Bitcoin Price Drops Below $70,000 Exposing Bull Trap

After a significant 7.73% rebound overnight, Bitcoin’s price shows that buyers are exhausted and unable to sustain this trend. BTC prices dropped 1.7% last night, starting the Asian trading session on a bearish note.

Trading below $70,000, buyers are under pressure from overhead supply as a bull trap becomes apparent. Will a bearish correction trigger a downward avalanche, pushing BTC prices below the $65,000 mark? Or is this just a retest before a major surge to new all-time highs?

Let’s take a detailed look at the price analysis for a clearer understanding of BTC’s price trend. Additionally, you can check our Bitcoin price forecast to see the chances of Bitcoin breaking the $100,000 milestone this year.

Bitcoin Price Performance

Bitcoin’s price nearly reached an all-time high but failed to maintain momentum above $71,000, resulting in a reversal within 24 hours. Bitcoin fell 1.77%, retesting the 23.60% Fibonacci level at $68,823.

The price drop supports a bullish outlook, with a post-retest reversal likely to sustain the current trend. Furthermore, a bullish breakout from the flag pattern indicates a potential price surge past the all-time high of $73,794.

However, a closer look shows that the $71,400 level has now rejected bullish attempts for the third time. This high-supply area is visible and warns of a bearish reversal.

Currently, BTC prices are at $69,758, down 0.54% intraday. This reflects ongoing bearish pressure, testing the support at $68,823.

Bitcoin ETF Sees Seven Consecutive Days of Inflows

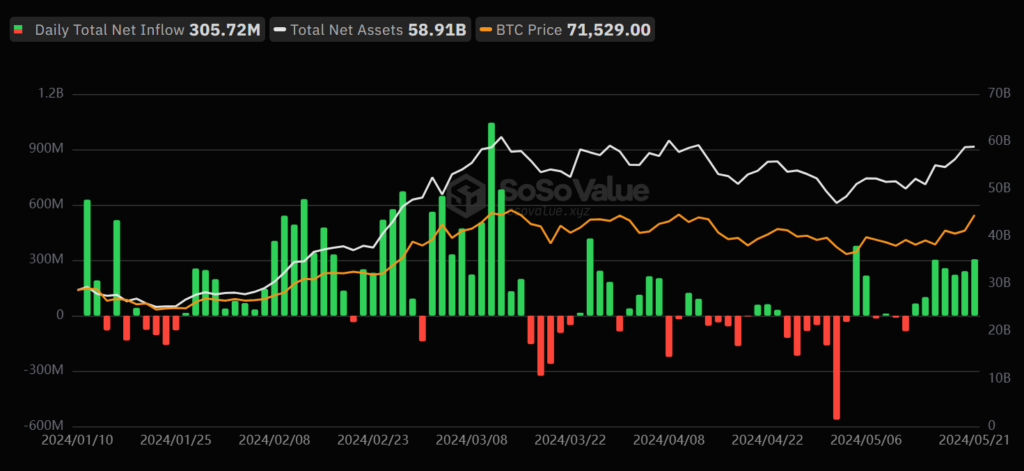

On May 21, Bitcoin spot ETFs saw a significant inflow of $306 million, continuing a seven-day streak of net inflows. Grayscale’s GBTC had no net outflows on the day, while BlackRock’s IBIT had a large single-day inflow of $290 million.

Overall, the total net asset value of Bitcoin spot ETFs reached $58.91 billion. This continued inflow suggests strong investor confidence and interest in Bitcoin through these ETFs.

Bullish Funding Rates Overlook the Trap

In the past seven days, Bitcoin’s open interest surged 15.5% to $16.76 billion, indicating increased market liquidity and volatility. On the other hand, a funding rate of 0.00803132 shows that long traders dominate, supporting a bullish outlook. Hence, derivative data indicates a generally bullish trend for Bitcoin prices.

On-Chain Shows Investor Confidence

Over the past seven days, Bitcoin transfer volume grew 106.44% to 924,412.09 transactions, reflecting a boom in trading activity. Supporting this, the binary CDD value of 0.28571428 indicates long-term holders are refusing to take profits, showing strong underlying confidence in Bitcoin. Therefore, this data supports a bullish outlook, suggesting Bitcoin prices may soon surge.

Will BTC Prices Stay Above $68,000?

Despite the bullish reversal from the $71,000 level and falling below $70,000, overall sentiment for Bitcoin remains bullish. With discussions around Ethereum ETFs circulating, Bitcoin prices are expected to continue the upward trend, increasing the attention in the crypto world.

Moreover, the retest narrative may soon end, extending Bitcoin’s upward rebound to break the $74,000 mark. In this scenario, the next stop this month could be $79,000.

However, a reversal below the $68,000 level could lead to a retest of the $65,000 area.