Persistent inflation

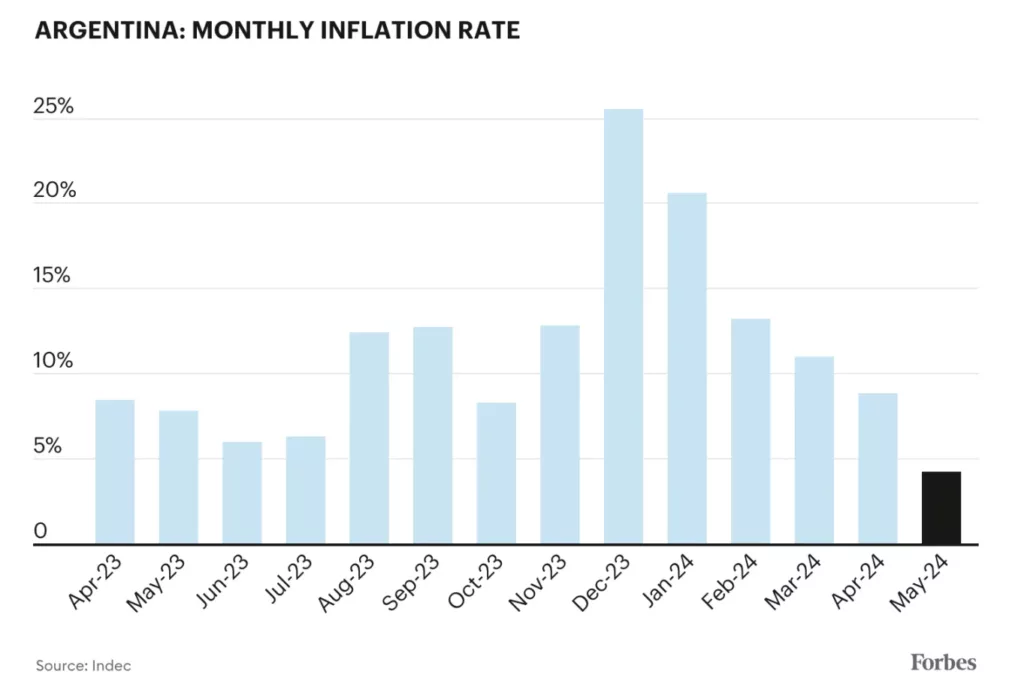

In recent years, Argentina has been marked by inflation, much like its renowned grilled beef. Over the past 12 months, the country’s cumulative inflation rate has reached 276%. A stark illustration of Argentina’s soaring inflation is the change in residents’ dietary habits—they are shifting from beef to more affordable proteins like pork and chicken. Some observers predict beef prices will rise by 600% this year, making steak no longer a staple for Argentinians.

While Argentinians are only now starting to seek alternatives to beef, they have been trying to escape the devaluation of the peso for decades. For 50 years, Argentinians have been buying dollars through black market agencies. The most famous black market operators even appear on Florida Avenue, a major street in the capital, Buenos Aires.

The best way to get dollars

The black market is a desperate choice for Argentinians, who risk being scammed. In these unauthorized and unsafe currency exchanges, Argentinians sometimes trade pesos for dollars at double the government-published rate. The current rate is 41% higher than the official 954 pesos to 1 dollar. This is not the only risk. According to the local newspaper La Nación, other major risks include customers being robbed by their trading counterparts or receiving counterfeit money.

Now, a new way to obtain dollars has emerged: cryptocurrency. Argentina’s cryptocurrency adoption rate (the proportion of cryptocurrency users to the total population) is higher than any other country in the Western Hemisphere. A study by Forbes in collaboration with SimilarWeb found that among the 130 million visitors to the 55 largest exchanges globally, 2.5 million were from Argentina.

Argentinians are not dabbling in memecoins or trying to get rich overnight with the next hot token. Instead, they usually buy and hold Tether (USDT), a synthetic dollar with a market cap of $112 billion. Maximiliano Hinz, the Latin American head of the cryptocurrency exchange Bitget, says, “Argentina is an outlier market; many people just buy USDT. We don’t see this happening elsewhere. Argentinians buy spot USDT and do nothing with it.”

Despite the appeal of stablecoins like USDT as a way out of inflation, they also come with risks. The country has yet to establish regulations to oversee this frenzied industry, and the world’s most trusted exchanges and markets (according to Forbes) are not the most widely used by Argentinians.

The Process of Dollarization

Argentina’s new libertarian president, Javier Milei, has expressed his willingness to dollarize Argentina. On May 17, he stated at a business conference that the country is moving towards a “competitive currency system” where everyone can choose which currency to use for payment and transactions.

He expects this will lead Argentina to “use the peso less and less. When we almost stop using the peso, we will move towards dollarization and eliminate the central bank so that corrupt politicians cannot steal wealth by printing money.”

Dollar stablecoins align with the idea of dollarization, but buyers must find a safe way to buy, hold, and use them. Argentina does not provide reliable safeguards for cryptocurrency users.

Argentina’s cryptocurrency adoption rate is higher than any other country in the Western Hemisphere. According to a Forbes study of Similarweb data, 2.5 million of the 130 million visitors to the 55 largest exchanges globally came from Argentina. Additionally, a report by the crypto data analysis company Chainalysis at the end of last year noted that as of July 2023, Argentina “led Latin America in terms of raw transaction volume, with an estimated transaction value of $85.4 billion.”

However, the stablecoin USDT chosen by Argentinians has a complex history. Tether, based in the British Virgin Islands, remains cautious about its internal operations, has never undergone an audit, and does not disclose which banks it uses. In 2021, the CFTC and the New York Attorney General respectively forced Tether to pay fines of $41 million and $18.5 million for falsely claiming that USDT was pegged one-to-one with the dollar. In a country still plagued by triple-digit inflation, these red flags seem to go unnoticed by users.

The risks extend to the exchanges and markets serving Argentina. In May, Forbes selected the world’s 20 most trusted cryptocurrency exchanges. None of Argentina’s top five crypto providers—Binance, eToro, BingX, HTX, and Bitget—made the list, due to a lack of domestic regulatory oversight.

Binance is the most visited exchange website, with traffic from Argentina exceeding that from any other country. However, Binance does not have a single national regulatory body overseeing it, let alone a local one.

How risky is it to do business with Binance? We know that Binance has previously admitted to violating U.S. anti-money laundering regulations, resulting in a $4.3 billion fine and long-term monitoring by U.S. regulators to prevent a recurrence.

But that’s not all. A previous Forbes investigation into Binance revealed that customers’ online account balances are unreliable, as the final say on their tokens lies with the company’s internal ledger, which is not public. The company has transferred funds off the exchange as collateral for issuing stablecoins. However, to Binance’s credit, it has not gone bankrupt, can generally handle customer withdrawals, and continues to operate normally.

It is difficult for ordinary Argentinians or other novice investors to understand and recognize these risks. Fernando Apud, a software engineer living in the northern province of Tucumán, recently evaluated local company Cocos Capital and larger, more complex sites like Binance.

While these sites claim security and convenience as their main selling points, he found that even large sites like Binance are reluctant to disclose basic information, such as whether they are registered to operate in Argentina and who actually owns the company.

When Forbes asked Binance’s Spanish-language communications team member Rose Zimler about Binance’s status in Argentina, she said the company “keeps in close contact with authorities” but is not yet registered in Argentina. She did not explain why it was not registered or whether it intended to register. She stated that Binance has 18 licenses globally.

Binance is not an exception. Argentina’s other top cryptocurrency exchanges are not registered with the National Securities Commission (CNV). They typically tell Forbes that they are trustworthy because of their good operational history. BingX brand ambassador Pablo Monti, representing the exchange’s communications team, declined to disclose the platform’s regulatory compliance nature in Latin America.

However, he told Forbes on May 20, “As we celebrate our sixth anniversary, BingX is further expanding into Argentina and other countries such as Turkey and Vietnam.” An eToro spokesperson did not address the lack of registration but stated, “As a company regulated by financial authorities in multiple jurisdictions globally, eToro is committed to complying with the applicable rules and regulations in the jurisdictions where it operates.”

Bitget is a cryptocurrency exchange with Argentine soccer star Lionel Messi as its brand ambassador. Maximiliano Hinz of Bitget said, “As far as I know, Bitget operates in Latin American countries without any license requirements.” Finally, the exchange HTX, associated with Justin Sun, did not respond to emails about its Argentine business.

Besides cryptocurrency exchanges, Argentinians can also use domestic companies to use cryptocurrency. These companies allow users to buy and spend cryptocurrency with prepaid cards, such as Lemon and Buenbit. However, these companies also have regulatory gaps. In the latest Chainalysis Latin America report, Lemon Cash compliance officer Alfonso Martel Seward stated that his company has about 2 million Argentine users, while the total number of crypto users in the country is about 5 million.

Argentinians have had enough of the peso. Since the country ended the one-to-one peg of the peso to the dollar in January 2002, the devaluation of the peso has caused significant trouble. Over the years, overspending and debt defaults have plagued the peso. A decade after the peg was broken, the peso had fallen to about 4 pesos to the dollar, and by early 2020, amid the COVID-19 pandemic, the exchange rate dropped to 64 pesos to the dollar.

According to Bloomberg, although peso devaluation initially boosted the country’s foreign trade at the beginning of the century, this benefit faded after 2009. Over the past 10 years, the inflation-adjusted GDP has declined by an average of 0.1% per year, with only four years of growth.

Trouble for Argentina

Why is Argentina in trouble? Besides a bloated public sector with 3.5 million employees and a lack of commitment to fiscal austerity, external factors like weather patterns (La Niña) have significantly impacted last year and this year’s grain exports, the country’s main source of hard currency. Argentina has experienced the worst drought in 60 years.

“It is unprecedented that all three crops—soybeans, corn, and wheat—have failed,” said Julio Calzada, head of economic research at the country’s main agricultural exchange. “We are all waiting for rain.” Reduced crop yields mean fewer dollar revenues, driving up food prices, increasing the risk of default, and raising interest rates.

In his inauguration speech on December 10, 2023, Milei made it clear that he plans to end past practices. “Today, we bury decades of failure and meaningless struggle,” he said. “There is no turning back.” At that time, Argentina’s annualized inflation rate was 143%, the trade deficit was $43 billion, and the fiscal deficit was equivalent to 3.5% of the country’s GDP. Six months into Milei’s term, inflation remained high, but the country achieved a trade surplus for six consecutive months, with a fiscal surplus equivalent to 1.1% of GDP.

Milei is working to reverse Argentina’s economic decline. His measures include firing tens of thousands of public sector employees, suspending public works, eliminating energy subsidies, raising taxes, and reducing revenue sharing between the federal government and provinces.

These measures faced widespread opposition, sparking street protests, and Milei’s austerity measures were significantly scaled back, with limited support in Congress. In June, a scaled-down fiscal package narrowly passed the Senate and is now headed to the House of Representatives.

Milei’s conservative strategy may be the tough medicine the country needs to move forward, but without a spoonful of sugar to make it easier to swallow.

Even if Argentina’s fortunes improve, decades of economic mismanagement mean people will continue flocking to dollars, whether in paper or digital form. But the government has done little to protect its citizens.

Argentina’s cryptocurrency regulations

What are Argentina’s cryptocurrency regulations? Three months ago, the CNV announced a registration requirement: “Anyone who sends advertisements to individuals residing in Argentina using web pages, social networks, or other means” and “receives user funds through any technology” must register. There is no registration deadline. CNV President Robert E. Silva stated, “Unregistered entities will not be able to conduct business in the country.”

This requirement is neither complex nor cumbersome for registrants. However, many of the 55 cryptocurrency companies in Forbes’ research operate in Argentina, yet none registered within three months of the rule taking effect on March 25. As of June 20, the public registry listed 48 companies, most of which are relatively small local operations. Argentine officials did not respond to multiple requests for comment on the matter.

Registration is just a small step, and it is clearly not enough for the world’s 22nd largest economy, with a GDP of $633 billion. Bitcoin and digital currencies were born out of the Great Recession in the U.S. in 2008. But if Bitcoin had started in this long-inflation and politically turbulent Andes country, it would be equally fitting.