Why Solana’s Market Stays Strong: Fundamentals and ETF Hopes Attract Capital

Following the expectations surrounding Bitcoin and Ethereum spot ETFs, Solana has emerged as the next ETF target favored by capital and speculation. Multiple issuers applying for Solana ETFs have boosted market confidence.

Strong fundamentals, significant institutional accumulation, and the U.S. election have further fueled optimism for Solana. This article will explore the main reasons behind Solana’s recent market outperformance.

Leading Data and Increased Institutional Holdings

Recently, Solana has shown strong market performance and gained more institutional favor.

Price information often significantly impacts user confidence and market expectations. According to CoinGecko, SOL’s price recently hit a three-month high, with a 31.1% increase over the past 30 days, outperforming many other cryptocurrencies, including Bitcoin and Ethereum.

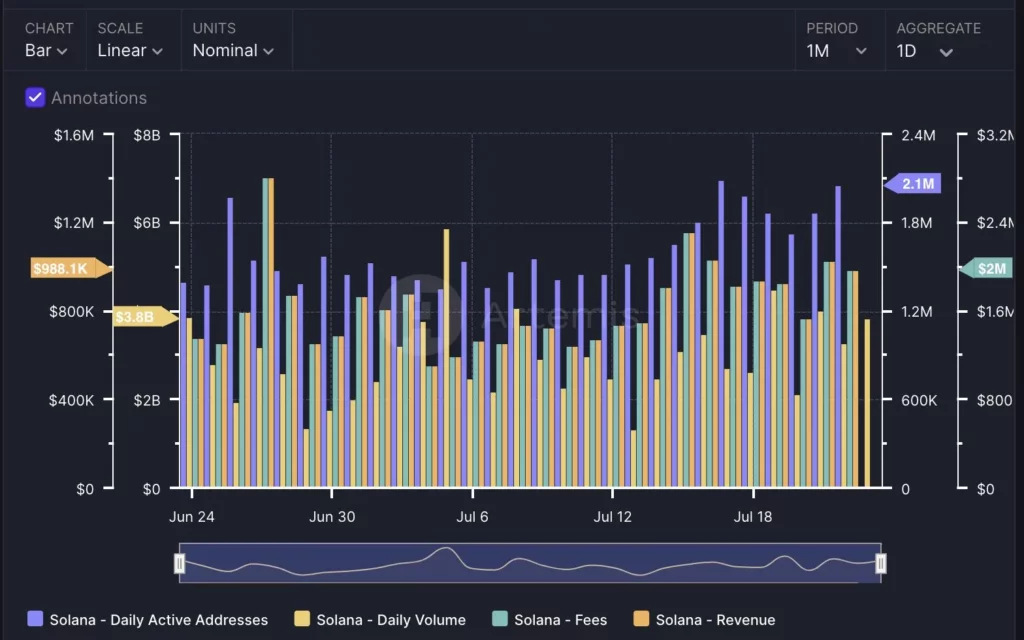

Artemis data indicates a 40.5% increase in Solana’s daily transaction volume over the past month, reaching $43.7 million. Daily active addresses rose by 75% to 2.1 million, mainly from wallets, MEME, and cross-chain bridges, with a higher proportion of new user addresses.

TVL increased to $5.2 billion, a 26.9% rise, while daily transaction fees grew by over 33.3% to $2 million, with daily revenue up by over 33.1%, primarily contributed by wallets, DeFi, and MEV.

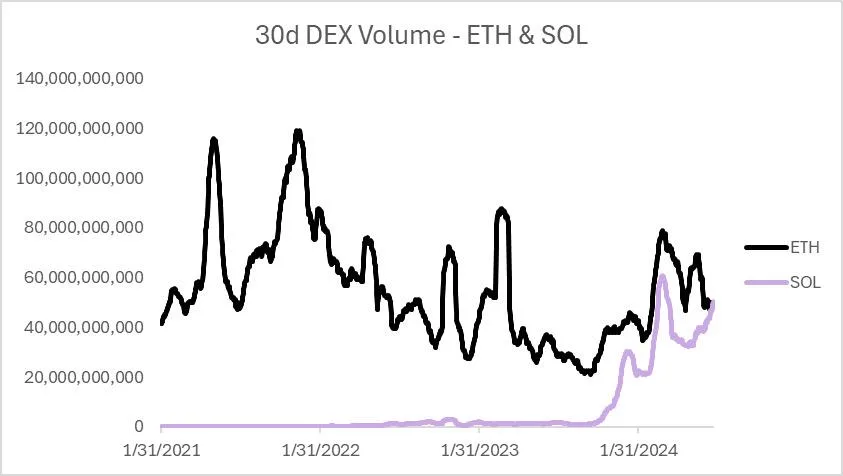

Additionally, Blockworks Research analyst Ryan Connor noted that Solana’s decentralized exchange (DEX) volume surpassed Ethereum’s for the first time in the past 30 days, making it the most used chain by this metric.

According to a Coin98 Analytics report, Solana’s fees and revenues saw substantial growth in Q2, generating over $26 million in revenue, a 42-fold increase year-on-year. SOL’s total transaction volume reached $292 billion, nearly a 7-fold increase from the previous year.

Dune data shows that Solana’s liquidity staking rate rose to 6.58%, with a 1.76% quarter-over-quarter increase, and the dominance of the top three suppliers decreased from 93% to 68.7%, indicating a healthier and more diversified market.

Given Solana’s robust fundamentals, several institutions have recently begun publicly accumulating Solana. For example, Canadian fintech company DeFi Technologies announced adding Solana to its digital asset reserves, holding 12,775 Solana tokens (approximately $2.03 million).

Canadian listed investment company Cypherpunk Holdings significantly increased its SOL holdings to over 63,000 tokens and announced operating its own Solana validator, staking 49,917 tokens (about $11 million).

“This is not something you see every day. We are now dealing with increasing investor interest in Solana—one of the most actively traded cryptocurrencies after Bitcoin and Ethereum,” commented Cboe’s global head of ETP listings on the Solana ETF 19b-4 application.

Stratos VC fund founding partner Rennick Palley also stated, “The easing of U.S. regulatory policies is increasing SOL’s appeal among professional investors.”

Multiple Issuers Submit Solana ETF Applications

Solana’s impressive market performance is partly driven by the anticipation of a Solana spot ETF, considered one of the most likely ETF candidates.

On June 27, VanEck announced it had submitted a Solana Trust (“VanEck Solana Trust”) application to the U.S. SEC, the first Solana ETF application in the U.S. If approved, the ETF will be listed on the Cboe BZX Exchange.

21Shares soon followed, submitting an S-1 filing for a Solana spot ETF, planning to list the 21Shares Core Solana ETF on the Cboe BZX Exchange. Digital asset management company 3iQ recently filed for a Solana ETF in Canada, planning to list under the ticker $QSOL, marking the first Solana ETF application in North America.

Franklin Templeton also expressed optimism for Solana, stating, “Besides Bitcoin and Ethereum, we believe there are other exciting developments driving the growth of the crypto space. Solana has shown extensive applications and is maturing, overcoming technical growing pains, and highlighting the potential of a high-throughput monolithic architecture.”

Nate Geraci, president of The ETF Store, recently revealed that an ETF issuer plans to apply for a combination spot ETF for Bitcoin, Ethereum, and SOL in the coming months.

VanEck, 21Shares, and Franklin Templeton, all issuers of U.S. Bitcoin and Ethereum spot ETFs, have increased external optimism for a Solana spot ETF. Currently, Cboe has submitted VanEck and 21Shares’ Solana ETF 19b-4 forms to the U.S. SEC. “Once the SEC acknowledges these filings, the decision clock starts ticking,” commented Nate Geraci.

With market sentiment ignited, political shifts during the U.S. election further boost the likelihood of a Solana spot ETF being approved. As Republican candidate Trump’s chances of winning rise, the likelihood of SEC Chair Gary Gensler, an aggressive regulator, stepping down has surged.

Markus Thielen, founder of 10x Research, predicted that although Gensler’s term ends on June 5, 2026, he might resign by January or February 2025 when Biden’s term ends. Previously, the SEC had classified SOL as an unregistered security multiple times, complicating its approval process.

“If SEC Chair Gary Gensler no longer serves post the 2024 presidential election, the chances of a Solana ETF being approved will increase,” said Matt Sigel. Crypto voters might play a key role in the election, with Washington’s regulatory environment shifting towards supporting cryptocurrencies.

James Seyffart, a Bloomberg ETF analyst, pointed out that the final deadline for a Solana ETF is mid-March 2025. However, the most important date is November. The possibility of launching in 2025 depends on a new administration at the White House and SEC.

Political Dynamics Bring Uncertainty

However, Solana’s close association with FTX founder SBF, a major donor to President Biden, adds political uncertainty. Notably, Solana founder Toly (Anatoly Yakovenko) has not publicly disclosed his political stance.

Based on capital inflows following the approval of Bitcoin spot ETFs, if Solana officially joins the ETF trend, it will directly stimulate its price. According to crypto market maker GSR Markets, if a Solana spot ETF launches in the U.S., its inflows could be 2%, 5%, and 14% of Bitcoin’s inflows in bearish, baseline, and ideal scenarios, respectively.

Given Solana’s market cap averaged 4% of Bitcoin’s over the past year, SOL could grow 1.4 times in a bear market, 3.4 times in a baseline scenario, and 8.9 times in an ideal scenario.