Bitcoin Consolidates Around $64,000, Poised for Bullish Breakout

On Thursday, both the stock and crypto markets experienced a rise followed by a decline.

The latest U.S. employment data showed a continued cooling of the labor market, with the number of continuing jobless claims hitting the highest level since November 2021. Financial markets opened positively but began to decline during the midday trading session.

Bitcoin data showed that Bitcoin consolidated around $65,000 early Thursday morning before dropping to a support level of $63,500 in the afternoon. As of the time of writing, Bitcoin is trading at $63,717, down approximately 1% over the past 24 hours.

Altcoins overall declined, with 90% of the top 200 tokens by market cap showing losses. Among the gainers, Galxe led with a 43.2% increase, followed by Argon (ANT) up 17%, and Mantle (MNT) up 8.5%. Worldcoin (WLD) saw the largest drop, down 13.4%, followed by Mog Coin (MOG) down 11.8%, and Brett (BRETT) down 9.5%.

The total cryptocurrency market cap currently stands at $2.33 trillion, with Bitcoin’s market dominance at 53.8%.

In U.S. stock markets, the S&P 500, Dow Jones, and Nasdaq indices all closed lower, down 0.78%, 1.29%, and 0.70% respectively. The Dollar Index rose 0.50% on the day, and the yield on the 10-year U.S. Treasury increased by 4.1 basis points to 4.2%.

Analysts at Secure Digital Markets stated, “This pullback is accompanied by a decrease in open interest and trading volume, indicating a weakening of the previous bullish momentum. The pause in the rally coincides with a significant sell-off in the stock market, particularly with the Nasdaq dropping 2.7% yesterday. If this market adjustment continues, it could further hinder the cryptocurrency rebound. A close below the 50-day moving average (around $64,000) could signal a further decline to $62,000.”

Bitcoin Establishes Support Around $64,000

BTC price retreated below $65,000 after reaching $66,000 on July 17 and spent most of July 18 retesting this level before dropping.

Market analyst Aksel Kibar noted in an X post that $65,000 is a “strong resistance level,” and the fact that BTC/USD has not significantly “pulled back” is “very favorable in the long term.” He said, “Holding resistance without showing an intention to sell is usually a sign of an imminent breakout.”

Data from IntoTheBlock supports Bitcoin’s upward trend, with its IOMAP model showing relatively strong support on the downside compared to the resistance faced on the rebound path.

For instance, the direct support levels provided by the 100-day and 200-day EMAs are around $62,700, close to the region where approximately 1.7 million addresses purchased about 840,920 BTC. Increased demand in this area could push prices higher.

Long-Term Bullish Outlook Remains

Most cryptocurrency analysts believe that the medium to long-term outlook for BTC remains bullish.

MN Trading founder Michaël van de Poppe indicated that Bitcoin’s network hash rate is evidence of the market nearing a bottom, having recently experienced the largest drop since the FTX collapse in 2022.

Poppe stated in a follow-up article, “Bitcoin has been steadily consolidating over the past four months. As long as it stays above $60,000, it is highly likely to continue rising. Gold prices are hitting all-time highs, yields are falling. Bitcoin’s rise is just a matter of time.”

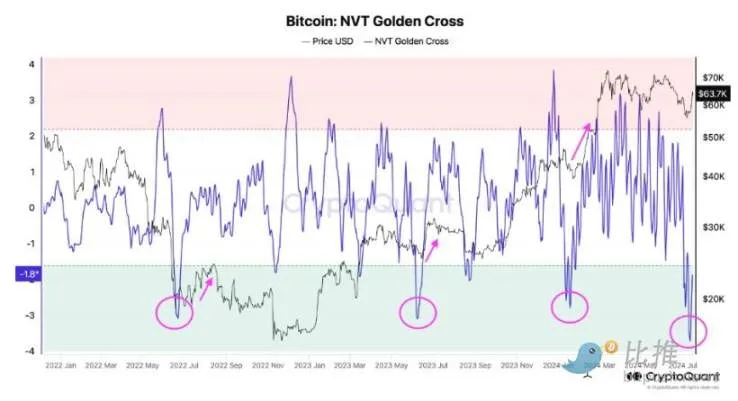

To further strengthen his argument, Poppe highlighted Bitcoin’s Network Value to Transactions (NVT) ratio, calling it an “important indicator for Bitcoin.”

He pointed out, “This is the lowest negative value in the past 2.5 years, worse than the Luna collapse, last summer’s correction, or Bitcoin’s post-listing adjustment. The correction is over, buckle up.”

Nansen.ai’s Chief Research Analyst Aurelie Barthere analyzed the macro factors favoring a BTC rebound.

In a report, Barthere said, “The weakening trend in the U.S. labor market that we have witnessed since the beginning of 2024 continues. Fed Chair Powell stated at the Economic Club this week that the Fed is now more focused on the risk of a rapid rise in unemployment, which means the Fed could achieve the OIS market’s expectation of 2-3 rate cuts by the end of the year.

For cryptocurrencies, as long as the U.S. economy slows without falling into a recession, low interest rates can be supportive.”