What is The Layer 2, and Why It‘s so Important?

To give a simple analogy, imagine a large company with a vast volume of business. To handle some of this workload, they establish a subsidiary company. The parent company represents Layer 1, while the subsidiary represents Layer 2. This way, the burden on the parent company is reduced.

Firstly, we need to define what Layer 1 is: Layer 1 networks are the foundational layer or the bottom layer infrastructure of blockchains. Also referred to as the mainnet or “Layer 1,” it not only defines the core rules of the ecosystem but also verifies and finalizes transactions, as seen in examples like Ethereum, Bitcoin, and Solana.

Layer 1 blockchains typically start with a focus on decentralization and security—both core principles of any sound network—and are maintained by a diverse global network of developers and participants (such as validators), with exceptions being few.

See also: What Is Blockchain Technology?

Due to the lack of any central authority or oversight, these platforms demand inherent security in the technology itself to protect users from fraud and attacks. Due to this prioritization in design, not to mention the significant resources needed to maintain a fully functional ecosystem, they often lack scalability.

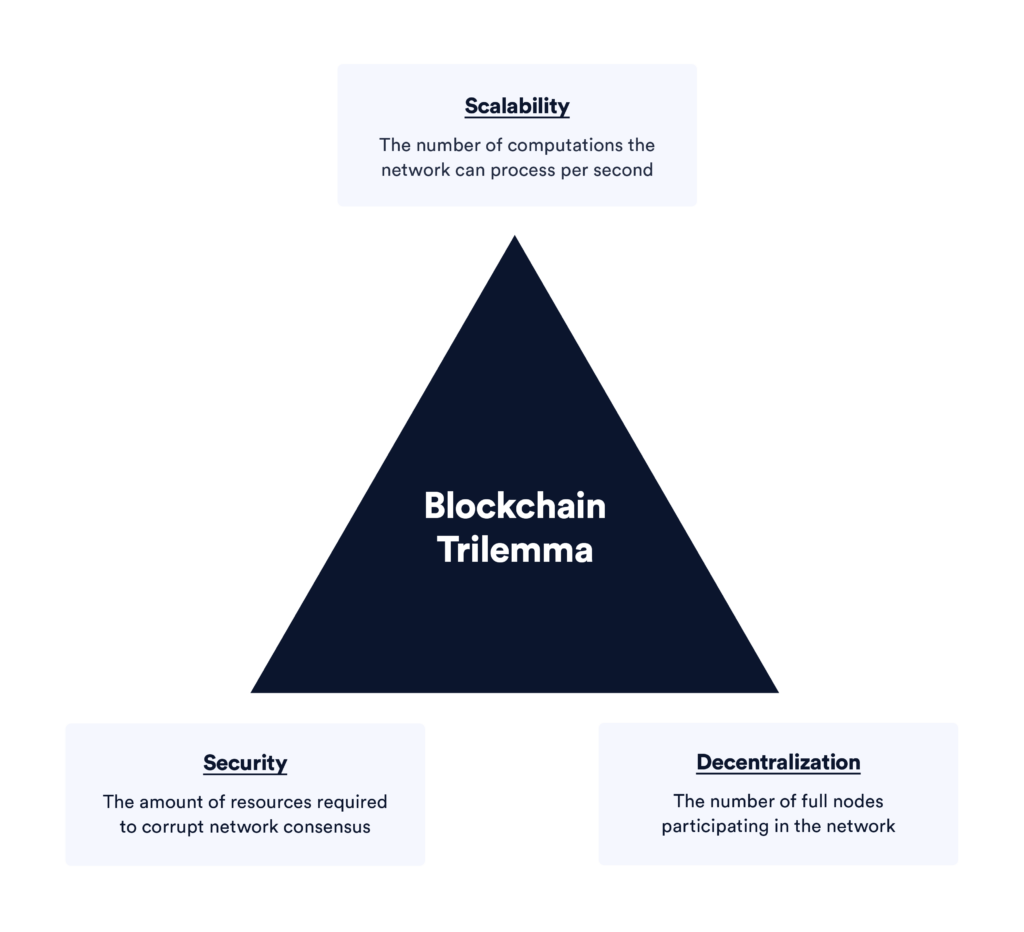

While some developers see the inability to balance security, decentralization, and scalability as an inevitable flaw in the technology (referred to as the blockchain trilemma), Layer 2 solutions like rollups on Ethereum and the Lightning Network on Bitcoin are one solution to address these issues.

What is Layer 2?

Layer 2 refers to a set of off-chain solutions built on top of Layer 1 (independent blockchains) that alleviate bottlenecks through scalability and reduced data. Imagine it like a restaurant kitchen—if every order had to be completed by one person from start to finish before confirmation and delivery, it would be a slow process, with only a few orders completed per hour. But Layer 2 is like preparation stations—there’s one for cleaning and cutting, one for cooking, one for assembling dishes—allowing tasks to be focused and completed more efficiently. When the time is right, the final staff can match each assembled dish with orders and confirm them before sending them to their final destination (the customer).

Payment platforms like Visa also employ similar systems. Visa doesn’t individually process thousands of daily microtransactions from vendors, which would clog the network within minutes; instead, it batches them, settling them periodically in the banking system. Then, banks categorize and store transactions through their internal equivalents of settlement layers. In this scenario, Visa serves as both Layer 2 and the broader network of institutions and governmental networks, which store transaction records and define the rules of the financial industry at Layer 1.

Ethereum also utilizes similar methods through features like optimistic and zero-knowledge (ZK) rollups, which alleviate the burden of managing transactions on the mainnet, leading to greater transaction inclusivity and throughput (higher transactions per second). All of these bring about a more seamless and practical user experience. Examples of Layer 2 solutions on Ethereum include Arbitrum, Optimism, Loopring, and zkSync.

Demand for Layer 2

Blockchain technology emerged in 2008. Since then, thousands of researchers and developers have been dedicated to addressing the scalability bottleneck of blockchain to meet the growing demands of applications. These bottlenecks have led to high transaction costs, slow execution speeds, and have been stumbling blocks to the mainstream adoption of blockchain technology.

Vitalik Buterin, co-founder of Ethereum, first proposed the concept of the “blockchain trilemma“, arguing that blockchain cannot simultaneously achieve scalability, security, and decentralization. Developers have to make trade-offs among these three dimensions. Today’s blockchain networks can only satisfy two of these dimensions at most simultaneously.

Layer 2 is an emerging technology that argues that the limitation of scalability in blockchain is due to the excessive tasks that blockchain needs to accomplish. There are three core functions of current blockchain:

- Transaction execution: processing and completing transactions. The measure is the number of calculations (including the number of transactions) that the blockchain can complete per second.

- Data availability: nodes and validators in the network need to store transactions, states, and other data. The measure is standard storage units, such as MB and GB.

- Consensus: nodes and validators need to reach consensus on network status and transaction ordering. The measure is the level of decentralization and finality speed, or the time required for all nodes to agree on a state change.

Why is Layer 2 Important?

While decentralization and security are features of Ethereum’s Layer 1 or mainnet, years of market adoption have led the network to its current capacity of over 1.5 million transactions per day. Additionally, due to the mainnet’s limitation of processing about 15 transactions per second, periods of high network activity often lead to data congestion. This, in turn, results in rising gas (transaction fees) and slows down application performance, although this might not be evident in the current bear market, it’s apparent we won’t always be in a bear market.

To address these issues, Layer 2 extends Ethereum as a separate blockchain on top of the Layer 1 network. As mentioned earlier, it communicates through smart contracts on Ethereum with a strong decentralized security model, aiding in alleviating the heavy burden of transactions on the mainnet. Essentially, while Layer 1 handles security, data availability, and decentralization, Layer 2 deals with transaction-related scalability.

In most cases, Layer 1 blockchains have:

- Node networks for protecting and verifying the network

- Block-producing networks

- Main blockchain and transaction data

- Associated consensus mechanisms

The difference with Layer 2 is that it provides:

- Cost reduction: Layer 2 bundle multiple off-chain transactions into a single Layer 1 transaction, helping reduce data loads. They also maintain security and decentralization by settling transactions on the mainnet.

- Practicality: With the combined advantages of higher transactions per second and lower fees, Layer 2 projects can focus on improving user experience and expanding application scope.

Most scalability issues are related to decentralization. Unlike traditional banks with closed and more efficient payment regulatory approaches, blockchain’s transaction and data management must undergo a series of systematic steps, such as acceptance, validation, and distribution on the network (with thousands of participants), while maintaining security and transparency.

How does Layer 2 Work?

Layer 2 protocols provide a second framework where transactions can occur separately from Layer 1. This means a considerable amount of work performed by the main chain can be moved to Layer 2. Then, Layer 2 applications publish transaction data to Layer 1 and are protected within blockchain ledgers and histories.

Like any other open or closed platform, accessibility to Layer 2 also varies. Some can be used by a range of applications, while others cater to the whims of specific projects. That said, several key components leveraged by Layer 2 include rollups and sidechains.

Layer 2 Rollups (Rollups)

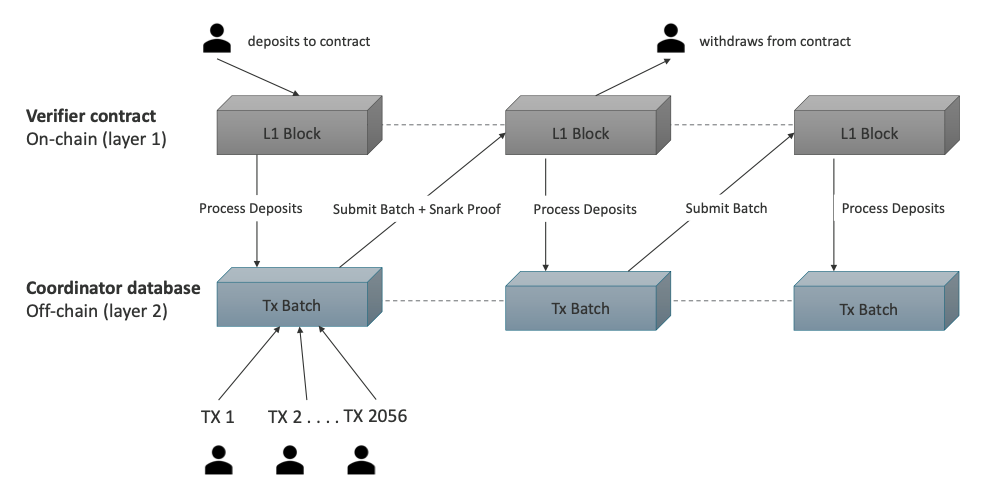

Rollups are a specific type of Layer 2 solution that executes hundreds of transactions off-chain, compressing them into a single compact data before publishing them back to the mainnet for anyone to review and dispute if deemed suspicious. By doing so, rollups not only leverage the security of Ethereum but can also reduce gas fees by up to 10–100 times.

While rollups help with deposits, withdrawals, and proof validation, there are subtle variations in the way rollups work, such as Optimism and ZK rollups, which publish data back to Layer 1.

Optimistic Rollups

Optimistic rollups run all transactions in parallel with the Ethereum main chain and then publish data back to Layer 1. Users are incentivized to transact on these Layer 2 due to competitive low fees. If there’s suspicion of fraudulent transactions, they can be challenged and assessed through fraud proofs. In this scenario, rollups operate the computation of transactions with available state data. Compared to ZK rollups (explained below), this means a slightly longer exit time to roll off and withdraw funds to Layer 1. However, “inside” rollup users still receive quick transaction confirmations.

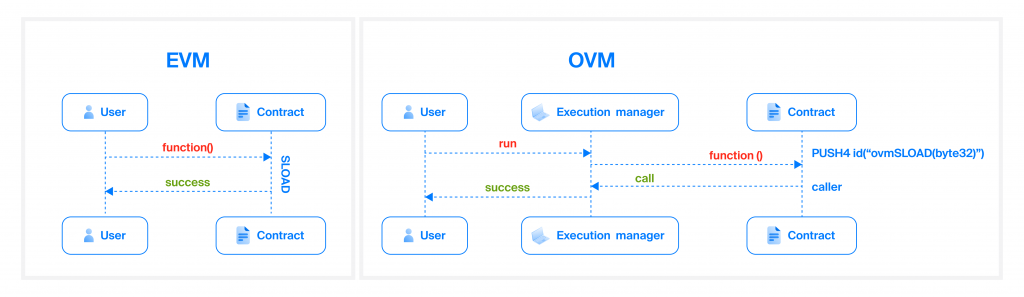

Generally, Optimistic rollups are compatible with Ethereum Virtual Machine (EVM) and Solidity, meaning anything possible on Ethereum Layer 1 can be replicated on Layer 2.

Examples of Optimistic rollups include Arbitrum, Optimism, and Boba.

Sidechains

From projects like xDai and Polygon PoS, sidechains are independent, EVM-compatible blockchains that run in parallel and interact with the mainnet through bridges. Since they use separate consensus mechanisms and aren’t protected by Layer 1, they aren’t technically considered Layer 2. However, they function similarly to Ethereum since they model on EVM. That said, sidechains bear greater risk for operators as users trust them with

their funds rather than the Ethereum protocol (or appropriate Layer 2). Note: (Polygon has completed multiple acquisitions through M&A, so the term “sidechain” might not be accurate anymore.)

Validiums

Validiums, such as StarkWare, use validity proofs (similar to ZK rollups) but don’t store data on Layer 1. Multiple validity chains can run in parallel, with each capable of processing around 10,000 transactions per second. However, due to the need for more specialized languages, support for general smart contracts is limited.

Sidechains and Validiums are blockchains that run in parallel with Ethereum and interact with assets through bridges connected to the mainnet. They don’t derive security or data from Ethereum itself, so they aren’t considered proper Layer 2 like Optimistic or ZK rollups. This is especially true considering potential security and trust implications. However, both extend scalability similar to Layer 2 by providing lower transaction fees and high throughput.

ZK Rollups

Compared to Optimistic rollups, ZK rollups generate cryptographic proofs to verify transaction authenticity. These proofs (published to Layer 1) are called validity proofs or SNARKs (Succinct Non-interactive Argument of Knowledge) or STARKs (Scalable Transparent Argument of Knowledge).

ZK rollups are more efficient as they maintain the state of all transfers on Layer 2, updated only through validity proofs. Since ZK rollup doesn’t require full transaction data, it’s easier to verify blocks and move Ethereum’s main token, Ether (ETH), to Layer 1. Validity proofs (accepted by ZK rollup contracts) have already verified the authenticity of transactions. That is to say, they don’t have full EVM support and run computations more intensively for applications with less on-chain activity.

zkSync and Starkware both use zk-proof solutions, but there are differences:

- While Starknet is technically a ZKRollup (on-chain data availability), it is essentially a Validium: the current architecture of the Cairo VM does not allow the enforcement of arbitrary transactions via L1.

- The mechanism for Validium is similar to zkRollup, but one difference is that data availability in zkRollup is on-chain, while Validium keeps it off-chain. This allows Validium to achieve higher throughput—but these centralized parts come at a cost: Validium operators can freeze users’ funds. Whereas zkSync is fully decentralized.

Why So Many Layer 2?

While we’ve covered the major Layer 2 (Optimistic rollups, ZK rollups, and sidechains), the ecosystem is ever-evolving, with some applications eventually being abandoned, like Plasma and state channels.

More Layer 2 Resources and Considerations

Since these Layer 2 are still in their early stages, there are still risks and varying degrees of misplaced trust assumptions compared to transacting on the mainnet. Also worth noting is that while leveraging the security of the mainnet layer, Layer 2 are only truly secure when fraud proofs are enabled, which (at the time of writing) they aren’t yet.

Blockchain bridges (which people can use to move assets to Layer 2) are also in early stages of development and carry high risks. Given all this, it’s advisable to conduct thorough due diligence before engaging in any Layer 2, through resources like L2BEAT, among others.