BTC falls below $57,000 to a two-month low, who is to blame?

Recently, the overall cryptocurrency market has been on a downward trend. According to OKX market data, at 4 p.m. this afternoon, BTC briefly fell below 57,000 USDT, temporarily trading at 57,131.1 USDT, with a 24-hour decline of 8.87%; ETH fell below 2,900 USDT, temporarily trading at 2,859 USDT, with a 24-hour decline of 9.07%.

Affected by BTC and ETH, altcoins have also experienced significant corrections. As of the time of writing, SOL is temporarily trading at 120.88 USDT, with a 24-hour decline of 10.57%; ORDI is temporarily trading at 32.21 USDT, with a 24-hour decline of 22.91%; BNB is temporarily trading at 547.5 USDT, with a 24-hour decline of 8.54%; OP has a smaller decline, currently trading at 2.43 USDT, with a 24-hour decline of 1.58%.

Under the influence of the overall market downturn, the total market capitalization of cryptocurrencies has also significantly shrunk. CoinGecko data shows that the current total cryptocurrency market capitalization has shrunk to $2.2 trillion, with a 24-hour decline of 8.56%. The enthusiasm of cryptocurrency users for trading has also declined significantly, with today’s fear and greed index reaching 54, and the weekly level changing from greed to neutral.

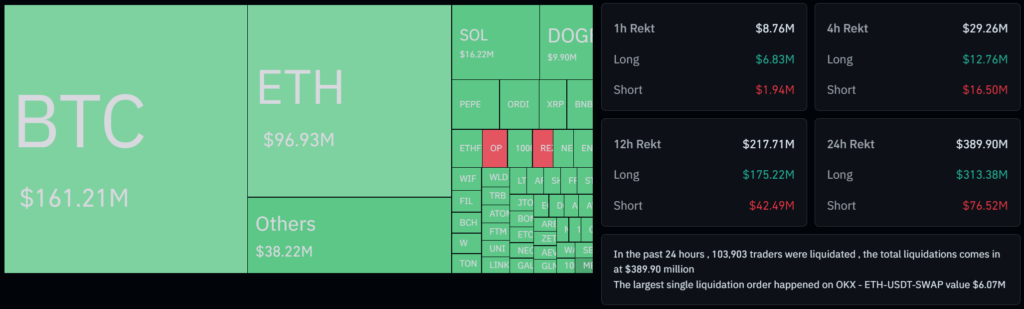

In terms of derivatives trading, Coinglass data shows that the total liquidation across the network in the past 24 hours amounted to $469 million, with the vast majority being long liquidations totaling $413 million. Looking at the specific cryptocurrencies, BTC liquidations amounted to $159 million, and ETH liquidations amounted to $122 million.

Reasons: Dim prospects for Fed rate cuts? Hong Kong ETF fell short of expectations? CZ sentenced to 4 months in prison?

The overall market downturn has been evident since early April. Although it briefly rebounded around April 20 due to the Bitcoin halving, the overall situation is still not optimistic.

From a global perspective, geopolitical tensions in multiple regions are escalating, with ongoing tensions between Iran and Israel leading to an overall decline in the global market. In addition, the prospect of Fed rate cuts is bleak, as several Fed officials have indicated that there will be no rate cuts before the end of the year. According to the semi-annual financial stability report of the Federal Reserve, inflation is still considered the top financial risk.

Therefore, changes in the global geopolitical landscape and the dim prospects for rate cuts have become the fundamental reasons for the decline in the cryptocurrency market.

From the perspective of ETFs, the net outflow of the US Bitcoin spot ETF was $162 million in the first five trading days. The main reason for the rise in Bitcoin prices this year is the inflow of funds into the US Bitcoin spot ETF and the future prospects brought by ETFs. However, when the funds flow out of the US Bitcoin spot ETF, the decline in the market is also expected.

However, according to a statement by 10x Research, this round of correction is due to the different risk management methods of institutional investors compared to most retail traders. After experiencing this correction, the price of Bitcoin is close to the average entry price of holders of the US Bitcoin ETF, which is about $57,300.

In addition, the opening of the Hong Kong Bitcoin spot ETF and Ethereum spot ETF did not meet expectations. Compared to the first day trading volume of the US Bitcoin spot ETF, it was only two thousandths. The amount of funds inflow has not been disclosed, which may lay the groundwork for future developments.

Furthermore, the highly anticipated trial of CZ in the early hours of today was also one of the triggers. However, compared to the previous suggestion of 3 years’ imprisonment by the US Department of Justice and prosecutors, a 4-month probation may be the best solution. The market also briefly rebounded, but it still cannot affect the overall downward trend.

Finally, from the perspective of the cryptocurrency market itself, it has become a consensus that there will be a brief correction after the historical halving.

The approval deadline for the first fund of the US Ethereum spot ETF is May 23, which may determine the current market trend. However, the market is not optimistic about this. According to several institutions and SEC insiders, the US Ethereum spot ETF will not be approved on May 23, so there may be a new round of market changes around May 23.

In addition to the above two expectations, the Hong Kong Bitcoin spot ETF and Ethereum spot ETF may also become potential factors affecting market trends. Although the first-day trading volume was not outstanding, the coverage of ETFs in Hong Kong will include countries and regions in the Asia-Pacific region such as Southeast Asia and the Middle East, which may become new sources of capital inflows in the cryptocurrency world. Although it has not yet been opened to mainland China, expectations still exist.

In summary, the future trend of the market is still in an overall upward trend, but there are uncertainties accompanying the expected results. CoinDarwin reminds everyone that the recent market fluctuations are significant, so please pay attention to investment risks.