Countdown to CZ’s Release: Can Binance Weather the Storm?

Last week, the U.S. Bureau of Prisons announced that Changpeng Zhao (CZ), who has been incarcerated for nearly four months, is set to be released on September 29. Following his 118 days in Lompoc II prison, CZ has been transferred to the RRM Long Beach for reentry supervision, where he remains under custody.

The news has sparked excitement in the market, with Binance’s new tokens climbing the charts in anticipation of the return of its spiritual leader. Positive sentiments are abundant on platforms like X, as the currently subdued market could really use a boost.

A Look Back at Recent Events

In November 2022, Binance reached a settlement with the U.S. Department of Justice (DOJ), the Commodity Futures Trading Commission (CFTC), the Office of Foreign Assets Control (OFAC), and the Financial Crimes Enforcement Network (FinCEN) regarding its past registration, compliance, and sanctions issues.

CZ ultimately admitted to violations of several laws, including the Bank Secrecy Act and the Commodity Exchange Act, leading to a staggering fine of $4.368 billion—FinCEN’s largest penalty to date.

Initially facing an 18-month sentence, the DOJ sought to increase it to three years. However, after receiving 161 letters of support and taking into account his guilty plea, CZ was sentenced to four months in prison, which he began serving in June.

Binance’s Transition and New Leadership

While a four-month sentence is not particularly long, CZ’s absence has coincided with significant leadership changes at Binance. Rachael Teng has officially taken over as CEO, guiding the company through a critical period of compliance and adaptation.

CZ’s departure marked the beginning of a new era for exchanges and the broader crypto space, signaling the end of the “Wild West” mentality. This transition has forced exchanges to focus on compliance, allowing institutions to enter the crypto arena—most notably through the launch of Bitcoin ETFs. Binance, leveraging its history, has aimed to shed past burdens and secure a competitive edge in the market.

Rachael Teng, with her extensive professional background, is poised to lead Binance in its global compliance efforts. While Binance may not currently plan to return to the U.S. market, it has secured 19 licenses globally, including new approvals in Thailand, India, and Brazil, showcasing its commitment to compliance.

Performance Amidst Challenges

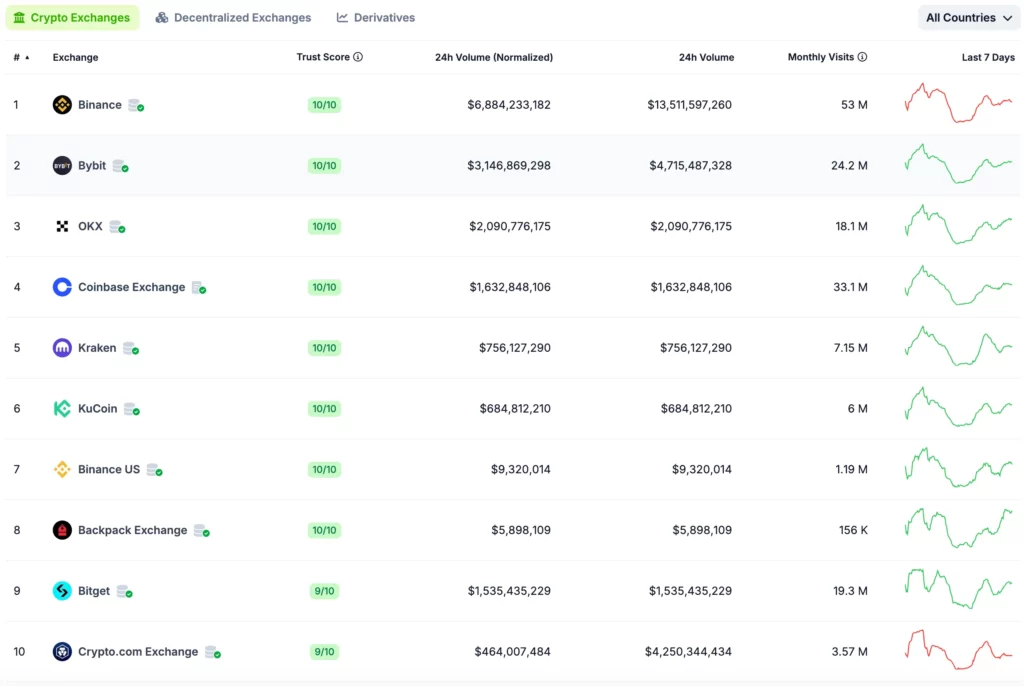

Despite initial concerns that CZ’s absence would impact Binance’s operations, data indicates that the exchange has performed remarkably well. According to CoinGecko, Binance’s daily trading volume remains robust, leading all exchanges with 24-hour trading figures and attracting over 530 million monthly users.

From DefiLlama data, Binance has seen a net inflow of over $4 billion since late November, solidifying its status as a market leader. Recently, Teng announced that Binance’s total trading volume has surpassed $100 trillion.

While Binance has managed to maintain its success, new challenges loom on the horizon.

Regulatory Hurdles and Controversies

In early 2023, Nigeria dealt Binance a significant blow, accusing the exchange of illegal financial activities and suggesting it had exacerbated the collapse of the local currency. Though rumors of a $10 billion fine were later debunked, Nigerian authorities detained Binance executives Tigran Gambaryan and Nadeem Anjarwalla, and tensions between Binance and Nigeria remain unresolved.

Additionally, Binance has faced scrutiny regarding its token offerings. Criticism emerged late last year regarding alleged “friends-and-family” coins on its Launchpad, particularly following the controversial listing of the Hooked Protocol. Despite public denials from Binance executives, the skepticism surrounding the integrity of its listings persisted.

In response, Binance unveiled an initiative to publicly recruit new projects, emphasizing the need for a healthy ecosystem that benefits regular investors and loyal community members.

Navigating the Future

CZ’s imminent return raises hopes for a revitalized Binance. However, due to the plea agreement, CZ will be barred from participating in daily operations for three years. Nevertheless, his stake in the company remains intact, allowing him to influence company performance indirectly.

Even though CZ has expressed no desire to return as CEO, he may still guide Binance’s strategy from the sidelines. Following the establishment of the plea agreement, CZ signaled an interest in investing in blockchain, AI, and biotechnology, while his non-profit initiative, Giggle Academy, awaits progress.

The Road Ahead

Can CZ steer Binance back to its former glory? The market landscape is markedly different now, and the challenges ahead are substantial. CZ has long been a prominent figure in the industry, but the current narrative is shifting. Fortunately, fresh talent and innovative ideas continue to flow into the crypto space, presenting opportunities for adaptation and growth.

Ultimately, CZ’s return could significantly bolster Binance’s position, restoring investor confidence and likely driving price surges for Binance-associated tokens. Speculation surrounding the “CZ release” phenomenon has already begun to circulate.

In summary, while the market may have changed, CZ remains a pivotal figure in the crypto community. His return is anticipated with optimism, as stakeholders look to him to navigate the complexities of the evolving landscape.