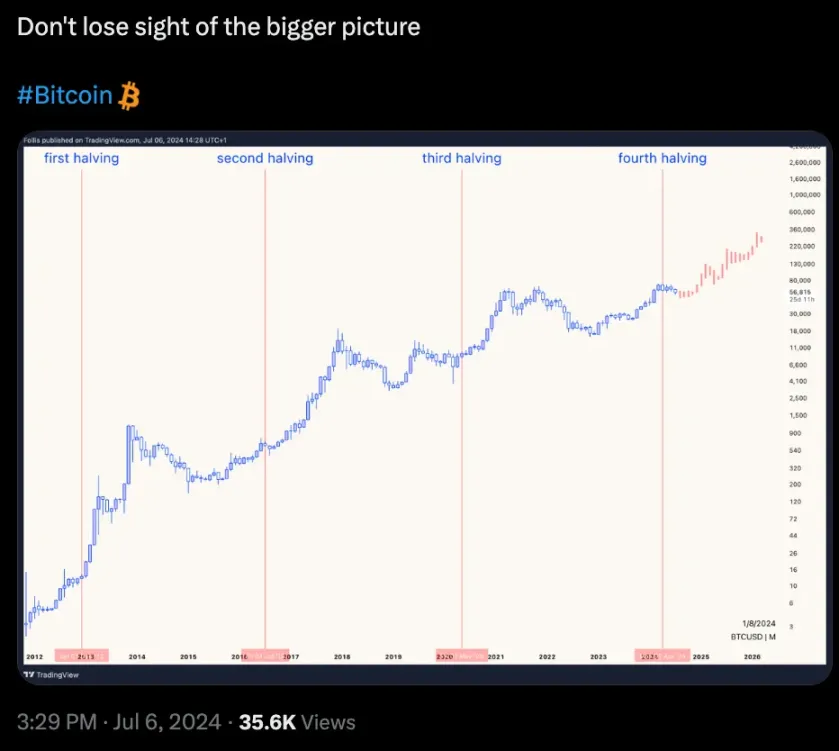

1. We Are Still in the Early Stages Compared to Previous Cycles.

2. Market Adjustments Are Inevitable.

In previous cycles, the market experienced deeper corrections. For instance, during 2016-17, adjustments ranged from -25% to -35%, while during 2020-21, the corrections reached -50% to -63%.

3. Number of Tokens Has Increased 50 Times.

While Liquidity Is the Same as in 2021, the Number of Tokens Has Increased 50 Times.

In other words, finding tokens with a hundredfold return has become much more difficult.

4. Bullish Catalysts.

- Continued inflows into Bitcoin ETFs

- The upcoming launch of Ethereum ETFs

- Regulatory shifts

- Interest rates at historic highs, with declines already starting in the EU and Canada

- Stocks at historic highs

- Gold near historic highs

- Stablecoin supply at historic highs

- Circle’s stablecoin meeting MiCA standards, driving financial and commercial integration

- Stripe integrating stablecoins

- Growth of PayPal’s new $PYUSD (issued $405 million)

- BlackRock promoting asset tokenization

- Newly issued altcoins down about 80%, resetting valuations

- Polymarket gaining traction outside the crypto-native sphere

- Blockchain finally beginning to scale

Finally, the resolution of issues with the German and U.S. governments and Mt. Gox will clear the last uncertainties.

5. Potential Bottom Signal

ETH Sentiment is Now at Its Lowest Point in 2024, Nearing Negative.

6. Possible Opportunity: Low Valuations in DeFi

In the summer of 2020, the crypto world witnessed a phenomenon later called “DeFi Summer.”

This period marked a significant turning point in the adoption and development of decentralized finance (DeFi) platforms.

At the time, users frequently jumped from one DeFi project to another, chasing higher rewards.

This frenzy brought enormous selling pressure, combined with token unlocks by investors and team members, leading to price drops of over 80% from their all-time highs.