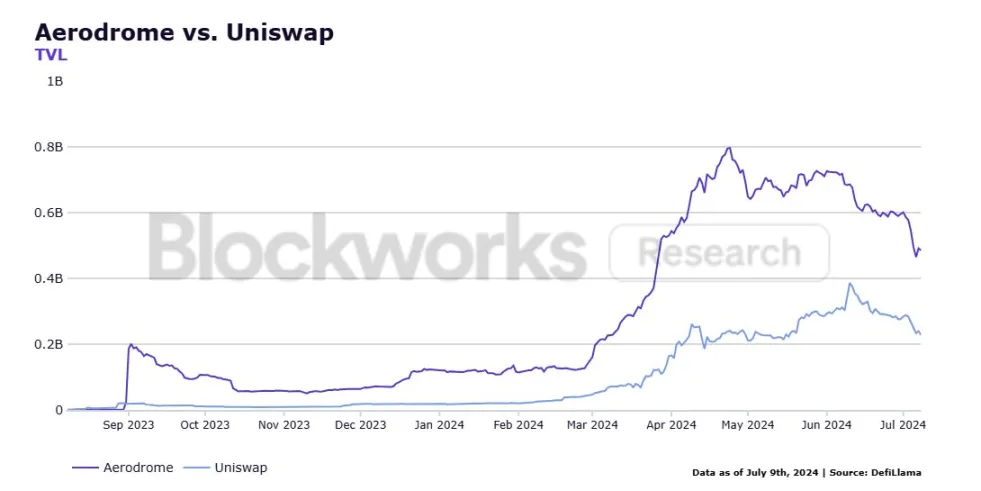

Aerodrome, a “MetaDEX,” combines elements from various DEXs such as Uniswap V2 and V3, Curve, Convex, and Votium. Since its launch, it has become the largest protocol by TVL on Base, with over $495 million locked, double that of Uniswap on Base.

Architecture of Aerodrome

Aerodrome’s success can be attributed to its unique architecture, which aligns incentives among different protocol participants, including traders, LPs, and protocols seeking liquidity for their tokens. This is achieved through its Ve governance model.

Participants must lock AERO tokens to collect fees. Locking tokens into veAERO allows users to direct the protocol’s token emissions to specific pools, where they receive 100% of the fees and emissions.

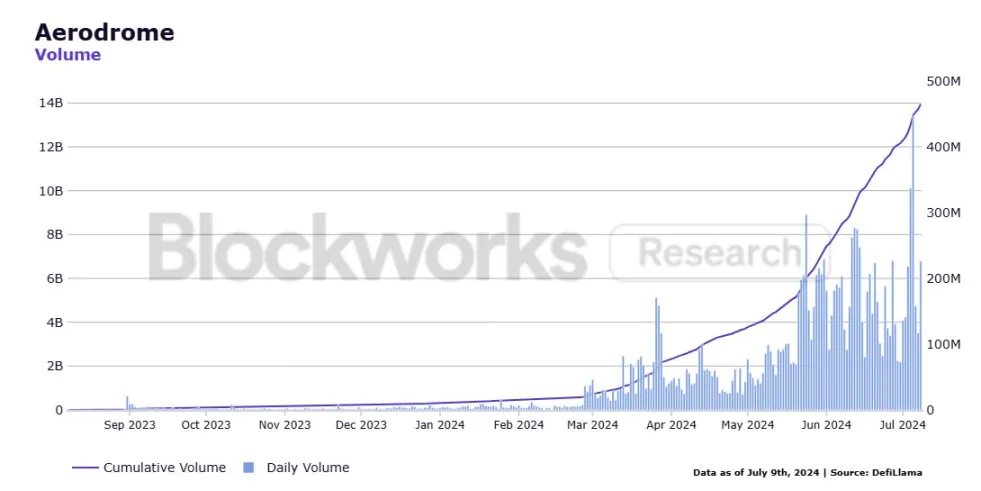

Due to these incentives, voters direct token emissions to the highest volume pools to maximize rewards. This creates a flywheel effect that attracts LPs, providing traders with low-slippage trading for popular token pairs. The resulting growth is evidenced by a significant increase in trading volume.

Innovation of Aerodrome

Recent protocol upgrades include Relay and Slipstream. Relay automates governance for liquidity providers, allowing them to deposit voting tokens into a vault to optimize voting and auto-compound rewards.

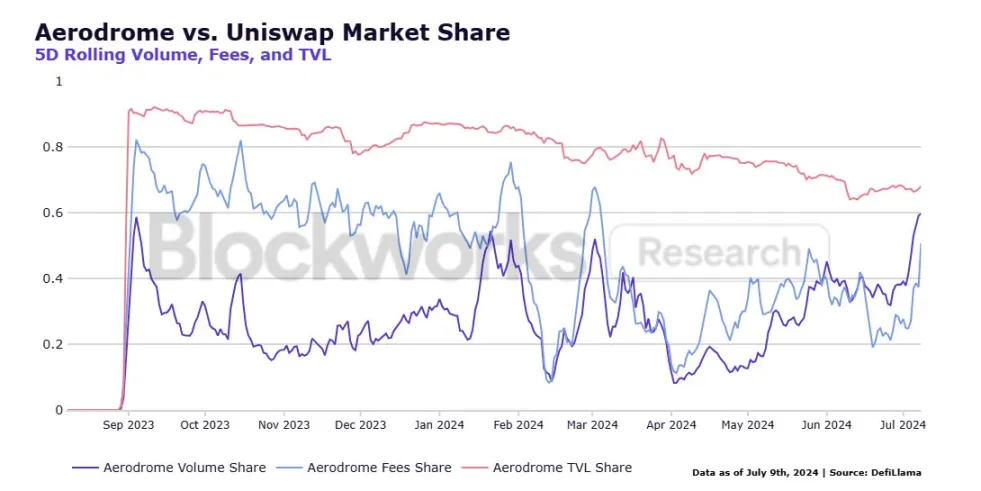

Slipstream introduces concentrated liquidity pools to Aerodrome, offering better execution prices for high-volume token pairs. Since its launch on April 22, Aerodrome has outperformed Uniswap in TVL, fees, and trading volume share, with increases of 68%, 51%, and 60%, respectively.

Ecosystem

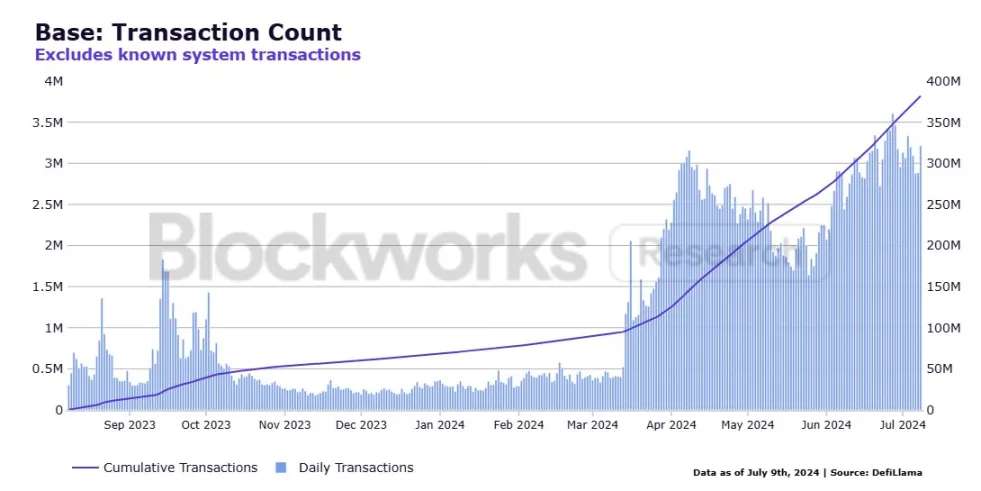

Another key factor in Aerodrome’s success is its bet on Base. The Base ecosystem has seen tremendous growth since its launch, currently exceeding 3 million daily transactions (excluding known system transactions).

Coinbase’s smart wallet, with over 110 million customers, will provide a mechanism to onboard millions of users directly to Base through a user-friendly interface reminiscent of Web 2.0 applications.

The overall correlation between Base’s daily transaction volume and the AERO token is 0.86. While it is challenging to statistically prove this correlation, it provides compelling evidence that AERO will benefit from increased Base adoption.

Aerodrome has experienced significant growth, but investors should be aware of potential risks, including competition from Uniswap. More information can be found in @_dshap‘s latest report.