Market Surge Fueled by Rate Cut Expectations as Bulls Take Charge

On Friday, various asset classes saw a widespread rally, with U.S. equities, cryptocurrencies, and gold all rebounding. This surge comes less than six days before a potential historic shift in the Federal Reserve’s monetary policy.

The rally was largely driven by investor expectations that the Federal Reserve may announce a 50-basis-point winterest rate cut during the Federal Open Market Committee (FOMC) meeting next Wednesday. Former New York Federal Reserve President Bill Dudley noted that there is “a strong case” for further cuts.

Currently, the CME Group’s FedWatch tool shows a 49% probability of a 50-basis-point cut, up from 28% just a day earlier.

Crypto Market Soars

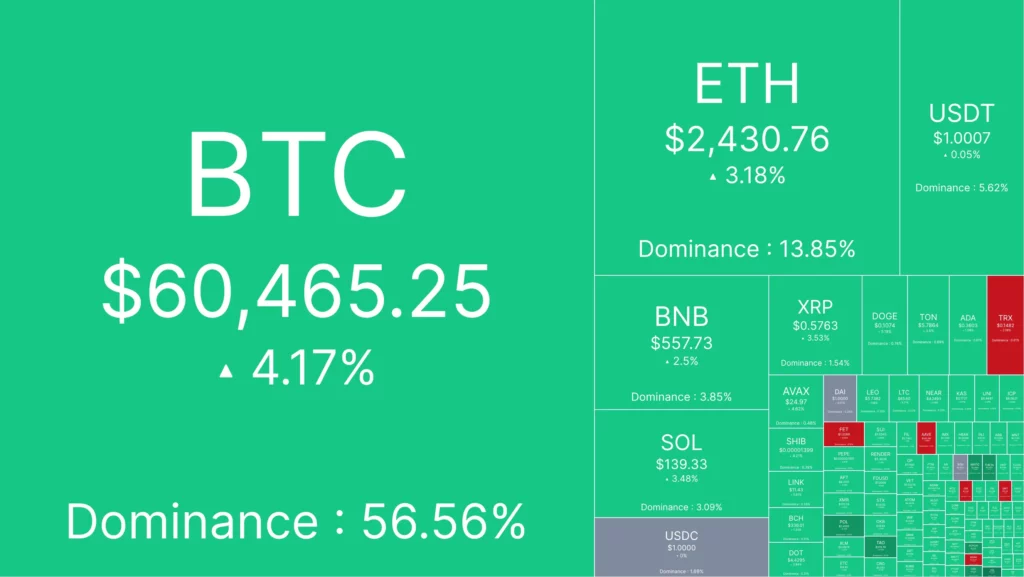

Earlier in the day, Bitcoin (BTC) surged over $2,500, rising from $58,000 to $60,500. After U.S. market hours, it broke past $60,000, and as of press time, BTC was trading at $60,465, marking a 24-hour gain of 4.17%.

Altcoins also performed strongly, with over 90% of the top 200 tokens posting gains. Nervous Network (CKB) led the way with a 45.3% increase, followed by Pol (POL) up 12.1%, and Popcat (POPCAT) up 11.9%. However, Sun (SUN) dropped 6.6%, BinaryX (BNX) fell 5.4%, and Worldcoin (WLD) declined 5.1%. The total cryptocurrency market cap stands at $2.1 trillion, with Bitcoin dominance at 56.4%.

U.S. Stock Market Climbs

U.S. equities also advanced, with the S&P 500, Dow Jones, and Nasdaq indices rising by 0.54%, 0.72%, and 0.65%, respectively. Notably, the S&P 500 and Nasdaq recorded their biggest weekly gains since November last year.

Increased Volatility Expected

Bitcoin finally closed the week on an upward trend. Analysts from Secure Digital Markets observed that the recent price movement aligns with a pattern of increased short-term volatility within a six-month downtrend. They predict that BTC could test the $62,000 to $64,000 range next week if this trend continues.

As for Ethereum (ETH), analysts noted that it continues to underperform compared to Bitcoin. The ETH/BTC chart shows a persistent bearish trend, suggesting that ETH may struggle to keep pace with BTC in the short term.

Despite the positive news around rate cuts, OKX Global’s Chief Business Officer Lennix Lai cautioned that asset prices are unlikely to experience a “straight rise” from here. He advised traders to brace for continued volatility.

“Given the current market uncertainty, we can expect significant fluctuations for the remainder of the month as traders react to broader economic indicators,” said Lai. “Short-term volatility is to be expected, but the increasing institutional participation in the crypto market may provide greater long-term stability and liquidity.”

According to an economist report commissioned by OKX, 69% of institutional investors plan to increase their exposure to digital assets over the next two to three years, indicating growing confidence in the crypto market despite short-term uncertainties.

Rate Cuts and Market Sentiment Driving Bitcoin Surge

Lai attributed the recent rise in BTC largely to anticipation of upcoming rate cuts and speculation of a new easing cycle. These macroeconomic factors, combined with shifting investor sentiment, are driving market dynamics.

“Currently, key support and resistance for BTC are around the $50,000 range,” Lai added. “This area is crucial for traders as it could determine the next direction for BTC’s price movement. That said, with increased institutional involvement and broader adoption, we may see these levels shift in the coming months.”

Lai expressed cautious optimism for BTC’s short-term outlook but remains bullish in the long run, citing institutional adoption, increased investment, clearer regulatory frameworks in major markets, and the expanding crypto ecosystem as key factors supporting long-term growth.

Crypto analyst and investor Jason Pizzino believes that once BTC converts the $61,500 resistance level into support, the next phase of the Bitcoin bull market will begin.

In a recent YouTube update, Pizzino stated, “If we start seeing some tests and short-term closes above $58,000, this could signal an early rebound. Next, we’ll likely test the more critical level of around $61,500, representing a 50% retracement from March to August. Overcoming and consolidating at this level would mark the next stage of the bull market, pushing towards new all-time highs.”

Pizzino also warned that volatility could still play a major role, with the possibility of Bitcoin falling more than 15% from current levels, but said this wouldn’t invalidate the bullish case.

“Bitcoin remains above key levels around $52,000 and $53,000, with August’s low of $49,000 still holding. Even if BTC retraces to around $40,000, it would still be in a macro bull market. From there, closing above $61,500 would signal the start of a new upward trajectory,” Pizzino concluded.