Unlocking Secrets of The Binance’s Investment Landscape

As a leading global cryptocurrency exchange, Binance not only provides trading services but also supports and funds promising blockchain projects through its investment incubation programs. These initiatives bring substantial profits to Binance and actively contribute to the prosperity of the entire blockchain ecosystem.

Advantages of Binance Labs’ External Investments

- Global Influence: As the venture capital arm of the leading exchange, Binance Labs benefits from strong reputation and resource support, giving it extensive influence and resources worldwide.

- Integration with Binance Ecosystem: One significant advantage for projects receiving investment from Binance Labs is the potential integration with the Binance ecosystem and listing on the Binance exchange. Startups gain enormous exposure and access to a large user base, enhancing their chances of success.

- Value Creation Services: Beyond funding, Binance Labs provides general consulting, operational support, and joint technical/product development services. These services help startups solve various issues, enhancing their competitiveness and sustainability.

- Rich Resources: As part of the world’s largest cryptocurrency exchange, Binance Labs boasts abundant resources and an extensive network, including technical, market, and business partners, providing valuable support and assistance to startups.

Criteria for Binance’s Investment Projects

Binance emphasizes innovation, sustainable business models, market adoption, team quality, and technical feasibility when selecting investment projects. Their rigorous and comprehensive investment criteria and evaluation processes ensure the discovery and cultivation of high-quality projects.

- Product Innovation: Innovation is a primary criterion. Binance considers whether the project offers new models that benefit users.

- Sustainable Business and Token Models: Binance focuses on the sustainability of the project’s business and token models, assessing if the long-term business model is profitable and whether token incentives are structured correctly.

- Adoption Rate: The traction of a project, including user numbers and revenue, is an important indicator of its value.

- Team Quality and Durability: Binance values the quality and durability of the project team, assessing whether the team can fully commit to the project, as stability and durability are crucial for development.

- Technical Feasibility: The feasibility of the project’s technology is the final assessment attribute, evaluating if the technology used is viable and realistic.

Binance Incubation Program

The Binance Incubation Program is a long-term investment initiative that supports early-stage blockchain startups with comprehensive resources, driving the growth of Web3 startups and helping founders achieve substantial progress and success in a changing industry environment.

- Long-term Support: The program offers long-term support, including funding, technology, marketing, and legal assistance to help startups overcome various early-stage challenges.

- Comprehensive Services: The program provides various services such as advisory support, market promotion, and technical guidance, helping startups build and develop their projects.

- Customized Support: The program offers tailored support and services based on the needs and characteristics of startups, helping them realize their maximum growth potential.

MVB Accelerator Program

The Most Valuable Builder (MVB) Accelerator Program, initiated by Binance Labs, focuses on BNB Chain and supports outstanding builders and startups within and outside the BNB Chain ecosystem. Winners receive grants, technical support, potential investment, and opportunities to list on the Binance main exchange, aiding their rapid expansion and growth.

- Short-term Acceleration: The MVB program provides short-term acceleration services, typically 8-10 weeks, helping startups quickly solve problems and optimize business models for rapid expansion.

- Deep Support: The program offers deep support and guidance in technology, market, and business models, aiding startups in achieving rapid business development.

- Concentrated Resources: The MVB program pools resources and expert teams from Binance Incubator to provide comprehensive support and services, helping startups achieve greater accomplishments in a short time.

Investment Project Numbers

As of May 15, 2024, Binance has publicly invested in 19 projects this year, with a total amount of approximately $364 million. These include Zest Protocol, UXUY, Movement, MilkyWay, BounceBit, StakeStone, Cellula, Derivio, QnA3, Privasea, Babylon, Renzo Protocol, Ethena, NFPrompt, Shogun, Analog, Puffer Finance, Memeland, and BracketX.

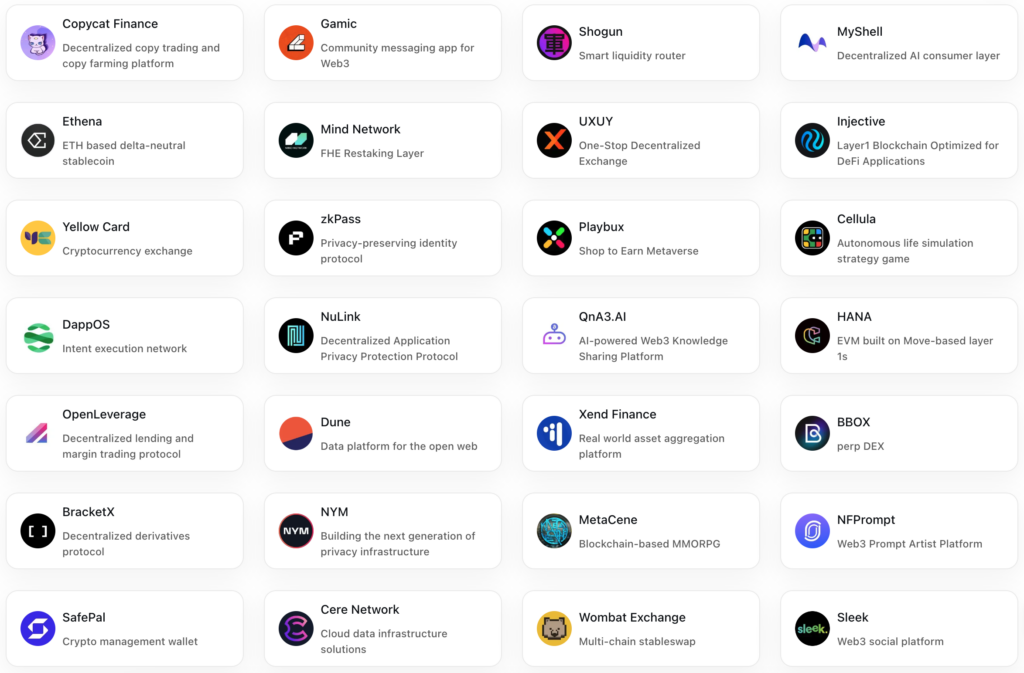

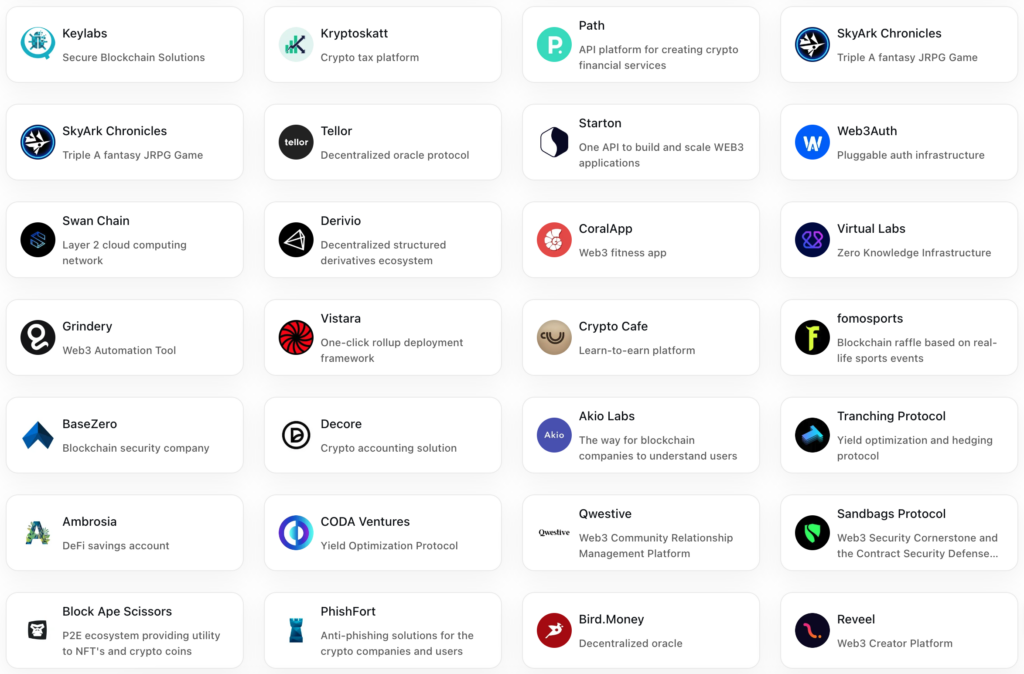

RootData records 193 external investment projects by Binance Labs, with 108 having issued tokens and are operational. The first six incubation programs included 65 projects, while the first six MVB accelerator programs included 36 projects.

- Infrastructure: Making up 38.3% of Binance Labs’ investment landscape, infrastructure is the cornerstone of the blockchain and cryptocurrency industry.

- DeFi: With a 20.7% investment share, DeFi has enormous market potential and is at the forefront of industry innovation.

- Gaming: Accounting for 16.5% of investments, gaming is another leading edge of industry innovation.

- Web3-related fields: Representing about 24.5%, including social entertainment, tools & information services, and NFTs, these fields are considered the next growth points in the cryptocurrency industry.

In terms of investment scale, Binance Labs primarily focuses on investments between $1 million to $10 million, with the most concentrated range being $1 million to $3 million, followed by $5 million to $10 million. Binance Labs predominantly participates as a non-lead investor.

Binance’s Investment in Highlight Projects

In past MVB accelerator programs, Binance Labs has invested in several high-quality projects, including decentralized domain protocol Space ID, Web3 infrastructure Overeality, interoperability communication protocol Multichain Event Protocol (MEP), mobile strategy game Meta Apes, tokenized investment portfolios Velvet Capital, multi-chain open data analytics platform Web3 Go, casual gaming platform Gameta, Ethereum scaling project AltLayer, perpetual DEX project KiloEx, lending protocol Kinza Finance, and AI blockchain-based virtual companion game Sleepless AI.

On March 1, Binance Labs announced 13 early-stage projects for the 7th season of the MVB accelerator program, covering DeFi, infrastructure, and application layers. These projects are innovative and promising in blockchain and artificial intelligence.

- BitU: A crypto-native collateralized stablecoin protocol offering higher yields using off-chain liquidity and efficiency. It features an Active Liquidity Management Module (ALMM) to address on-chain and off-chain stablecoin borrowing rate differences and introduces trusted custodians for safer fund storage and yield distribution.

- Blum: A hybrid CeDeFi exchange allowing cryptocurrency trading via a Telegram mini-program, offering off-chain order books, on-chain settlements, and centralized or self-custody options, along with derivative trading services.

- Surf Protocol: A perpetual contract trading platform based on Base, offering leveraged trading, pre-market trading, and points trading for low-cap tokens.

- Vooi: A cross-chain perpetual contract DEX aggregator supporting multiple DEXs, allowing users to trade without gas fees with up to 100x leverage.

- Aggregata: A DePIN-driven AI data storage project creating high-quality data and pricing it, enabling users to share, sell, and find AI datasets on its marketplace.

- Nesa: A lightweight Layer 1 for AI, utilizing on-chain ZKML for highly private, secure, and trusted query execution for AI inference, introducing a privacy-centric decentralized inference protocol.

- Nimble Network: A composable AI protocol allowing AI agents, data providers, and compute resources to combine and use ML models and data, aiming to extend to IP, creators, advertising, personalization, and chatbot fields.

- Aspecta: An AI-driven digital identity ecosystem platform creating an AI-generated identity system, Aspecta ID, for developers and others to showcase, connect, and explore, offering exclusive DAO, ecosystem, and application access.

- Holoworld: A decentralized AI virtual character marketplace and social platform, allowing anyone to create intelligent AI bots with a few clicks.

- Opinion Labs: A dynamic opinion and continuous prediction market, creating an on-chain social infrastructure with its first product being an on-chain opinion market and content community DApp, AlphaOrBeta.

- Side Quest: A gaming social platform offering various games, opportunities, and interactions.

- Story Chain: An AI story-writing NFT application allowing users to create stories with unique chapters and art using LLM and image AI, minting them as NFTs.

- Tilted: A game asset marketplace for buying, selling, and trading game assets, skins, and NFTs on-chain, ensuring cross-game compatibility.

Challenges and Difficulties

- Regulatory Uncertainty: The blockchain industry faces regulatory uncertainties across different countries and regions, posing risks and challenges to Binance’s investments. Binance needs to closely monitor regulatory changes and formulate corresponding risk management strategies.

- Security and Trust Issues: The blockchain field has security and trust challenges, such as smart contract vulnerabilities and network attacks. Binance needs to strengthen due diligence and security reviews of investment projects to ensure user asset safety and reliability.

- Increased Competition: With the intensifying competition in the blockchain industry, Binance faces competitive pressure from other exchanges and investment institutions. To maintain its competitive edge, Binance needs to continuously enhance its technical capabilities and service levels, seeking innovative and potential projects for investment and incubation.

Future Development Directions

- Ecosystem Building and Open Innovation: Binance can continue to increase investment in the blockchain ecosystem, actively participate in ecosystem building and open innovation, promoting the widespread application and adoption of blockchain technology.

- Community Governance and Co-governance Mechanism: Binance can establish more robust community governance and co-governance mechanisms, encouraging community member participation and contributions for shared ecosystem building and sharing.

- Global Expansion and Strategic Cooperation: Binance can further expand its global business layout, establishing closer cooperation with projects and institutions worldwide to jointly promote blockchain industry development.

- **Innovative Technologies and Application Scenarios**: Binance can continuously focus on the development of innovative technologies and application scenarios such as AI, DePIN, and liquid staking, actively exploring blockchain applications in DeFi, gaming, Web3, education, and other fields, promoting the deep integration and innovative development of blockchain technology.

Summary

As a leading cryptocurrency exchange, Binance’s investment landscape also leads the investment wave in the crypto industry, holding a significant position.

By continuously optimizing investment strategies, strengthening ecosystem building, and driving technological innovation, Binance is expected to further consolidate its leading position in the blockchain ecosystem, driving the industry’s growth and development.