Exploring Owlto Finance: Addressing the Cross-Chain Interoperability Dilemma

The Rapid Evolution of DeFi and Fragmented Liquidity

Since the introduction of Ethereum rollups with Arbitrum and Optimism, a multitude of Ethereum Layer 2 solutions has emerged in just over a year. The replicability of technology has made launching chains as easy as a click, leading to over 50 chains based on OP Stack’s Superchain and more than 50 Layer 3 solutions via Arbitrum Orbit in various developmental stages. Additionally, hundreds of other Layer 2 solutions leveraging zk-rollup technology are also thriving.

This proliferation of Ethereum Layer 2 solutions has led to an unavoidable issue: each Layer 2 operates independently, competing for Total Value Locked (TVL) and fragmenting Ethereum’s liquidity. Liquidity remains a persistent theme in Web3, and we currently find ourselves in an era where disparate public chains contribute to dispersed liquidity. Vitalik Buterin has vividly described this situation on Twitter, highlighting that as Ethereum has overcome numerous challenges and skepticism, the current dilemma lies in the excessive fragmentation of operations between Layer 2 chains.

Looking beyond the Ethereum ecosystem, competition exists among various Layer 1 chains as well, including Solana, Sui, and BSC, forming a multi-chain landscape where Ethereum holds a leading position while other chains orbit around it. Each Layer 1 ecosystem has also birthed promising Layer 2 solutions.

For instance, since the surge of inscriptions last year in the Bitcoin ecosystem, dozens of notable Layer 2 solutions have emerged, alongside various Appchains, SVM Rollups, and sidechains in Solana, and multiple Layer 2 solutions taking shape in BSC and other chains. With limited capital in the crypto space spread across so many chains, it’s evident how fragmented liquidity can become.

The Cross-Chain User Experience: A Challenge

Current cross-chain bridges can facilitate asset transfers but often result in poor user experiences. Users face several hurdles:

- They must navigate multiple independent websites, connect wallets, authorize transactions, and endure slow waits that can last from tens of seconds to several minutes, all while hoping their funds arrive safely at the other end.

- The urgency to capitalize on trending memes adds to the anxiety, as users often need to move funds across chains just to engage with the latest trends. Delays can turn opportunities into costly misfires.

- Low liquidity can yield poor exchange rates during cross-chain transfers. Since liquidity fluctuates over time, the unpredictability of losses during these transactions can be significant, especially when trying to capitalize on meme trends.

- Security remains a pressing concern. Vitalik has noted that cross-chain solutions are weak links in the blockchain ecosystem. Notable incidents include the theft of 120,000 ETH from Wormhole in February 2022, making it the second-largest theft in crypto history, and recent vulnerabilities in protocols like Across and LI.FI.

Cross-chain operations need not be this complicated; a liquidity solution is essential.

A Unified Cross-Chain Liquidity Approach

Imagine a protocol that simplifies transaction processes, allowing users to submit a request based solely on their trading intent. The system would then automatically aggregate liquidity from various chains, enabling efficient asset conversions with minimal friction costs. This could significantly alleviate the fragmentation issues among public chains.

Owlto Finance, a cross-chain interoperability protocol, has released a new technical white paper on October 30, 2024, titled “Intent-Centric Cross-Chain Liquidity Trading,” aiming to address the challenges of cross-chain liquidity in DeFi. With this approach, users will no longer need to grapple with complex cross-chain procedures; they will only need to input their intent, and the system will automatically integrate liquidity across chains for optimal asset conversion and minimized transaction costs.

This innovative solution is poised to greatly enhance user experiences, providing a decentralized, secure, and transparent trading environment while achieving the best transaction costs and time efficiency through unified liquidity pools.

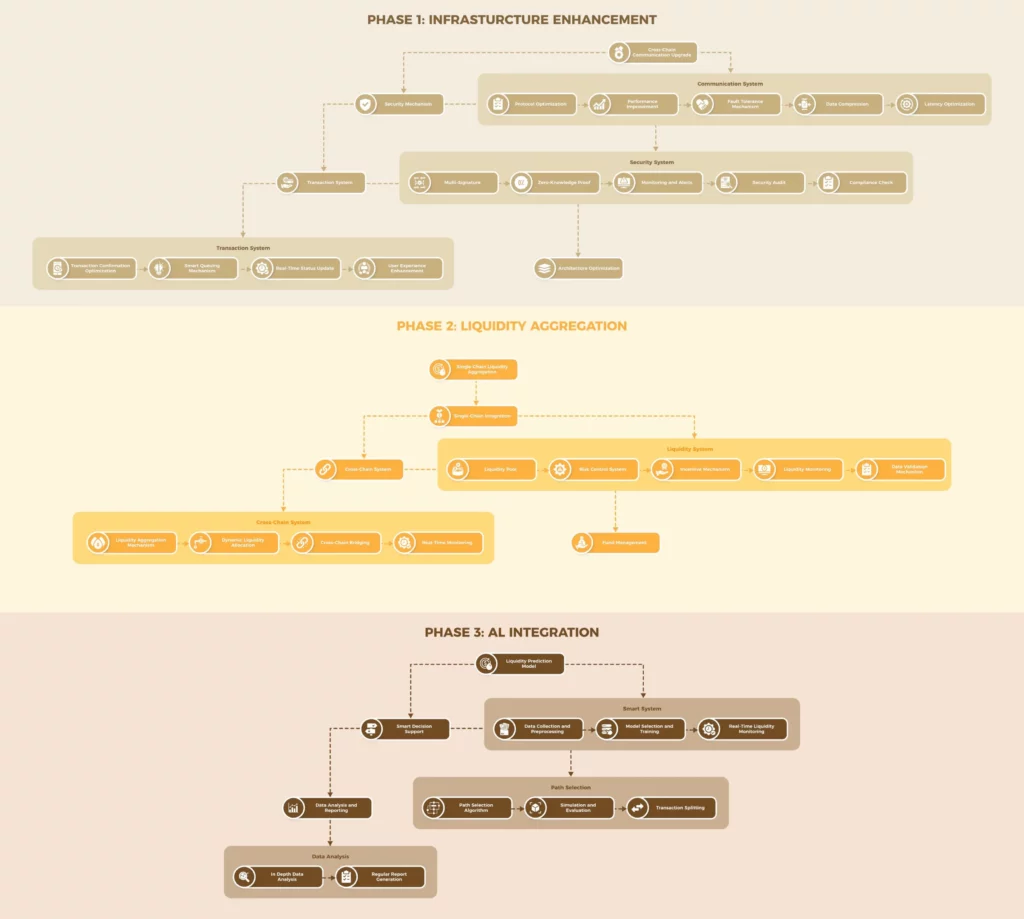

Phase One: Integrating Cross-Chain Liquidity through Interoperability

Within just a year of its establishment, Owlto Finance has emerged as a leader in the cross-chain bridge sector, boasting over 2 million users across more than 200 countries. It ranks among the top three in cross-chain trading volume on DefiLlama, with a peak market share of 33%.

Owlto aims to create a comprehensive interoperability solution for Web3 users, enabling seamless asset flow across chains. Achieving this goal is no small feat, so how has Owlto accomplished it?

Owlto has established cross-chain liquidity pools that enhance interoperability between different chains. For users, greater interoperability means accessing a wider range of chains and a richer landscape for asset circulation. By bridging various ecosystems and connecting EVM and non-EVM heterogeneous chains, users can move funds from Chain A to Chain B with minimal friction, thereby increasing the efficiency of asset circulation and utilization in DeFi.

Owlto’s cross-chain liquidity pools have already addressed this need, integrating over 50 networks and facilitating asset liquidity flow among Ethereum, Bitcoin, and Solana ecosystems. This has expanded the use cases for assets across different networks and increased potential yield opportunities. To date, Owlto has enabled over 1.6 million cross-chain transactions on Bitcoin Layer 2 and around 8 million on other chains, with a total user base exceeding 2 million.

Furthermore, Owlto has improved user experience through enhanced cross-chain speed and security. Approximately 90% of cross-chain transactions can be completed within 30 seconds, with an AA rating from CertiK security audits.

Owlto’s cross-chain DEX aggregator functions as an information tracker, identifying the best liquidity pools across different networks to facilitate lower-slippage trades, thus avoiding high slippage issues caused by limited liquidity in single pools. Owlto has deployed this DEX aggregator function on about 20 chains, bridging liquidity between different tokens.

Through these measures, Owlto Finance has achieved comprehensive integration of liquidity pools across multiple chains, enhancing the depth and efficiency of cross-chain trading. Specific initiatives include:

- Liquidity Aggregation Mechanism: Designing and implementing a mechanism to integrate liquidity resources across chains, ensuring interoperability and minimizing slippage and price discrepancies.

- Smart Contract Management and Scheduling: Automating the management and scheduling of cross-chain liquidity to enable dynamic allocation and optimize resource utilization.

- Cross-Chain Liquidity Bridging: Facilitating liquidity interchange between different chains to ensure safety and efficiency in cross-chain liquidity.

- Real-Time Monitoring: Establishing a real-time monitoring system to track the status and changes in liquidity pools.

- Liquidity Reading and Integration: Developing tools and interfaces to read and integrate liquidity data in real time, ensuring accuracy and timeliness to support cross-chain transactions.

Phase Two: Ensuring the Security of Cross-Chain Asset Flow through ZK and Node Security Verification

“Decentralization” and “security” are always the foremost principles in the crypto world.

While effective solutions for cross-chain liquidity issues have emerged, problems related to “security” and “privacy protection” in the cross-chain space still need to be addressed. According to DefiLlama, over $2.8 billion has been stolen from cross-chain bridges, accounting for nearly 40% of the total stolen funds in the Web3 industry.

Therefore, the transmission and storage of transactions require high security to prevent tampering or theft. Although on-chain transaction transparency is high, it can also expose users’ trading intentions, leading to privacy risks.

To tackle the issues of “security” and “privacy protection,” Owlto is introducing the following two solutions:

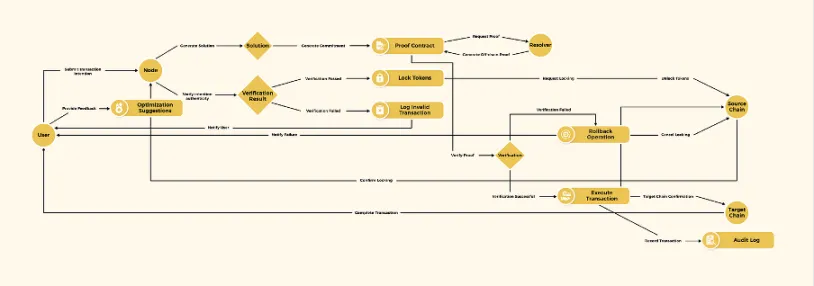

- Node Security Verification: A decentralized solution can effectively prevent single points of failure, enhancing the security of asset flow between different networks. Owlto’s “Node Security Verification” utilizes staked tokens based on decentralized consensus and incorporates a “node penalty mechanism” and “node incentive mechanism” to ensure data security. If a node transmits fraudulent data, its staked tokens will be penalized (Slashing mechanism). Conversely, nodes that actively participate and execute honestly will not only earn additional rewards through staking but also receive transaction fee shares and token incentives for successfully executing trading paths. This design ensures that nodes maintain honest behavior in a decentralized environment and prevents malicious activities.

- Zero-Knowledge Proofs: The introduction of “zero-knowledge proofs” ensures that verifiers can confirm user intent and execute transactions correctly without knowing specific transaction details. If an attempt is made to transmit a forged protocol, the generated commitment will fail verification, ensuring the security of the entire transaction process while protecting user privacy. Additionally, during the verification phase, zero-knowledge proofs prevent Miner Extractable Value (MEV) attacks, enhancing the overall security of the system.

Furthermore, Owlto Finance is committed to improving the efficiency, security, and user experience of cross-chain bridges through specific measures, including:

- Simplifying Cross-Chain Communication: Implementing advanced cross-chain communication protocols to reduce data transmission delays and increase transaction speeds.

- Enhancing Security: Introducing multi-signature mechanisms to ensure transaction integrity and tamper resistance, while also employing zero-knowledge proof technology to protect user privacy and prevent data leaks.

- Optimizing Transaction Confirmation: Streamlining the transaction confirmation process to shorten confirmation times and enhance user experience; implementing smart queuing and priority processing mechanisms to reduce transaction congestion; providing real-time transaction status updates to improve visibility into transaction progress.

- Improving Scalability: Utilizing distributed system design to ensure high concurrency processing capability, while adopting a modular architecture to support future functionality expansion and upgrades.

Phase Three: Implementing Intent-Centric Cross-Chain Liquidity Trading Using AI Technology

Owlto Finance will introduce an intent-centric trading model, which differs from traditional trading methods by not being limited to a specific path for transaction completion. Instead, it allows for transactions through any path as long as the expected outcomes meet user constraints.

Within this framework, users only need to sign a transaction intent, expressing their expected outcome. Protocol nodes are responsible for evaluating different liquidity providers across multiple blockchain networks, including decentralized exchanges (DEXs) and market makers.

Using smart routing and algorithms, nodes will select the optimal cross-chain liquidity path, ensuring that the transaction result aligns with user intent. During this process, users’ assets will be held in smart contracts, with funds released to liquidity providers only upon successful transaction completion, ensuring the safety of user funds.

For example, suppose a user wants to convert 1000 USDT on Ethereum to BNB on BNB Chain, aiming to receive at least 1.2 BNB. After submitting the transaction intent, the protocol will analyze data and market conditions using AI algorithms to find the best path across various chains.

A potential process might involve first converting USDT to ETH on Arbitrum, then transferring ETH to BNB Chain, and finally exchanging ETH for BNB on BNB Chain. Once the nodes identify the optimal path, the transaction will commence. This approach can more effectively utilize liquidity pools and favorable exchange rates across chains, while reducing transaction costs and time.

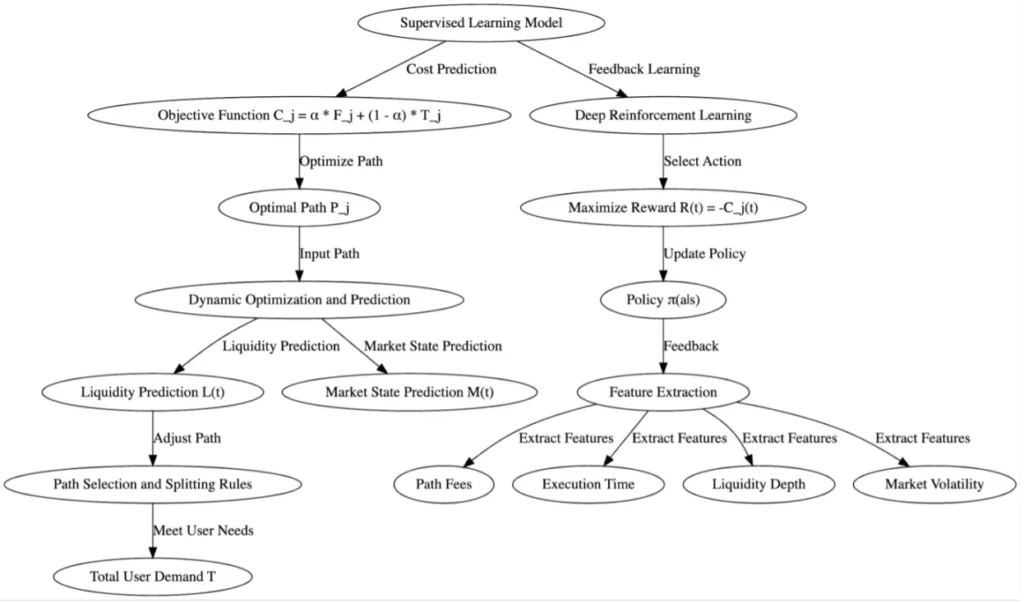

In the above “intent-centric cross-chain liquidity trading” model, AI plays a crucial role:

- Liquidity Prediction: AI algorithms analyze historical data and current market conditions to predict liquidity changes across different chains, allowing for proactive adjustments to liquidity pool configurations. By assessing liquidity resources across multiple chains, nodes can leverage liquidity provided by various decentralized exchanges or liquidity pools.

- Path Optimization: AI algorithms identify the best trading paths, ensuring users receive optimal liquidity while minimizing transaction costs and time. If necessary, transactions can be split into smaller amounts and executed through multiple paths to ensure optimal liquidity utilization and cost minimization.

- Data Analysis and Reporting: In-depth analysis of cross-chain transaction data generates detailed reports and insights to help protocol developers and users better understand market dynamics and liquidity conditions.

Through these measures, Owlto Finance aims to enhance the intelligence of liquidity management and trading path optimization using AI technology, specifically including:

- Liquidity Prediction Model Development: Developing and training AI models to analyze historical data and market trends for real-time liquidity change predictions, supporting dynamic adjustments to liquidity pool configurations.

- Trading Path Optimization: Integrating AI algorithms to analyze trading data and market conditions, optimizing trading paths to improve execution efficiency.

- Intelligent Decision Support: Utilizing AI to generate trading suggestions and strategies, assisting user decision-making and providing personalized trading optimization solutions to enhance user experience. Continuous Learning and Improvement: Implementing machine learning mechanisms to continually update and optimize AI models, gathering user feedback and market data to improve the accuracy and efficiency of AI algorithms.

Conclusion

Currently, DeFi still faces many inconveniences and security risks, and the crypto industry is not yet ready to serve billions of users. Owlto’s vision is to create an intent-centric cross-chain liquidity protocol that integrates intent, zero-knowledge proofs, smart contracts, and AI technology.

Through trading split algorithms and smart trading routing algorithms, Owlto aims to help users achieve optimal liquidity across multiple chains and select the best paths to reduce transaction costs, addressing the complexities of cross-chain transactions and the issue of insufficient market liquidity in a secure and decentralized manner.