Why is Ethena a Truly Big Opportunity?

Ethena is the fastest-growing DeFi product in history. Within just a few months, its yield-generating stablecoin has reached $3 billion in size. No other stablecoin has grown as quickly as USDe. The first chapter of the Ethena story focused on creating a secure and high-performing stablecoin. It has withstood extreme market fluctuations and is now undoubtedly targeting the biggest competitor in the stablecoin space—Tether, with a $160 billion market cap.

Ethena has evolved from being a “DeFi-native stablecoin” to a compliance-friendly stablecoin with a strong value proposition and improved distribution channels. The introduction of USTb, BlackRock’s involvement in fiscal products, and the drop in interest rates have created favorable conditions for Ethena to become a leader. These factors are positioning USDe to become a mainstream stablecoin in the cryptocurrency market.

With many inefficiencies in the market, you now have the opportunity to buy into the strongest and fastest-rising asset in one of the largest verticals in crypto at a fraction of WIF’s market cap.

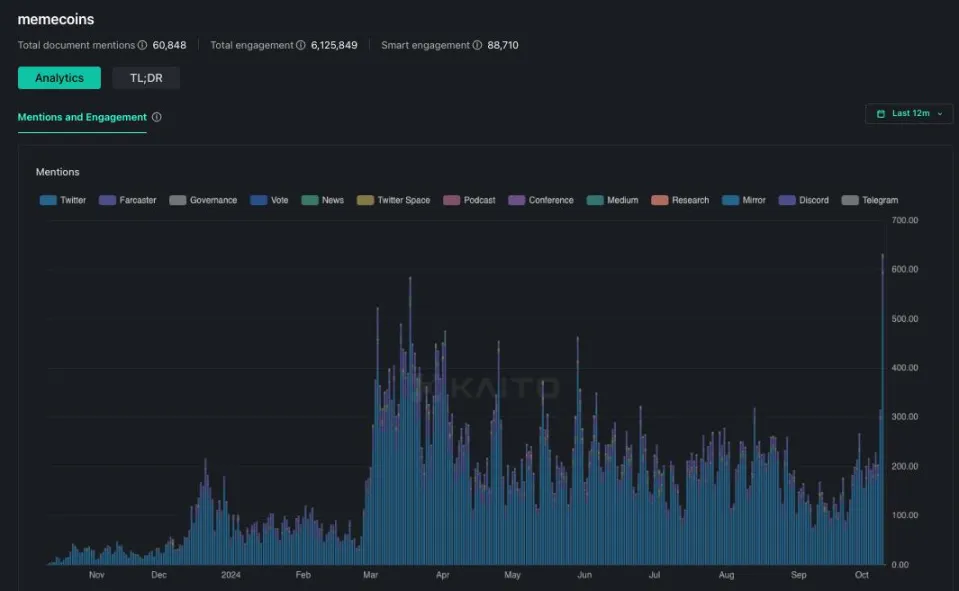

Existing Meta-Narrative

This cycle has been dominated by memes. The market has realized that paying for tokens of overvalued, unreliable projects (priced far beyond most VC cost bases) is a manipulated game. Instead, we’ve embraced the freer, more open meme game. Meme tokens’ continued outperformance compared to other altcoins has led some to call it “financial nihilism”—ignoring fundamentals to chase narratives. While this has been the most profitable trade in crypto for the past two years, it has become so widespread that even memes are now receiving unprecedented attention.

As the market gets swept up in meme mania, it forgets a timeless lesson from all markets: The hottest speculation is always built on a kernel of truth.

The rise of memes is a crypto-native, retail-driven phenomenon. What these retail participants forget is that the best-performing liquid assets over time are always built on parabolic growth in fundamentals. This is because only a fundamental anchor can provide a Schelling point (a focal point or equilibrium recognized by all participants) for all crypto-native capital pools: retail, hedge funds, proprietary trading firms, and long-only liquidity funds. This was the crux of the Solana story this cycle—investors who focused on developer engagement in early 2023 could form a fundamental case for Solana’s ecosystem growth, enjoying nearly 10x returns over the following year.

You may also recall the liquidity boom of Axie Infinity, with a 500x surge and millions of users flocking to the game during the market frenzy. Another well-known example is Luna, whose $40 billion UST circulated globally, offering a 1,000x return if you bought Luna from the lows and correctly exited before the collapse.

While financial nihilism has been the dominant trend this cycle, some might argue that it stems from a lack of strong product-market fit (PMF) among current VC projects, creating this skewed consensus view. However, it only takes one project to make the masses dream again.

I believe Ethena is the strongest candidate to take that spot this cycle.

Fundamentals

When it comes to stablecoins, only two things truly matter:

1. Value Proposition – Why Should You Hold It?

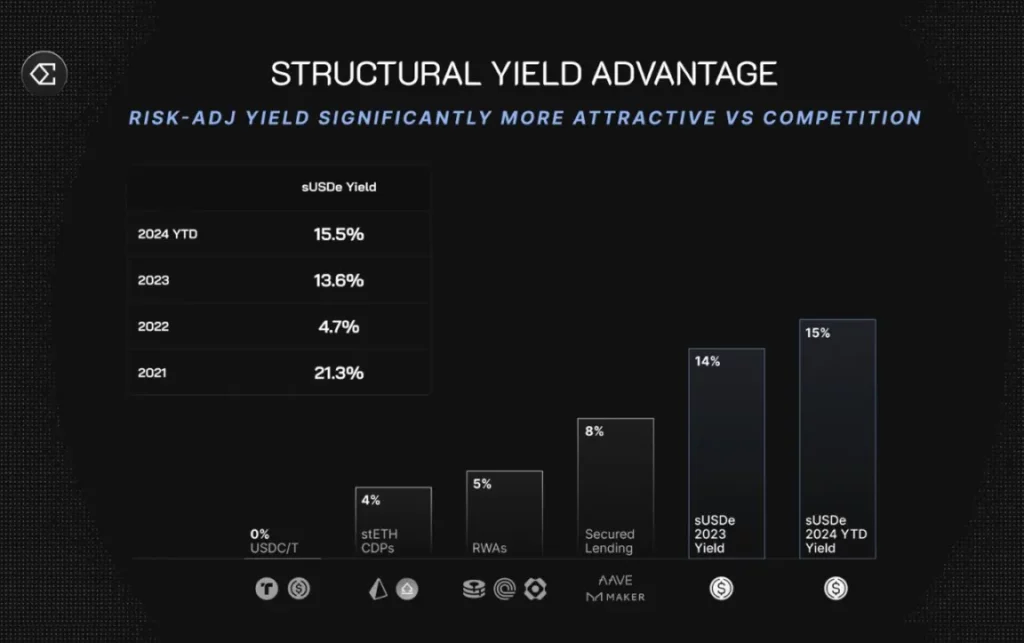

Ethena’s product and value proposition are quite simple. Deposit $1, and you’ll receive a delta-neutral position composed of staked ETH and a short position on Ethereum, earning yield. Assuming funding rates normalize, sUSDe offers the highest sustainable yield among stablecoins today (10-13% APY). This substantial value proposition has made Ethena the fastest-growing stablecoin in history, peaking at $3.7 billion TVL within seven months, and stabilizing at around $2.5 billion after a drop in funding rates.

The term “delta-neutral position” refers to an investment strategy aimed at offsetting price changes by holding both long and short positions on an asset, keeping the market value of the position relatively stable. In Ethena’s case, this strategy is achieved by staking ETH (long) and holding a short position on ETH to maintain stable value while earning yield.

sUSDe, Ethena’s issued stablecoin, has grown rapidly by offering high yields. However, it’s important to note that high yields often come with risk, and investors should consider potential risks alongside rewards. Additionally, changes in funding rates can impact both the yield and total locked value of the stablecoin.

Looking at the market, it’s clear that sUSDe is the undisputed high-yield king of the crypto space. Why would you still hold Tether today and give up the yield your dollars could earn? Most likely because Tether is the easiest to access and has the best liquidity. This brings us to the second point…

2. Distribution – How Easy Is It to Access and Use as Currency?

When launching any new stablecoin, distribution channels are the most critical factor for adoption. USDT is the number one stablecoin today because it’s the benchmark currency on every centralized exchange. That in itself is a huge moat, and it could take years for an emerging stablecoin to start gaining market share.

Yet USDe has managed to do just that. With Bybit’s support, it has become the second-largest stablecoin available on a centralized exchange, featuring an integrated auto-yield generation function. This allows users to access a superior stablecoin collateral without additional friction. So far, no other decentralized stablecoin has been accepted by any major centralized exchange, underscoring the significance of this achievement.

The total stablecoin balance sitting on centralized exchanges is approximately $38.6 billion—15 times USDe’s current supply. Even if just 20% (a small portion) of that supply decides that earning 5-10% yield on USDe is better than forgoing it, this would imply nearly a 4x growth in USDe’s addressable market from here. Now, imagine what happens when all major centralized exchanges adopt USDe as collateral?

Catalyst 1: Structural Decline in Interest Rates

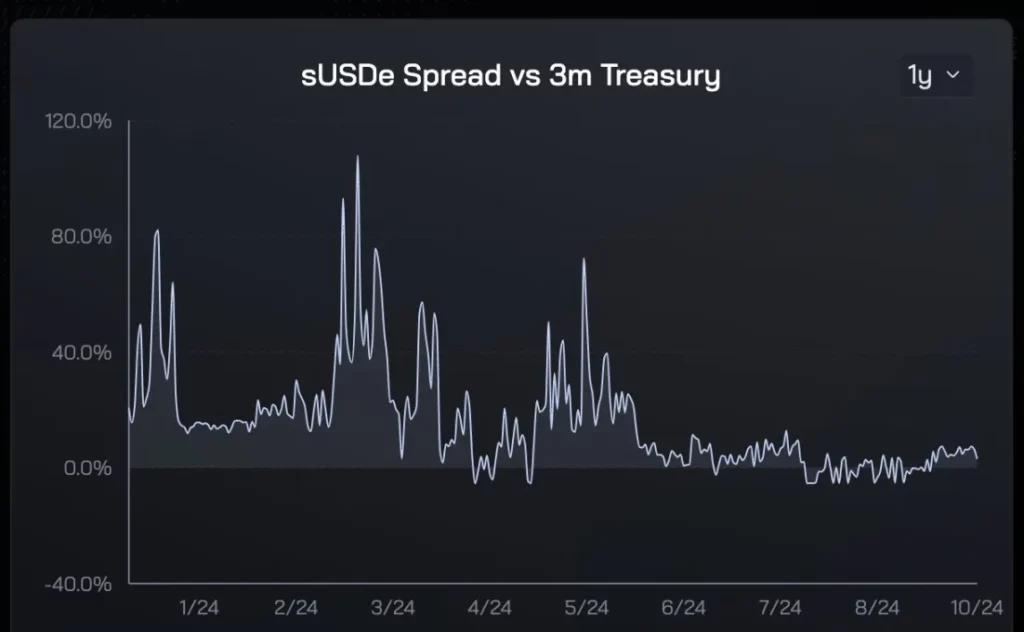

Since Ethena’s inception, the yield premium of sUSDe over the Federal Reserve’s funds rate has averaged 5-8%. This structural advantage drove billions of yield-seeking crypto capital into Ethena within its first nine months.

In September, Powell reduced the Federal Reserve’s funds rate by 50 basis points, marking the beginning of a long-term decline in global risk-free rates. The current dot plot estimates suggest the Fed funds rate will stabilize between 3% and 3.5%, indicating a roughly 2% rate cut over the next 24 months. However, this has little to do with Ethena’s yield sources. In fact, it could be argued that this has an indirect positive effect on financing rates (market appreciation -> improved risk/reward -> increased demand for leverage -> higher financing rates).

When these factors combine, this powerful mix drives up the interest rate spread, which is where Ethena’s true product value lies.

As seen in the two charts referenced above, market demand for USDe is highly sensitive to its yield premium over U.S. Treasuries. During the first six months of elevated yield premiums, USDe’s supply grew dramatically. As the premium decreased, so did the demand for USDe. Based on this historical data, I am confident that once the yield premium returns, USDe’s growth will reaccelerate. Importantly, this tailwind is both easy for most market participants to understand and appealing to them.

Over time, I expect this to significantly enhance Ethena’s presence in the market, much like how Luna and UST dominated in 2021 when DeFi yields began to decline, anchored by the 20% yield guarantee from UST in Anchor.

Catalyst 2: USTb

USTb launched two weeks ago, and in my view, it is a game-changer that will significantly drive the adoption of USDe.

A brief overview of USTb:

- A stablecoin 100% backed by BlackRock and Securitize;

- It functions exactly like other stablecoins earning yield from U.S. Treasuries, without additional custodian/counterparty risk;

- It can serve as a subset of USDe, allowing sUSDe holders to earn Treasury yields when traditional financial yields exceed those in crypto.

The market has not fully grasped the significance of this. After USTb’s launch, assuming you are confident that exchanges like Binance won’t collapse (even if they did, USDe wouldn’t go to zero as it is fully backed by BTC and stETH), there’s no reason to hold any other stablecoin in crypto besides USDe. In the worst-case scenario, you earn similar yields as competitors, and if not, you earn returns based on the market’s risk appetite.

By integrating USTb into the backend, the yield volatility of sUSDe is now significantly smoothed out, eliminating the largest concern about Ethena’s lack of sustainable yields during a bear market. This reduction in yield volatility also increases the likelihood of future centralized exchange integrations.

With these two catalysts in play, Ethena’s stablecoin offering is now comprehensive, outperforming all competitors in the market.

Tokenomics: Strengths, Weaknesses, and Opportunities

One major downside of VC tokens is that if you hold them long enough, you naturally become the exit liquidity for early investors, teams, and other stakeholders receiving token rewards. This alone has caused the market to completely abandon some of the most PMF (Product-Market Fit) projects in this cycle, opting instead for pure meme coins.

Ethena is no different from typical VC tokens. Since its peak, ENA has dropped by about 80% due to high launch valuations and airdropped supply entering the market. Over the last six months, the first-season airdrop has been fully unlocked, with 750 million tokens hitting the market. These unlocks, coupled with reduced demand for leverage, ultimately shattered ENA’s narrative, which is why no one holds ENA today, and why I strongly believe a significant repricing is inevitable.

So, why should you consider this “evil” VC token now? The answer is simple—the amount of ENA flowing into the market will drastically decrease over the next six months, greatly easing the sell pressure. Yesterday, the first batch of tokens was released, and out of a total of $125 million in new supply, farmers claimed only $30 million, opting to lock up the remaining tokens. Considering that farmers have been marginal sellers over the past few months, what happens when they stop selling? The price has already found a natural bottom at $0.20 and is now forming higher highs and higher lows around $0.26.

From now until April 2025, the only additional inflation will come from the remaining ~300 million farmers’ reward tokens entering the market, but at $0.28, that only amounts to about $450,000 daily (less than 1% of daily trading volume). To put this into perspective, TAO faced daily inflation pressure of $4 million to $5 million, yet its price surged by 250% over the last month. The point here is that when conditions are right, inflation unlocks typically don’t matter during token revaluation phases. After April 2025, team/VC tokens will begin unlocking, so we have about six months to validate this thesis.

How Big is the Dream?

Despite being the only major new product with clear PMF in this cycle, ENA has failed to break into CoinGecko’s top 100. From a technical analysis standpoint, ENA’s high-frequency trading chart looks exceptionally clean. Given the fundamental drivers and the easing of inflationary pressure, I foresee ENA reclaiming the $1 level. Even then, ENA’s market cap would only be comparable to POPCAT’s recent peak of $1.5 billion in circulating market cap.

Looking ahead, Ethena has a solid foundation to scale USDe into the tens or even hundreds of billions of dollars. As crypto stablecoins gain more market share due to international cross-border payments, a $1 trillion market is not out of reach. By then, if ENA isn’t a top 20 token, I would be surprised, as it’s the best product in the largest vertical of the crypto market.

When we will reach this target is unknown, but Ethena is my bet for crypto’s next great dream this cycle. As always, none of this should be considered financial advice. Please DYOR (Do Your Own Research).

I am, of course, a long-term holder of this token, but if the data later contradicts this view, I may change my position.