Solayer Analysis: All You Need to Know About Restaking

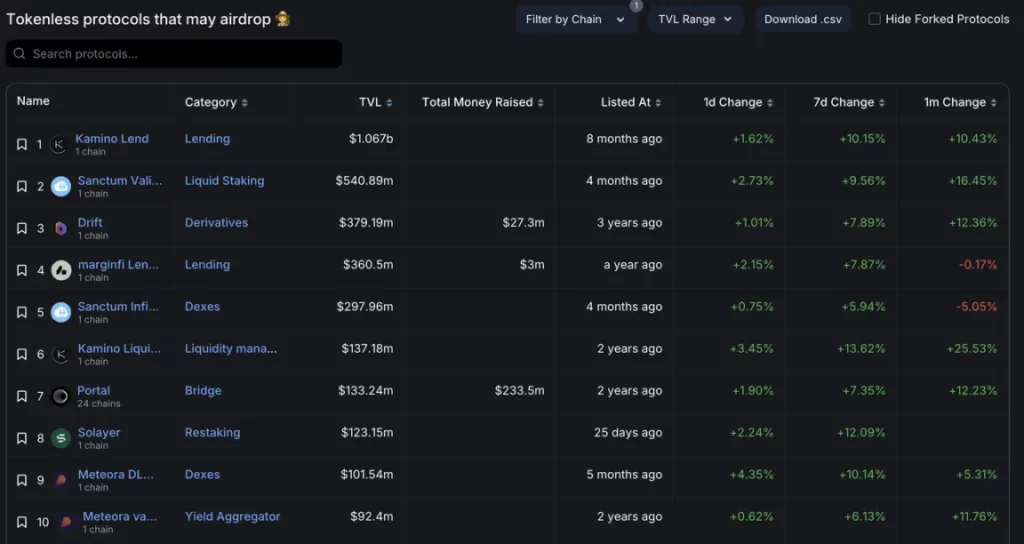

As the market gradually recovers, the Sanctum airdrop has landed but with less impact than expected. With a large amount of funds “unlocking,” what will be the next noteworthy project in the Solana ecosystem that attracts significant capital inflows?

Solayer, a rising star in Solana’s restaking space, announced the completion of its Builder Round financing on July 2, with a strong lineup of investors. As of July 15, its platform’s TVL has exceeded $120 million. With the anticipation of an airdrop, can Solayer attract more funds? How can you participate in the project? This article will give you a quick overview of this promising new player in Solana’s restaking scene.

What is Solayer?

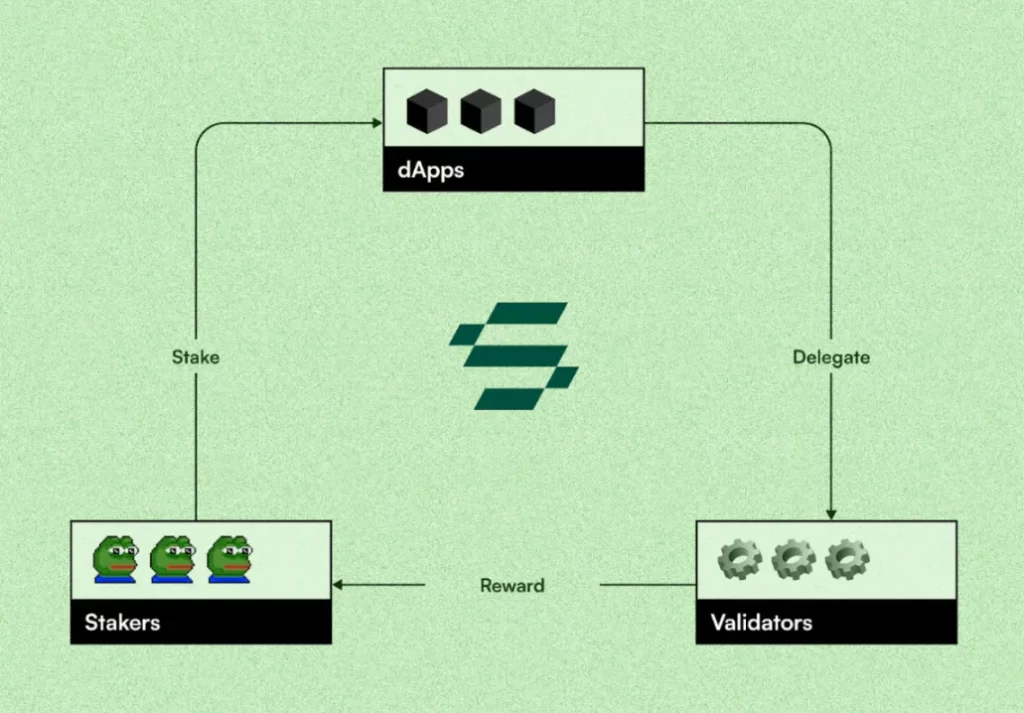

Solayer is a restaking protocol in the Solana ecosystem. Leveraging its decentralized cloud infrastructure, it allows SOL holders to stake their assets in other Solana protocols or DApp services that require security and trust. In addition to PoS staking rewards, users can earn MEV and AVS returns. Currently, Solayer supports deposits of native SOL, mSOL, and JitoSOL assets.

Solayer uses Solana stakers as validators, providing high decentralization and security while avoiding the trust risks of centralized service providers or proprietary tokens. It offers decentralized applications (DApps) an easy way to create their own AVS LSTs, with Solana’s native staking rewards as the base incentive, plus additional MEV rewards. DApps can also receive a portion of the staking commission, which can be configured for the underlying operators in the future.

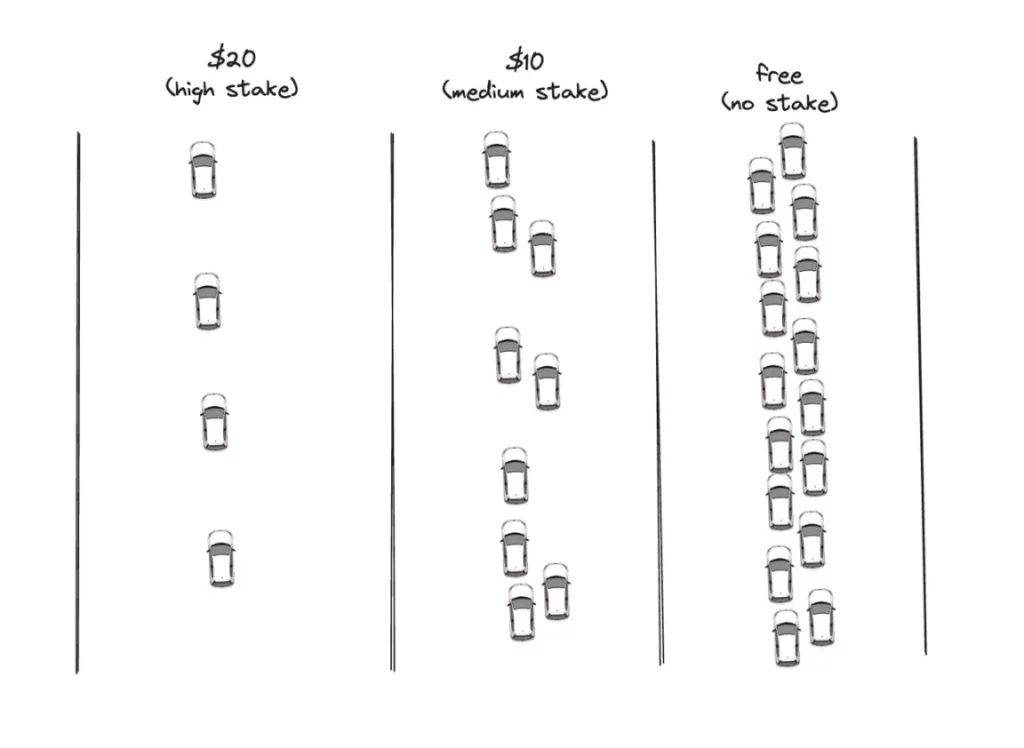

Solayer’s role can be simply explained by imagining Solana as a highway with varying tolls and congestion levels for different lanes. Different DApps as cars have varying speed and toll tolerance needs. Solayer coordinates funds, highways, and toll collectors, serving as an intermediary.

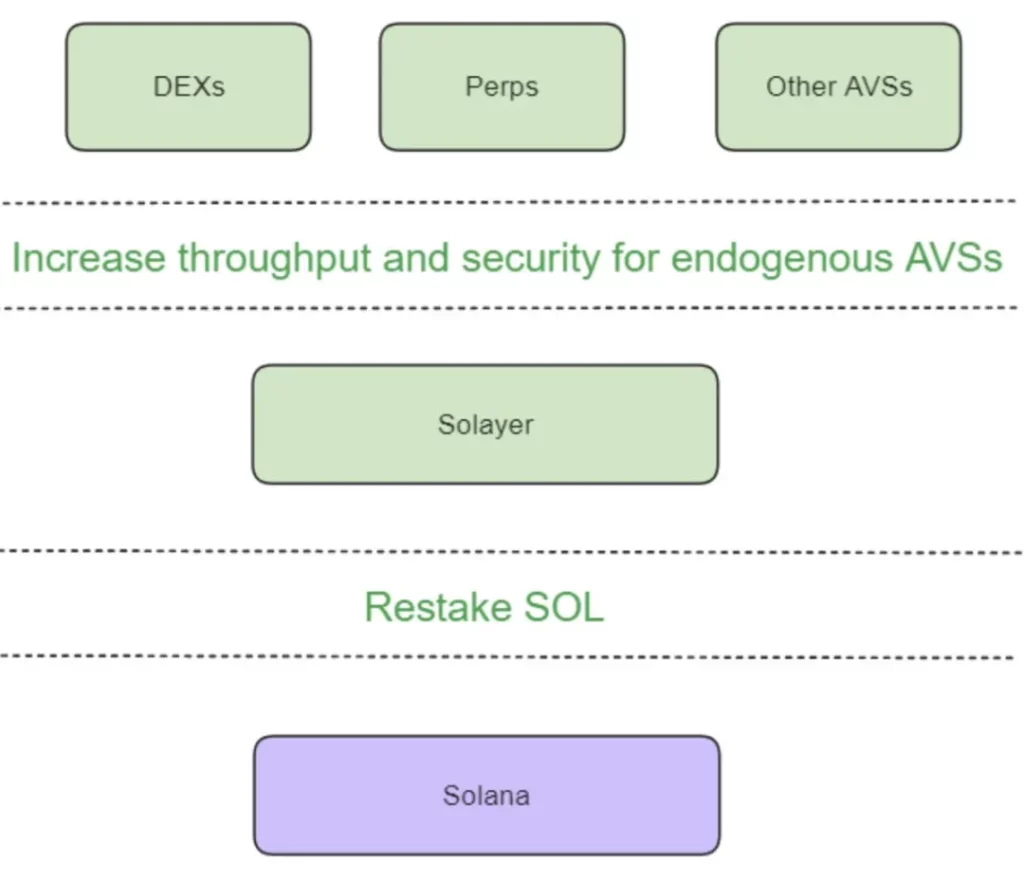

Solayer, as Solana’s restaking protocol, leverages decentralized cloud infrastructure to offer users restaking avenues for returns. Through Endogenous AVS, it provides Solana DApps with greater block space and priority transaction opportunities.

Funding Status

Currently, Solayer has no institutional investors, but its Builder Round financing announced on July 2 includes strong backers like Solana Labs co-founder Anatoly Yakovenko, Solend founder Rooter, Tensor co-founder Richard Wu, and Polygon co-founder Sandeep Nailwal.

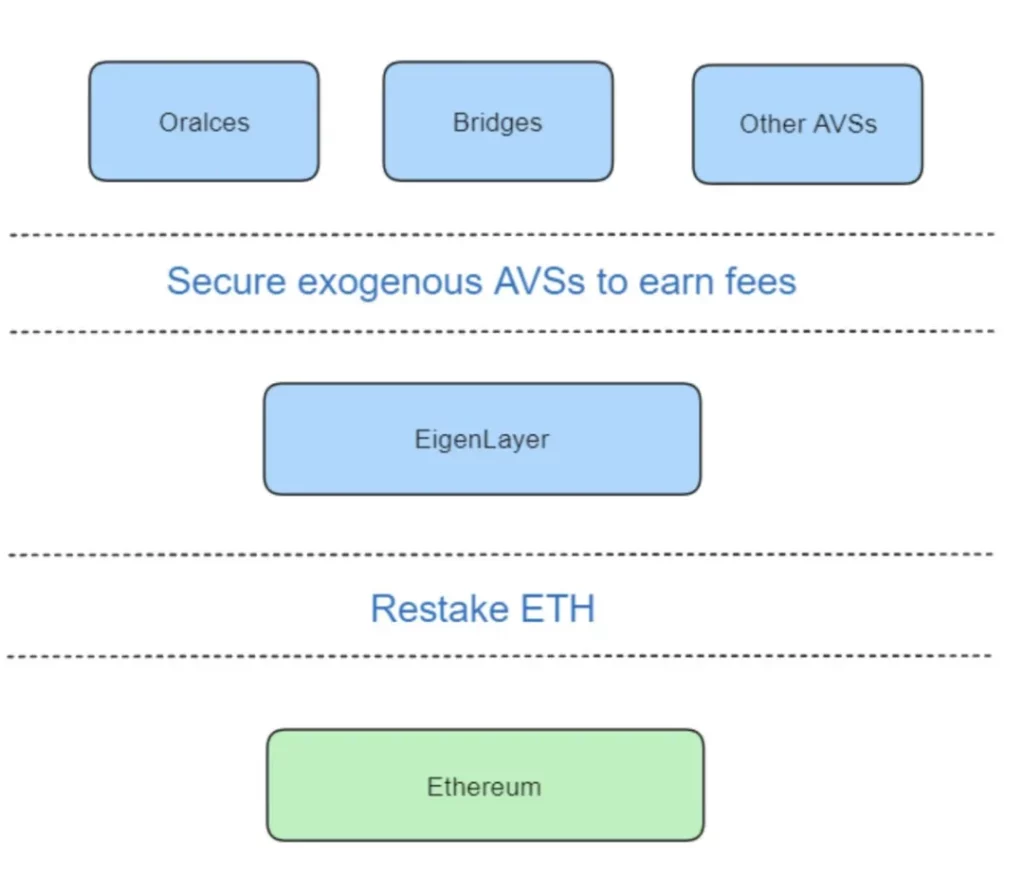

Solana’s EigenLayer

As Solana’s EigenLayer, Solayer differs mainly in the restaking system’s focus on solving different problems.

Exogenous AVS and Endogenous AVS

EigenLayer’s restaking primarily supports Ethereum scaling solutions. Solana, as an integrated blockchain, does not rely on Layer 2 like modular Ethereum and focuses more on applications. Solayer supports both Exogenous AVS and is dedicated to Endogenous AVS within Solana. Its goal is to provide Solana DApps with greater block space and priority transaction possibilities.

Solayer redefines restaking for Solana while addressing developers’ security and performance needs, especially as the base L1 network congestion worsens. It introduces Endogenous AVS: Solana native programs using SOL PoS for application security and throughput.

Additionally, Solayer’s AVS unbinding process is managed by a delegation manager, allowing for custom unbinding processes up to 2 days, and providing an emergency exit mechanism for users if AVS operations cease.

How to Restake on Solayer?

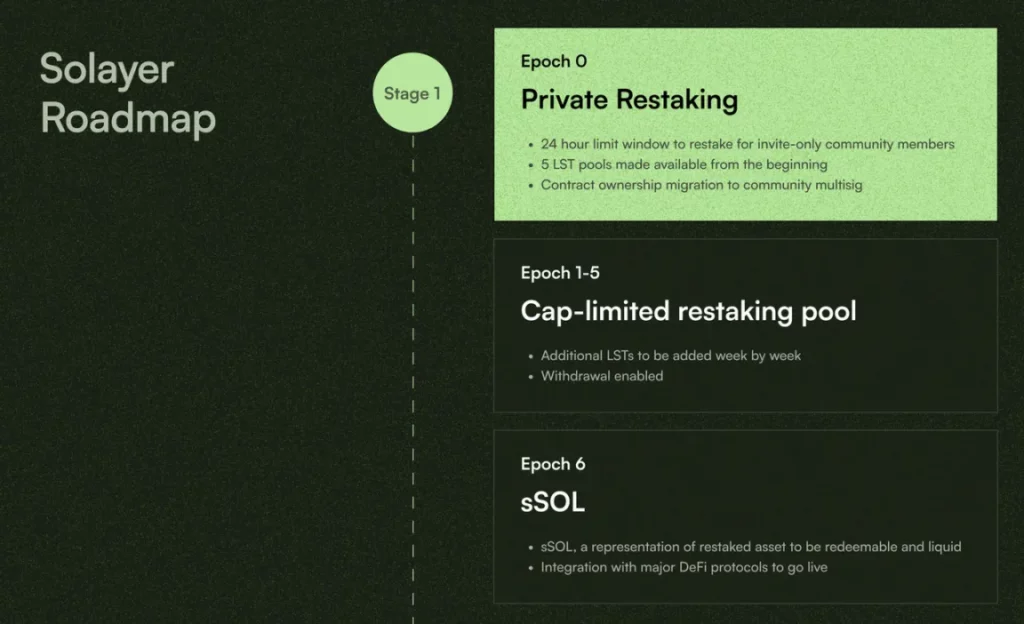

Solayer Labs is developing a multi-phase points plan, rewarding early participants. Early depositors (whitelisted early supporters) will have 24 hours to deposit any amount with higher points multipliers.

Phase one, starting May 27, had a TVL cap of $50 million for Cycle 1, reaching the cap by June 15. Deposits over 10 SOL unlock a permanent invite code, and completing 3 tasks earns more points. Tasks include inviting friends, depositing LST, and maintaining deposits over multiple phases.

Currently in phase three, TVL has no cap, and users can stake anytime. Native SOL deposits earn more points compared to other assets.

Restaking Security and Future Prospects

Restaking projects derived from liquid staking can utilize idle staked assets for additional returns, enhancing the base layer’s security for Ethereum. However, the necessity of restaking for Solana remains debated.

Blockworks Research’s Ryan Connor views Ethereum as a “modular” blockchain dependent on Layer 2, making restaking highly practical due to its vast staked asset base. Solana, being an “integrated” blockchain, has lesser needs compared to Ethereum and other modular systems.

Concerns about protocol risks and security, including the potential for hacks and the lack of trust in protocols, pose significant challenges. Despite these concerns, Solayer, as the highest TVL restaking protocol on Solana, remains a project worth watching.