Overview of Lombard: Babylon Ecosystem’s Re-Staking Protocol

Recently, BTCFi has sparked a new wave of interest, with an increasing number of DeFi protocols eyeing the $1.5 trillion market and exploring ways to enhance the capital efficiency of Bitcoin.

On August 22, the first phase of the Babylon mainnet was officially launched, allowing BTC holders to lock their tokens on the Bitcoin network. Babylon aims to leverage Bitcoin’s security to provide protection for other PoS chains while also introducing potentially vast liquidity into DeFi.

Lombard, a re-staking protocol within the Babylon ecosystem, released its beta version on August 21, followed by its mainnet launch the next day. Lombard’s flagship product, LBTC, is a yield-generating, cross-chain, and highly liquid Bitcoin derivative, backed 1:1 by BTC. In July, Lombard completed a $16 million seed funding round led by Polychain Capital.

How does Lombard utilize LBTC to drive innovation in the Bitcoin re-staking ecosystem? This article translates Lombard’s official blog, providing a detailed explanation of how LBTC operates.

Introduction of Lombard

Lombard is committed to transforming Bitcoin’s role from a simple store of value into a productive financial tool, fostering the growth of the digital economy. Despite Bitcoin being the largest cryptocurrency by market capitalization, valued at over a trillion dollars, much of it remains idle, with limited practical use compared to other digital assets. Lombard sees connecting Bitcoin to decentralized finance (DeFi) as a key opportunity to change this situation.

If just 10% of Bitcoin’s $1.5 trillion market value flows into DeFi, the total value locked (TVL) in the ecosystem could more than double, sparking unprecedented growth and sustainable market dynamics. Lombard believes this potential can be unlocked through LBTC, a secure, liquid Bitcoin primitive.

The Current State of Bitcoin

Bitcoin has long been hailed as “digital gold,” a powerful store of value and a hedge against inflation. Its decentralized nature and security make it the leader in the cryptocurrency market, with a market cap exceeding a trillion dollars, far surpassing all other cryptocurrencies.

However, while Bitcoin dominates the market, its practical utility within the broader crypto ecosystem remains limited. Unlike Ethereum, Bitcoin’s architecture does not easily lend itself to more complex financial applications like DeFi, where assets such as USDC, USDT, and Ethereum are thriving.

Currently, Bitcoin is primarily used for holding and transferring value, with little use in generating yield or participating in decentralized financial markets. This limitation leads to many Bitcoins being idle, missing out on the opportunities available to more flexible assets in the DeFi space, such as Ethereum.

What Holds Bitcoin Back?

One major factor limiting Bitcoin’s development is its simple scripting language. Bitcoin’s script is not Turing-complete, meaning it cannot support complex logic or smart contracts like Ethereum. While this design increases security and stability, it also restricts Bitcoin’s functionality in more advanced decentralized applications.

As a result, Bitcoin has struggled to integrate fully into the burgeoning DeFi ecosystem, which requires more complex scripts and contract capabilities.

Another factor is Bitcoin’s proof-of-work (PoW) consensus mechanism. Although PoW is highly secure, it is less resource-efficient and adaptable compared to newer proof-of-stake (PoS) systems. PoW requires significant computational power and energy consumption, which not only limits scalability but also hinders Bitcoin’s integration with other blockchain ecosystems. PoW’s design prioritizes security and decentralization, sacrificing flexibility and efficiency, which restricts Bitcoin’s broader utility in the rapidly evolving crypto landscape.

Babylon and Lombard Bring Utility and Liquidity to Bitcoin

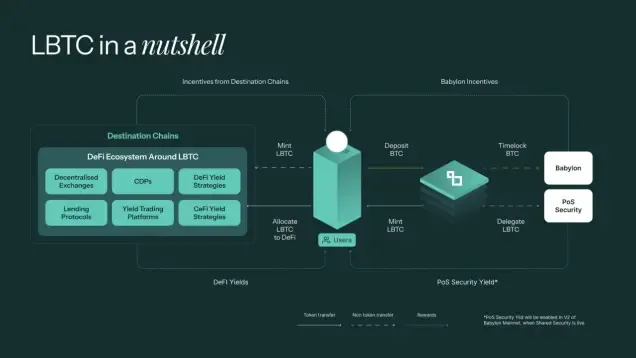

Now, Bitcoin’s immense economic value can be used to secure PoS networks. The launch of Babylon’s Bitcoin staking mainnet marks a significant milestone. Babylon enables Bitcoin to be staked in a trustless and self-custodial manner, allowing BTC holders to contribute to the economic security of various PoS systems, including PoS chains, layer 2 (L2) aggregations, and data provision layers.

By staking Bitcoin through Babylon, users retain full control of their assets while earning rewards and enhancing the security of these networks. The direct staking of Bitcoin on Babylon lacks liquidity, which is where Lombard comes in.

Lombard’s liquid Bitcoin derivative, LBTC, can directly interact with the Babylon protocol, keeping staked Bitcoin liquid and usable in the DeFi space. This integration not only unlocks new utility for Bitcoin holders—allowing them to earn yields, stake, trade, and transfer assets—but also strengthens the security of PoS networks.

Through Babylon, Lombard’s LBTC bridges the gap between Bitcoin’s vast economic value and security capabilities with the dynamic opportunities in PoS and DeFi ecosystems, marking a transformative phase for Bitcoin in the decentralized economy.

About LBTC: A New Bitcoin Primitive

LBTC is designed to expand the utility of Bitcoin for everyone, from individual holders to large institutions. It allows users to earn native yields, participate in DeFi, and more, all while maintaining the security and liquidity of their assets. Here are five key features related to LBTC:

Yield-Generating Bitcoin: Unlock native yields and rewards with LBTC

If you’ve experienced the benefits of platforms like EigenLayer, you’ll find LBTC’s yield-generating capabilities even more compelling. BTC deposited into Lombard is staked to Babylon, earning yields while remaining usable in DeFi.

This makes LBTC a versatile product, ideal for Bitcoin holders looking to earn passive returns through low-risk staking.

Seamless DeFi Integration: LBTC is highly liquid and widely usable

LBTC is seen as a promising DeFi collateral. It can be used in combination with various DeFi protocols such as Pendle, Morpho, and Gearbox. LBTC is designed to maintain Bitcoin’s liquidity while keeping it productive, thus enhancing capital efficiency.

This move could encourage Bitcoin holders to bring their assets out of cold storage and into lending pools, yield vaults, and trading platforms for potential additional returns.

Flexibility: LBTC’s cross-chain accessibility

Lombard allows users to mint Bitcoin on their chosen network, supporting trustless transfers across different ecosystems. With LBTC, Bitcoin can be used across multiple blockchains like Ethereum, Solana, and Cosmos, transforming each blockchain into a Bitcoin DeFi ecosystem.

By making LBTC natively available on multiple blockchain networks, Lombard unleashes Bitcoin’s potential, reduces fragmented liquidity, enhances market efficiency, and enables seamless movement across ecosystems.

Security Design: Advanced protection for LBTC

Security is a crucial component of LBTC’s design, ensuring it remains highly secure within the Bitcoin ecosystem. Lombard collaborates with cryptographers from Stanford and Carnegie Mellon to implement industry-standard key management and signature infrastructure, addressing the challenges of Bitcoin programmability.

Lombard’s security alliance validates every transaction within the protocol, enhancing LBTC’s security. Furthermore, the architecture is reinforced through multiple audits and real-time security monitoring, capable of detecting and responding to potential threats before they materialize.

Decentralized Infrastructure of LBTC

From the outset, Lombard has focused on building an infrastructure that minimizes trust. The security alliance architecture on Lombard protocol, where multiple independent entities validate transactions, is designed to reduce the risk of single points of failure.

LBTC is designed to operate without a trusted intermediary, promoting transparency and community-driven governance. Due to its permissionless nature, any DeFi platform can integrate LBTC without needing centralized approval. Additionally, time-lock mechanisms for multi-party approval and governance decisions help reduce counterparty risks, maintaining the stability of LBTC within the ecosystem.

LBTC represents an innovation within the Bitcoin ecosystem, with capabilities that extend beyond traditional use cases. By generating yields, enhancing liquidity, and supporting decentralized networks, LBTC has the potential to transform Bitcoin’s role in the digital economy.

The collaboration with Lombard and Babylon suggests that Bitcoin may enter a new phase, playing a more significant role in the DeFi space, providing new opportunities for future growth and sustainability.

How LBTC Works

Here’s how the LBTC process works:

- Deposit BTC on the Bitcoin network: Users deposit their native Bitcoin through the Lombard WebApp. Deposits can be made from any Bitcoin address or any Bitcoin wallet, including DeFi wallets, hardware wallets, or any centralized exchange.

- Stake BTC on Babylon: Once deposited, Lombard stakes the Bitcoin into Babylon’s secure staking infrastructure. Lombard manages all fees associated with Babylon staking on behalf of Lombard users.

- Mint LBTC on Ethereum: After staking, users can mint LBTC tokens equivalent to the amount of BTC staked and send them to a pre-selected Ethereum address. Since Bitcoin remains staked on Babylon, staking rewards will be directly credited to LBTC tokens.

LBTC can be deployed across multiple blockchain ecosystems and can be used on various chains, such as Ethereum at launch, and potentially on Solana and Cosmos over time. LBTC will always maintain its 1:1 backing with BTC as it is transferred and used across different networks.

In summary, LBTC aims to transform the way Bitcoin is used in the digital economy by enabling yield generation, enhancing liquidity, and protecting decentralized networks.

Currently, Lombard is implementing a phased rollout strategy to ensure LBTC’s widespread use across the DeFi space. Initially, LBTC will launch on the Ethereum mainnet, where most Bitcoin liquidity and blue-chip protocols currently reside. Following this, Lombard plans to expand LBTC to Ethereum’s layer 2 networks and eventually to innovative Bitcoin layer 2 and next-generation blockchain networks.