L1 and L2 are Crowded, Which Layer 3 Projects Deserve Your Attention?

Ethereum’s Progress

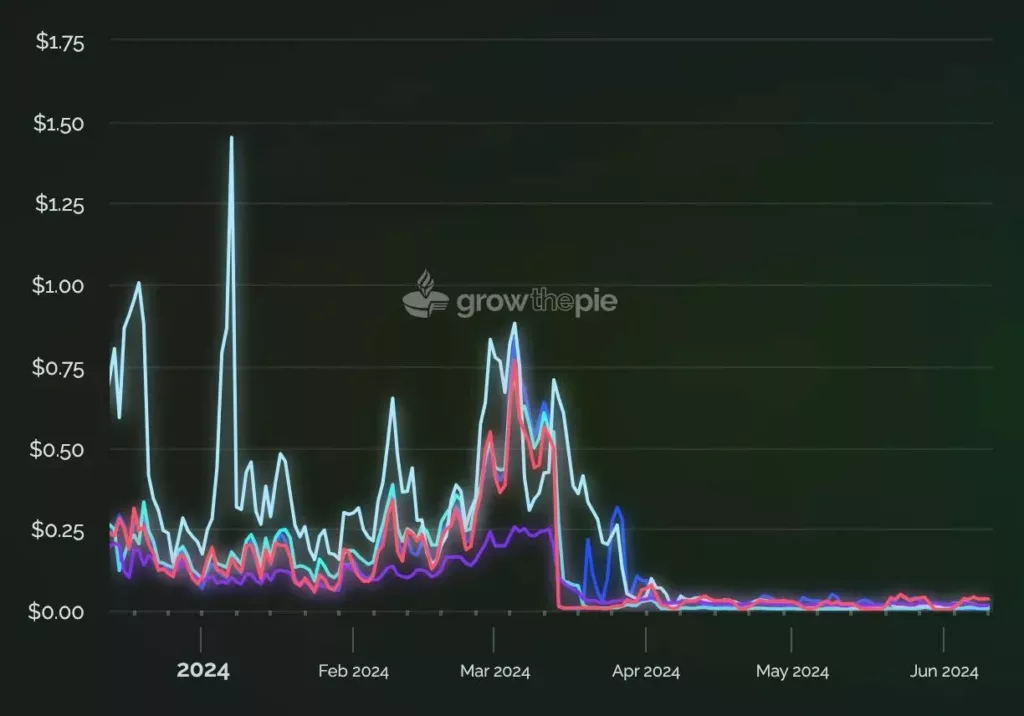

In recent years, Ethereum has made significant strides, transitioning from Proof of Work (PoW) to Proof of Stake (PoS) through “The Merge.” Recently, the “Dencun” upgrade, which includes proto-danksharding, has made Layer 2 transactions cheaper.

Before Dencun, Layer 2 transaction fees were around $0.50, but now they are just a few cents, greatly enhancing the expansion of new applications on Ethereum.

Impact of Dencun

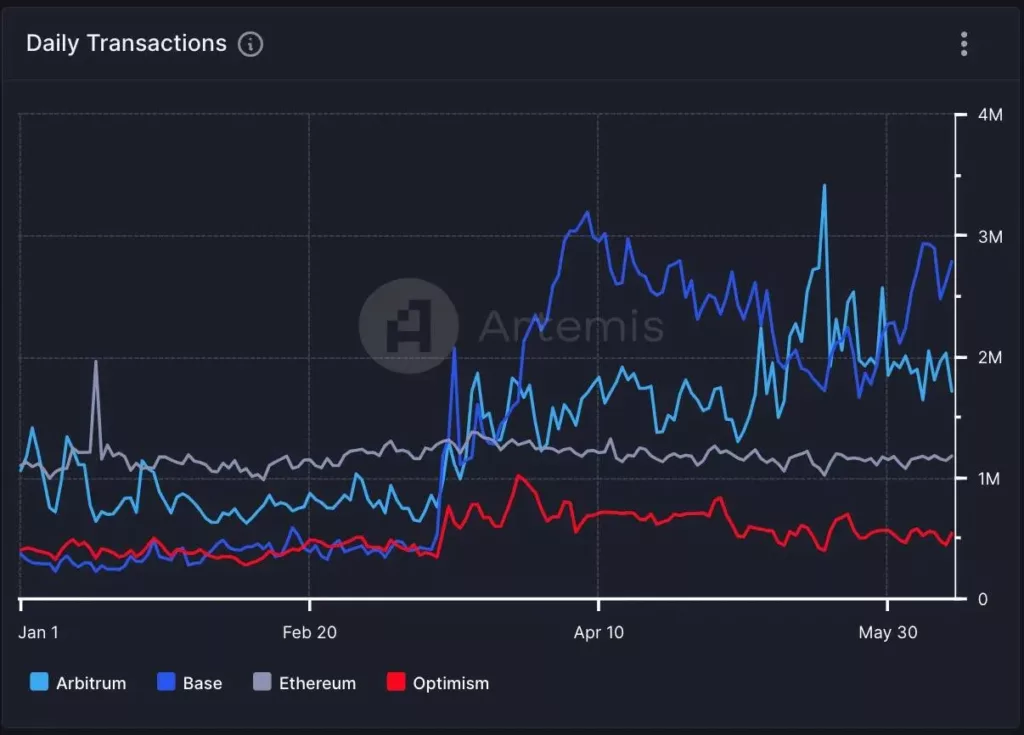

Since the Dencun upgrade, Arbitrum and Base have surpassed Ethereum mainnet in daily transactions, a trend that continues. Although Ethereum’s scaling efforts are ongoing, this upgrade marks a significant step forward, with infrastructure greatly improved since the last cycle.

The increased activity and transaction volume on Arbitrum and Base chains in recent months might just be the tip of the iceberg for this cycle.

Layer 3 Expansion

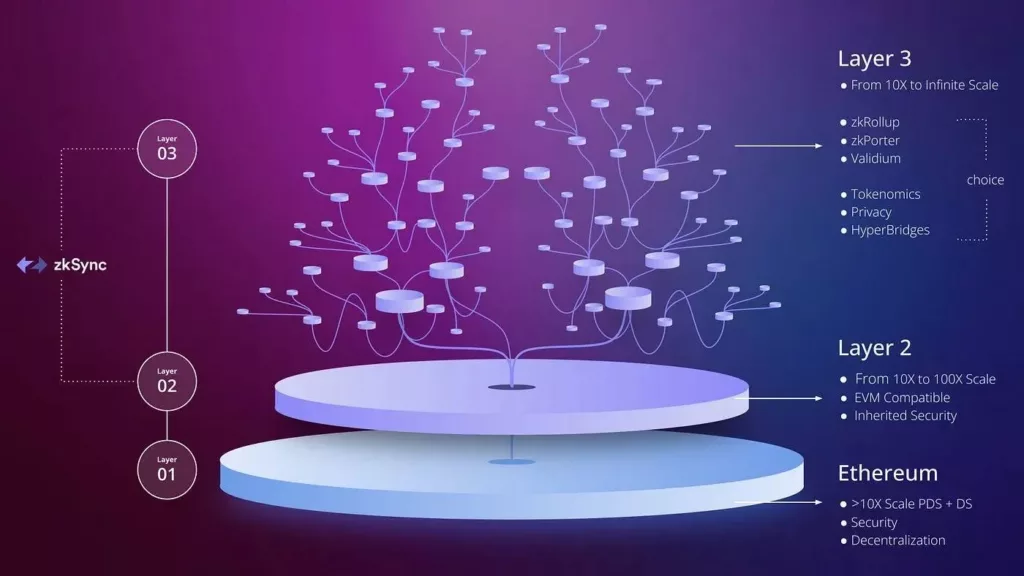

Ethereum’s initial rollups, Optimism and Arbitrum, were optimistic rollups. Now, there are more Layer 2 optimistic and zero-knowledge rollups, most of which are classified as general-purpose. Applications choose their rollup based on the required feature set and security needs.

For instance, apps like Uniswap can operate on general-purpose Layer 2s like Arbitrum One. However, for crypto games, NFT projects, or other applications needing higher throughput or very low transaction fees (e.g., $0.0001), different solutions are necessary. This is where Layer 3 comes into play.

Examples of Layer 3 frameworks include Arbitrum Orbit and zkSync Hyperchains. Although still in the early stages, Layer 3 promises to further scale Ethereum by creating highly customizable, cheap, fast, and interoperable chains with varying degrees of security and decentralization.

Degen Chain (DEGEN)

Degen Chain is an innovative new blockchain launched in January 2024, quickly gaining attention with a fully diluted valuation (FDV) exceeding $2 billion within three months.

Initially launched on Farcaster’s Degen channel, a new social app allowing users to “tip” for quality content, Degen uses Arbitrum Orbit for construction, Base for settlement, and AnyTrust for data availability (DA). After an initial surge in total value locked (TVL), the DEGEN price stabilized.

Sanko (DMT)

Another interesting Layer 3 application is Sanko, a chain built using Arbitrum Orbit, settled on Arbitrum L2, and utilizing AnyTrust for data availability. Sanko focuses on NFTs and gaming, leveraging Layer 3’s low costs and high throughput. Sanko’s native token, DMT, performed well in 2024.

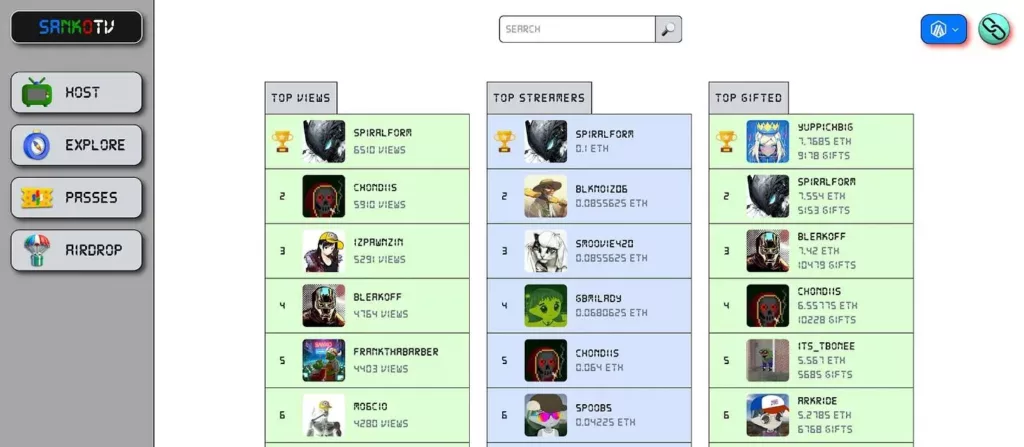

Dream Machine is an intriguing application on Sanko L3, which is a platform integrating social and gaming elements. Sanko.TV combines gaming and streaming entertainment, allowing users to buy passes for their favorite streamers and gain access to private chat rooms, similar to Friend.tech.

Sanko demonstrates the customizability of Layer 3 chains, showcasing its potential. The rise in DMT prices indicates sustained interest in the content Sanko is building. The innovative combination of gaming and social elements makes it an appealing value proposition. As social applications gain momentum, Sanko is undoubtedly a project worth watching.

Future of Layer 3

Layer 2 mainnets have been live for several years, achieving significant progress in scaling Ethereum. While the scaling roadmap continues, highly customizable Layer 3s seem like the logical next step. Many projects are already experimenting with Layer 3, achieving varying degrees of success.

However, an interesting use case and temporary hype do not necessarily make a good investment. In the cases of DEGEN and DMT, native tokens have experienced significant volatility, and these chains are far from proven.

Now that Layer 2 scaling has reduced transaction fees to just a few cents, opportunities and use cases have greatly increased. It is crucial to track the application trends resulting from increased throughput and customizability. Layer 3 will undoubtedly offer some interesting investment opportunities.