Can Bitcoin Staking Lead the Next Wave of Liquidity?

In recent years, Bitcoin’s scalability challenges have been a central issue in the blockchain space. As Bitcoin continues to solidify its position as “digital gold,” the market is actively seeking ways to enhance its liquidity and scalability. Several solutions, including sidechains, the Lightning Network, and Layer 2 scaling technologies, have emerged, but none have yet achieved mass adoption or consensus.

Staking, especially the concept of staking and re-staking, has introduced a new dynamic to Bitcoin’s financial logic. By staking Bitcoin, users can generate additional yields, improving both liquidity and increasing its potential utility in decentralized finance (DeFi). The recent launch of the Babylon mainnet has brought renewed attention to re-staking, leading to a significant increase in Bitcoin network transaction fees, showcasing the growing interest in this space.

On August 22, Babylon launched the first phase of its Bitcoin staking mainnet. According to mempool.space, Bitcoin network transaction fees surged to over 1,000 satoshis/byte, compared to the usual fees below 5 satoshis/byte. Babylon reported that its first phase reached a 1,000 BTC staking cap in just six blocks. Babylon’s staking platform showed that 1,000.04549438 BTC were staked by approximately 12,720 users.

Babylon’s mainnet not only attracted liquidity but also led market participants to reassess Bitcoin’s capital efficiency. Through re-staking protocols, investors can optimize returns without sacrificing asset security, increasing overall market liquidity. This model has become particularly appealing in an environment where on-chain transaction costs continue to rise.

In a recent report by ArkStream Capital, they projected that BTCFi, fueled by Bitcoin’s liquidity release, could become a $100 billion market. They foresee Bitcoin’s Layer 2 solutions and applications as the next major trend in the industry.

This article will explore the latest developments in Bitcoin re-staking, analyze its financial underpinnings, and consider its future trajectory.

Bitcoin Liquid Staking: An Overview

Bitcoin, as a proof-of-work (PoW) network, relies on miners to maintain consensus. However, with the rise of DeFi, Bitcoin’s application scenarios have broadened. Liquid staking is an emerging mechanism aimed at enhancing Bitcoin’s capital efficiency and liquidity, allowing users to lock their Bitcoin in staking contracts while still maintaining its liquidity.

The primary advantage of liquid staking lies in its broad applicability within DeFi. With Bitcoin being recognized as a highly secure asset, more financial applications are beginning to rely on its economic security. Tokens generated from staked Bitcoin can be used in decentralized money markets, stablecoins, insurance, and more, increasing the capital efficiency of these applications.

Currently, there are three main approaches to achieving Bitcoin liquid staking, each with distinct advantages and drawbacks.

- On-Chain Self-Custody Model: This method leverages Bitcoin scripts to create staking contracts, using advanced cryptographic techniques to ensure the security and finality of staked assets. This approach maintains decentralization but is complex and can face challenges with cross-chain synchronization. Babylon is a key player in this category.

- Centralized Custody Model: In this model, Bitcoin is transferred to regulated custodial accounts, where it is tokenized on other blockchains. While easier to implement and faster to deploy, this method has lower decentralization and raises concerns about trust and security. BounceBit represents this approach.

- Multi-Party Computation (MPC) and Cross-Chain Bridge Model: This model stores Bitcoin in multi-signature wallets, utilizing decentralized oracles and cross-chain bridges to migrate Bitcoin to other chains. Though MPC adds some decentralization, cross-chain bridges pose inherent security risks. Projects like Chakra leverage this approach.

Babylon and Its Role in Bitcoin Staking

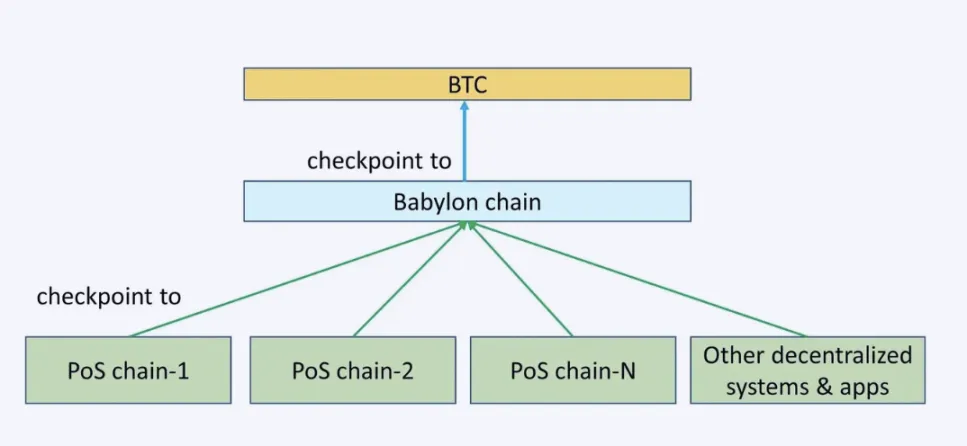

Babylon offers a unique staking mechanism, allowing Bitcoin holders to stake their assets without the traditional use of cross-chain bridges or custodians. Instead, it uses cryptographic techniques that allow Bitcoin to be staked and earn rewards while providing security for other proof-of-stake (PoS) chains.

Babylon’s staking process involves Bitcoin transactions with two UTXO outputs: one locked by a time script and the other using a temporary address with a single-use signature (EOTS). Validators who follow the protocol earn rewards from PoS chains, while dishonest actors risk losing their staked BTC.

Babylon’s architecture consists of three layers: the Bitcoin network layer, a control layer that connects the Bitcoin network and Cosmos Hub, and a data layer for PoS consumer chains. By leveraging Bitcoin’s security to secure other networks, Babylon plays a role similar to Eigenlayer but with a focus on Bitcoin.

Chakra: ZK-Powered Bitcoin Re-Staking

Chakra is another innovative project in the Bitcoin re-staking space. Utilizing zero-knowledge proofs (ZK), Chakra allows users to stake Bitcoin while maintaining privacy and security. Through cross-chain bridging, Chakra extends its services to Bitcoin Layer 2 solutions.

In 2024, the project raised funding from several prominent investors and is now integrated with Babylon, enabling seamless staking transitions and offering rewards across multiple platforms.

Lombard: Unlocking Bitcoin’s DeFi Potential

Lombard offers cross-chain liquidity through its LBTC token, which represents staked Bitcoin. Users stake BTC on Babylon’s platform and receive LBTC on Ethereum, maintaining a 1:1 ratio.

Lombard recently raised $16 million to expand its operations, positioning itself as a major player in the Bitcoin staking ecosystem.

Future Prospects

The Bitcoin staking landscape is rapidly evolving, with projects like Babylon, Chakra, and Lombard offering different approaches to improve Bitcoin’s capital efficiency. These innovations, combined with increasing institutional interest, point to a future where Bitcoin can play a larger role in DeFi and secure other blockchains.

As these technologies mature, Bitcoin’s liquidity could be unlocked further, opening up new market opportunities and potentially leading to the next major wave of liquidity in the crypto space.

In conclusion, Bitcoin staking has the potential to revolutionize the network’s liquidity dynamics, driving innovation and opening up new applications across DeFi and other blockchain ecosystems.